Connecticut Articles of Association of a Professional Association

Description

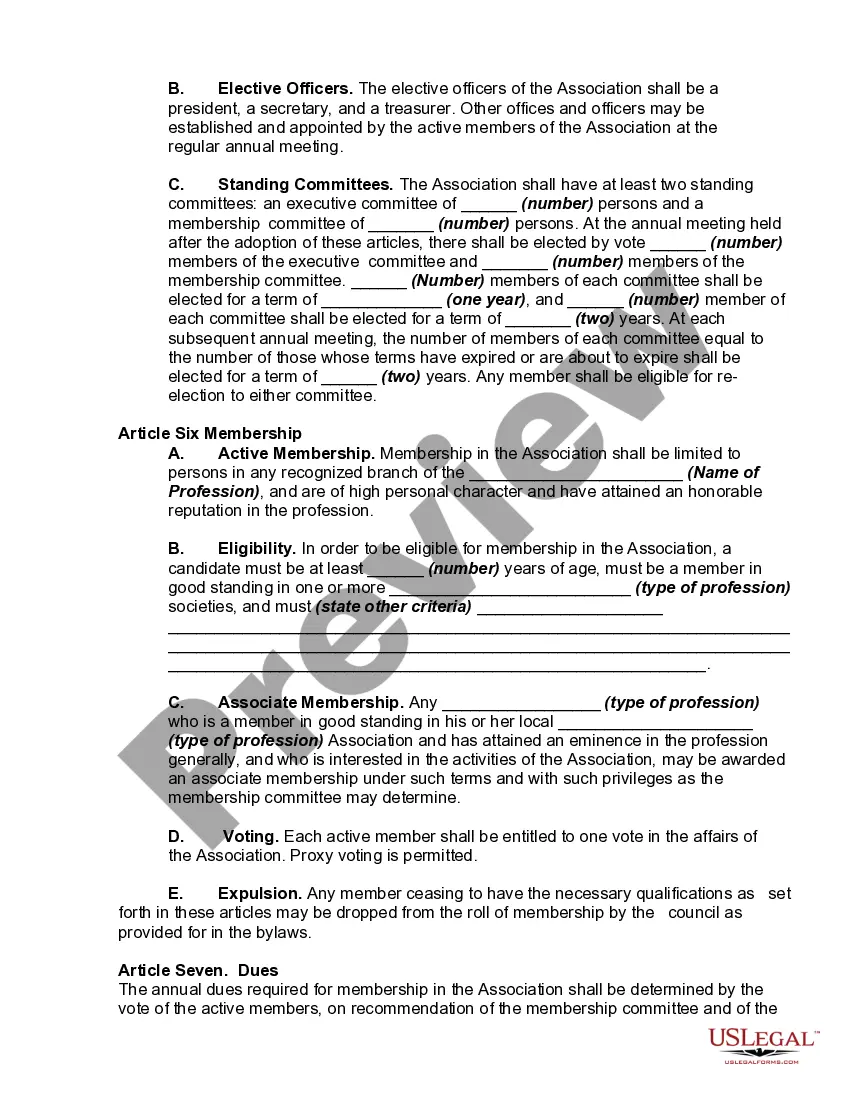

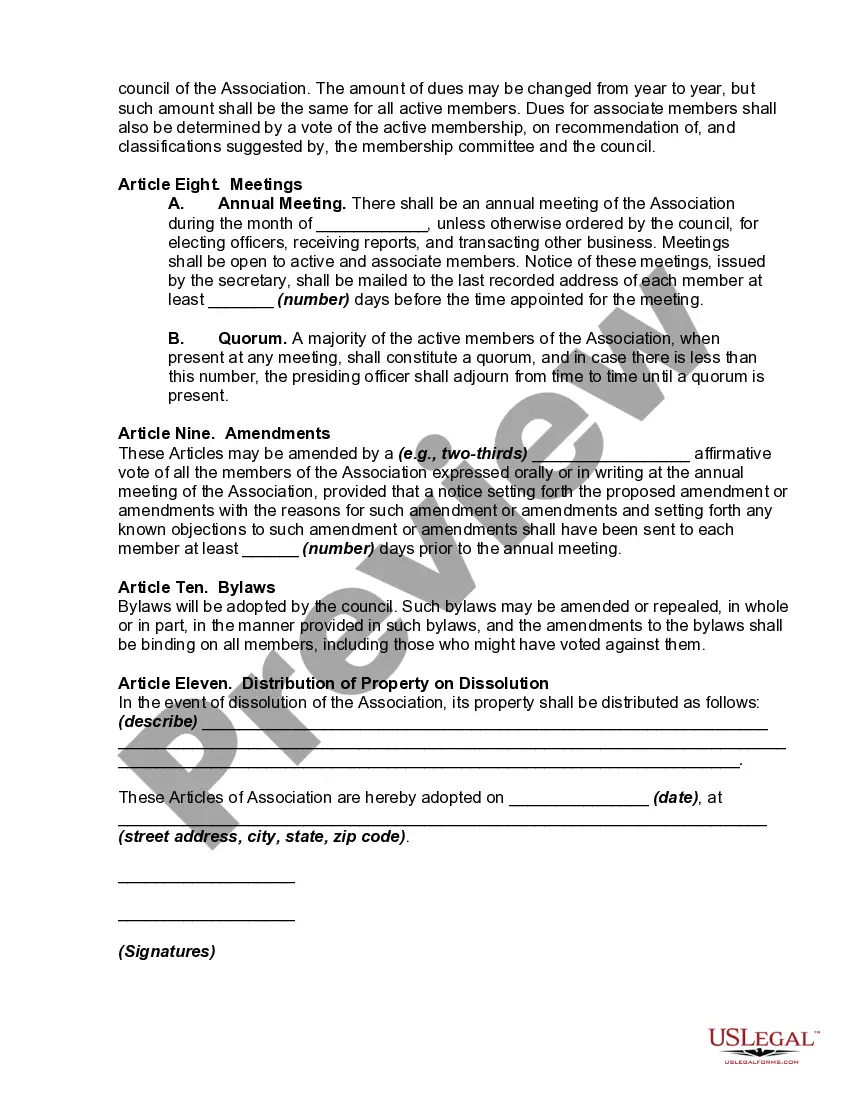

Statutes in some jurisdictions require that the constitution or articles of association, and the bylaws, be acknowledged or verified. In some jurisdictions, it is required by statute that the constitution or articles of association be recorded, particularly where the association or club owns real property or any interest in real property.

How to fill out Articles Of Association Of A Professional Association?

Choosing the best lawful document template can be a have a problem. Obviously, there are tons of templates available on the Internet, but how can you get the lawful kind you require? Take advantage of the US Legal Forms internet site. The services gives 1000s of templates, like the Connecticut Articles of Association of a Professional Association, that can be used for enterprise and personal requires. All of the types are examined by experts and fulfill state and federal requirements.

Should you be previously authorized, log in to your accounts and click the Obtain button to have the Connecticut Articles of Association of a Professional Association. Make use of your accounts to appear through the lawful types you might have purchased earlier. Go to the My Forms tab of your accounts and acquire an additional backup in the document you require.

Should you be a fresh user of US Legal Forms, allow me to share simple directions for you to follow:

- Very first, make certain you have chosen the correct kind for the metropolis/area. You can examine the shape making use of the Review button and study the shape explanation to make sure this is the best for you.

- When the kind fails to fulfill your needs, make use of the Seach industry to obtain the appropriate kind.

- Once you are sure that the shape is proper, click the Purchase now button to have the kind.

- Opt for the costs program you need and enter the required information. Create your accounts and buy the transaction making use of your PayPal accounts or credit card.

