Connecticut Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose

Description

How to fill out Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement Of Purpose?

If you require complete, download, or create valid file templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s user-friendly and straightforward search to find the documents you need.

Various templates for commercial and personal purposes are sorted by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Connecticut Bylaw Provision For Securing Federal Nonprofit Status Article Restatement of Purpose in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to receive the Connecticut Bylaw Provision For Securing Federal Nonprofit Status Article Restatement of Purpose.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, consult the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

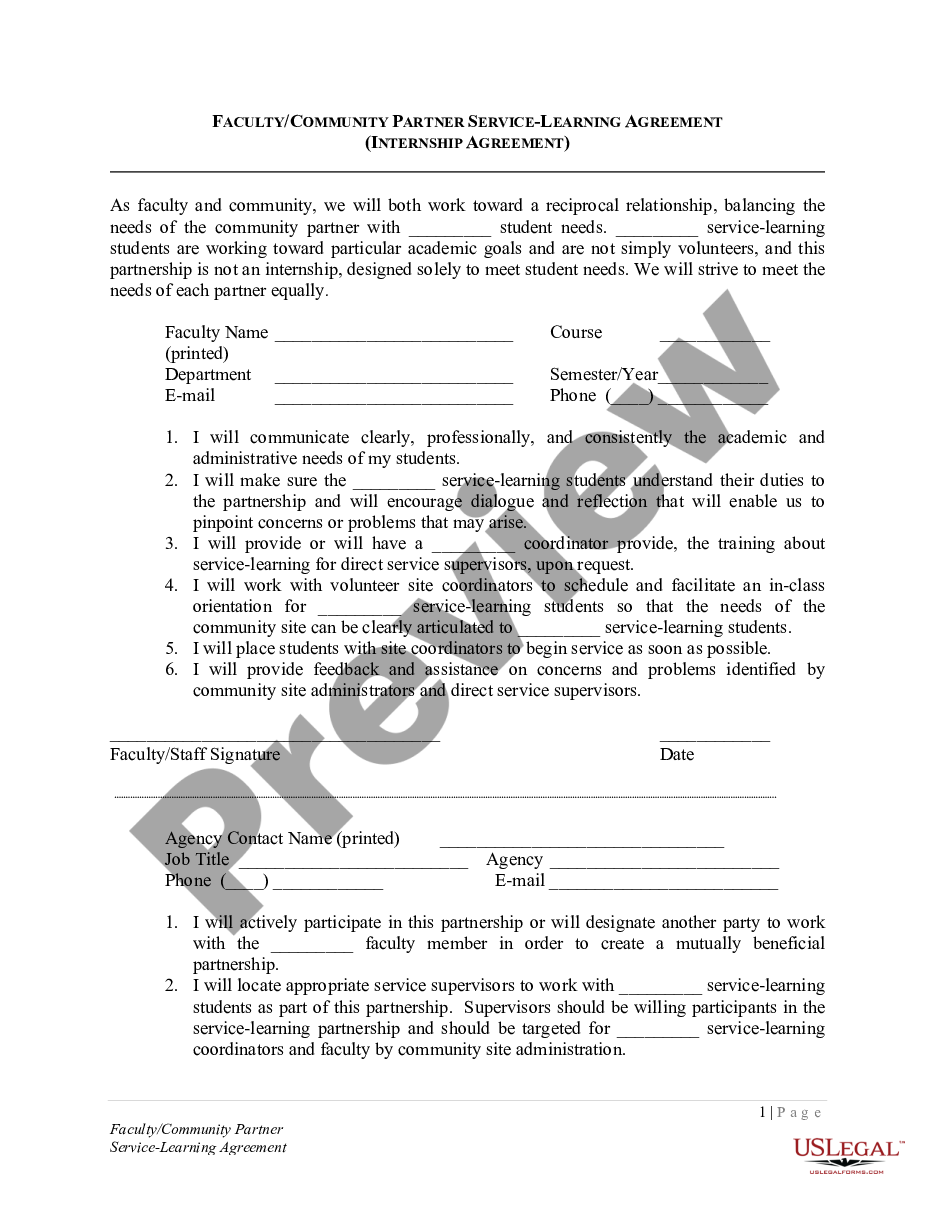

- Step 2. Use the Review option to examine the form’s content. Make sure to read the overview.

- Step 3. If you are not content with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

When writing nonprofit bylaws, begin with a clear outline of your organization’s structure, purpose, and governance. Make sure to cover key elements such as membership, board composition, and meeting procedures, following the Connecticut Bylaw Provision For Obtaining Federal Nonprofit Status Article Restatement of Purpose. Use straightforward language to ensure clarity and compliance. Additionally, consider using resources from platforms like US Legal Forms to access templates and examples that can help shape your bylaws effectively.

Articles of incorporation are a set of formal documents filed with a government body to legally document the creation of a corporation. Articles of incorporation generally contain pertinent information, such as the firm's name, street address, agent for service of process, and the amount and type of stock to be issued.

Section 501(c)(3) is the portion of the US Internal Revenue Code that allows for federal tax exemption of nonprofit organizations, specifically those that are considered public charities, private foundations or private operating foundations.

Should your organization decide to legally incorporate in order to apply for tax-exemption status through the IRS, you must file your organization's bylaws with your state government. The IRS examines all the legal requirements of a corporation, including bylaws, when determining whether to grant tax-exemption.

What to include in nonprofit bylawsGeneral information. This section should outline some basic information about your nonprofit, including your nonprofit's name and your location.Statements of purpose.Leadership.Membership.Meeting and voting procedures.Conflict of interest policy.Committees.The dissolution process.More items...?

Write a first draft of your bylawsArticle I. Name and purpose of the organization.Article II. Membership.Article III. Officers and decision-making.Article IV. General, special, and annual meetings.Article V. Board of Directors.

When you incorporate, your name is registered with the state you operate in and is therefore secured. It limits any personal liability. Members, board members, and director's liability are limited within the clauses of the articles. It adds credibility to your nonprofit.

Bylaws should include, at a minimum, the following:Governance Structure.Control provisions.Director's terms.Officers.Voting procedures.Committees.Conflicts of Interest.Amendments.More items...?

A nonprofit organization is one that qualifies for tax-exempt status by the IRS because its mission and purpose are to further a social cause and provide a public benefit. Nonprofit organizations include hospitals, universities, national charities and foundations. You're invited to join a private network of CEOs.

The primary reasons for incorporation are limited liability protection of the directors, credibility, and tax purposes. Without forming a legal entity, the members' and directors' personal assets (home, retirement savings2026 everything) are at risk in a lawsuit.