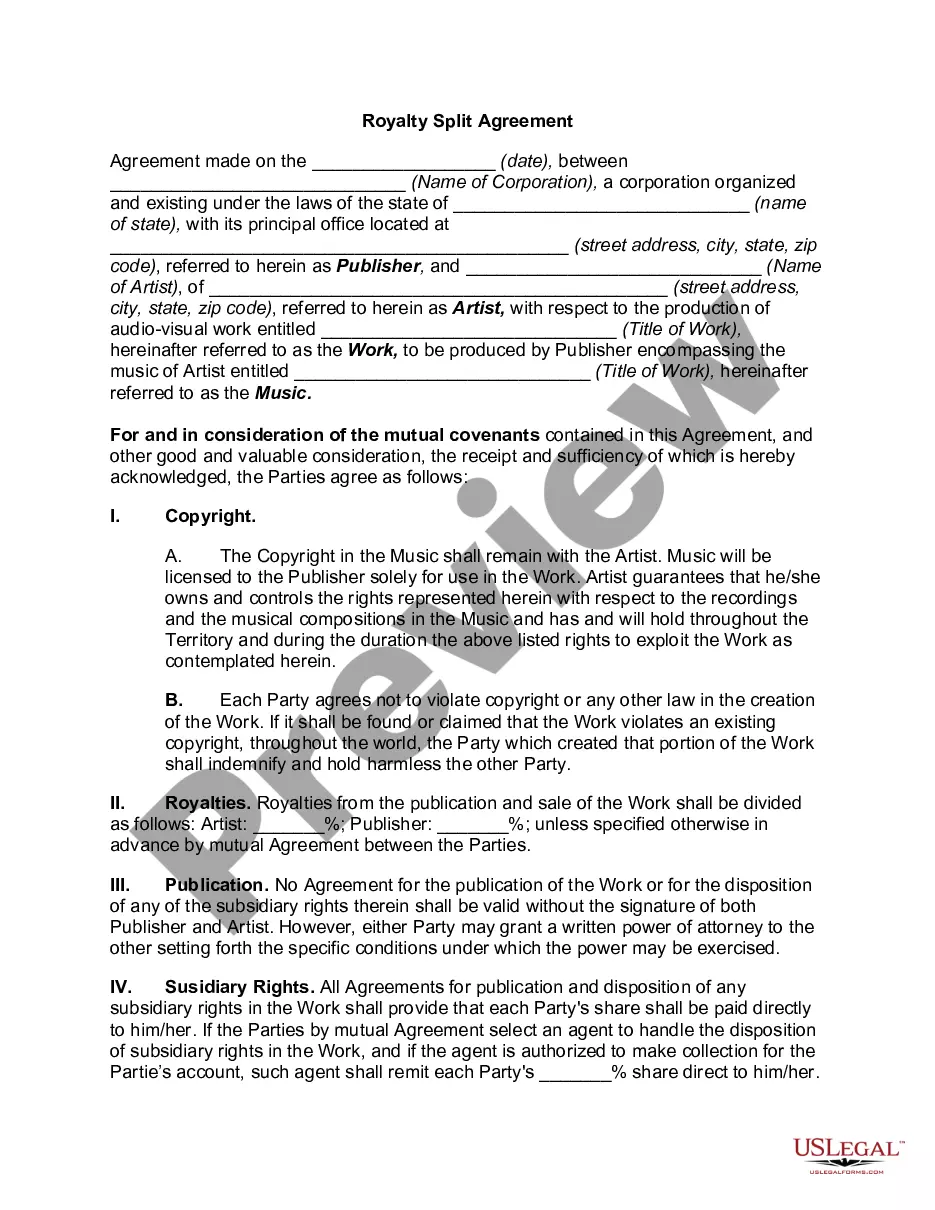

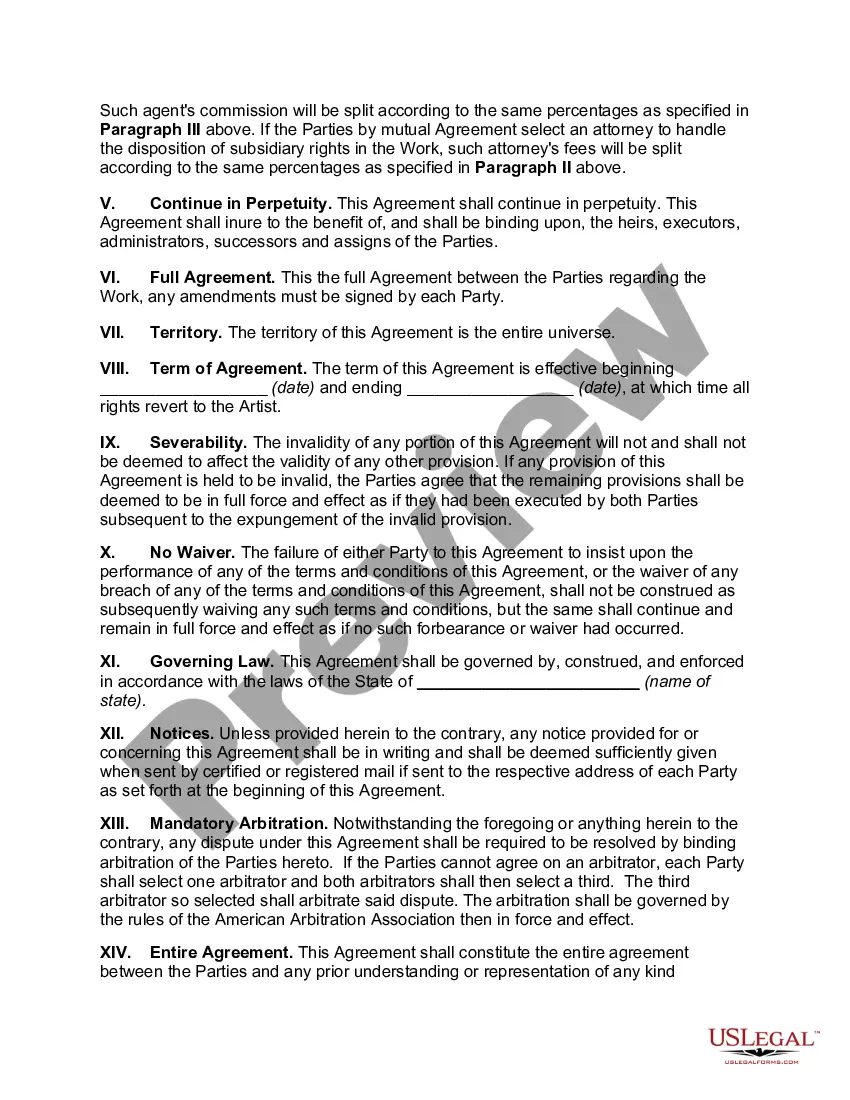

Connecticut Royalty Split Agreement

Description

How to fill out Royalty Split Agreement?

You can spend hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms provides a wide array of legal documents that have been evaluated by experts.

You can download or print the Connecticut Royalty Split Agreement from the service.

To acquire an additional copy of the form, use the Search field to find the template that suits your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can fill out, modify, print, or sign the Connecticut Royalty Split Agreement.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure you have chosen the correct document template for your area/city of preference.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

