Connecticut Private Client General Asset Management Agreement

Description

How to fill out Private Client General Asset Management Agreement?

Are you in a position where you occasionally require documents for various businesses or particular activities nearly every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of document templates, such as the Connecticut Private Client General Asset Management Agreement, specifically designed to comply with state and federal regulations.

Once you find the suitable form, click Buy now.

Choose your preferred pricing plan, fill in the necessary details to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Connecticut Private Client General Asset Management Agreement template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Locate the form you need and ensure it is appropriate for the correct city/county.

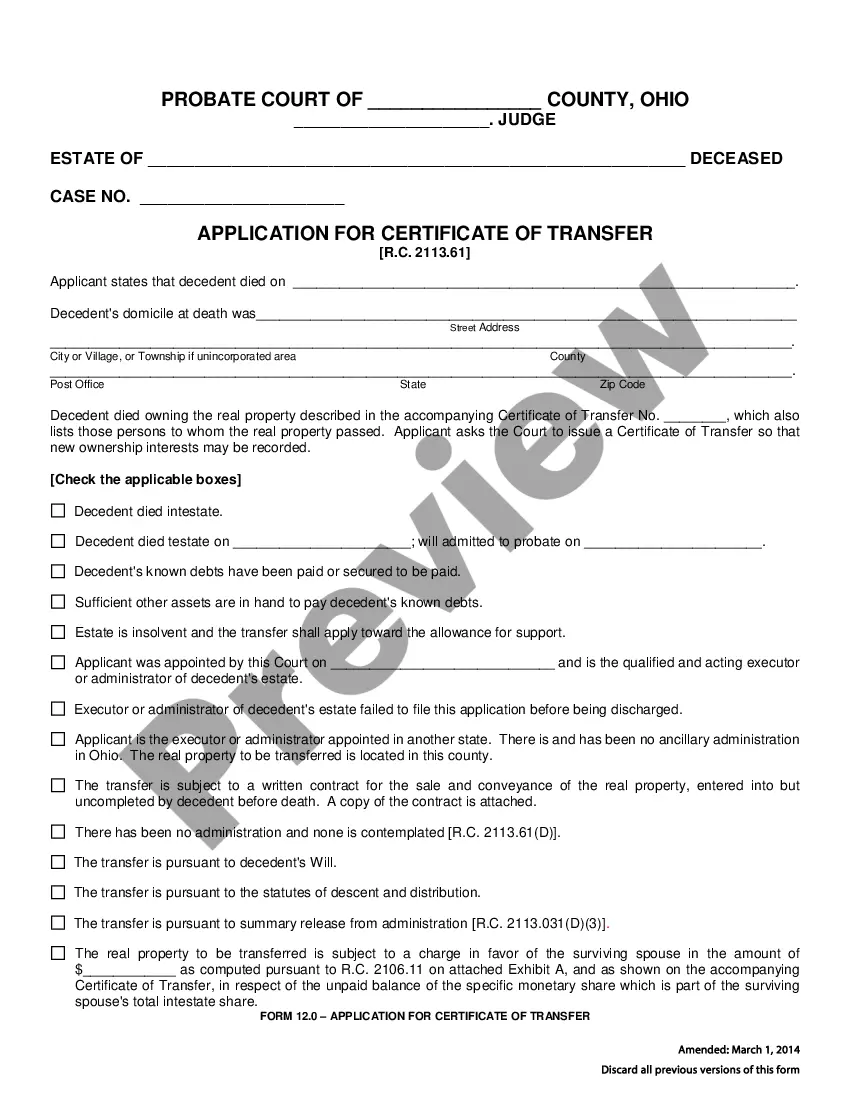

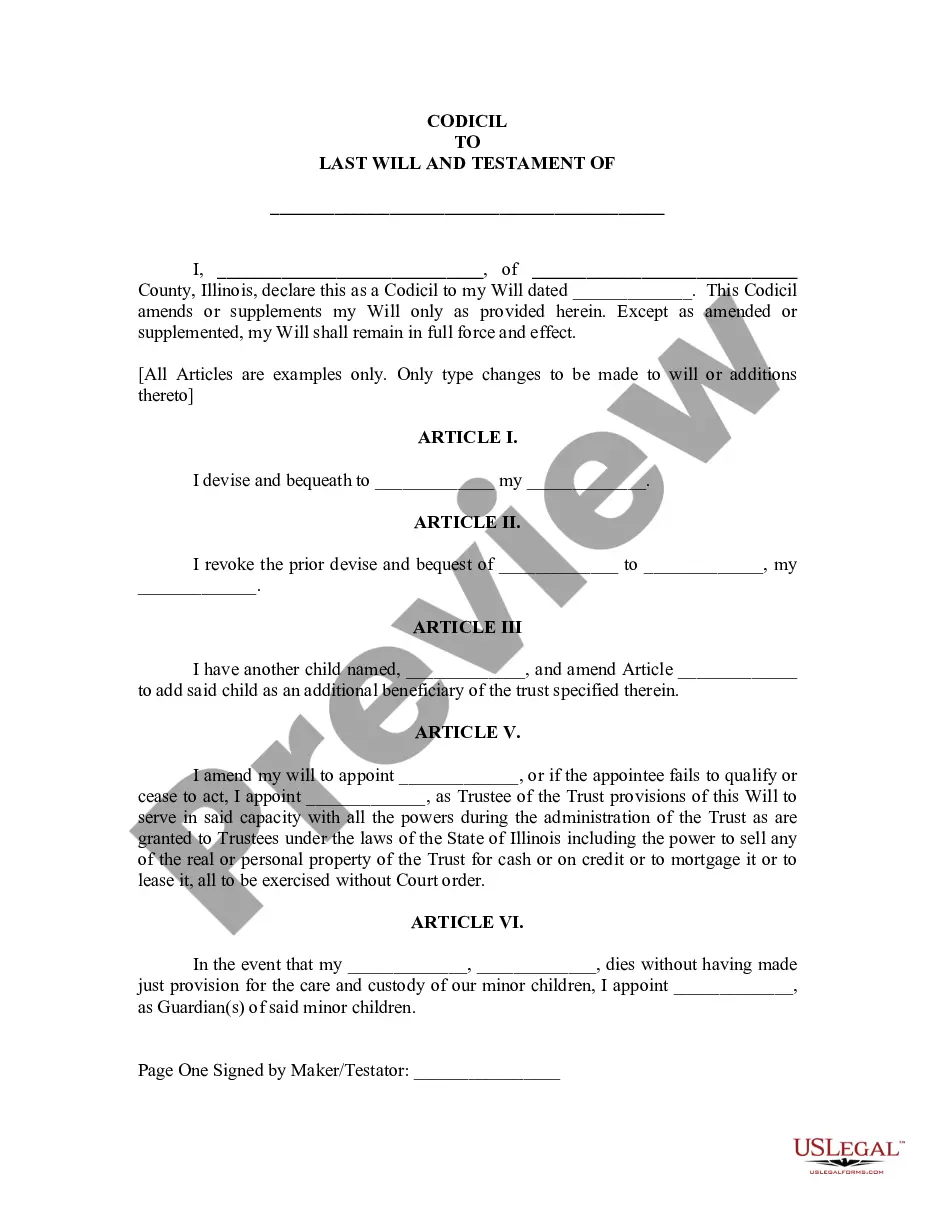

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the right form.

- If the form does not match your requirements, use the Search field to find the form that fits your needs.

Form popularity

FAQ

An Investment Management Agreement, often referred to as an IMA, is a contract that outlines the relationship between an investor and an investment manager. This document specifies the terms, responsibilities, and investment strategies that the manager will follow on behalf of the investor. If you are looking for a tailored approach, a Connecticut Private Client General Asset Management Agreement can help create a framework that fits your unique financial goals. Utilizing services from platforms like uslegalforms can streamline the process, ensuring your interests are well protected.

You can file an LLC in Connecticut without an operating agreement, although it is not recommended. Without this document, your business may lack clear governance, increasing the risk of disputes among members. Moreover, operating without an agreement can complicate decision-making processes. To protect your interests, use the Connecticut Private Client General Asset Management Agreement as part of your filing process.

Yes, you can draft your own operating agreement for your LLC. However, it is vital to ensure that the document complies with Connecticut laws and adequately addresses your business's specific needs. A poorly written agreement can lead to misunderstandings or legal issues down the line. Consider utilizing the Connecticut Private Client General Asset Management Agreement as a guideline to create a comprehensive and effective document.

