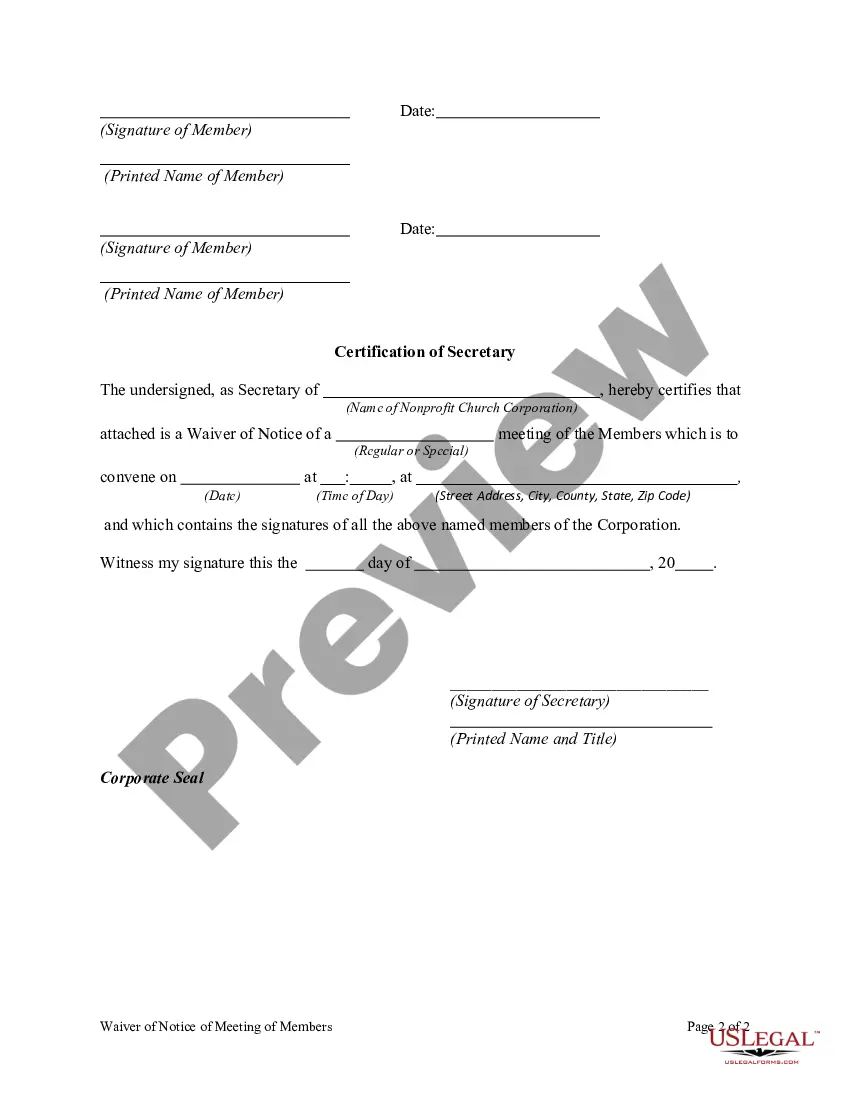

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Connecticut Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

