Connecticut Sample Letter for Insufficient Amount to Reinstate Loan

Description

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

It is feasible to dedicate hours on the Web attempting to locate the valid document template that meets the state and federal standards you need.

US Legal Forms offers a vast array of valid forms that are reviewed by experts.

It is easy to obtain or print the Connecticut Sample Letter for Insufficient Amount to Reinstate Loan from my services.

Once you have found the format you want, click on Purchase now to proceed. Select the pricing plan you desire, enter your details, and register for a US Legal Forms account. Complete the transaction. You may use your Visa, MasterCard, or PayPal account to purchase the valid form. Select the format of the document and download it to your device. Make modifications to your document if needed. You can complete, edit, sign, and print the Connecticut Sample Letter for Insufficient Amount to Reinstate Loan. Obtain and print a vast number of document templates using the US Legal Forms website, which provides the largest assortment of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can sign in and then click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Connecticut Sample Letter for Insufficient Amount to Reinstate Loan.

- Every valid document format you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

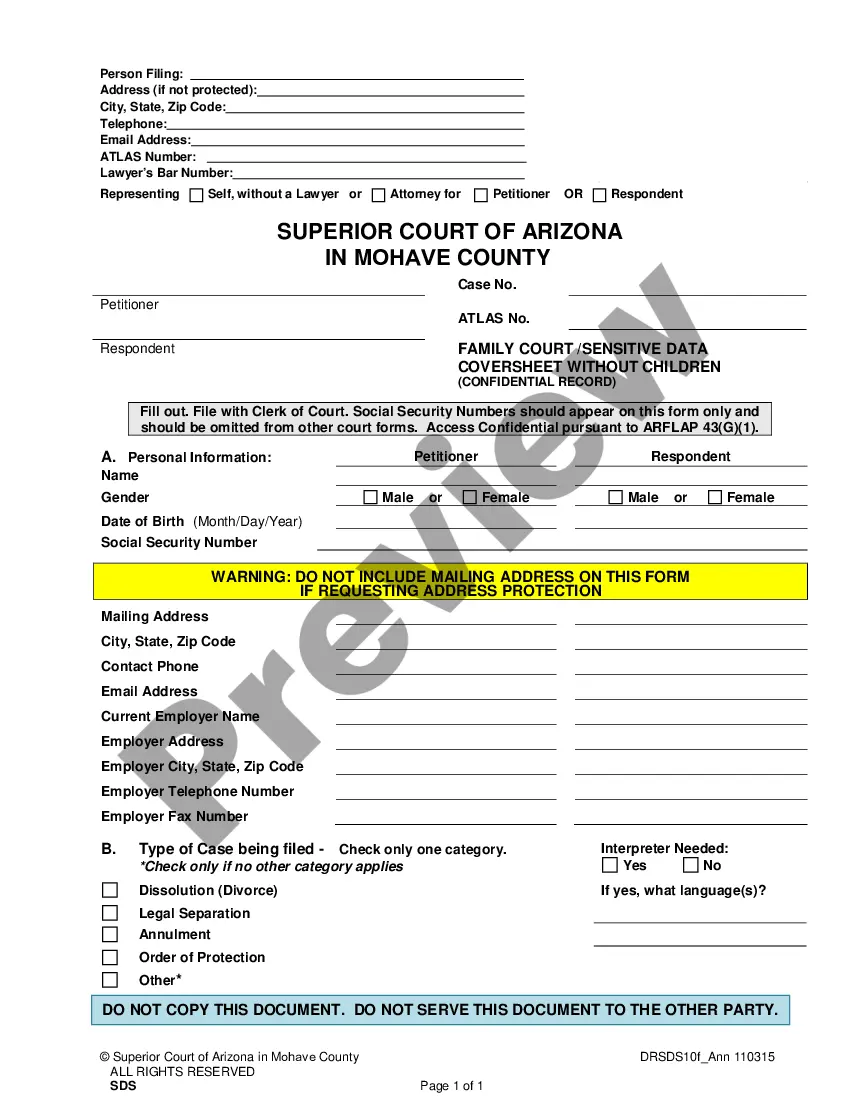

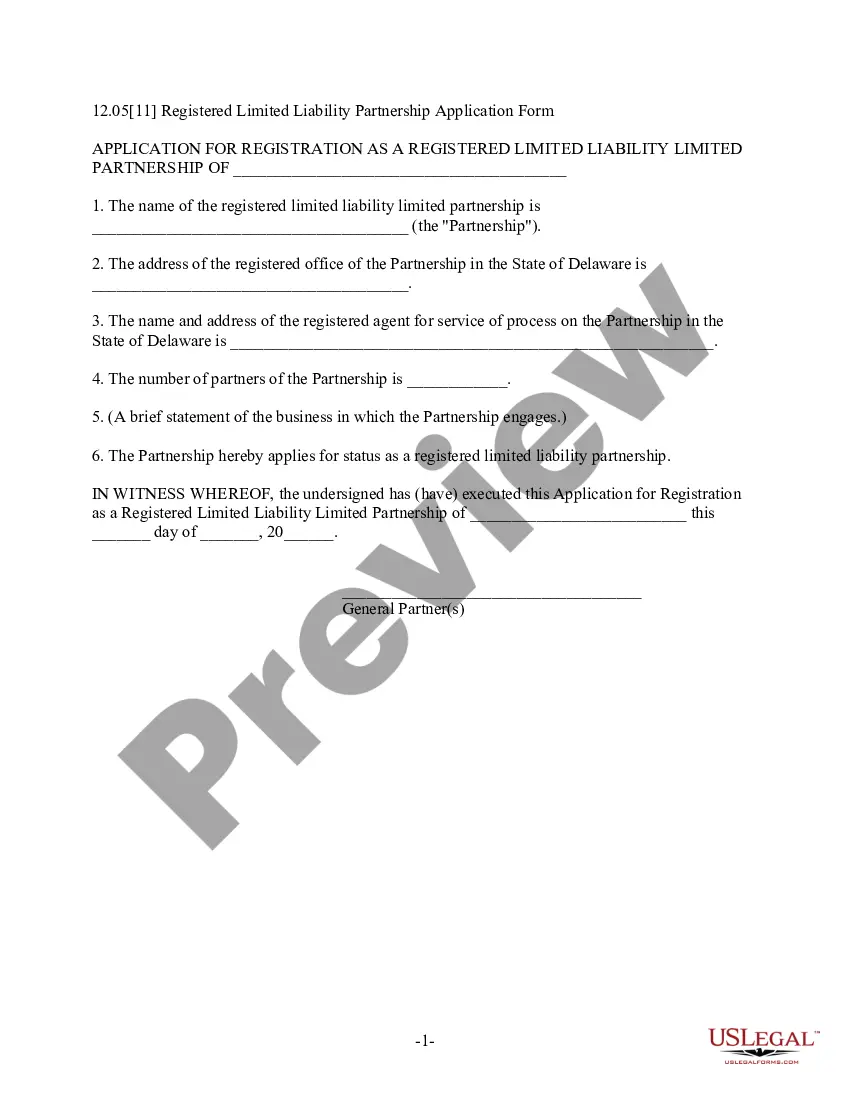

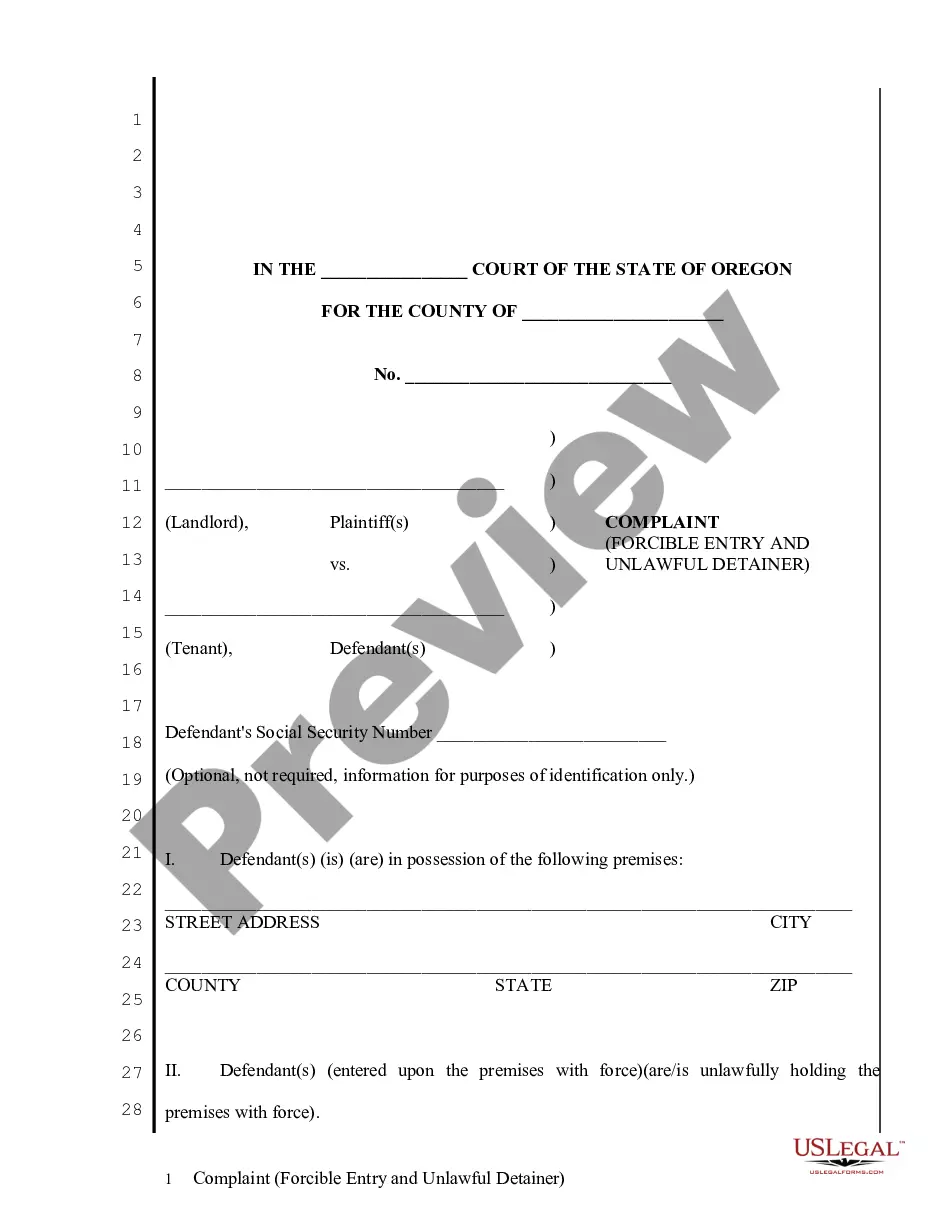

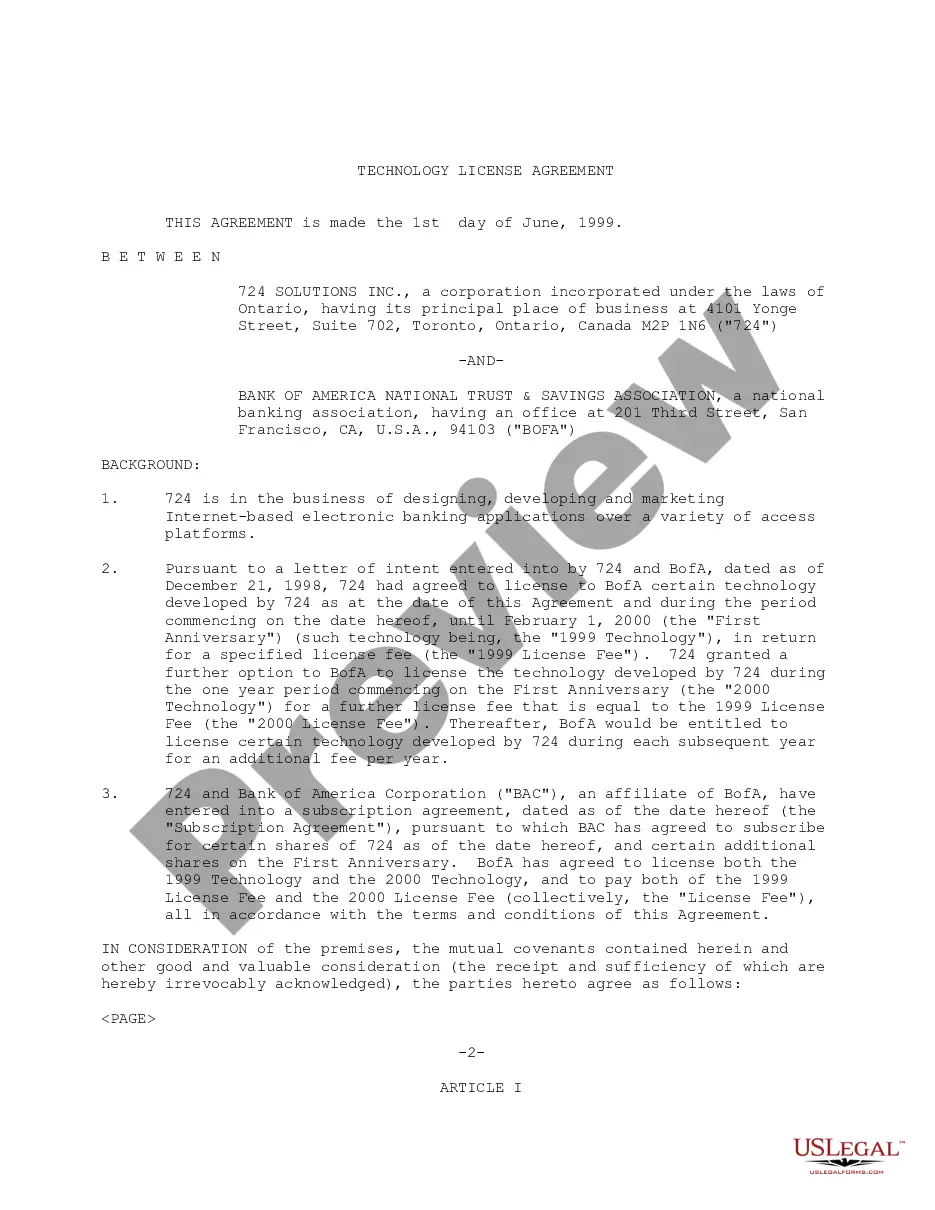

- First, ensure that you have selected the appropriate document format for your county/city of choice. Review the form description to confirm you have chosen the right form.

- If available, use the Review button to examine the document format as well.

- To find an additional variation of the form, utilize the Search area to identify the format that suits your needs and preferences.

Form popularity

FAQ

When writing a hardship letter to a creditor, start with a polite greeting and state your intention clearly. Explain your financial challenges in a brief and honest way, providing any supporting documents if necessary. Lastly, propose a reasonable solution