Connecticut Notice of Disputed Account

Description

How to fill out Notice Of Disputed Account?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal uses, organized by categories, states, or keywords. You can find the latest versions of documents like the Connecticut Notice of Disputed Account in moments.

If you already have a monthly membership, Log In and download the Connecticut Notice of Disputed Account from the US Legal Forms collection. The Download button will show up on every form you view. You can access all previously acquired forms in the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the downloaded Connecticut Notice of Disputed Account.

Each template added to your account does not have an expiration date and is yours indefinitely. So, if you wish to download or print an additional copy, just go to the My documents section and click on the form you need. Access the Connecticut Notice of Disputed Account with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you want to use US Legal Forms for the first time, here are simple instructions to help you begin.

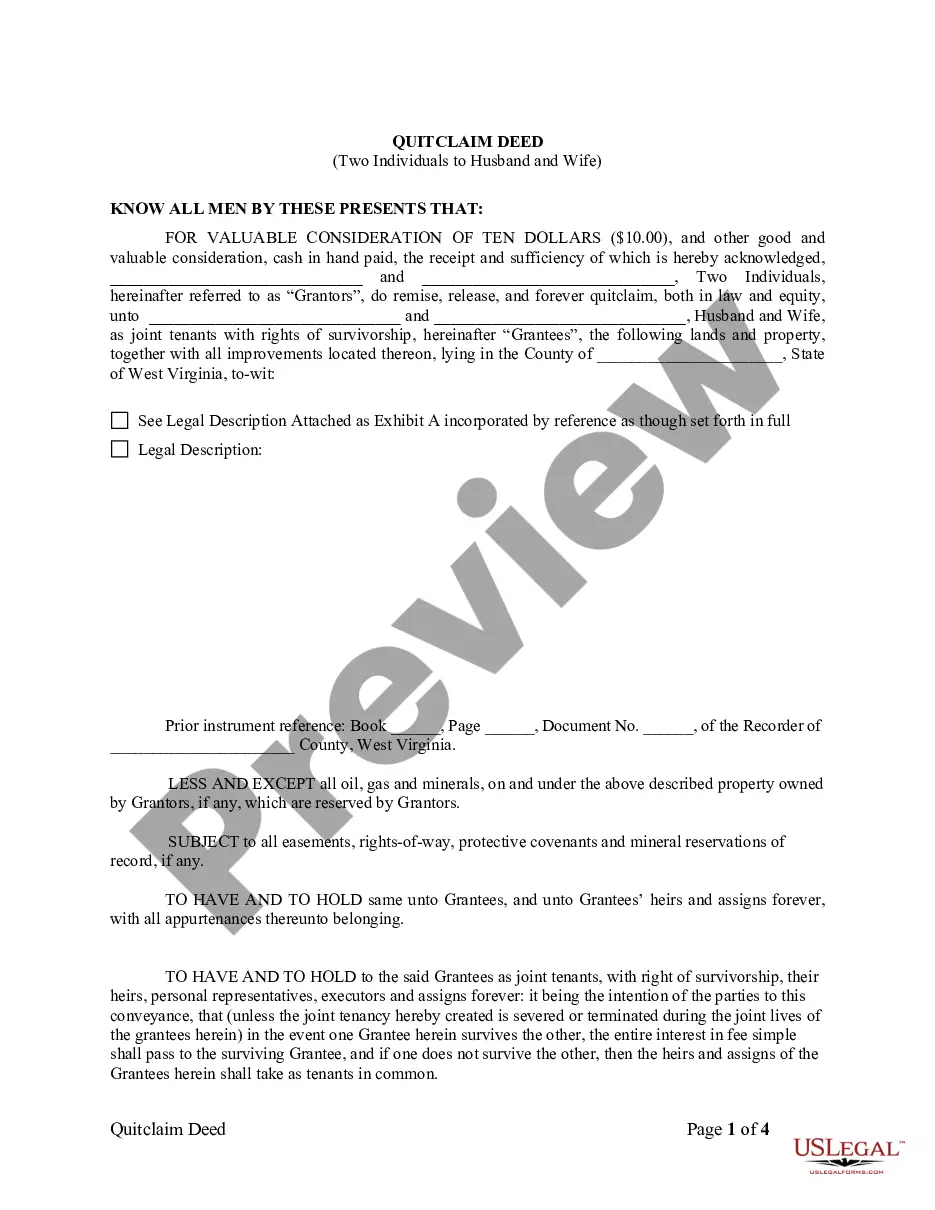

- Ensure you have selected the correct form for the city/state. Click on the Preview button to check the content of the form. Read the form's description to make sure you have chosen the correct form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the pricing plan you prefer and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

In Connecticut, the limit for small claims court is $5,000 for most cases. This amount allows individuals to resolve disputes efficiently without the need for a formal trial. If you receive a Connecticut Notice of Disputed Account, seeking resolution through small claims court can be an effective option. Remember, this process provides a straightforward way to handle monetary disagreements and can often be resolved more quickly than traditional court procedures.

The 11-word phrase to stop debt collectors is, 'I do not owe you this debt, please cease contact.' By articulating this phrase clearly, you can assert your rights and potentially halt collection efforts. Utilizing a Connecticut Notice of Disputed Account can further support your position in disputing a claimed debt.

In Connecticut, creditors generally have six years to pursue collections for most types of debts, beginning from the last payment date. After this period, collection efforts must cease as the debt becomes uncollectible. It’s prudent to understand your situation and consider a Connecticut Notice of Disputed Account if a collector continues their efforts beyond this timeframe.

The new debt collection rule, which became effective federally, aims to clarify and regulate how debt collectors can communicate with consumers. It restricts practices that may be considered harassment, such as frequent calling or contacting consumers at inconvenient times. This rule complements local laws, including the Connecticut Notice of Disputed Account provisions, which further protect your rights.

The new debt collection law in Connecticut enhances consumer protections and requires creditors to provide more transparency and disclosure before initiating collections. This law ensures that consumers receive clear information about their debts, allowing them to dispute account inaccuracies with a Connecticut Notice of Disputed Account. It increases accountability for debt collectors, fostering fairer practices.

In Connecticut, a debt typically becomes uncollectible after a period of six years from the date of the last payment or acknowledgment of the debt. This statute of limitations protects consumers by limiting how long creditors have to pursue collection after this timeframe. If you get a Connecticut Notice of Disputed Account regarding an older debt, it may be beneficial to review the timeline associated with it.

The Creditors Collection Practices Act in Connecticut protects consumers from unfair debt collection practices. This law regulates how creditors may communicate with debtors, ensuring they do not employ harassment or deceitful tactics. If you receive a Connecticut Notice of Disputed Account, knowing your rights under this act can empower you to respond appropriately.

In small claims court, there is no strict dress code, but it is important to look presentable. Wearing business casual attire is often recommended to show respect for the court. Although a formal suit is not necessary, dressing appropriately can positively impact how you are perceived during your case. Being prepared ensures you remain focused on your Connecticut Notice of Disputed Account.

If you wish to appeal a determination made by the Connecticut Department of Revenue Services, you should file your appeal with the Connecticut Superior Court. Make sure to adhere to the deadlines set forth by the department for filing appeals. Always include a copy of the determination you are contesting. This ensures that your Connecticut Notice of Disputed Account can be effectively reviewed.

To file a complaint against a bank in Connecticut, start by collecting all evidence supporting your claim, such as account statements and relevant communications. Submit your written complaint to the bank's customer service or compliance department, and request a formal investigation. If issues persist, consider filing a formal complaint with the Connecticut Department of Banking. This may help resolve matters related to your Connecticut Notice of Disputed Account.