Connecticut Letter Requesting Transfer of Property to Trust

Description

How to fill out Letter Requesting Transfer Of Property To Trust?

If you require thorough, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and practical search to find the documents you need.

A range of templates for business and personal purposes are sorted by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to locate alternate versions of the legal form template.

Step 4. Once you have found the form you need, click on the Get Now option. Choose the payment plan you prefer and enter your information to register for an account.

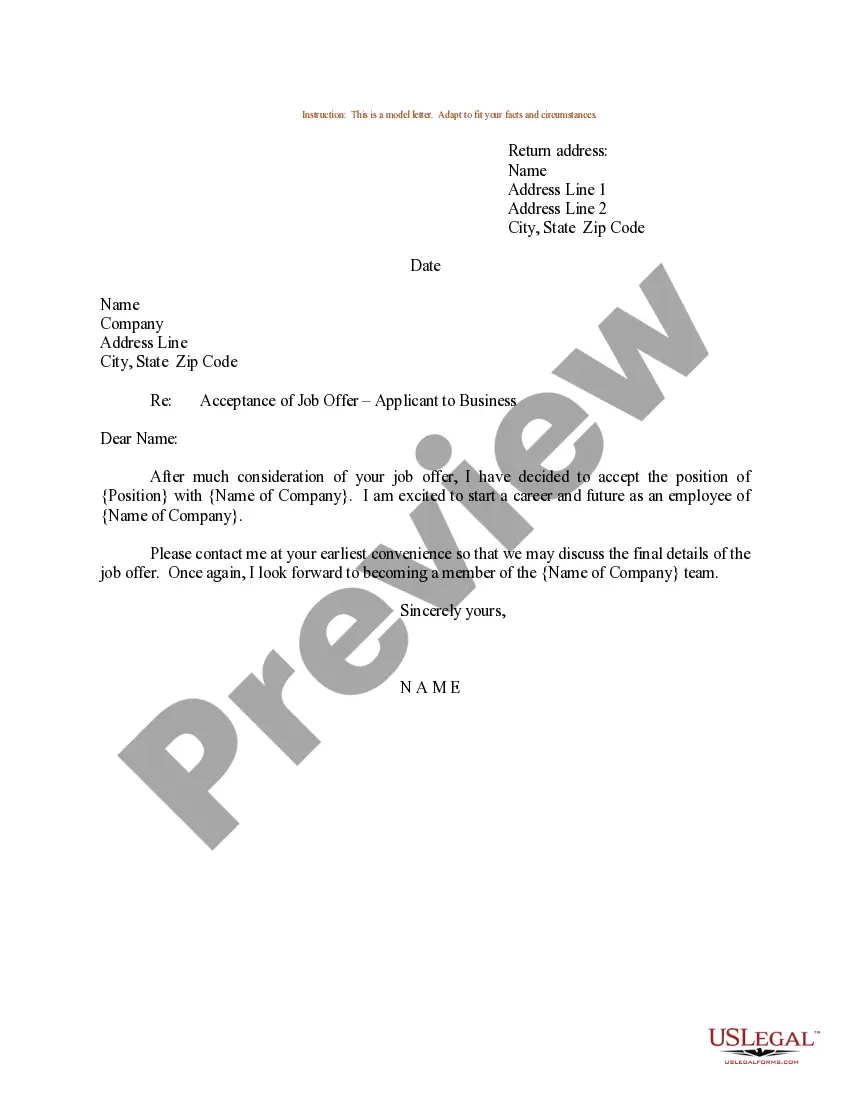

- Utilize US Legal Forms to obtain the Connecticut Letter Requesting Transfer of Property to Trust in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download option to retrieve the Connecticut Letter Requesting Transfer of Property to Trust.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

