Connecticut Assignment of Assets

Description

How to fill out Assignment Of Assets?

US Legal Forms - one of the biggest collections of legitimate documents in the United States - offers a range of authentic form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can obtain the most recent forms like the Connecticut Assignment of Assets in just seconds.

If you already have a monthly subscription, Log In to download the Connecticut Assignment of Assets from your US Legal Forms library. The Download button will be visible on every form you see. You have access to all previously downloaded forms in the My documents section of your account.

Next, select the pricing plan you prefer and enter your information to register for an account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

- If you're using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your area/county.

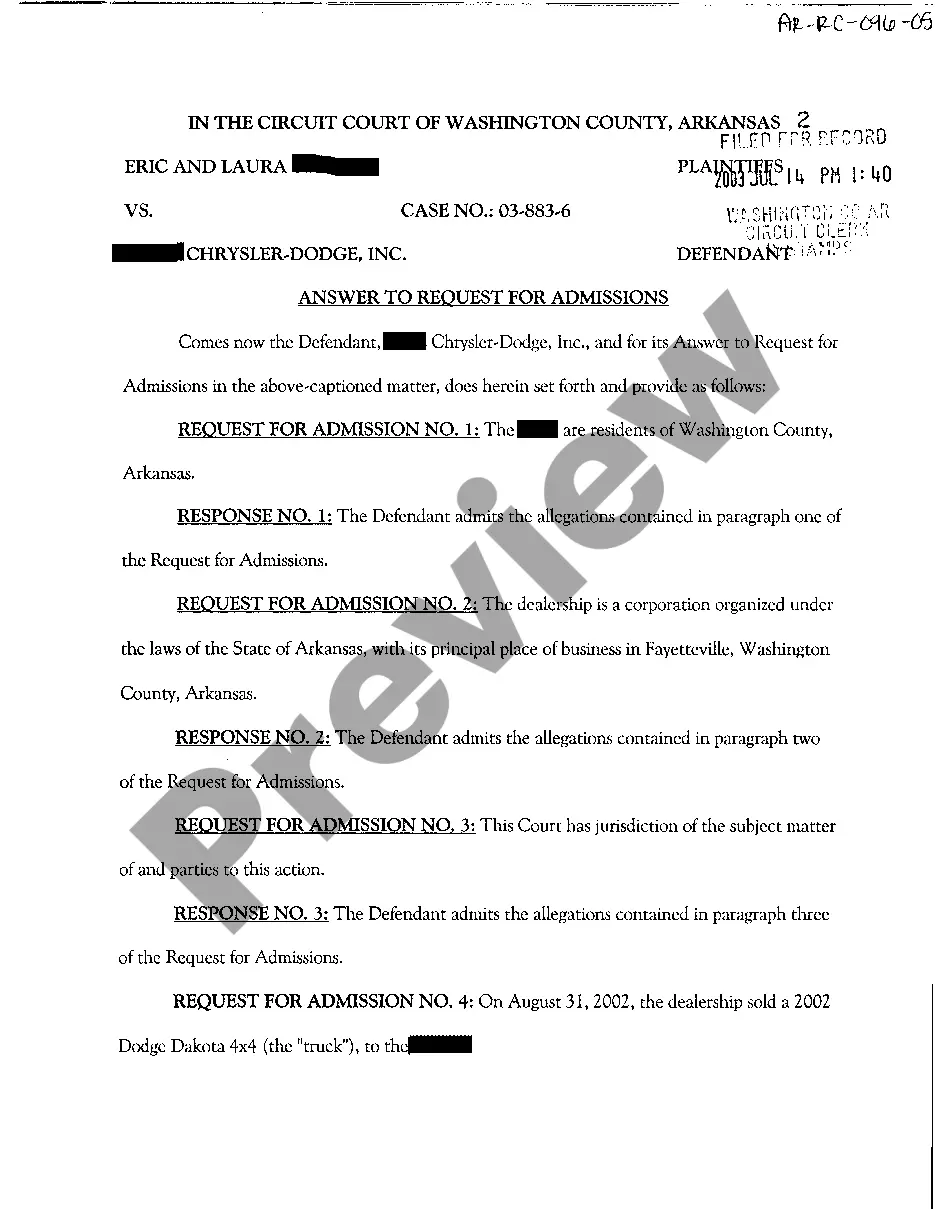

- Click on the Review button to evaluate the form's content.

- Check the form description to make sure you have the correct form.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

Form popularity

FAQ

Common methods of transferring assets include outright sales, gifts, or through estate planning strategies like trusts. Each method has specific legal requirements and implications, particularly in Connecticut, where the Assignment of Assets plays a significant role in asset distribution during legal proceedings. For clarity and ease, consider using uslegalforms to access necessary documents for any asset transfer method.

The process of asset transfer involves identifying the asset, agreeing on the terms of the transfer, and drafting the necessary legal documentation. Once both parties sign the documents, the transfer can be executed. Familiarizing yourself with the Connecticut Assignment of Assets can assist in ensuring the transfer process meets all legal requirements and protects all parties involved.

The best way to transfer assets depends on the type of asset and the circumstances surrounding the transfer. Using a structured approach, including drafting legal documents and possibly involving a professional, can provide clarity and security. For those navigating Connecticut Assignment of Assets, tools and templates available on uslegalforms can simplify the process.

To transfer assets from one person to another, you usually need to complete and sign a legal document that specifies the details of the transfer. This could include a transfer of title or ownership agreement. In cases where complex asset transfers are involved, consider using platforms like uslegalforms, which provide templates and guidance for Connecticut Assignment of Assets, ensuring your transfer is legally sound.

In a Connecticut divorce, assets are divided based on the principle of equitable distribution, meaning that assets are divided fairly but not necessarily equally. The court considers several factors, including the length of the marriage, the cause of the breakdown, and each party's financial situation. Utilizing a Connecticut Assignment of Assets can help streamline this process by clearly delineating ownership before the divorce is finalized.

An assignment of assets refers to the legal transfer of ownership of one party's assets to another. This process is often formalized through a written agreement, ensuring clarity and legality. In Connecticut, understanding the nuances of the Connecticut Assignment of Assets can be crucial to navigate financial obligations and rights effectively.

To transfer assets, you need to follow specific legal processes which typically involve drafting legal documents. In Connecticut Assignment of Assets, documents like deeds, bills of sale, or assignment agreements are used to officially transfer ownership. It's essential to ensure that the transfer is appropriately documented to protect both parties and avoid future disputes.

The Connecticut Transfer Act governs the necessary processes surrounding the transfer of certain types of properties, particularly commercial real estate. It includes regulations intended to protect the environment and maintain public safety during such transactions. Understanding this act is essential when engaging in Connecticut Assignment of Assets to ensure full compliance with state laws. Utilizing services such as USLegalForms can provide you with the necessary documentation and guidance.

The Relocation Act in Connecticut pertains to the rights and responsibilities of both property owners and tenants when relocating under certain conditions. This act can impact how assets are assigned during a relocation process. Familiarity with this act is vital when navigating the Connecticut Assignment of Assets, as it addresses specific compensation and notification requirements. Whether you are a tenant or a property owner, understanding this act helps avoid future disputes.

An example of a transfer of assets includes selling a piece of real estate, where ownership and associated rights are moved from one party to another. This transfer typically requires legal documentation to comply with the Connecticut Assignment of Assets requirements. Other instances can include the transfer of business assets or financial instruments. Each type of asset transfer carries different legal implications under Connecticut law.