Connecticut Letter regarding trust money

Description

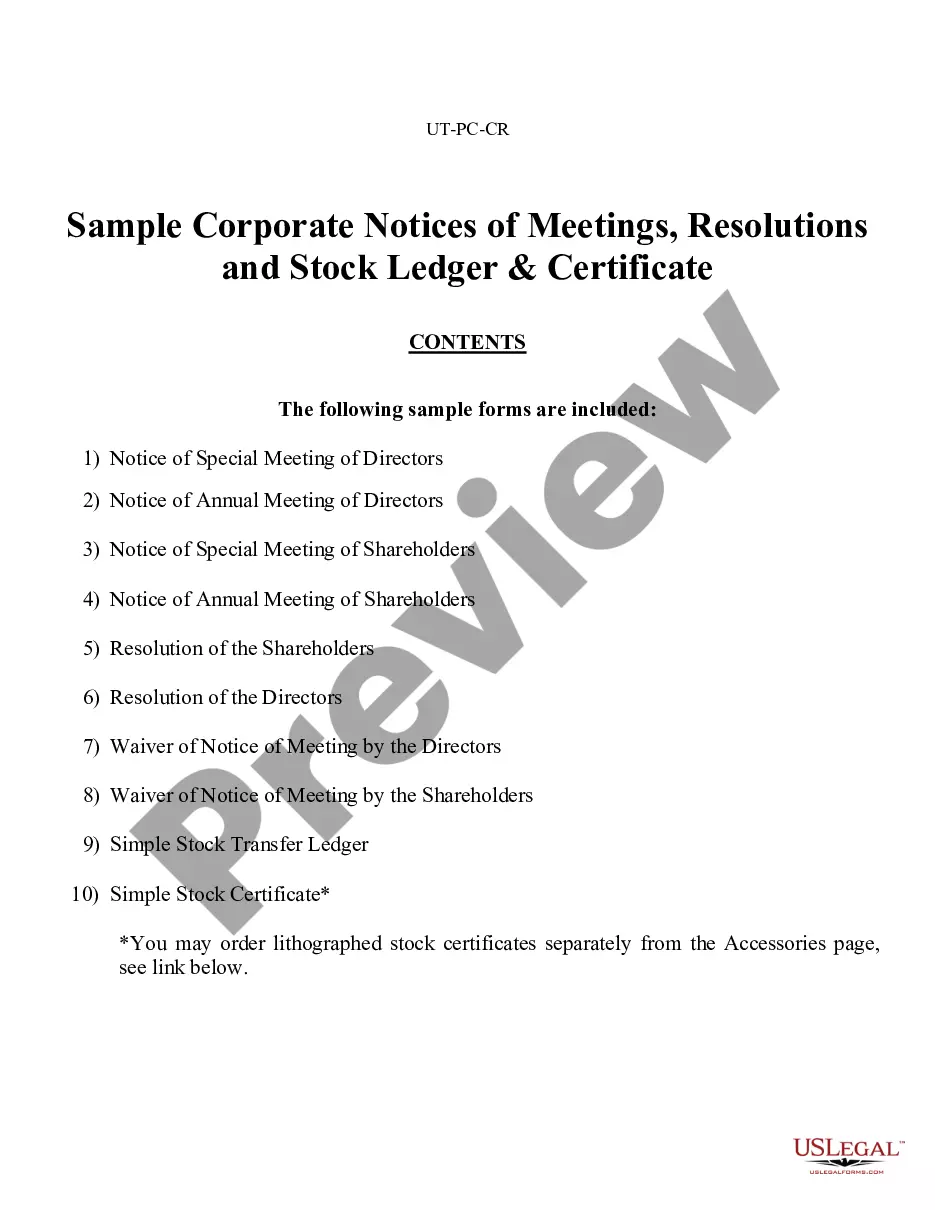

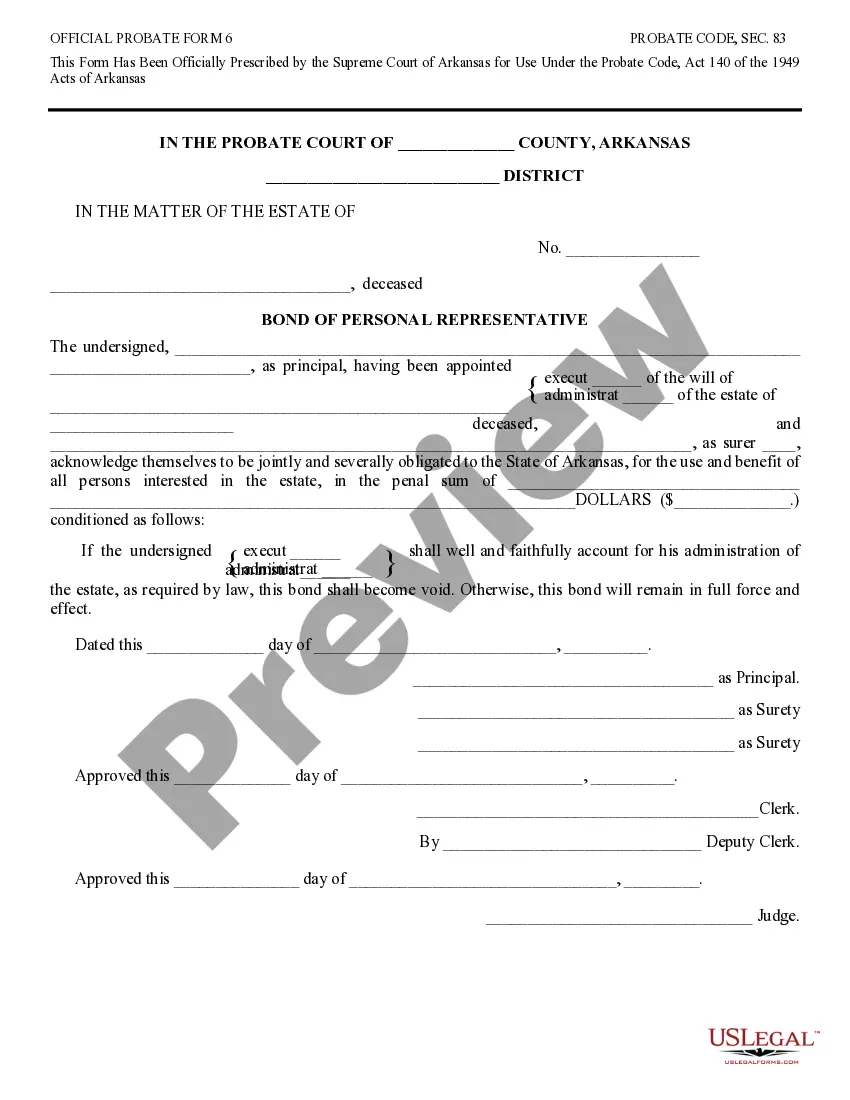

How to fill out Letter Regarding Trust Money?

Selecting the optimal legal document format can be challenging.

Of course, there are numerous templates accessible online, but how can you find the legal version you require.

Utilize the US Legal Forms website. The platform offers a vast selection of templates, including the Connecticut Letter regarding trust funds, which can be used for both business and personal purposes.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Connecticut Letter regarding trust money.

- Use your account to review the legal forms you have previously purchased.

- Navigate to the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, below are some easy steps to follow.

- First, make sure you have selected the correct form for your city/area. You can preview the form using the Preview button and read the form description to ensure it is the right one for you.

Form popularity

FAQ

The federal gift tax law provides that every person can give a present interest gift of up to $14,000 each year to any individual they want. This means that each parent can each give each of their children and grandchildren $14,000 (two parents permits a total gift per recipient of $28,000).

Identify yourself as a beneficiary of the irrevocable trust in the body of the letter. State that you are requesting money from the trust, and the reason for the request. Include supporting documentation. For example, if you are requesting money to pay medical bills, enclose copies of the bills.

Schedule K-1 is an IRS tax form that reports a beneficiary's income, credits, and deductions from a trust or estate. For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

Income of a trust that has a tax identification number is reported to that tax identification number with a Form 1099, and a trust reports its income and deductions for federal income tax purposes annually on Form 1041.

If you put things into a trust, provided certain conditions are met, they no longer belong to you. This means that when you die their value normally won't be counted when your Inheritance Tax bill is worked out. Instead, the cash, investments or property belong to the trust.

Trusts can help your heirs avoid a lengthy and expensive probate process after you pass away. You can also arrange gifts of money or property per your instructions to the trustee.

For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return. The trust must also generate a Form 1041 to report the total amount of income the trust earned from the grantor's date of death.

Beneficiaries of a trust typically pay taxes on distributions they receive from the trust's income. However, they are not subject to taxes on distributions from the trust's principal.

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.