Connecticut Software Consulting Agreement

Description

How to fill out Software Consulting Agreement?

Are you currently in a situation where you require documents for either business or personal reasons almost every single day.

There are numerous legal document templates accessible online, but locating those you can rely on is not easy.

US Legal Forms offers thousands of template forms, including the Connecticut Software Consulting Agreement, which can be tailored to meet state and federal requirements.

Once you find the appropriate form, click on Buy now.

Choose the pricing plan you prefer, provide the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Connecticut Software Consulting Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct municipality or county.

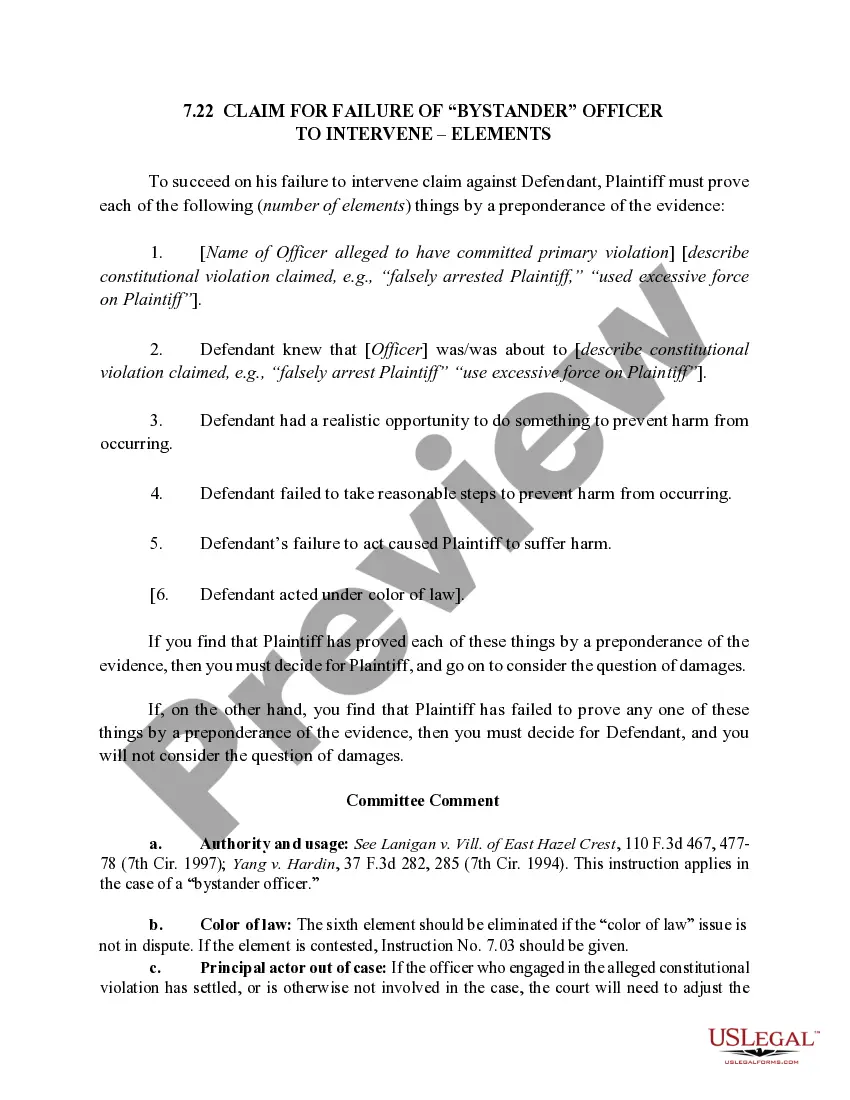

- Use the Review button to evaluate the document.

- Look over the description to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the document that suits your needs.

Form popularity

FAQ

Professional services are not subject to sales tax in the state of California.

Sales of canned software - delivered on tangible media are subject to sales tax in Connecticut. In the state of Connecticut, so long as no tangible personal property was delivered to the buyer in addition to downloaded software, the software will be taxed at 1% rate applicable to computer and data processing services.

Are services subject to sales tax in Connecticut? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Connecticut, specified services are taxable.

Business Use: Electronically accessed or transferred canned or prewritten software, and any additional content related to such software, that is sold to a business for use by the business remains taxable at the 1% rate as computer and data processing services.

Connecticut law imposes a 6.35% sales tax on all retail sales and certain business and professional services (CGS § 12-408). Business and professional services in Connecticut are presumed to be exempt from the state's sales tax unless specifically identified as taxable by state law.

Tax Structure Business management and consulting services are subject to Connecticut sales and use taxes if the services apply to core business activities or human resource management activities (CGS § 12-407 (a) (37) (J)) and Conn.

Several exemptions are certain types of safety gear, some types of groceries, certain types of clothing, children's car seats, children's bicycle helmets, college textbooks, compact fluorescent light bulbs, most types of medical equipment, and certain motor vehicles.

California: SaaS is not a taxable service. However, software or information that is delivered electronically is exempt. The ability to access software from a remote network or location is exempt. Under California sales and use tax law, there must be a transfer of TPP, in order to have a taxable event.

A consulting contract should offer a detailed description of the duties you will perform and the deliverables you promise the client. The agreement may also explain how much work you will perform at the client's office and how often you will work remotely.

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.