Connecticut Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

Selecting the optimal sanctioned document template can be a challenge. Naturally, there are numerous templates accessible online, but how do you find the sanctioned document you need? Utilize the US Legal Forms website. The service offers thousands of templates, including the Connecticut Reorganization of Partnership by Modification of Partnership Agreement, which can be utilized for business and personal purposes. All of the documents are reviewed by professionals and comply with state and federal regulations.

If you are already a registered user, Log In to your account and click the Download button to obtain the Connecticut Reorganization of Partnership by Modification of Partnership Agreement. Use your account to look through the sanctioned documents you might have previously acquired. Navigate to the My documents tab of your account and get another copy of the document you need.

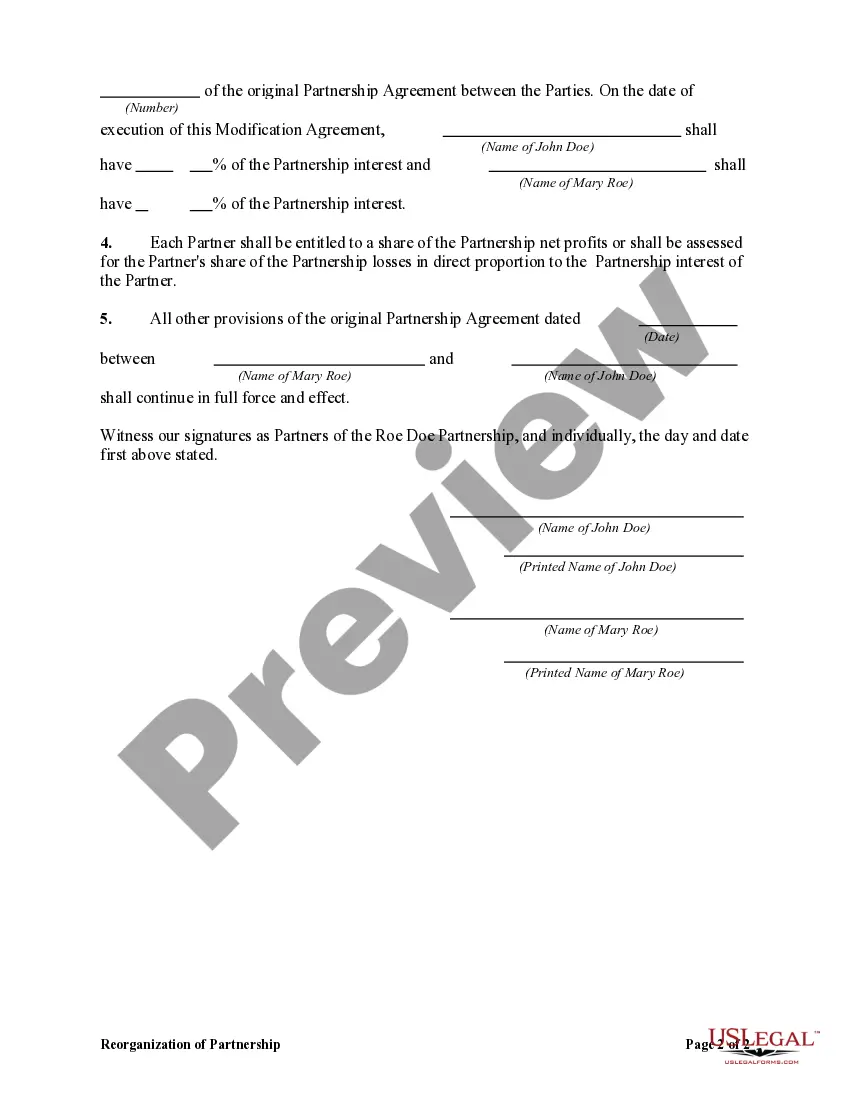

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct document for your city/county. You can preview the form using the Preview button and review the document description to confirm it is appropriate for you.

