Connecticut Irrevocable Trust Agreement Setting up Special Needs Trust for Benefit of Multiple Children

Description

How to fill out Irrevocable Trust Agreement Setting Up Special Needs Trust For Benefit Of Multiple Children?

Should you desire to be thorough, procure, or obtain official document templates, rely on US Legal Forms, the largest collection of legal documents available online. Take advantage of the site's user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords. Use US Legal Forms to access the Connecticut Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children in just a few clicks.

If you are already a US Legal Forms member, Log Into your account and select the Download option to locate the Connecticut Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children. You can also find documents you have previously obtained in the My documents section of your account.

Every legal document template you obtain is yours to keep indefinitely. You have access to each document you have acquired within your account. Click the My documents tab and select a document to print or download again.

Engage and obtain, and print the Connecticut Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

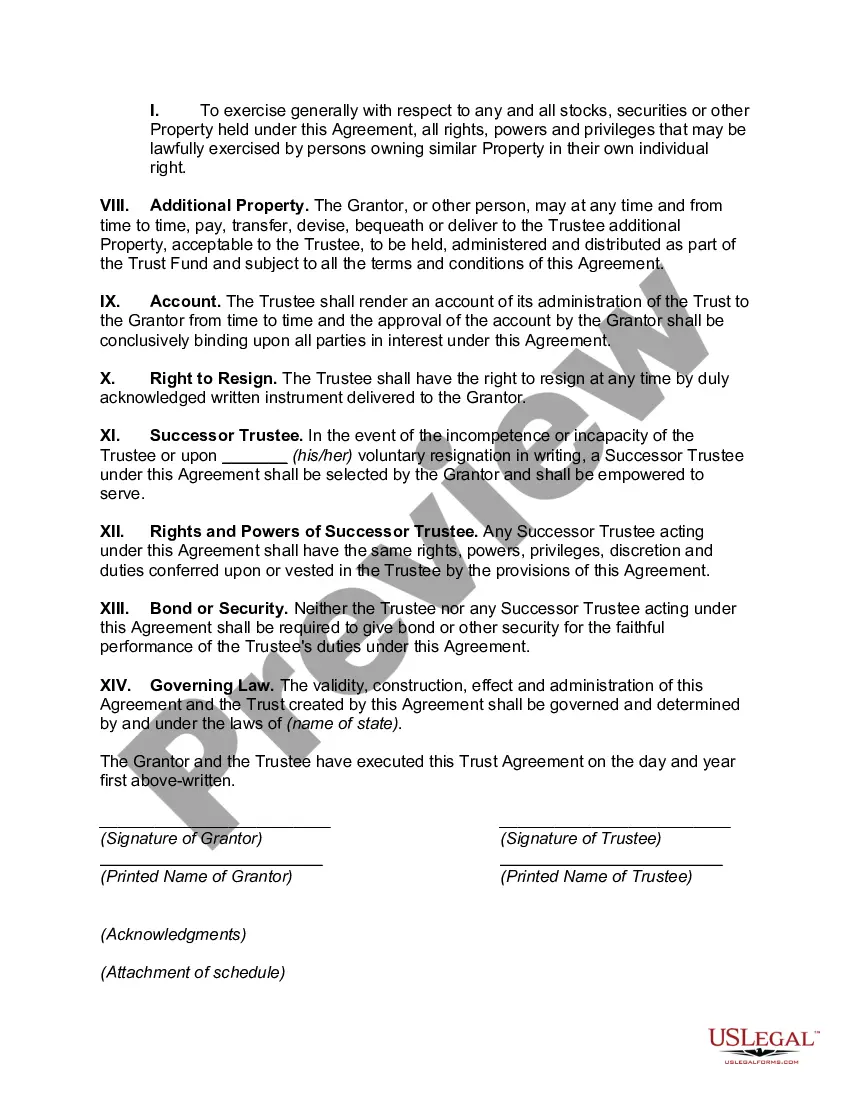

- Step 1. Ensure that you have chosen the form for the correct city/region.

- Step 2. Use the Preview option to review the contents of the form. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the page to find alternative types of your legal document format.

- Step 4. Once you have found the form you need, select the Purchase Immediately option. Choose your preferred pricing plan and enter your details to create an account.

