Connecticut Acknowledged Receipt of Goods

Description

Goods are defined under the Uniform Commercial Code as those things that are movable at the time of identification to a contract for sale. (UCC ??? 2-103(1)(k)). The term includes future goods, specially manufactured goods, and unborn young of animals, growing crops, and other identified things attached to realty.

How to fill out Acknowledged Receipt Of Goods?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a broad assortment of legal document designs that you can purchase or print. By using the website, you'll access a vast number of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest editions of forms such as the Connecticut Acknowledged Receipt of Goods in mere moments.

If you already hold a membership, Log In and obtain the Connecticut Acknowledged Receipt of Goods from the US Legal Forms library. The Download option will be available on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to finalize the transaction.

Obtain the format and download the form to your device. Make edits. Complete, modify, and print and sign the downloaded Connecticut Acknowledged Receipt of Goods. Every template added to your account has no expiration date and belongs to you indefinitely. Thus, to download or print another copy, simply visit the My documents section and click on the form you need. Access the Connecticut Acknowledged Receipt of Goods with US Legal Forms, the most extensive collection of legal document designs. Utilize a wide variety of professional and state-specific designs to meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, follow these simple steps to get started.

- Ensure that you have selected the correct form for your city/state.

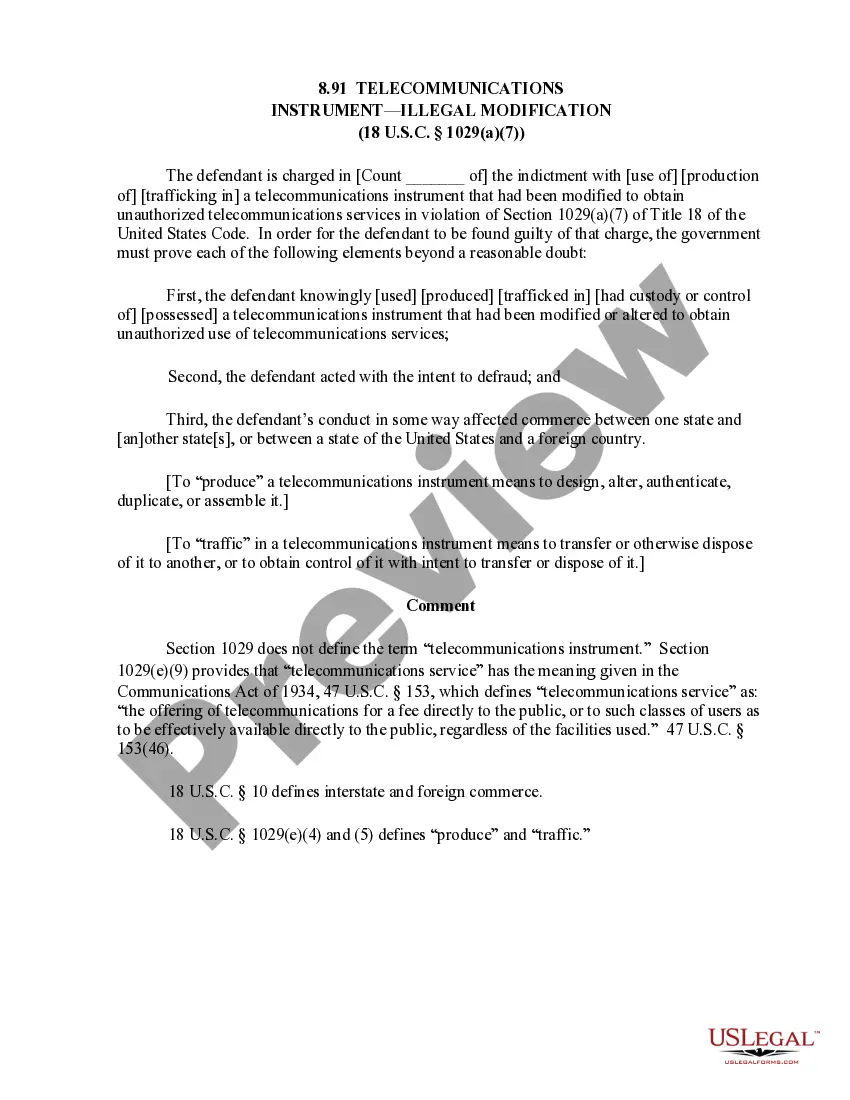

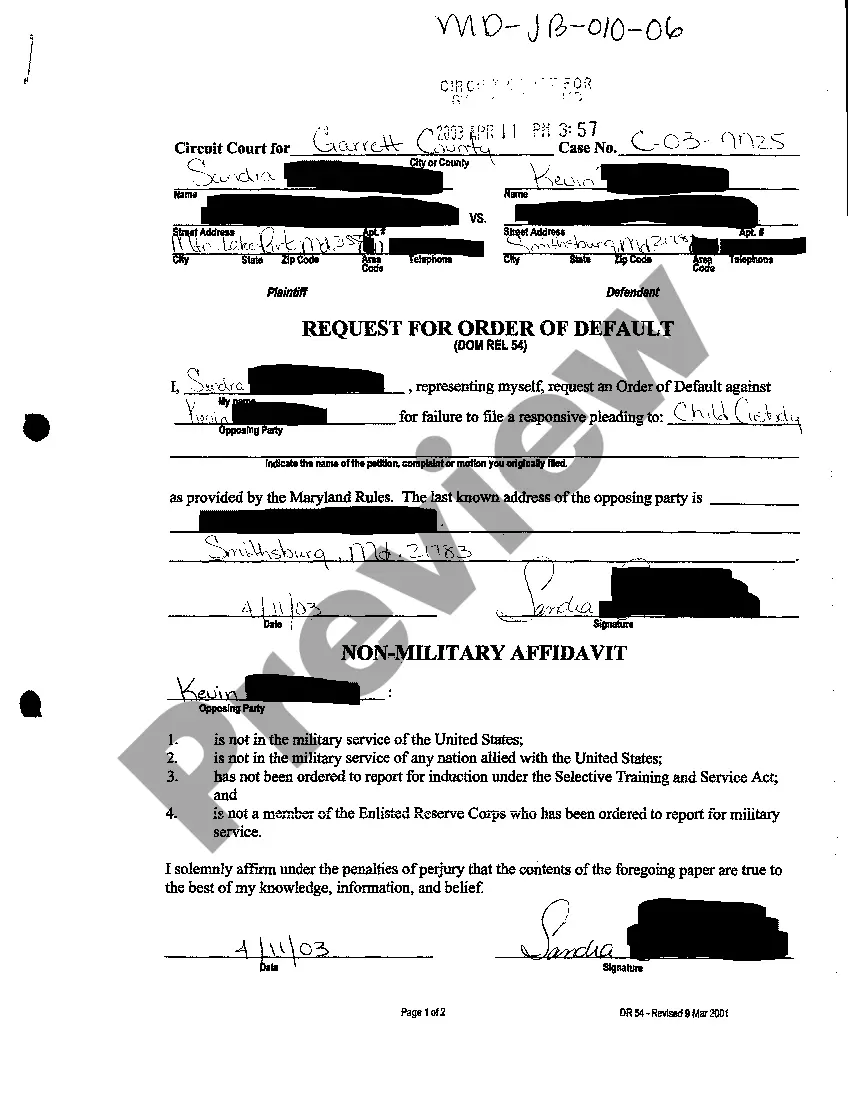

- Click on the Preview option to examine the content of the form.

- Review the form description to confirm that you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

The 7.35% tax in Connecticut refers to the current state sales tax rate on goods and services. Businesses charging sales tax must apply this rate when processing transactions. Make sure to include documentation, like your Connecticut Acknowledged Receipt of Goods, for any taxable purchases.

Connecticut does accept amended tax returns electronically. Taxpayers can file changes online through the Department of Revenue Services portal. When filing an amendment, having your Connecticut Acknowledged Receipt of Goods can help substantiate any updates or corrections you are making.

