Connecticut Charitable Contribution Payroll Deduction Form

Description

How to fill out Charitable Contribution Payroll Deduction Form?

Selecting the appropriate authorized document template can be quite challenging. Clearly, there are numerous designs available online, but how will you secure the official type you need? Utilize the US Legal Forms website. The platform offers a multitude of layouts, such as the Connecticut Charitable Contribution Payroll Deduction Form, which you can utilize for business and personal purposes. All of the forms are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Connecticut Charitable Contribution Payroll Deduction Form. Use your account to search through the legal forms you have previously acquired. Navigate to the My documents section of your account and download another copy of the document you need.

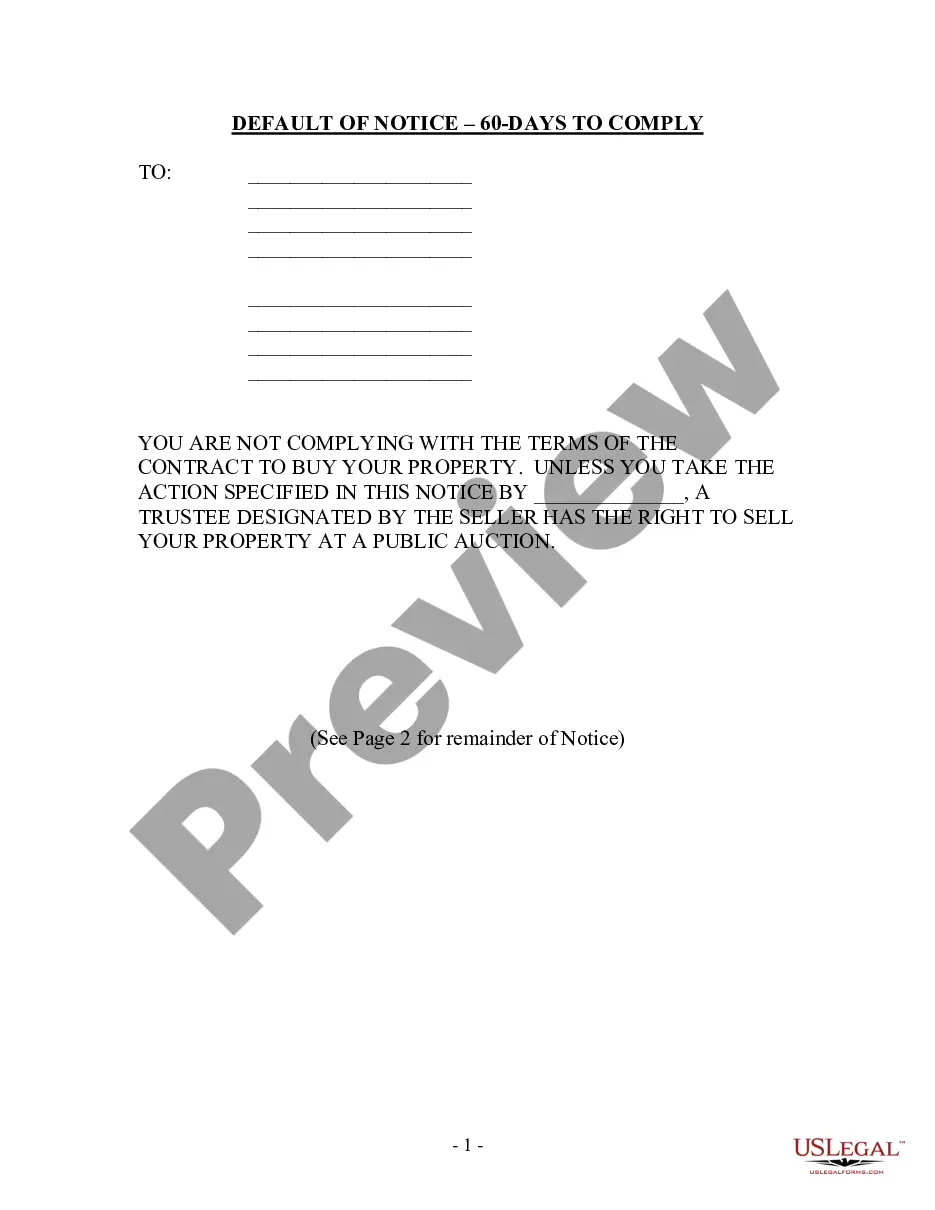

If you are a new user of US Legal Forms, here are simple instructions you can follow: Initially, ensure you have selected the correct form for your region/state. You can review the form using the Preview option and read the form description to confirm it is the correct one for you. If the form does not fulfill your requirements, utilize the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Get now button to acquire the form. Select the pricing plan you desire and enter the necessary information. Create your account and finalize the payment with your PayPal account or credit card. Choose the document format and download the authorized document template to your device. Complete, modify, and print and sign the obtained Connecticut Charitable Contribution Payroll Deduction Form.

- US Legal Forms represents the largest repository of legal forms where you can discover various document templates.

- Leverage the service to download professionally crafted documents that comply with state requirements.

Form popularity

FAQ

Deductible Charitable Contributions Generally, you can deduct any cash contributions you make and/or the fair market value of any donated property, such as clothing, household items, or vehicles. You can also claim a deduction for the contribution of stocks.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

Pre-tax deductions: Medical and dental benefits, 401(k) retirement plans (for federal and most state income taxes) and group-term life insurance. Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations.

A charitable deduction is not allowed for services performed by a taxpayer on behalf of a charity or for a taxpayer's time expended doing charitable work (Regs. Sec. 1.170A-1(g); Grant, 84 T.C. 809 (1985), aff'd 800 F.

For tax year 2020, you may deduct donations worth up to 60% of your income. Make sure that you have written receipts or bank/payroll deductions for any contributions. Any non-cash donations such as clothing have to be deducted at fair market value.

By giving through recurring or one-time payroll deduction, your donation is automatically deducted from your paycheck, there are no extra fees and because employees' payroll donations come out of their after-tax earnings, their donation is tax-deductible.

Recording a Donation If you made a cash donation, start by setting up the charitable organization as a new vendor for your company. Next, record the outgoing money as a check or a bill in the name of the charity and the corresponding payment, like you would for any other bill.

Instead, your charitable donations come out of your after-tax earnings. So you can deduct the total amount deducted from your payroll checks during the year on the Gifts to Charity line of your Schedule A (if you choose to itemize instead of claiming the standard deduction).

Charitable donations are tax deductible and the IRS considers church tithing tax deductible as well. To deduct the amount you tithe to your church or place of worship report the amount you donate to qualified charitable organizations, such as churches, on Schedule A.

If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: 2022 You are NOT a surviving spouse filing an original or amended joint return with the decedent; and 2022 You are NOT a personal representative (defined later) filing, for the decedent, an original Form 1040, 1040-SR, 1040A, 1040EZ,