Connecticut Assignment of Debt

Description

How to fill out Assignment Of Debt?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can acquire the latest versions of forms such as the Connecticut Assignment of Debt in just a few minutes.

If you already have a monthly subscription, Log In and obtain the Connecticut Assignment of Debt from the US Legal Forms library. The Download button will be visible on every form you view. You have access to all previously saved forms in the My documents section of your account.

Proceed with the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Choose the format and download the form to your device. Edit. Complete, modify, print, and sign the saved Connecticut Assignment of Debt.

Each template you save in your account has no expiration date and is yours permanently. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you desire.

Access the Connecticut Assignment of Debt with US Legal Forms, one of the most expansive collections of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Ensure you have selected the correct form for the city/state.

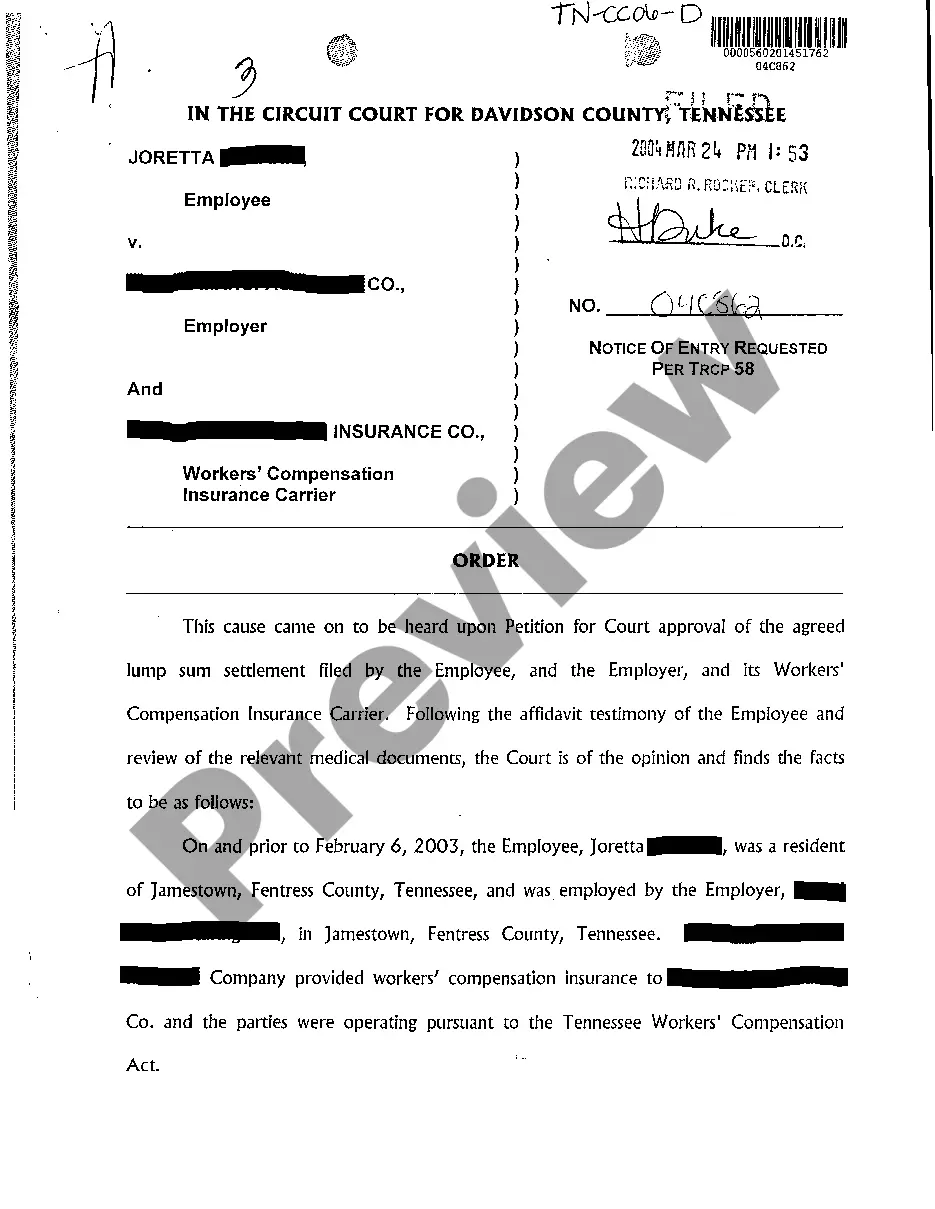

- Click on the Preview button to review the form’s content.

- Read the form description to confirm you have chosen the correct form.

- If the form doesn’t meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase Now button.

- Then, select the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

When a debt is assigned, the original creditor relinquishes its rights to the debt, transferring them to another party. This means that you may receive communication from a new collector seeking payment. In Connecticut Assignment of Debt scenarios, being proactive by documenting communications and understanding your rights can help protect you. Platforms like US Legal Forms can provide essential resources to navigate this process smoothly.

The assignment of debt can change your credit profile and financial responsibilities. When a debt is assigned, it may shift who is responsible for repayments and how those payments are structured. Especially in cases of Connecticut Assignment of Debt, the assigned entity might pursue collections more aggressively. Understanding the implications can empower you to manage your debts effectively and make informed decisions.

Connecticut's debt situation involves complex financial metrics, including both state and local government debt. While the overall debt depends on various factors, it's essential to understand how this impacts residents and businesses. The Connecticut Assignment of Debt can shift financial responsibilities, affecting how debts are perceived and resolved in the state. Staying informed about your state’s financial health is important for planning your personal finances.

When a debt is assigned, it means that the original creditor transfers the rights of the debt to another party. This new party, often called the assignee, now holds the right to collect the debt. In Connecticut Assignment of Debt cases, this process can help the original creditor recover funds while providing the assignee the opportunity to manage the debt. Understanding this can offer clarity when dealing with financial obligations.

To outsmart a debt collector, keep detailed records of all communications and know your rights. Understanding the Connecticut Assignment of Debt can also provide you with more options for managing your debts. Always consult with a legal expert if needed to ensure you are fully protected.

The eleven-word phrase is, 'I request that you cease all communication with me.' Using this phrase clearly communicates your wishes to the debt collector. Additionally, knowing about the Connecticut Assignment of Debt can further protect your interests.

Avoid admitting any liability or making promises you cannot keep when speaking to a creditor. Refrain from discussing personal financial details that could be used against you. It's beneficial to stay informed about processes like the Connecticut Assignment of Debt to handle conversations with creditors confidently.

To effectively stop debt collectors, you can send a written request asking them to cease communication. This formal notice invokes your rights under the Fair Debt Collection Practices Act. You can also consider using the Connecticut Assignment of Debt to resolve your financial obligations more easily.

The 777 rule refers to the guideline that debt collectors must follow when trying to recover unpaid debts in Connecticut. It essentially states that they cannot contact you more than seven times in a seven-day period for a single debt. Understanding your rights under this rule can empower you, especially when dealing with the Connecticut Assignment of Debt process.

Yes, an assignment should ideally be in writing to ensure its validity and enforceability. A written document provides clear evidence of the agreement between the parties and outlines the terms of the debt transfer. For your Connecticut Assignment of Debt, relying on platforms like USLegalForms can help you generate the required documentation efficiently.