Connecticut Invoice Template for Farmer

Description

How to fill out Invoice Template For Farmer?

If you wish to finalize, obtain, or print valid document templates, utilize US Legal Forms, the largest assortment of valid forms available online.

Make use of the site`s straightforward and convenient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours permanently. You will have access to each form you saved in your account.

Select the My documents section and choose a form to print or download again. Complete and obtain, and print the Connecticut Invoice Template for Farmer with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to find the Connecticut Invoice Template for Farmer with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Connecticut Invoice Template for Farmer.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for your respective area/region.

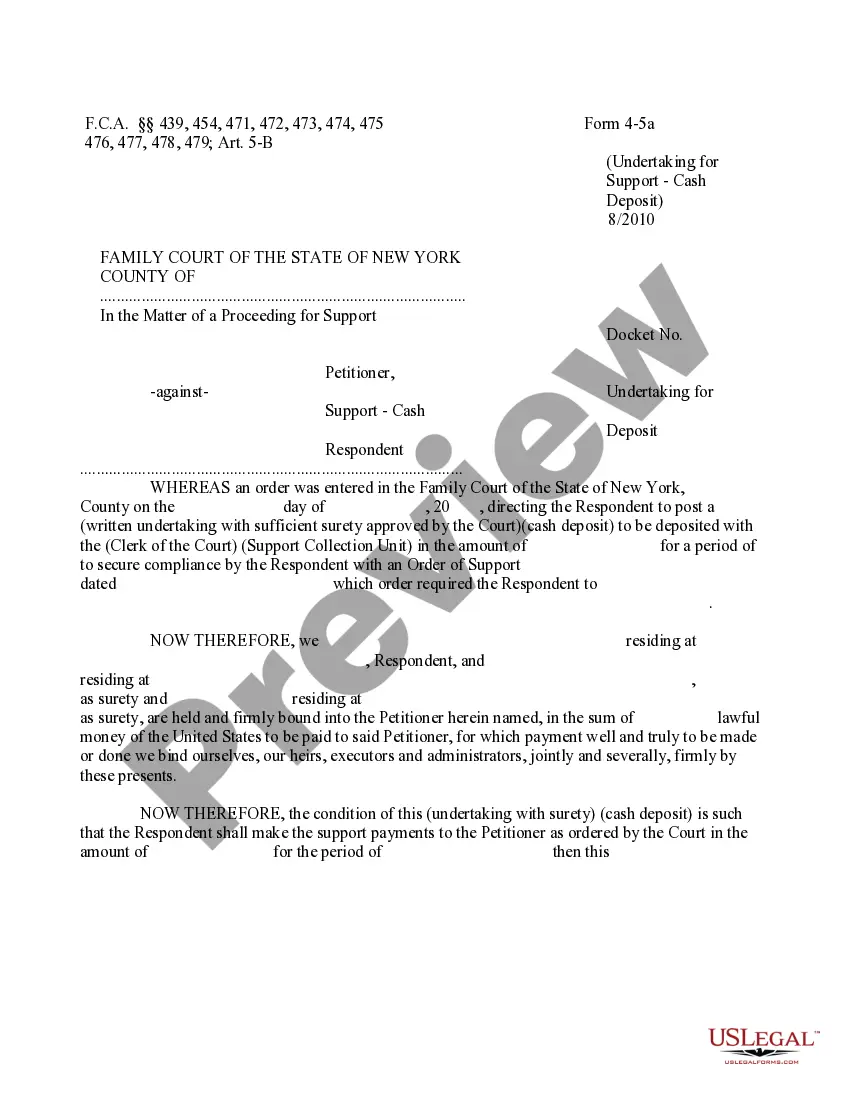

- Step 2. Use the Preview option to review the form`s details. Remember to check the overview.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form design.

- Step 4. Once you have found the form you desire, click on the Purchase now button. Choose your preferred payment plan and input your credentials to register for an account.

- Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Connecticut Invoice Template for Farmer.

Form popularity

FAQ

Filing taxes as a farm involves reporting income from your agricultural activities, as well as any allowable deductions for expenses related to those activities. You will typically use Schedule F on your tax return to report this information. A Connecticut Invoice Template for Farmer can help you organize your financial documents and track your income and expenses. Keeping good records makes the filing process smoother and helps in maximizing deductions.

The IRS requires that a property is primarily used for farming to be classified as a farm. This includes growing crops, raising livestock, and other agricultural activities that produce income. Maintaining clear financial records with tools like a Connecticut Invoice Template for Farmer can demonstrate your operations to satisfy IRS requirements. Therefore, it is vital to keep accurate documentation of your farming activities.

To qualify your property as a farm, it must be used predominantly for agricultural production, such as crops or livestock. In addition to land use, the property must generate income to satisfy tax requirements. A Connecticut Invoice Template for Farmer helps you maintain detailed records of sales and expenses, supporting your claim for agricultural classification. Understanding these criteria will help you optimize your operations.

A farm generally starts at around 10 acres in Connecticut, although this can vary based on local definitions. The amount of land can influence the classification, but actual farming activity is equally important. Using a Connecticut Invoice Template for Farmer can assist in documenting your activities, ensuring that your land qualifies for agricultural benefits. Always review local regulations for the most accurate information.

The minimum acreage required to designate land as a farm varies by state, but Connecticut typically recognizes farms starting at around 10 acres. However, qualifying factors also include the nature of the agricultural activities undertaken. To keep track of your operations, consider using a Connecticut Invoice Template for Farmer to record your farming activities. This will make it simpler to manage your records and meet regulatory requirements.

Many farms in Connecticut can qualify for tax exemptions based on their agricultural production and use. If your farm meets certain criteria, you may benefit from exemptions on sales tax for items used in production. Using a Connecticut Invoice Template for Farmer can streamline your record-keeping and make it easier to apply for these exemptions. Always check with a tax professional for detailed guidance.

In Connecticut, you generally need at least 10 acres to qualify your land as a farm for tax purposes. However, smaller properties may still qualify based on the designation of agricultural use and income generated. A Connecticut Invoice Template for Farmer can help you maintain records of farm income to support your tax claims. Understanding the specific requirements is essential to maximize your tax benefits.

Filing Connecticut State sales tax requires you to complete the appropriate sales tax return form. You can file online or submit a paper form, depending on your preference. Utilizing a Connecticut Invoice Template for Farmer can help you accurately track your sales and ensure compliance with sales tax regulations. Make sure to submit your return on time to avoid penalties.

To write a simple invoice, include your business name, the client's name, and a detailed list of services. Clearly state costs and the total amount due, along with payment instructions. Aim for clarity and conciseness to avoid confusion. A Connecticut Invoice Template for Farmer can facilitate this process by providing a straightforward format.

Creating an invoice template can be easy using online tools or software. Start by drafting the essential elements, such as your business name, services, and payment details. Save the template for repeat use and tailor it as needed. Consider using a Connecticut Invoice Template for Farmer to ensure compliance with local regulations.