- Step 5. Complete the payment process. You may use your credit card or PayPal account for the transaction.

- Step 6. Download your legal document format and save it to your device.

- Step 7. Fill out, modify, and print or sign the Connecticut Irrevocable Trust Agreement Establishing Special Needs Trust for the Benefit of Multiple Children.

Form popularity

FAQ

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.

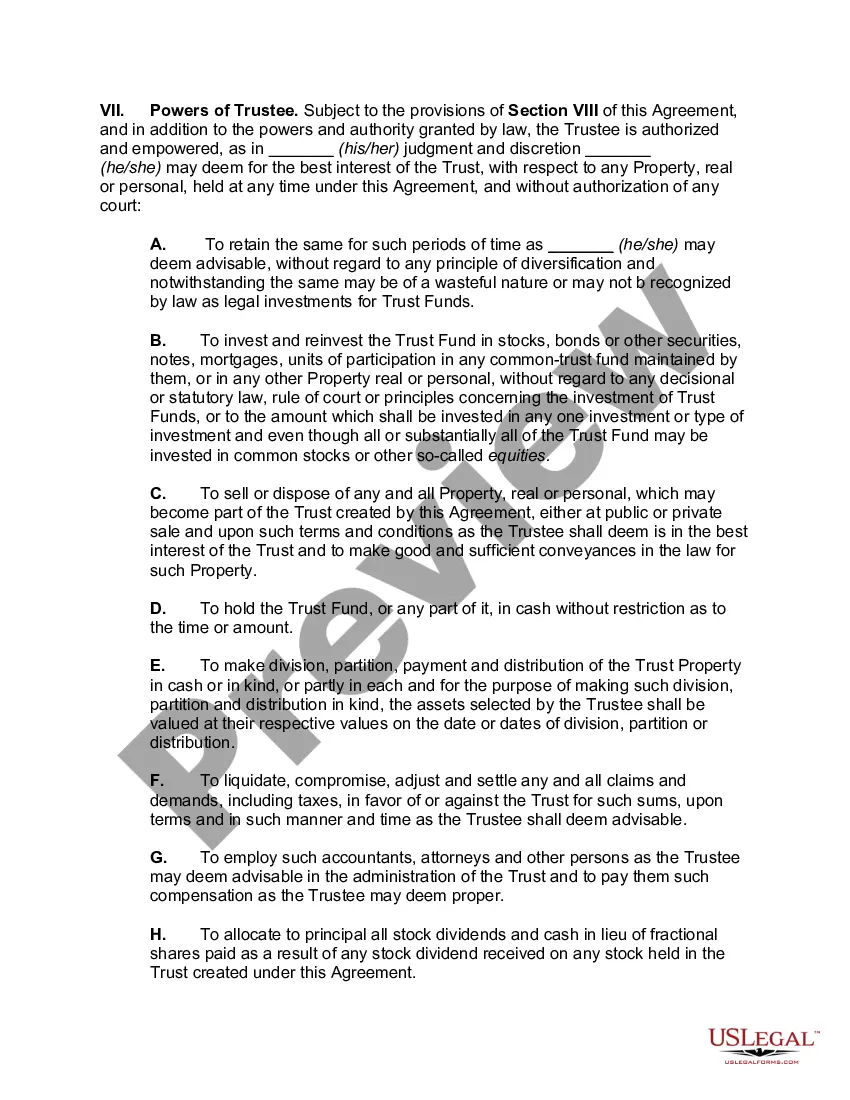

An irrevocable trust is a trust that can't be amended or modified. However, like any other trust an irrevocable trust can have multiple beneficiaries. The Internal Revenue Service allows irrevocable trusts to be created as grantor, simple or complex trusts.

