Connecticut Notice of Returned Check

Description

How to fill out Notice Of Returned Check?

It is feasible to spend time online searching for the appropriate legal document template that meets both state and federal standards you require.

US Legal Forms provides thousands of legal documents that have been evaluated by professionals.

You can easily download or print the Connecticut Notice of Returned Check from my services.

If you want to discover another version of your document, utilize the Lookup field to find the template that fulfills your needs and specifications.

- If you possess a US Legal Forms account, you can sign in and select the Download option.

- Following that, you can complete, modify, print, or sign the Connecticut Notice of Returned Check.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of any purchased form, go to the My documents section and click the appropriate option.

- If it's your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the area/city you prefer. Review the form details to confirm you have chosen the right one.

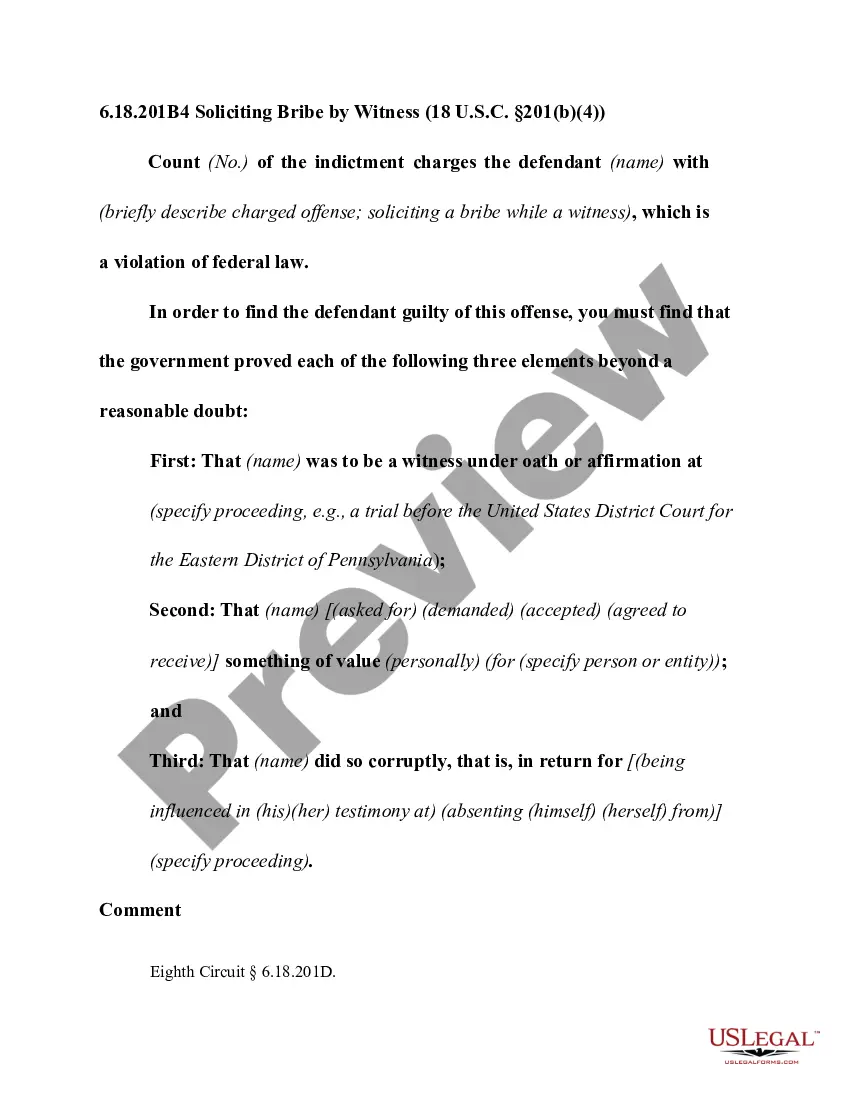

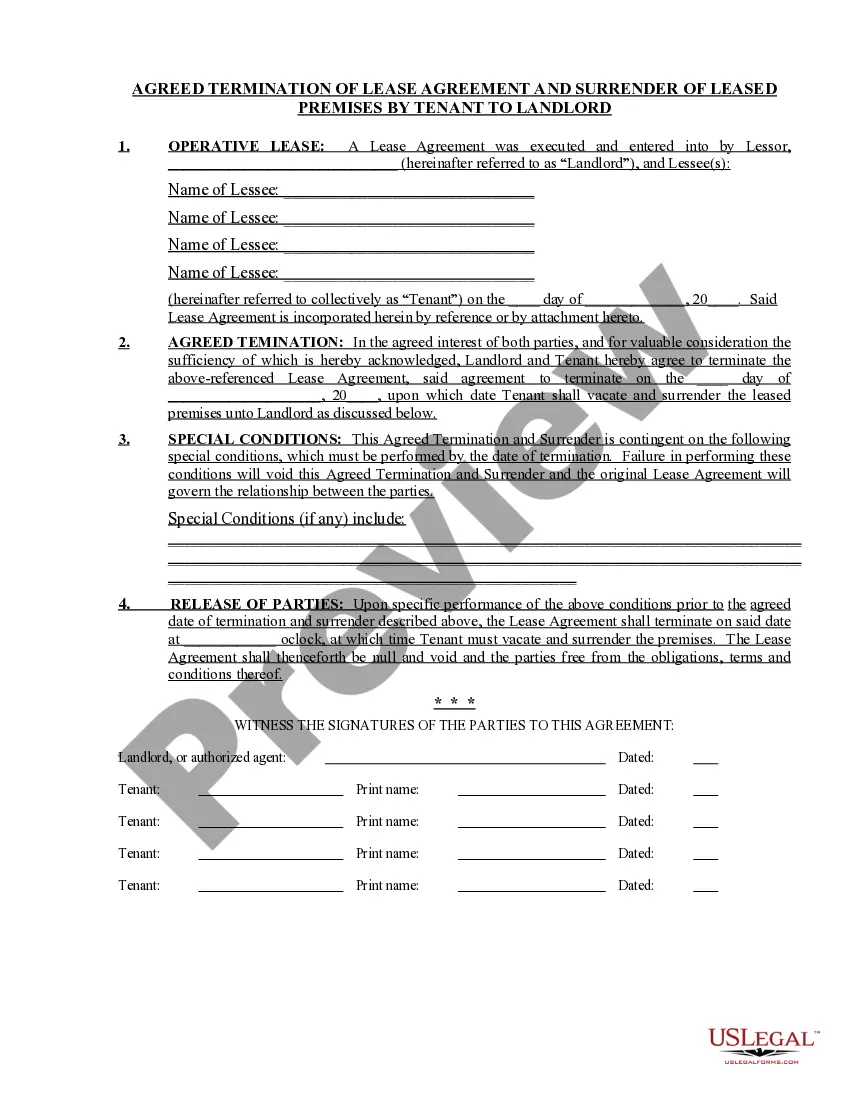

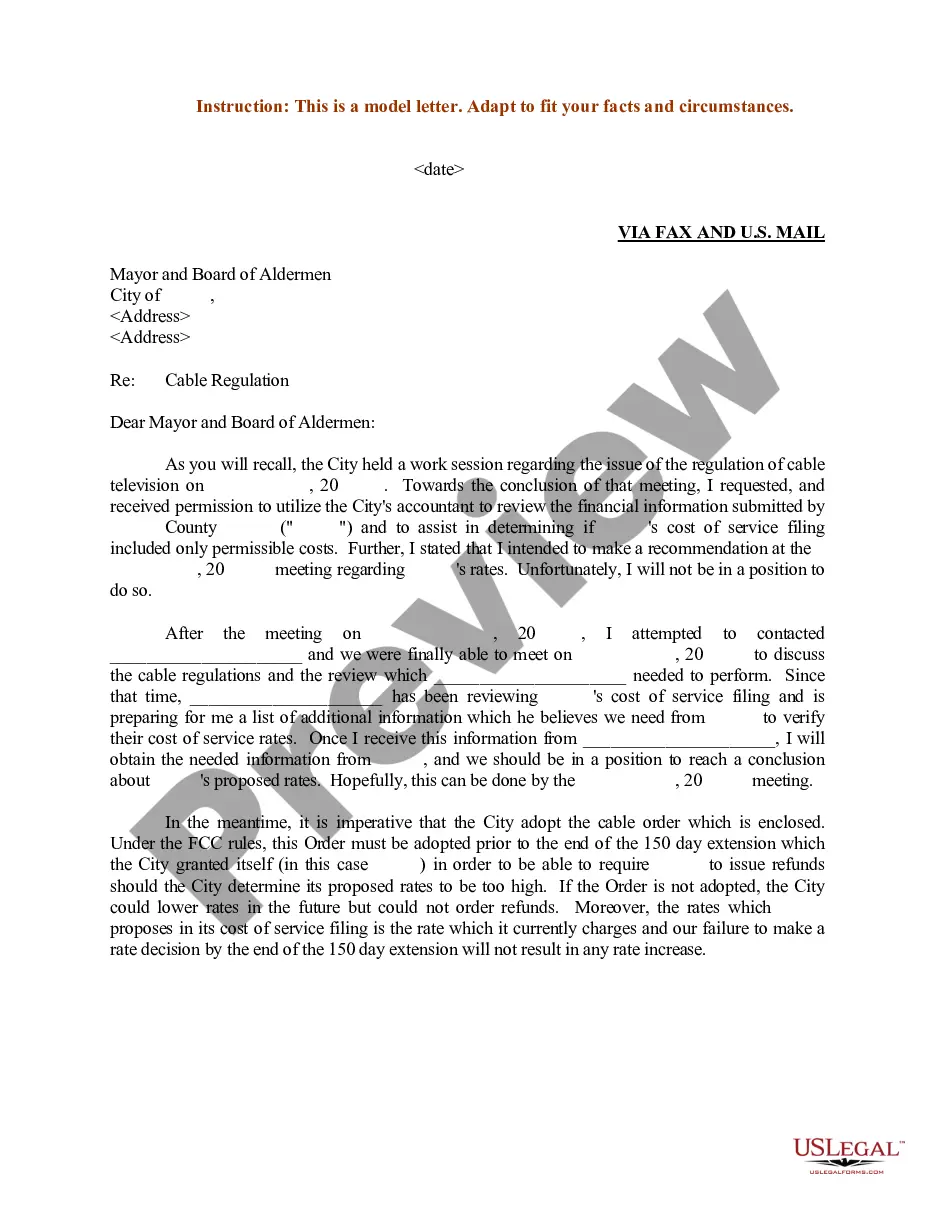

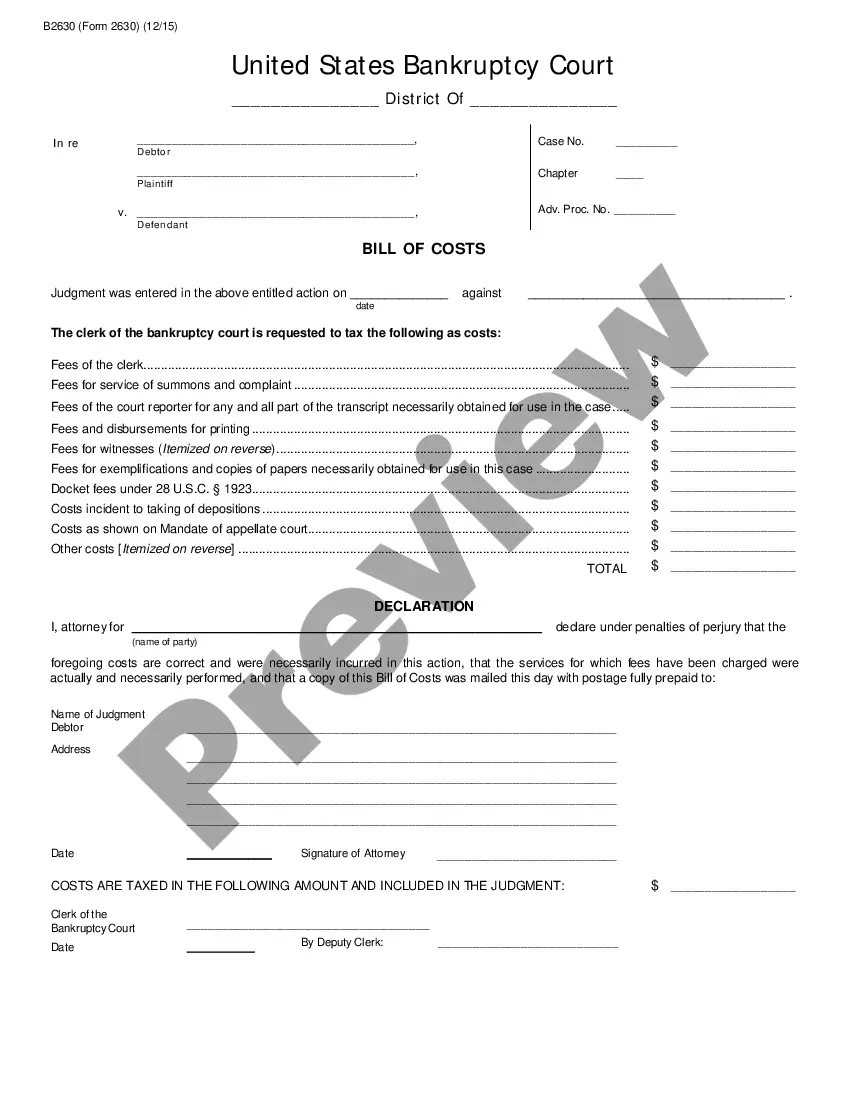

- If available, utilize the Review feature to examine the document template at the same time.