Yes, Connecticut has an online sales tax system. Businesses and consumers can manage their sales tax obligations easily through the state's online platforms. When completing sales online, it's wise to maintain your Connecticut Acknowledged Receipt of Goods for record-keeping and compliance purposes.

You must file a Connecticut state tax return if you meet certain income thresholds set by the state. This applies to residents and those who earned income in Connecticut. Ensure you keep records, such as your Connecticut Acknowledged Receipt of Goods, to support your filing.

Yes, you can file your Connecticut tax return online. The Connecticut Department of Revenue Services offers a user-friendly online system where you can complete your tax return easily. It’s important to keep your Connecticut Acknowledged Receipt of Goods handy while filing, as it can help clarify your transaction details.

You can file Connecticut sales tax online through the Department of Revenue Services (DRS) website. Simply create an account or log in, then follow the prompts to submit your sales tax return. Remember to include your Connecticut Acknowledged Receipt of Goods to ensure that your transaction is properly documented.

Acknowledging receipt of goods is essential for both parties involved in a transaction. Start by inspecting the goods and recording any discrepancies before signing off on the delivery. By using resources like USLegalForms, you can access professionally crafted documents for Connecticut Acknowledged Receipt of Goods, making the process efficient and legally sound.

You can acknowledge a received product by reviewing its condition and logging the details in a receipt format. This confirmation can be as simple as signing a document or creating a comprehensive report that outlines the product specifications. For Connecticut Acknowledged Receipt of Goods, USLegalForms offers easy-to-use templates that ensure your acknowledgement meets all legal requirements.

To formally acknowledge a receipt, draft a clear document that includes the date, description of the goods, and your signature. This becomes a record of the transaction and confirms acceptance of the items received. When it comes to Connecticut Acknowledged Receipt of Goods, using a professional service like USLegalForms can simplify this process by providing the necessary templates and guidance to ensure correctness.

Acknowledging receipt of an item is straightforward. You can do this by signing a receipt or providing a written confirmation that states you have received the item. For legal purposes in Connecticut, consider using a template from USLegalForms to ensure your acknowledgment complies with local regulations regarding Connecticut Acknowledged Receipt of Goods.