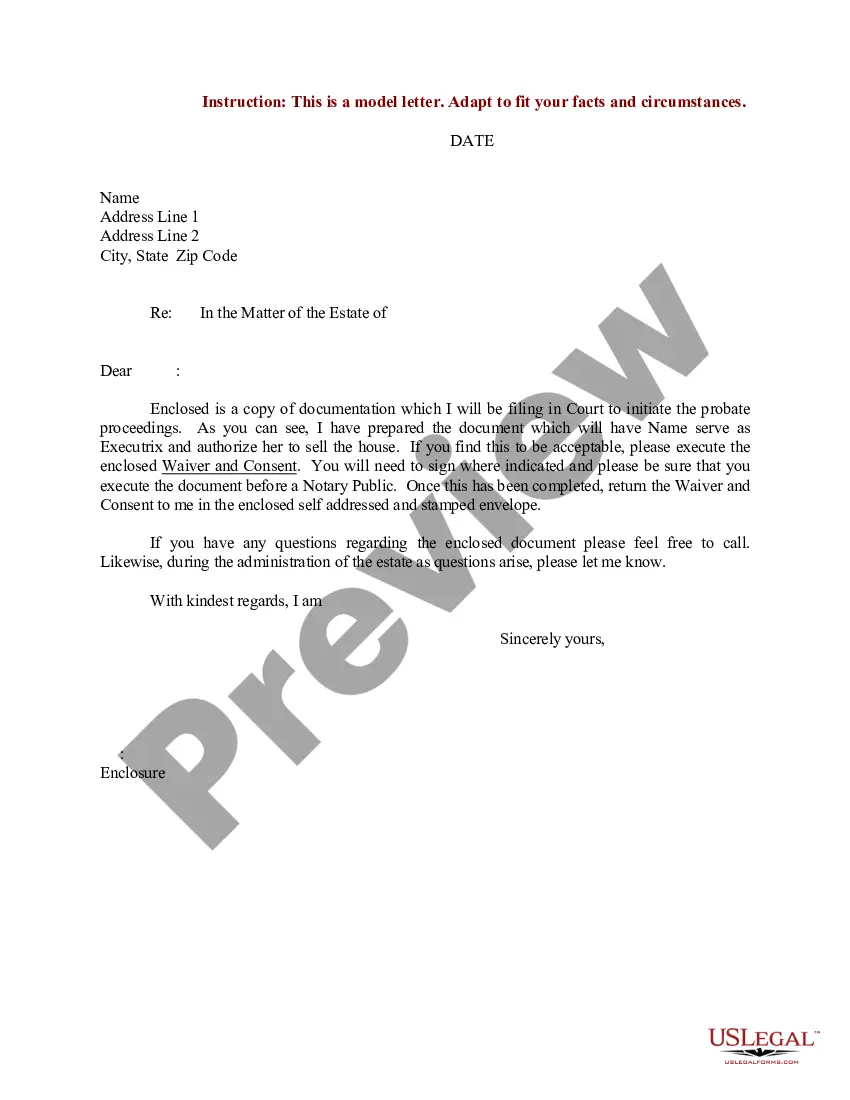

Connecticut Sample Letter for Estate Administration

Description

How to fill out Sample Letter For Estate Administration?

US Legal Forms - one of several biggest libraries of legal kinds in the USA - gives a variety of legal document themes you are able to down load or produce. Utilizing the web site, you can get 1000s of kinds for business and specific functions, categorized by types, claims, or keywords and phrases.You can get the most up-to-date models of kinds such as the Connecticut Sample Letter for Estate Administration in seconds.

If you already have a registration, log in and down load Connecticut Sample Letter for Estate Administration through the US Legal Forms local library. The Acquire key will show up on each type you view. You have access to all previously downloaded kinds within the My Forms tab of your respective account.

In order to use US Legal Forms initially, listed here are easy instructions to help you started out:

- Be sure you have chosen the best type for the area/region. Go through the Preview key to review the form`s information. Browse the type explanation to actually have chosen the appropriate type.

- If the type does not suit your specifications, take advantage of the Lookup area on top of the screen to find the one who does.

- In case you are satisfied with the form, validate your option by clicking the Buy now key. Then, choose the costs program you like and offer your qualifications to register for the account.

- Method the transaction. Make use of your bank card or PayPal account to finish the transaction.

- Find the file format and down load the form on your product.

- Make alterations. Load, edit and produce and signal the downloaded Connecticut Sample Letter for Estate Administration.

Every design you included in your account lacks an expiry date and is also the one you have permanently. So, in order to down load or produce another backup, just visit the My Forms portion and click in the type you want.

Gain access to the Connecticut Sample Letter for Estate Administration with US Legal Forms, one of the most considerable local library of legal document themes. Use 1000s of professional and status-certain themes that meet up with your business or specific needs and specifications.

Form popularity

FAQ

The final accounting shows all activity that occurred in the estate, starting with the value of the inventory (the value of all solely-owned assets on the decedent's date of death), showing all bills and expenses that were paid, and listing a proposed distribution of the remaining assets in the probate estate.

An executor of a deceased person's estate typically has to show an accounting of the estate to the beneficiaries and heirs unless the beneficiaries and heirs waive their privilege. The accounting is a way to prove the executor settled the estate legally and as the deceased intended.

1) A petitioner filing a PC-212, Affidavit in Lieu of Probate of Will/Administration, may use this form to request an order of distribution if (a) assets exceed expenses and claims or (b) a person who paid expenses or claims waives reimbursement for payment of the expense or claim.

Full "probate" is ONLY required by law if the person who dies, with or without a will, (1) owned real estate (not just a life use) that does not pass by the deed to the "surviving" joint owner, OR (2) owned $40,000 or more of other assets that also don't pass by beneficiary or joint ownership to another person.

An executor must account to the residuary beneficiaries named in the Will (and sometimes to others) for all the assets of the estate, including all receipts and disbursements occurring over the course of administration.

Can your executor take money from the estate? The executor is not the owner of the estate, meaning they do not have rights to the assets within the estate. They are however permitted to be paid for their duties. This does not mean they are free to take whatever sum of money they wish from the estate account.

A Letter of Appointment of Executor helps prove you have been put in charge of someone's estate after they have passed away. As Executor, you've been given the duty to manage the estate and carry out the directions of the will; however, a court may require official documentation.

If you're wondering whether an executor can override a beneficiary, you're asking the wrong question. An executor can't override what's in a Will.