Connecticut Credit Information Request

Description

How to fill out Credit Information Request?

Are you in a position that requires documents for occasional organizational or personal purposes.

There are numerous official document templates available online, but finding reliable ones isn’t simple.

US Legal Forms offers a vast array of form templates, including the Connecticut Credit Information Request, designed to comply with state and federal regulations.

Choose your preferred payment plan, provide the necessary information to set up your account, and finalize your purchase using PayPal or a credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Credit Information Request template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city/state.

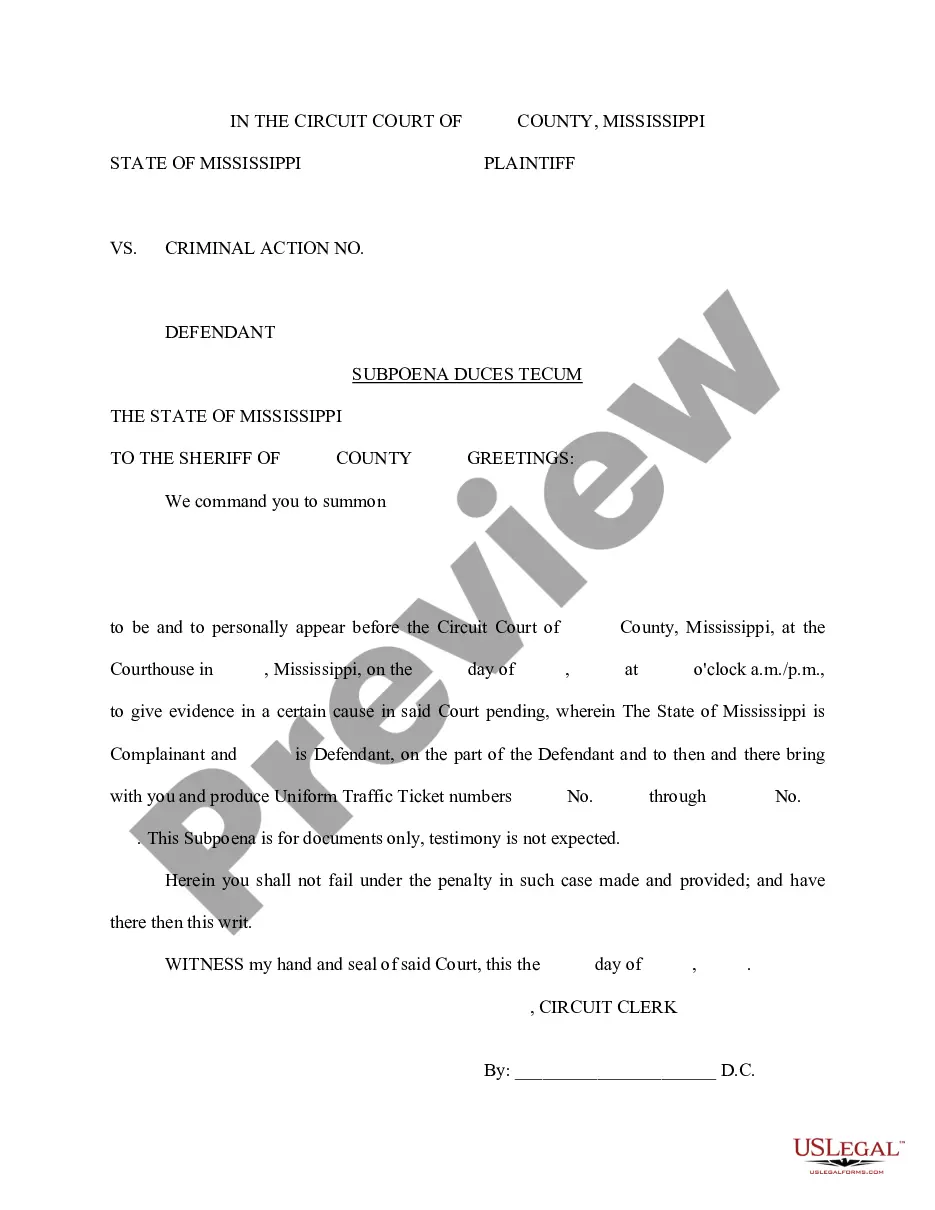

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the right form.

- If the form isn’t what you need, use the Search field to find a form that meets your requirements.

- When you locate the appropriate form, click Get now.

Form popularity

FAQ

You can request and review your free report through one of the following ways:Online: Visit AnnualCreditReport.com.Phone: Call (877) 322-8228.Mail: Download and complete the Annual Credit Report Request form . Mail the completed form to:

When we get your credit score, we request the information from TransUnion UK on your behalf. This is known as a Consumer Credit File Request, you can see this in your Search history under Soft Searches. This won't have any impact on your score, and the searches cannot be seen by any third parties.

These are the only ways to order your free credit reports:visit AnnualCreditReport.com.call 1-877-322-8228.complete the Annual Credit Report Request Form and mail it to:

Where to Send Your Credit Dispute LetterExperian. Dispute Department. PO Box 4500. Allen, TX 75013.Equifax. PO Box 740256. Atlanta, GA 30374-0256.TransUnion. TransUnion Consumer Solutions. PO Box 2000. Chester, PA 19016-2000.17-Dec-2019

Key Takeaways. A credit report is a detailed summary of an individual's credit history, prepared by a credit bureau. Reports include personal information, details on lines of credit, public records such as bankruptcies, and a list of entities that have asked to see the consumer's credit report.

The Consumer Credit Act and the General Data Protection Regulation (GDPR) gives you the right to request a one-off statutory credit file from TransUnion. Your statutory credit file gives you the details about your credit accounts, missed payments and the people with whom you have financial links.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Your dispute letter should include the following information:Your full name.Your date of birth.Your Social Security number.Your current address and any other addresses at which you have lived during the past two years.A copy of a government-issued identification card such as a driver's license or state ID.More items...?26-Feb-2021

9 of the best dispute reasons for collections on a credit reportIncorrect identifying information.Closed accounts reported as open.Accounts that are incorrectly reported as late or delinquent.Debts listed on your credit report more than once.Incorrect dates of payments or delinquencies.More items...?14-Sept-2021