Connecticut Self-Assessment Worksheet

Description

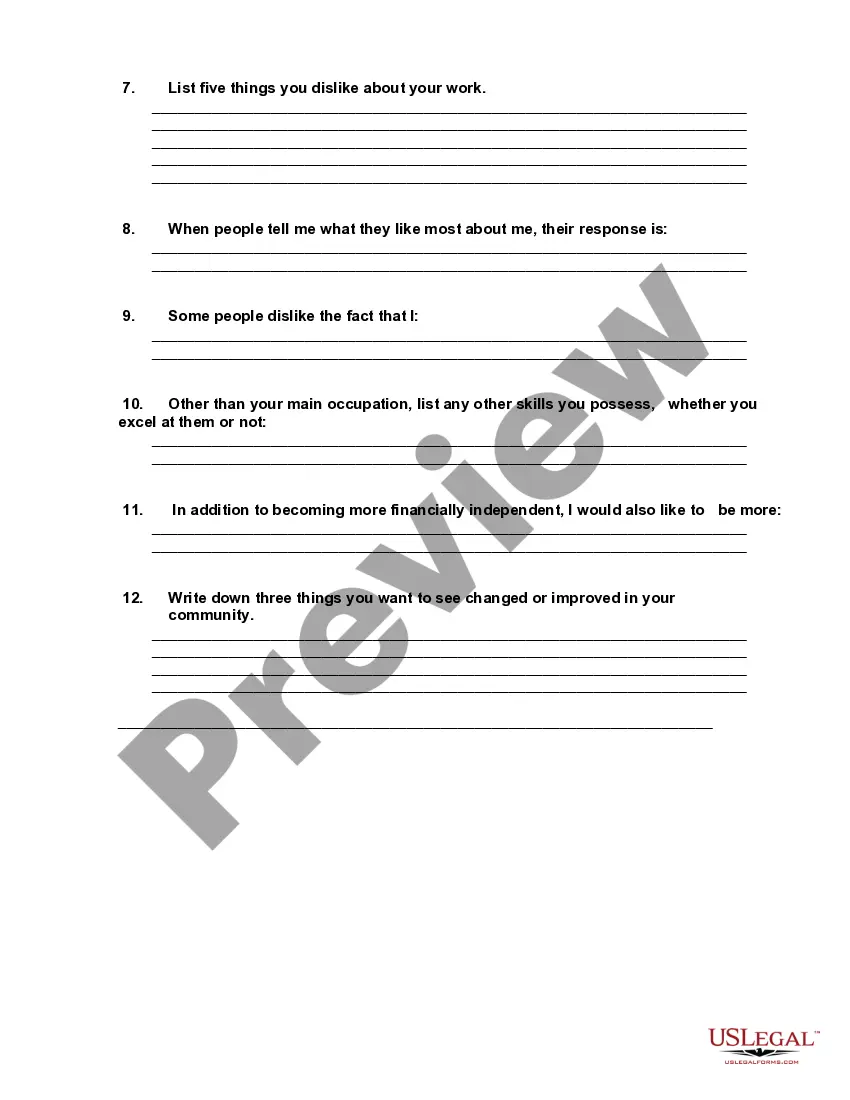

How to fill out Self-Assessment Worksheet?

Selecting the optimal licensed document template may be challenging. Of course, there are many designs available online, but how do you find the legal form you require? Utilize the US Legal Forms website. The platform provides thousands of templates, including the Connecticut Self-Evaluation Worksheet, suitable for both professional and personal uses. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to acquire the Connecticut Self-Evaluation Worksheet. Use your account to browse the legal documents you have previously purchased. Visit the My Documents section of your account to get another copy of the file you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your locality. You can view the form using the Preview button and read the form description to confirm it suits your needs. If the form does not meet your requirements, use the Search field to locate the appropriate form. Once you are confident that the form is suitable, click the Download now button to obtain the form. Choose the pricing package you want and enter the necessary information. Create your account and complete the transaction using your PayPal account or Visa or Mastercard. Select the document format and download the legal document template to your device.

- Ensure you have selected the right form for your location.

- Check the form using the Preview button.

- Review the form description to confirm it suits your needs.

- Use the Search field to find the correct form if needed.

- Click the Download now button once you are sure the form is appropriate.

- Proceed with payment options to purchase your documents.

Form popularity

FAQ

assessment worksheet is a tool that helps taxpayers summarize their income and deductions. The Connecticut SelfAssessment Worksheet provides a structured way to collect and organize necessary information for filing your taxes. This worksheet not only simplifies the preparation process but also ensures you don't miss any important details.

You can use the HMRC online service to file your company, charity or association's: Company Tax Return (CT600) for Corporation Tax. supplementary return pages CT600A, CT600E and CT600J.

Generally, the amount subject to self-employment tax is 92.35% of your net earnings from self-employment. You calculate net earnings by subtracting ordinary and necessary trade or business expenses from the gross income you derived from your trade or business.

In most cases you do need to attach accounts to your CT600. For exceptions, see below. You can attach accounts in two formats: iXBRL for most companies.

Despite the term 'self-assessment' you don't have to do it yourself, as you can hire an accountant to do it for you. An accountant is almost more likely to complete it accurately and minimise the tax you have to pay.

Self-assessment tax is to be calculated by subtracting all available tax credits, that is advance tax, TDS, MAT/AMT, TCS, credit, and relief existing under section 87A/90/90A/91. The taxpayer is required to give self-assessment tax along with the interest and payment if any has been levied.

CT600 form: what you need to fill inCompany information (boxes 1-4): basic company details.About this return (boxes 30-35): state the accounting period the return relates to.About this return (boxes 80-85): tick the box to say whether the accounts are for the period you've stated, or a different period.More items...

To calculate the real rate of return after tax, divide 1 plus the after-tax return by 1 plus the inflation rate. Dividing by inflation reflects the fact a dollar in hand today is worth more than a dollar in hand tomorrow.

How to get startedFind your company, using either company name or number, with our realtime company look up.Enter your accounting period start date.Select whether your Limited Company is a Small or Micro entity (there is a help to aid your choice)Select to file a CT600 along with IXBRL accounts.More items...?

The short answer is yes, you can do your return yourself. There is no legal or IRS requirement that business owners hire a tax professional to prepare their returns. That said, most business owners prefer to get tax pros to do their tax returns.