or request a temporary adjustment. Using a Connecticut Sample Letter for Insufficient Amount to Reinstate Loan can streamline this process and ensure you cover all essential points.

Reinstating a house means bringing a mortgage back into good standing after it has fallen behind on payments. This process usually involves paying off the overdue amounts and any associated fees. Once reinstated, you can continue making regular mortgage payments and maintain ownership of the property. Utilizing a Connecticut Sample Letter for Insufficient Amount to Reinstate Loan can help communicate your intent to reinstate your loan effectively.

To write a successful hardship letter, begin by clearly explaining your situation. Describe the reasons behind your financial difficulties in a straightforward manner. Include any relevant details that may support your case, such as loss of income or unexpected expenses. If you need assistance, consider using a Connecticut Sample Letter for Insufficient Amount to Reinstate Loan as a guide.

To reinstate a loan, you must first find out the amount needed to bring the loan current. You can get this information by requesting a "reinstatement quote" or "reinstatement letter" from the loan servicer.

Reinstating your mortgage before the foreclosure process is something that many lenders are agreeable to. With that, many lenders are happy to accept a reinstatement arrangement. If you fall behind on your mortgage payment, reach out to your lender for a reinstatement quote.

Who Can Get a Mortgage Loan Modification?Long-term illness or disability.Death of a family member (and loss of their income)Natural or declared disaster.Uninsured loss of property.Sudden increase in housing costs, including hikes in property taxes or homeowner association fees.Divorce.

You may be able to reinstate the loan by catching up on payments. However, you will need to repay all past due bills, including late fees and the costs a lender incurs from repossession.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

The deadline for reinstating your loan is 90 days after you were served with a foreclosure notice. By this deadline, you will be required to make up the missed payments and pay other fees and expenses.