US Legal Forms is the largest collection of sanctioned documents where you can find a variety of document templates. Utilize the service to obtain professionally crafted papers that meet state regulations.

- If the document does not fulfill your requirements, utilize the Search field to find the correct document.

- Once you are confident that the document is suitable, click the Get now button to obtain the document.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the sanctioned document template to your device.

- Complete, modify, print, and sign the obtained Connecticut Reorganization of Partnership by Modification of Partnership Agreement.

Form popularity

FAQ

A partnership agreement may be voided if it involves illegal activities or is not signed by all partners. Misrepresentation or fraud in the creation of the agreement can also render it void. Understanding the Connecticut Reorganization of Partnership by Modification of Partnership Agreement helps partners ensure that their agreement adheres to legal standards. Consulting legal professionals can help validate the agreement and avoid pitfalls.

A partnership may be terminated through dissolution, withdrawal of a partner, or expiry of the partnership term. Each method has its legal implications, and it is vital to clarify these in your partnership agreement. The Connecticut Reorganization of Partnership by Modification of Partnership Agreement can provide a framework for a well-structured termination process. Ensure your agreement addresses these scenarios to avoid complications.

Yes, a partnership agreement can be amended when all partners agree to the changes. It is essential that the process for amending the agreement is clearly outlined in the original document. Utilizing the Connecticut Reorganization of Partnership by Modification of Partnership Agreement can facilitate necessary changes while maintaining compliance. Engaging legal services or platforms like USLegalForms can provide clarity and assistance in this process.

A partnership agreement becomes legally binding when it meets specific criteria such as mutual consent, a lawful purpose, and consideration exchanged among partners. Clear terms defining each partner's rights and obligations contribute to the binding nature of the agreement. The Connecticut Reorganization of Partnership by Modification of Partnership Agreement emphasizes the importance of clear documentation. For added assurance, consider having the agreement reviewed by a legal professional.

Dissociation of a partnership occurs when a partner withdraws or is expelled from the partnership. This can arise due to retirement, bankruptcy, or breach of the partnership agreement. Understanding the Connecticut Reorganization of Partnership by Modification of Partnership Agreement can help partners address the implications of such dissociation early on. Addressing this topic in your agreement can prevent confusion and ensure a smooth transition.

Creating a partnership agreement involves outlining the roles, responsibilities, and contributions of each partner. Clearly define profit-sharing, decision-making processes, and the mechanism for dispute resolution. When considering the Connecticut Reorganization of Partnership by Modification of Partnership Agreement, ensure the agreement reflects the current needs of your partnership. Utilizing platforms like USLegalForms can provide templates and guidance to draft an effective partnership agreement.

A partnership can be dissolved under various circumstances, such as mutual agreement among partners, bankruptcy, or when a partner withdraws. Additionally, reaching the partnership's term or purpose can trigger dissolution. The Connecticut Reorganization of Partnership by Modification of Partnership Agreement allows partners to clarify dissolution procedures in advance, minimizing disputes. It is advisable to formalize this process in your partnership agreement.

To file a partnership return, you must complete Form 1065, which details the profits and losses of the partnership. All partners should receive a Schedule K-1, summarizing their share of the partnership's income, deductions, and credits. The Connecticut Reorganization of Partnership by Modification of Partnership Agreement can influence how returns are filed, ensuring compliance with state regulations. Consulting with a tax professional can streamline this process.

Recent legislation in Connecticut has introduced notable changes to the pass-through entity tax system, focusing on simplification and fairness. These adjustments aim to ease the tax burdens on partnerships and LLCs, creating a more accommodating environment. As you consider the Connecticut Reorganization of Partnership by Modification of Partnership Agreement, staying informed about these changes can enhance your strategic planning.

Connecticut income tax rates range from 3% to 6.99%, based on your income level. This system applies to both individuals and entities, affecting how incomes are taxed statewide. When you think about the Connecticut Reorganization of Partnership by Modification of Partnership Agreement, it’s important to account for how this tax rate can impact your overall tax burden.