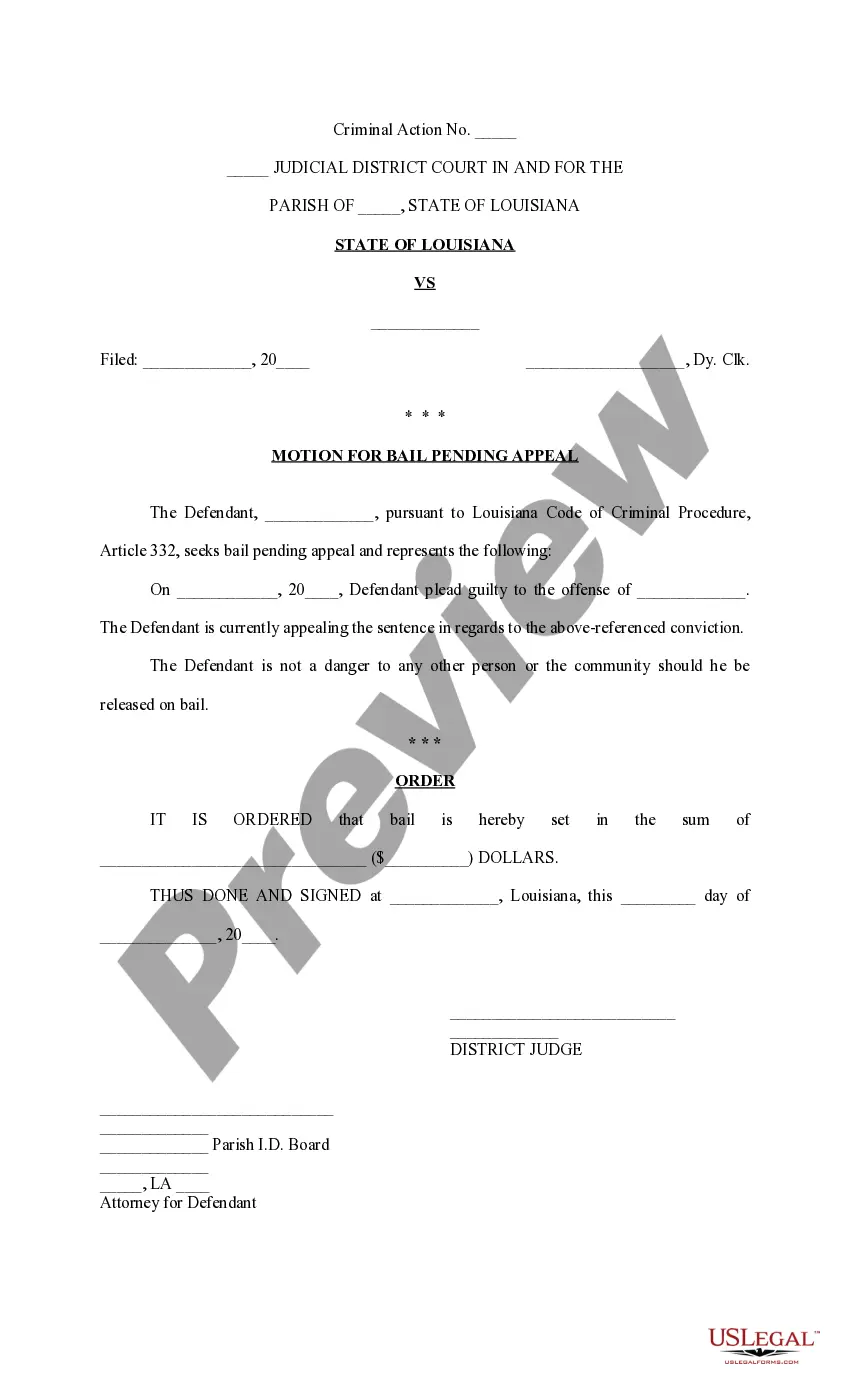

- Step 2. Utilize the Preview feature to review the form's content. Do not forget to read the summary.

Form popularity

FAQ

The trustees are not legally bound to follow a Letter of Wishes, but it is guidance that they must take into account and in practice it is usually followed.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

Letters of wishes are just wishes, they are not legally binding on anyone involved in (or outside of) your will. If you want your wishes to be binding, they must be included directly within the terms of your will. Whilst a letter of wishes offers a great deal of flexibility, it will not be suitable for all purposes.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

What should I include in a letter of wishes? The purpose of a letter of wishes is to support the will and aid the persons dealing with your estate. It therefore should not contain anything that conflicts with your will.

Potential DisadvantagesEven modest bank or investment accounts named in a valid trust must go through the probate process. Also, after you die, your estate may face more expense, as the trust must file tax returns and value assets, potentially negating the cost savings of avoiding probate.

Reference the name of the irrevocable trust, and the trust account number if applicable. Write a salutation followed by a colon. Identify yourself as a beneficiary of the irrevocable trust in the body of the letter. State that you are requesting money from the trust, and the reason for the request.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.