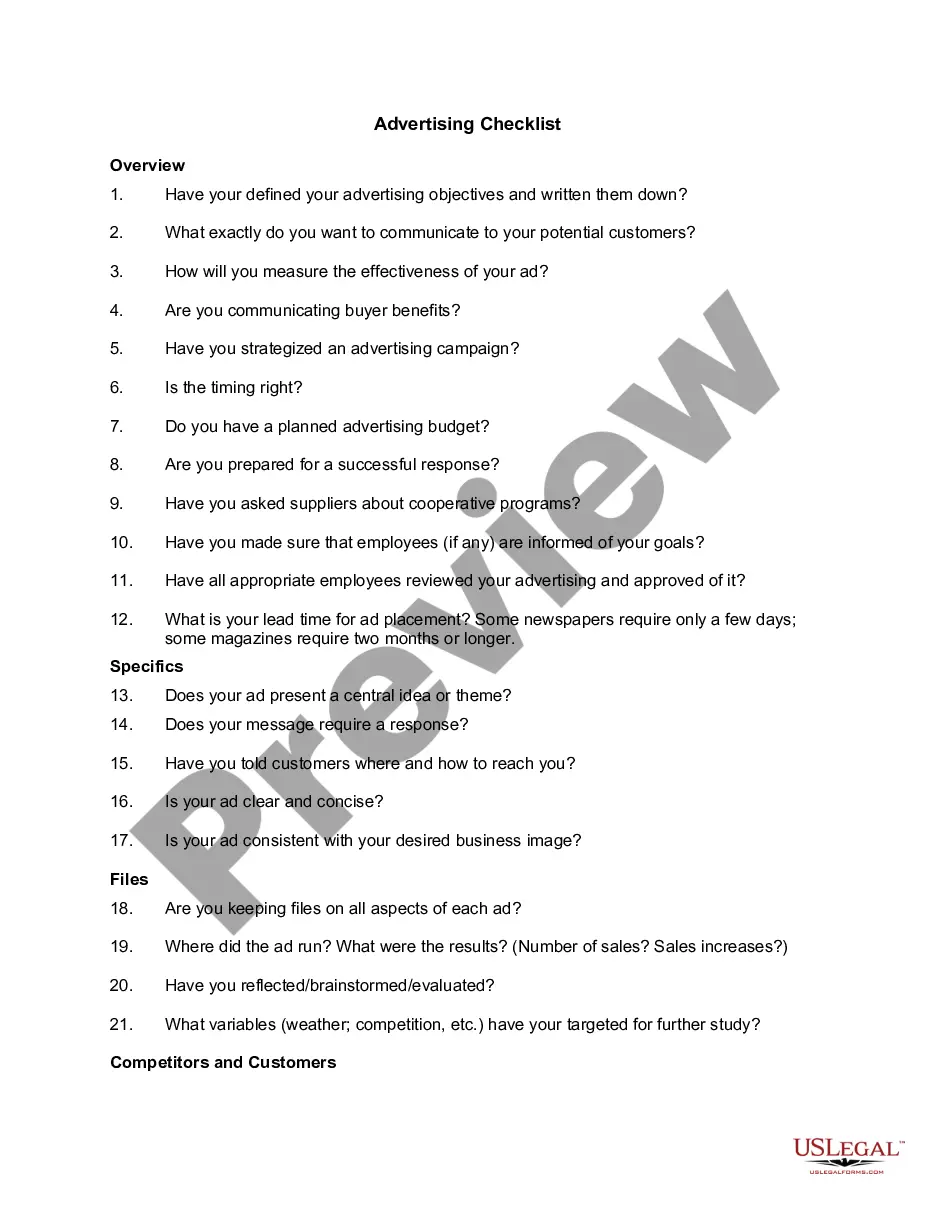

Connecticut Advertising Checklist

Description

How to fill out Advertising Checklist?

Are you currently situated in a location where you frequently require documents for both business or personal purposes every day.

There are numerous legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of document templates, such as the Connecticut Advertising Checklist, which is designed to meet federal and state regulations.

Once you find the right template, click Get now.

Choose the pricing plan you want, provide the necessary information to create your account, and complete the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you will be able to download the Connecticut Advertising Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you require and ensure it is for the correct area/region.

- Utilize the Preview button to review the document.

- Read the description to confirm that you have selected the correct template.

- If the template is not what you need, use the Search box to find the one that meets your requirements.

Form popularity

FAQ

The entertainment tax in Connecticut is imposed on certain live entertainment events, which can include advertising to promote these events. It's important for businesses to be aware of this tax when planning promotional activities. The Connecticut Advertising Checklist can help you identify when this tax applies and how to incorporate it into your marketing strategy.

In general, yes, income generated from advertising activities is taxable in Connecticut. This includes payments received for ad placements or promotional services. You can find useful guidelines about reporting this income in the Connecticut Advertising Checklist to ensure you meet all tax obligations.

In Connecticut, commissions earned from advertising services may be subject to sales tax. The specifics can depend on the nature of the transaction, so consulting the Connecticut Advertising Checklist is advisable. This checklist can clarify nuances regarding sales tax on different types of commissions in advertising.

Starting a business in Connecticut involves several steps. You must select a business structure, register your business name, and obtain necessary licenses and permits. Additionally, reviewing the Connecticut Advertising Checklist can provide insights into marketing regulations that apply right from the start, ensuring you are well-prepared to promote your business legally.

In Connecticut, advertising is generally considered taxable. Businesses must include this in their planning to ensure compliance with state sales tax regulations. To help navigate these rules, refer to the Connecticut Advertising Checklist. This checklist provides a straightforward summary of applicable taxes related to advertising services.