Connecticut Invoice Template for Waiting Staff

Description

How to fill out Invoice Template For Waiting Staff?

If you need to download, acquire, or print legitimate document formats, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site’s user-friendly and efficient search function to find the documents you require.

A selection of formats for commercial and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form format.

Step 4. Once you have identified the form you need, click on the Buy now option. Choose your preferred pricing plan and enter your details to create an account.

- Use US Legal Forms to obtain the Connecticut Invoice Template for Waiting Staff in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download option to retrieve the Connecticut Invoice Template for Waiting Staff.

- You can also access forms you previously saved within the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure you have selected the form for the appropriate city/state.

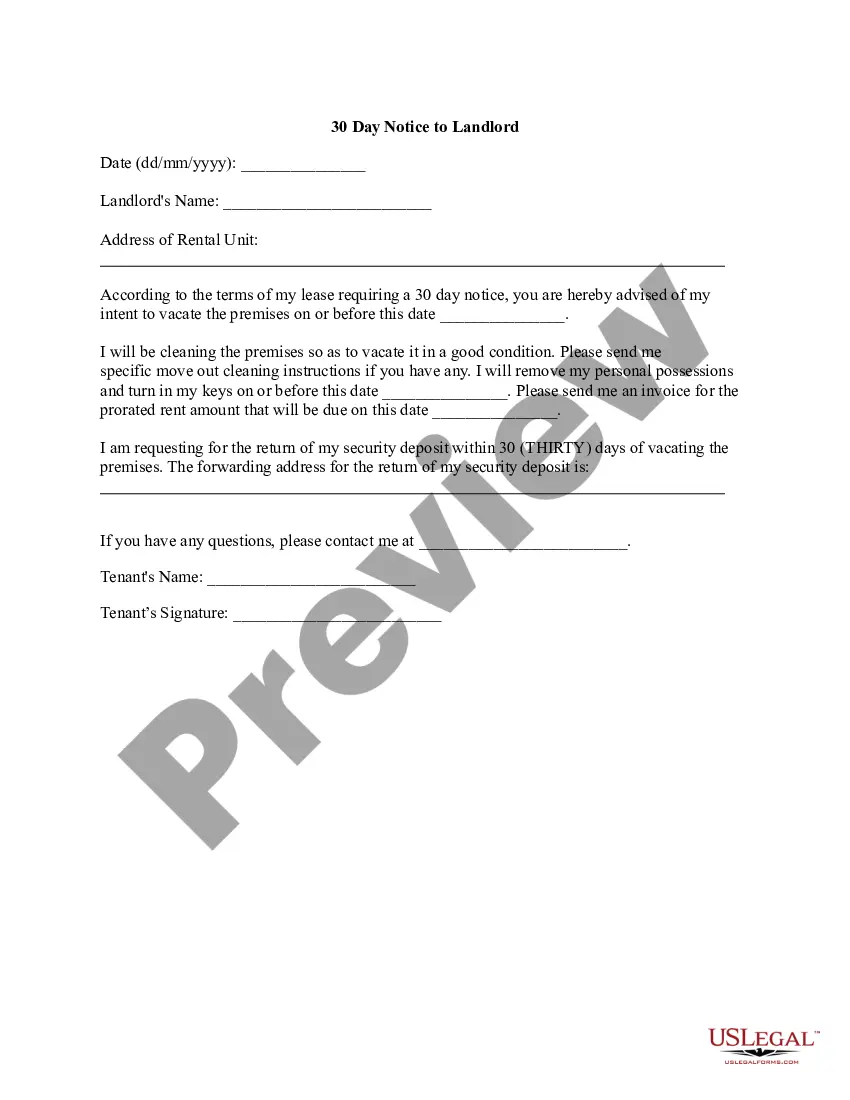

- Step 2. Utilize the Preview option to review the form's content. Be sure to read the description.

Form popularity

FAQ

Creating a simple invoice is an uncomplicated process with the Connecticut Invoice Template for Waiting Staff. Start by collecting all the details, then fill in the template with your information and services provided. Make sure to include a clear total amount and payment instructions to facilitate a smooth transaction for your clients.

Yes, there are various templates available in Microsoft Word for invoice creation, including those suited for waiting staff. The Connecticut Invoice Template for Waiting Staff can easily be adapted in Word by downloading the template and customizing it with your specific details. This allows for flexibility and personalization while maintaining a professional appearance.

Formatting an invoice correctly is crucial for professionalism. When using the Connecticut Invoice Template for Waiting Staff, organize the information into clear sections: header with your logo, client information, itemized list of services, and total amount due. Use consistent fonts and spacing to enhance readability, ensuring that the format looks polished and easy to navigate.

Setting up an invoice template with the Connecticut Invoice Template for Waiting Staff is straightforward. Begin by selecting a software tool or platform that allows template creation, such as U.S. Legal Forms. Input essential details like date, items/services billed, payment due date, and any applicable taxes to create a professional and clear invoice format.

To set up an invoice template using the Connecticut Invoice Template for Waiting Staff, start by determining the necessary information you need to include, such as your business name, contact details, the client’s information, and a breakdown of services provided. You can customize the template to include your logo and define payment terms. Ensure that all relevant sections are clearly labeled for easy understanding.

Your Connecticut tax registration number can be found on your tax registration certificate, which you received upon registering your business with the Department of Revenue Services. Additionally, you may find it by logging into your online account on their official website. Keeping this number handy is essential for filing taxes and completing invoices, especially when using a Connecticut Invoice Template for Waiting Staff.

Sales tax is applied online during transactions based on the seller's location and the buyer's location. E-commerce platforms automatically calculate applicable taxes during the checkout process. For service providers, like waiting staff, including sales tax in your invoicing process is crucial. Using a Connecticut Invoice Template for Waiting Staff helps ensure that sales tax is applied correctly.

Connecticut's sales tax is currently set at 6.35%, with specific goods and services facing different rates. However, some items, like hotel accommodations, may incur a higher rate of 7.35%. Businesses should always be aware of these rates when creating invoices. A Connecticut Invoice Template for Waiting Staff can help ensure accurate calculations of this tax.

Filling out an invoice template is straightforward and requires specific information. Start by including your business name and contact details at the top, followed by the client's information. Clearly list the services provided, along with dates, quantities, and rates. Using a Connecticut Invoice Template for Waiting Staff can simplify this process, ensuring that you capture all relevant details while saving time.

Absolutely, you can file your Connecticut tax return online. The Connecticut Department of Revenue Services offers an online portal for filing tax returns securely. This feature saves time and allows you to complete your filing from anywhere. When preparing your documents, a Connecticut Invoice Template for Waiting Staff can ensure that all income, including tips, is properly accounted for.