An asset management agreement is a contract between a client and an asset manager outlining the management of investment assets. It typically specifies the client's financial goals, strategies for investing, and the responsibilities of the asset manager. This agreement is crucial for ensuring that both parties understand their roles and expectations. Integrate the Connecticut Private Client General Asset Management Agreement to address your unique asset management needs.

While an operating agreement is not legally required in Connecticut, it is an essential tool for LLCs. It helps define rights, responsibilities, and management roles among members. Without this agreement, you may face challenges in resolving conflicts or addressing issues in your business. Using resources like the Connecticut Private Client General Asset Management Agreement can simplify the process and enhance your LLC's stability.

Connecticut law does not mandate that LLCs have an operating agreement. However, having one is highly advisable as it outlines the management structure and operating procedures of your business. A well-crafted document can provide clarity and help prevent disputes among members. Consider using the Connecticut Private Client General Asset Management Agreement to ensure your agreement meets legal standards.

A hedge clause in Connecticut law provides specific protections within a legal agreement, particularly concerning potential risks. In the context of a Connecticut Private Client General Asset Management Agreement, this clause can safeguard both clients and asset managers from unforeseen market shifts. By clearly defining the limits of liability, a hedge clause facilitates a more secure investment environment. Understanding this clause helps clients make informed decisions regarding their asset management.

The purpose of a management agreement is to outline the responsibilities and expectations between a client and a management firm. In a Connecticut Private Client General Asset Management Agreement, this document serves to clarify investment strategies, fees, and performance metrics. By establishing these terms, both parties can work together towards mutual financial goals. Having a well-structured management agreement enhances transparency and trust.