Form popularity

FAQ

When a check is returned to sender, it usually means that the funds are insufficient or that there is some issue with the account. In Connecticut, a Notice of Returned Check serves as a formal notification to inform you of the situation. You may face fees charged by your bank, and the payee can take further action to collect the owed amount. To prevent issues, consider using the US Legal Forms platform to understand your rights and obligations related to a Connecticut Notice of Returned Check.

Writing a letter for a returned check requires clarity and specificity. Start by stating the reason for the return, such as insufficient funds, and reference the Connecticut Notice of Returned Check for proper formatting. Clearly outline how you plan to resolve the issue, and ensure to include your contact information for further communication. This letter not only demonstrates professionalism but also helps maintain a good relationship with the payee.

If your check was returned, you first need to understand why it happened. Common reasons include insufficient funds or a closed account. After addressing the issue, consider using the Connecticut Notice of Returned Check to formally notify the recipient of the returned payment. This notice serves as a professional way to clarify the situation and outline your next steps.

If someone gives you a check that bounces, it’s important to address the situation calmly and professionally. You should notify the check writer and provide them with the Connecticut Notice of Returned Check as evidence. This situation can usually be resolved through direct communication, helping ensure you receive your payment.

A returned check notice is an official document that informs the recipient that their check could not be processed. This notice typically outlines the reasons for the return and any associated penalties. Understanding how to interpret and respond to a Connecticut Notice of Returned Check is vital for managing financial transactions.

When you receive a returned check, you should verify the reasons outlined in the Connecticut Notice of Returned Check. It’s wise to reach out to the person or entity that issued the check to understand the circumstances surrounding the return. This proactive approach can help you recover your funds faster and maintain good relationships.

Writing a bad check over $500 can lead to serious consequences, including criminal charges in addition to civil penalties. In Connecticut, you may face fines or even jail time if found guilty. Receiving a Connecticut Notice of Returned Check in such situations should prompt immediate action to rectify the matter and educate yourself on check writing regulations.

If a check is returned, the first step is to contact the issuer to discuss the situation. Clear communication can help resolve misunderstandings and often leads to prompt payment. You may also want to keep a copy of the Connecticut Notice of Returned Check for your records, as it provides important details regarding the transaction.

Checks can be returned to the sender for several reasons, such as insufficient funds in the account, a closed account, or errors in the information on the check. When you receive a Connecticut Notice of Returned Check, it indicates that the bank could not process the check as expected. Understanding these reasons helps you prevent future issues and manage your finances better.

When a check is returned to the sender, it typically indicates that the bank could not process the check for one reason or another. The sender will receive a Connecticut Notice of Returned Check, which will explain the situation and necessary next steps. It’s crucial to address any underlying issue with the check to maintain a good relationship with the recipient and avoid further complications. Utilizing platforms like uslegalforms can assist you in understanding and resolving such issues effectively.