- Opt for the file structure and obtain the lawful document template to your gadget.

- Comprehensive, modify and printing and sign the obtained Connecticut Articles of Association of a Professional Association.

US Legal Forms will be the greatest library of lawful types in which you can find numerous document templates. Take advantage of the company to obtain expertly-produced papers that follow status requirements.

Form popularity

FAQ

Can I be my own Registered Agent in Connecticut? You can be your own agent, as long as you are a resident of the state, over 18 years old, and are generally available during business hours.

No, it's not legally required in Connecticut under § 34-243d. Single-member LLCs need an operating agreement to preserve their corporate veil and to prove ownership. And multi-member LLCs need one to help provide operating guidance, determine voting rights and contributions.

Filing fees can change, you should contact the Secretary of State for the most current fees. Timeline. Processing time can take up to six weeks depending on the volume of submissions. However, there are 24-hour expedited services that are available for a minimal fee of about $50 per transaction.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email or in person, but we recommend faxing. Normal processing takes up to 5 business days, plus additional time for mailing, and costs $55 for certification.

Connecticut LLC Cost. Connecticut's state fee for LLC formation is $120. Connecticut LLCs also need to file an annual report every year, which costs $80. Depending on your industry and business needs, you might have additional expenses, such as licensing fees, business insurance, and registered agent fees.

Forming a PLLC in Connecticut (in 6 Steps) Step One) Choose a PLLC Name. ... Step Two) Designate a Registered Agent. ... Step Three) File Formation Documents with the State. ... Step Four) Create an Operating Agreement. ... Step Five) Handle Taxation Requirements. ... Step Six) Obtain Business Licenses and Permits.

The registered office must be located at a street address (a P.O. Box alone is not acceptable) within the State of Connecticut.