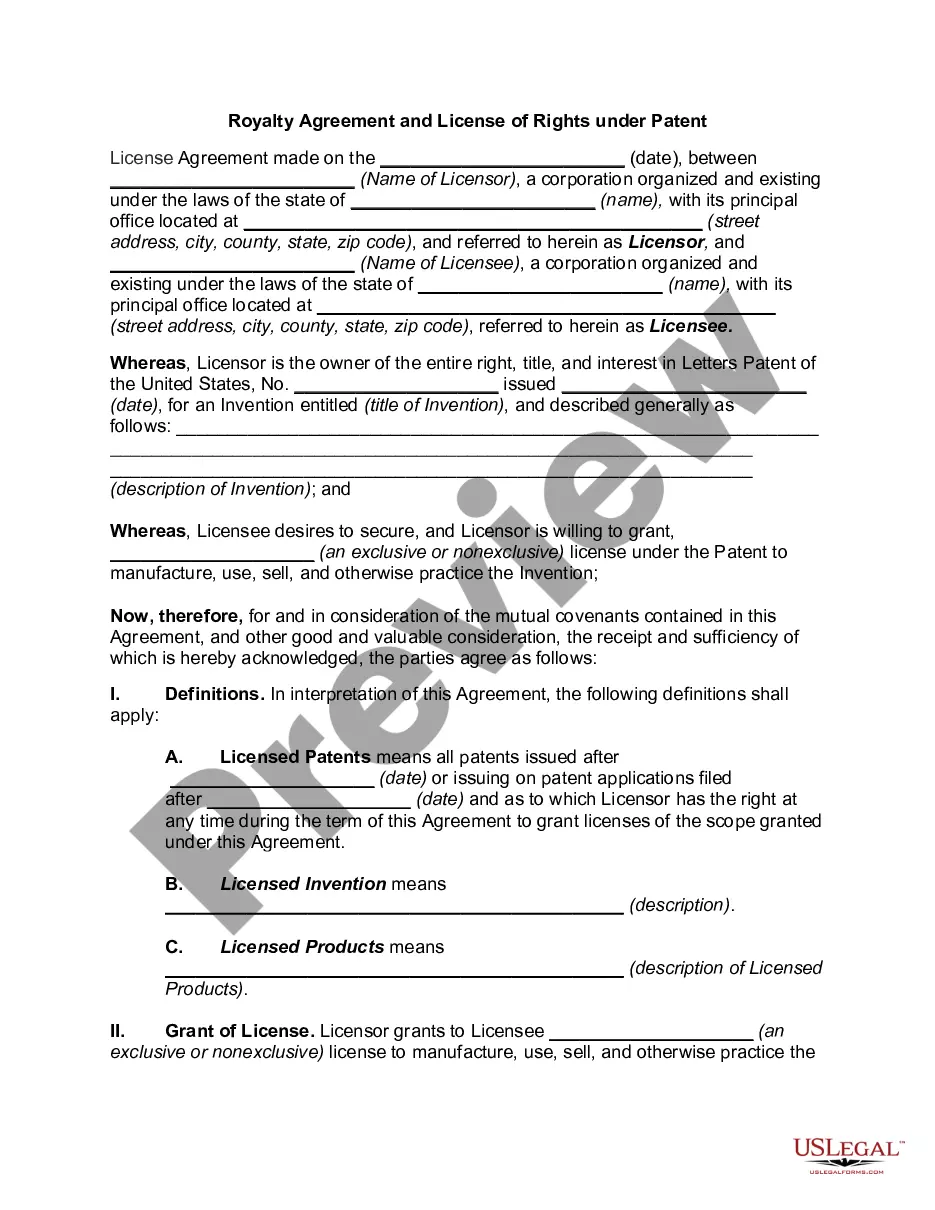

The 25% rule also refers to a technique for determining royalties, which stipulates that a party selling a product or service based on another party's intellectual property must pay that party a royalty of 25% of the gross profit made from the sale, before taxes.

In most cases, licensors prefer a royalty rate that falls within 25% to 75% range of the sublicensing income. Their stake usually amounts to more than half of all profits. In rare cases, the licensee can negotiate a rate split and apply their own royalty obligation to the sale of sub-licensed products.

When negotiating terms, always establish a minimum guarantee income. That way the licensor guarantees himself / herself a pay check regardless of the licensee company's performance. 2.) Avoid terms that involve royalty rates based off net profit.

Mostly, the common royalty rate among many industries considered is about 7% of gross sales, a magical almost arbitrary number but it is based on the sales price, and an estimated average of all industries, without calculating profits, that means the 7% is from sales price, and not the net profits.

Royalties and their contractual terms are negotiable between the issuer and investors. Since royalties are contracts, they can be changed with the approval of the parties.

In most cases, licensors prefer a royalty rate that falls within 25% to 75% range of the sublicensing income. Their stake usually amounts to more than half of all profits. In rare cases, the licensee can negotiate a rate split and apply their own royalty obligation to the sale of sub-licensed products.

Under the traditional recording agreement, recording artist royalties usually range from 10% to 25% of the suggested retail price for top-line albums (although many record companies have begun to compute royalties on the wholesale price).

The base formula for royalty calculation is royalty revenue = sales x royalty percentage. You can choose to keep things old school, and do the math for each and every SKU.

Here are a few things you can do to get a higher royalty rate for your invention.File a non-provisional patent application or have an issued patent.Establish proof of demand.Pull-through marketing.Manufacture and sell the product first.When negotiating, ask the company first instead of throwing out a number.More items...?

25% Rule for Intellectual Property Patent or trademark owners use the 25% rule as a yardstick for defining a reasonable amount of royalty payments.