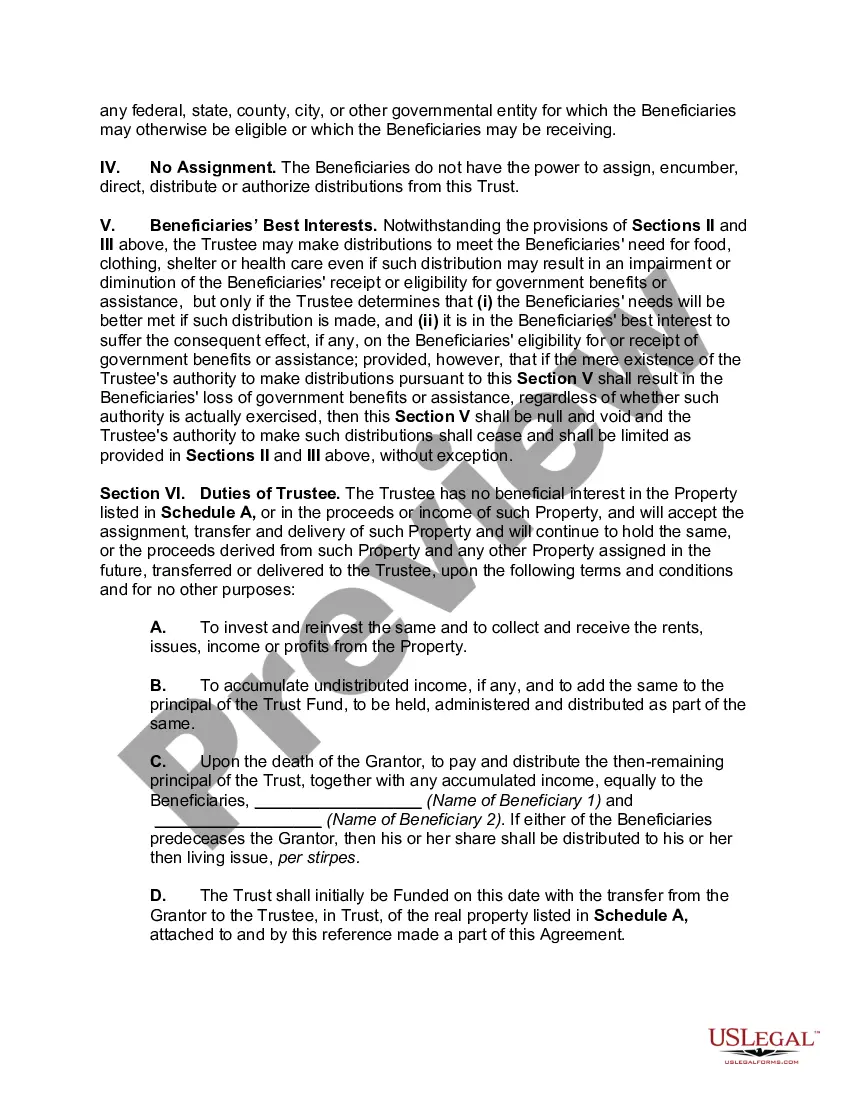

How to set up a special needs trustThink about your wishes for your loved one. This is one of the most important steps, as it determines how funds will be distributed.Choose trustees. A trustee will help manage, invest and disburse funds for your loved one, so choose wisely.Create your trust.Fund it.Invest your funds.

Primary Beneficiary vs.A living trust can have both primary beneficiaries and contingent beneficiaries. This is true both for a single-grantor trust and a joint living trust, a common option for spouses as it allows for multiple grantors.

Yes, there is no limit to the number of POD beneficiaries allowed on an account. Each POD beneficiary will receive an equal share of the assets in an account at the time of the passing of the last owner on the account. For example, if there are 4 POD beneficiaries, each will receive 25% of the funds.

All these elements are important to address and start preparing the trust.Estimate the Funds Required For Special Needs Care. One of the major considerations while setting up a trust us to identify the fund's trust will require.Preparing the Trust Deed.Registering the Trust Deed.

Trusts can have more than one beneficiary and they commonly do. In cases of multiple beneficiaries, the beneficiaries may hold concurrent interests or successive interests.

A primary beneficiary is an individual or organization who is first in line to receive benefits in a will, trust, retirement account, life insurance policy, or annuity upon the account or trust holder's death. An individual can name multiple primary beneficiaries and stipulate how distributions would be allocated.

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

Trusts can have more than one beneficiary and they commonly do. In cases of multiple beneficiaries, the beneficiaries may hold concurrent interests or successive interests.