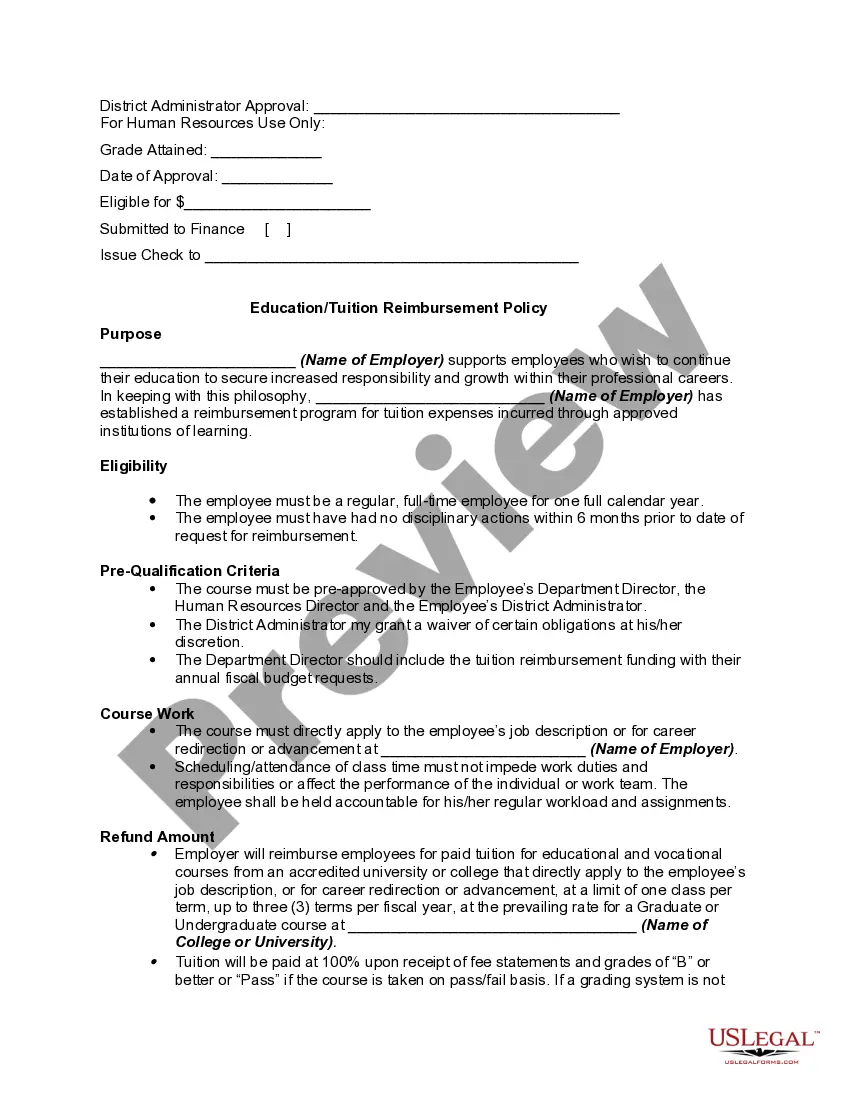

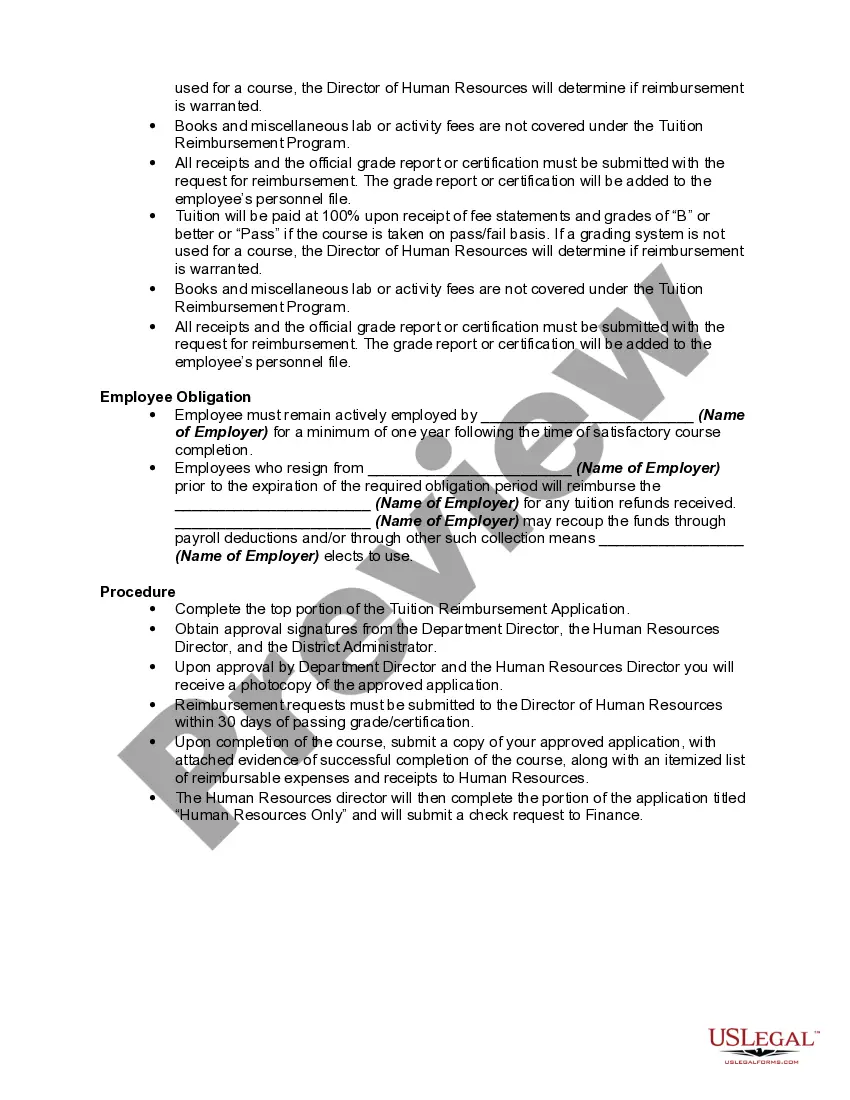

Many companies these days have a tuition reimbursement program. This is a program through which a company pays for part or all of an employee's tuition. In a company which has a tuition reimbursement program, the company generally wants to encourage employees to pursue professional development. Some companies limit the types of education they will pay for, expecting employees to take training and classes relevant to the type of work the company does, or to take classes which can lead to a higher position in the company. For example, a company might pay for someone to get an MBA with the goal of retaining that person and creating an opportunity for advancement.

Employees enrolled in a tuition reimbursement program usually need to make a certain grade point average, and they cannot drop out of school. If they fail to meet these standards, they will be expected to repay the company, and they may also be required to pay if they quit working while school is in session or if they quit shortly after school ends.