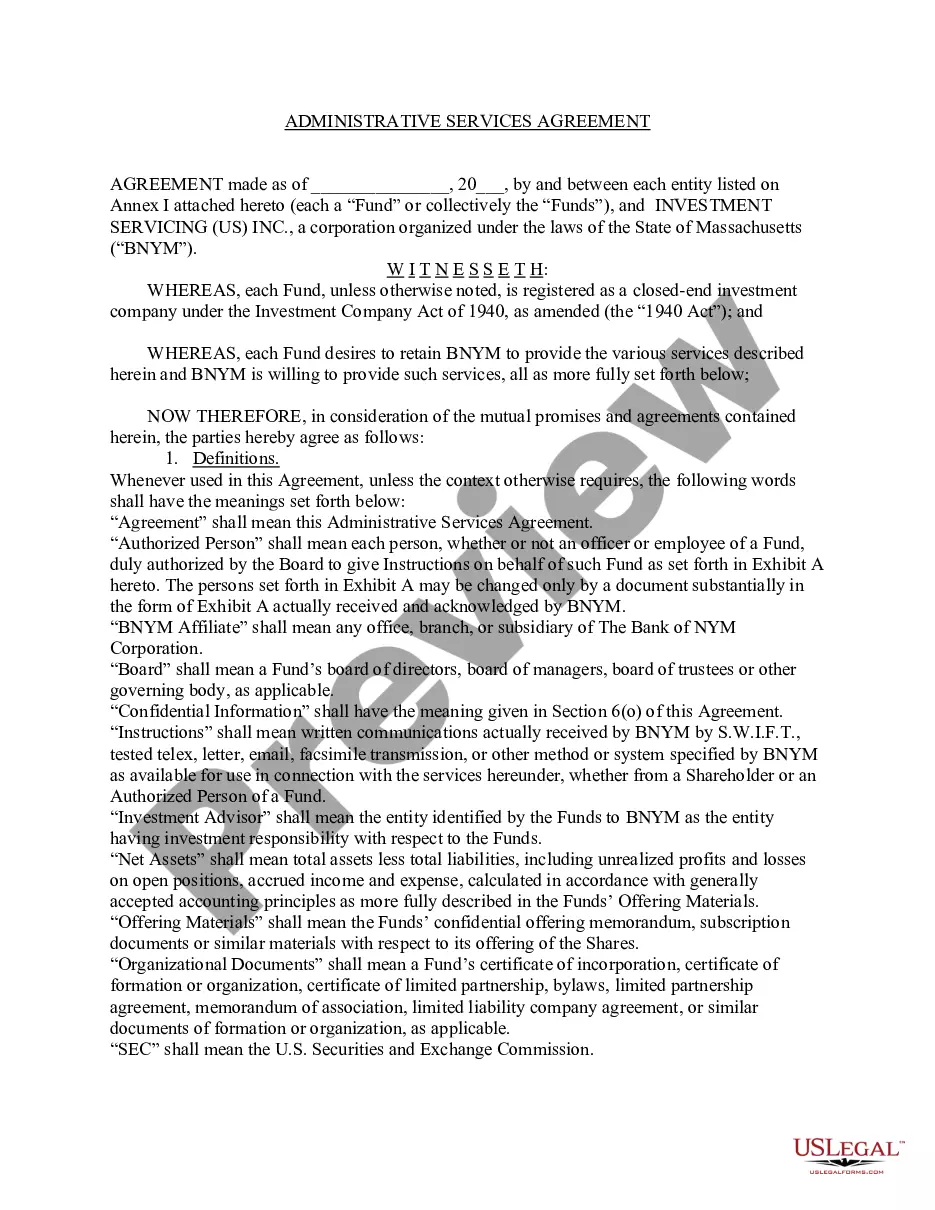

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print. Through the website, you can access thousands of forms for both business and personal uses, categorized by types, states, or keywords.

You can find the most recent forms such as the Connecticut Waiver of Notice of Meeting of members of a Nonprofit Church Corporation in just minutes.

If you already have a monthly subscription, Log In and download the Connecticut Waiver of Notice of Meeting of members of a Nonprofit Church Corporation from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Fill in, revise, print, and sign the saved Connecticut Waiver of Notice of Meeting of members of a Nonprofit Church Corporation. Each template you add to your account has no expiration date and belongs to you permanently. Therefore, if you want to download or print another copy, just visit the My documents section and click on the form you need. Gain access to the Connecticut Waiver of Notice of Meeting of members of a Nonprofit Church Corporation with US Legal Forms, the most extensive library of legal document templates. Utilize numerous professional and state-specific templates that fulfill your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your area/state. Click the Review button to examine the form's content.

- Check the form description to confirm that you've chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you want and provide your details to create an account.

Form popularity

FAQ

'Notice of presentation waived' refers to a situation where members of a nonprofit church corporation agree not to receive prior notice for a specific meeting or presentation. This phrase indicates that all members have acknowledged their acceptance of this decision, allowing the meeting to take place without the usual formalities. Understanding this concept is essential when dealing with a Connecticut Waiver of Notice of Meeting of members of a Nonprofit Church Corporation.

The Board of Directors is the collective boss of the CEO/Executive Director of a non-profit corporation.

The keys to avoiding conflicts of interest are having statements and policies for managing them and creating awareness for potential conflicts. Because of the negative consequences to the organization, each board member has a responsibility to identify and address potential conflicts.

Your board of directors is the primary decision maker for your nonprofit and is responsible for overseeing its management. As a result, your board should approve any decision involving significant financial, legal, or tax issues, or any major program-related matter.

Generally, the D role is held by one person. But a board of directors in which each member has voting power can be a collective D as well.

2. Can my board of directors contain family members? Yes, but be aware that the IRS encourages specific governance practices for 501(c)(3) board composition. In general, having related board members is not expressly prohibited.

What to Include in a Conflict of Interest PolicyA statement about an individual's duty to disclose any conflicts of interest.The process for reviewing potential conflicts of interest.Details about disciplinary actions for violating the policy.More items...?

The executive director hires, supervises, and motivates the staff of the nonprofit. (2) Development and Management of Policies and Programs. The executive director works with the staff to develop policies to guide the organization and programs to fulfill its charitable purpose.

Q: Can any or all of the nonprofit's board members live out of state? A: While not required by federal law, many states have residency requirements for a corporation's board members. No states require that all board members live in the state of incorporation, only the registered agent is required to live in-state.

A conflict of interest is signified by someone who has competing interests or loyalties. An individual that has two relationships that might compete with each other for the person's loyalties is also considered a conflict of interest.