Connecticut Sample Letter for Explanation of Insurance Rate Increase

Description

How to fill out Sample Letter For Explanation Of Insurance Rate Increase?

Are you currently in a situation where you require documents for both business or specific purposes almost every day.

There are numerous legal document templates accessible online, but locating ones you can rely on isn’t straightforward.

US Legal Forms provides a vast array of form templates, similar to the Connecticut Sample Letter for Explanation of Insurance Rate Increase, that are designed to comply with state and federal regulations.

Once you find the appropriate form, click Get now.

Select the pricing plan you prefer, enter the required details to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Connecticut Sample Letter for Explanation of Insurance Rate Increase template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct city/state.

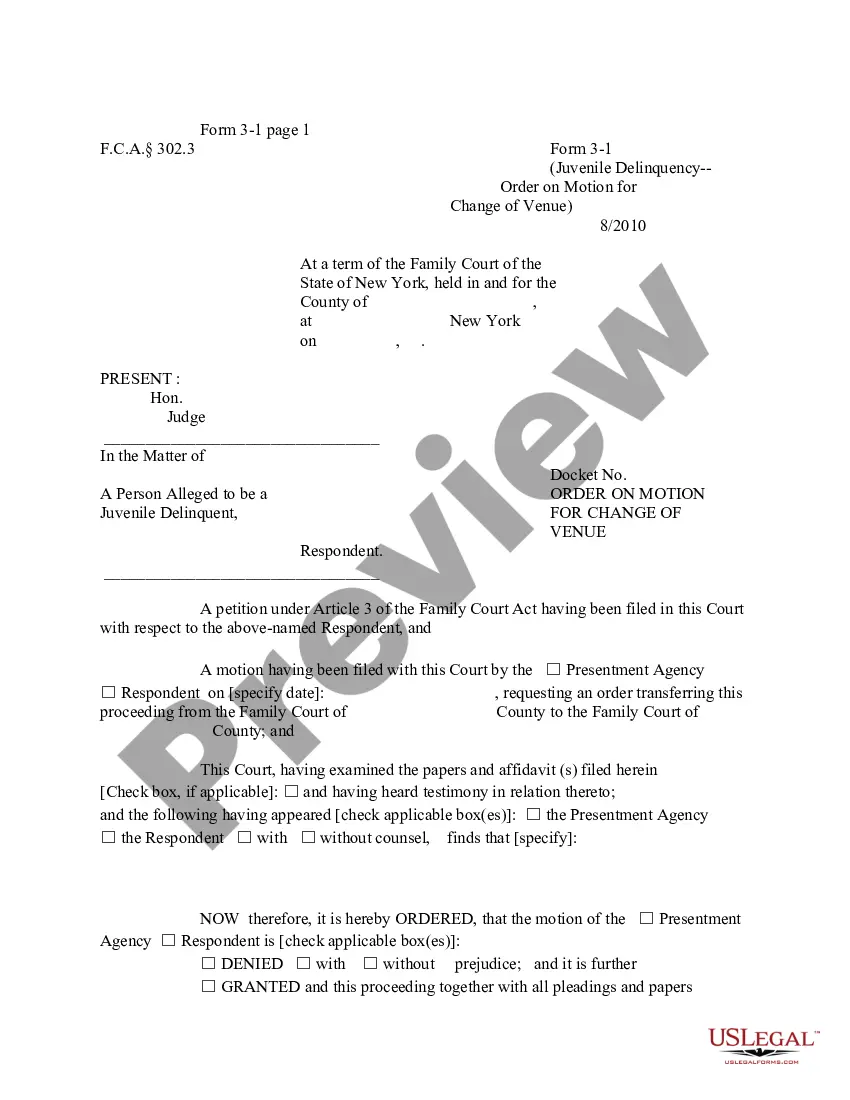

- Utilize the Preview option to examine the document.

- Review the summary to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Research section to find the form that meets your needs.

Form popularity

FAQ

Writing a strong demand letter involves being clear, concise, and assertive about your expectations. Clearly outline your grievances, including specifics to support your claims. A Connecticut Sample Letter for Explanation of Insurance Rate Increase can provide a solid foundation for your letter. Finally, do not forget to state what you want as a resolution, making it easier for the recipient to respond.

To write an insurance demand letter, start by clearly stating your case and why an increase is unjustified. Including relevant details, such as policy numbers and dates, enhances your letter's credibility. Utilize a Connecticut Sample Letter for Explanation of Insurance Rate Increase as a helpful template to ensure you've covered all necessary points in a concise manner. Lastly, be sure to maintain a professional tone throughout.

Yes, you can write a demand letter without a lawyer. Many people choose to do this to save on legal fees. Using a Connecticut Sample Letter for Explanation of Insurance Rate Increase can guide you in structuring your letter effectively. However, if your situation is complicated, consulting a lawyer may still be beneficial.

If your credit score goes down due to increased debt, decreased income, missed or late payments, too many credit inquiries, or some other reason, your insurance company may choose to increase your premiums to protect themselves.

An experience letter is written by an insurance company that has covered you in the past. The letter details your record with them. An experience letter can help you prove your insurance history, which can be helpful when you're looking for new insurance.

IRDAI proposes to hike third-party motor insurance premiums for FY2022-23. From the past two financial years (FY 2020-21 and FY 2021-22), the IRDAI had not revised the rates. Hence, till now, the rates remained the same that Irdai laid down for FY 2019-20.

An experience letter is one of the essential documents provided by the employer to the employee. It consists of the work done and skills attained by a person in the duration of working in an organization.

The experience rating helps an insurance company determine the likelihood that a particular policyholder will file a claim. In this sense, the past loss experience of a policyholder is used to determine future changes to the premium charged for the policy.

7 Tips for Writing a Demand Letter To the Insurance CompanyStep 1 of 2. 50%Organize your expenses.Establish the facts.Share your perspective.Detail your road to recovery.Acknowledge and emphasize your pain and suffering.Request a reasonable settlement amount.Review your letter and send it!

There are some things that are outside of your control but could still affect your premium, including: rising repair costs, an increase in distracted drivers on the road, more drivers on the road, higher speed limits in your geographic area, and an increase in uninsured drivers.