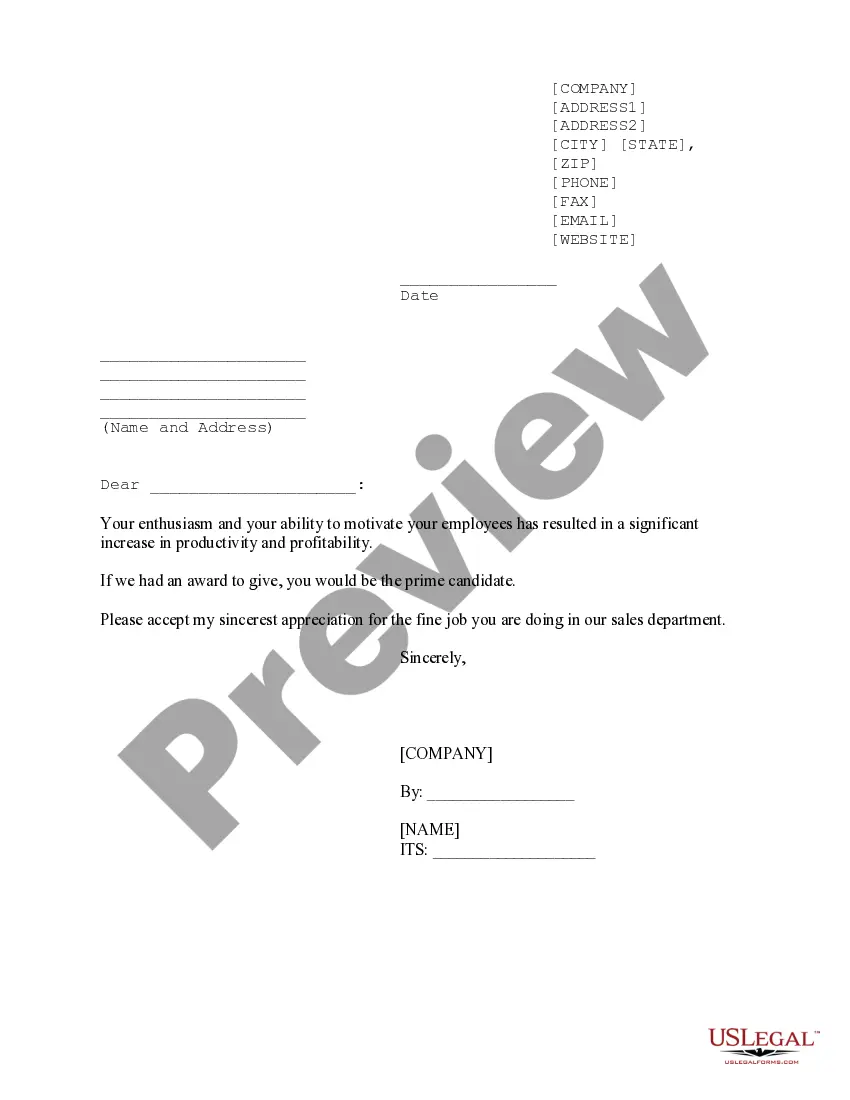

Connecticut Sample Letter for Asset Sale

Description

How to fill out Sample Letter For Asset Sale?

US Legal Forms - one of several largest libraries of lawful varieties in America - gives a wide array of lawful document layouts it is possible to down load or print out. Utilizing the internet site, you can find a huge number of varieties for organization and specific uses, sorted by classes, suggests, or search phrases.You will find the most recent variations of varieties such as the Connecticut Sample Letter for Asset Sale in seconds.

If you currently have a membership, log in and down load Connecticut Sample Letter for Asset Sale from your US Legal Forms catalogue. The Download button will appear on every kind you see. You have access to all earlier saved varieties within the My Forms tab of your own bank account.

If you wish to use US Legal Forms initially, here are easy recommendations to get you started out:

- Ensure you have picked the best kind for your town/area. Click the Review button to analyze the form`s content. Browse the kind outline to actually have selected the correct kind.

- If the kind does not suit your needs, use the Search area near the top of the display screen to find the one who does.

- If you are satisfied with the shape, verify your option by clicking the Purchase now button. Then, select the pricing prepare you prefer and offer your references to sign up to have an bank account.

- Process the deal. Use your bank card or PayPal bank account to accomplish the deal.

- Select the format and down load the shape in your device.

- Make adjustments. Load, change and print out and indicator the saved Connecticut Sample Letter for Asset Sale.

Every single design you included in your bank account does not have an expiration particular date and is also your own permanently. So, if you want to down load or print out an additional version, just visit the My Forms area and click on on the kind you require.

Gain access to the Connecticut Sample Letter for Asset Sale with US Legal Forms, by far the most extensive catalogue of lawful document layouts. Use a huge number of professional and condition-distinct layouts that satisfy your company or specific demands and needs.

Form popularity

FAQ

Tax liability is the total amount of tax debt owed to a government by an individual, corporation, or other entity. Income taxes, sales tax, and capital gains tax are all forms of tax liabilities. Taxes are imposed by various taxing authorities, including federal, state, and local governments.

Under successor liability, the purchaser of a business is liable for the taxes of the previous owner to the extent of the purchase price of the business unless the purchaser obtains a tax clearance certificate from DRS. Successor liability applies where: A person voluntarily sells a business; or.

The liability of the successor or purchaser of a business or stock of goods extends to taxes incurred with reference to the operation of the business by the predecessor or any former owner, including the sale thereof, even though not then determined against the former owner, to interest thereon to the date of payment ...

Enacted to fill a $1.5 billion budget gap Lamont inherited in 2019, the surcharge brings the total sales tax on restaurant meals and prepared foods in grocery stores to 7.35 percent. It raises about $70 million a year.

A purchaser who has committed to purchasing the business or stock of goods of a seller may submit Form AU-866, Request for a Tax Clearance Certificate, to the Department of Revenue Services (DRS). The DRS will issue a tax clearance certificate or escrow letter within sixty (60) days of receipt of Form AU-866.

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies.