Connecticut Sample Letter for Annual Report - Dissolved Corporation

Description

How to fill out Sample Letter For Annual Report - Dissolved Corporation?

Are you presently in the placement the place you require papers for sometimes enterprise or individual reasons just about every day time? There are a variety of legal document templates accessible on the Internet, but locating versions you can rely on is not straightforward. US Legal Forms delivers 1000s of form templates, like the Connecticut Sample Letter for Annual Report - Dissolved Corporation, which can be published in order to meet federal and state requirements.

If you are presently knowledgeable about US Legal Forms site and have an account, just log in. Following that, it is possible to download the Connecticut Sample Letter for Annual Report - Dissolved Corporation web template.

If you do not come with an account and wish to start using US Legal Forms, adopt these measures:

- Find the form you need and ensure it is for your right area/region.

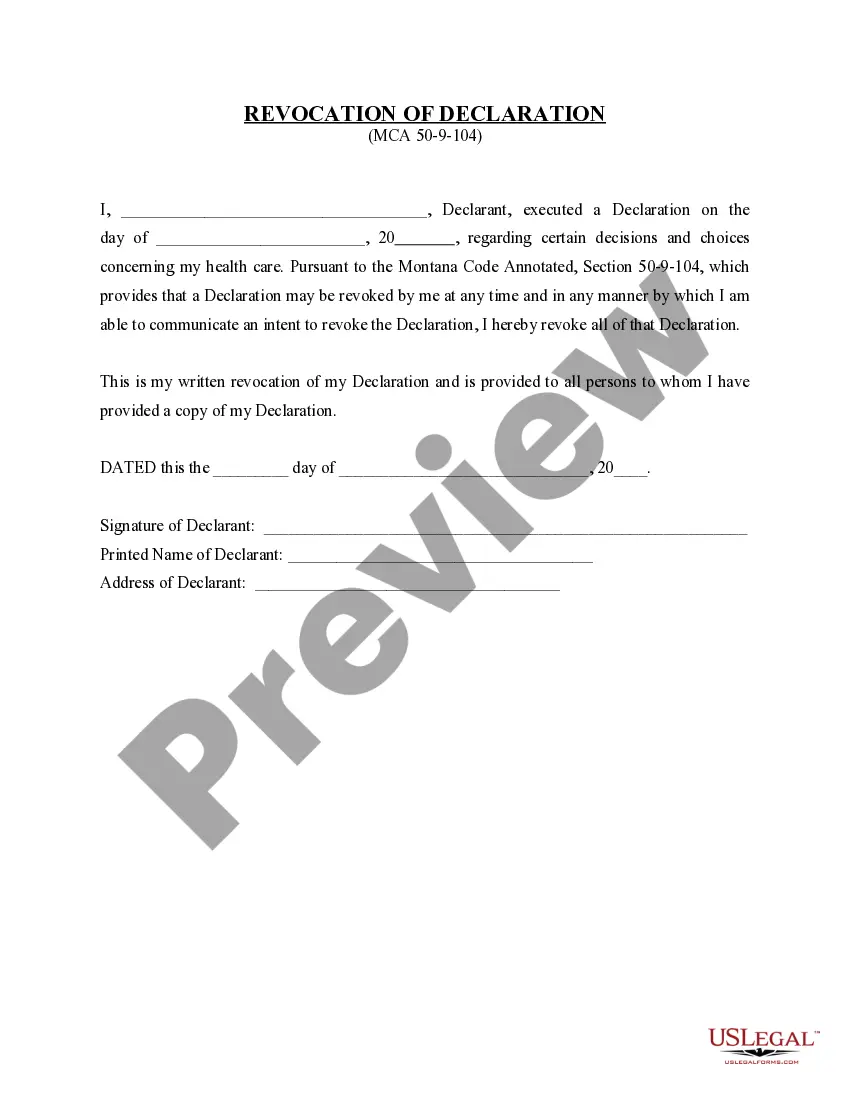

- Take advantage of the Preview option to analyze the shape.

- See the information to actually have chosen the right form.

- When the form is not what you`re searching for, make use of the Research discipline to obtain the form that meets your requirements and requirements.

- When you discover the right form, just click Purchase now.

- Select the pricing strategy you would like, fill out the desired details to create your bank account, and pay for an order using your PayPal or credit card.

- Decide on a handy data file structure and download your duplicate.

Get every one of the document templates you may have purchased in the My Forms menu. You may get a additional duplicate of Connecticut Sample Letter for Annual Report - Dissolved Corporation any time, if possible. Just click on the required form to download or printing the document web template.

Use US Legal Forms, one of the most substantial variety of legal types, to save efforts and stay away from blunders. The support delivers professionally produced legal document templates which you can use for a variety of reasons. Make an account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

This intent to dissolve should include the following information: A detailed description of the claim. Information regarding the claim, the amount of the claim, and whether it is admitted to or not. A mailing address where any claims can be sent. A deadline: This must be at least 120 days after the written notice date.

Connecticut law requires annual report filings for all corporations, nonstock corporations, limited liability companies, limited liability partnerships and limited partnerships. For more information, go to business.ct.gov/file-annual-report.

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.

Connecticut law requires the following domestic (Connecticut) and foreign (outside Connecticut) business entities to file annual reports: Limited Liability Companies, Stock Corporations, Non-Stock Corporations, Limited Liability Partnerships, and Limited Partnerships.

To dissolve a Connecticut corporation, you just need to file a Certificate of Dissolution with the Connecticut Secretary of the State, Commercial Recording Division (SOTS). Connecticut has forms available for use but you can draft your own articles of dissolution as long as they contain the required information.

To dissolve a Connecticut corporation, you just need to file a Certificate of Dissolution with the Connecticut Secretary of the State, Commercial Recording Division (SOTS). Connecticut has forms available for use but you can draft your own articles of dissolution as long as they contain the required information.

To reinstate your LLC, you'll have to submit the following to the Connecticut Secretary of the State: a completed Reinstatement Package. a $120 reinstatement fee. an annual report for the current year. any penalties owed.

Connecticut SOTS does not require original signatures on your articles of dissolution. Submit your documents to SOTS by mail, fax or in person. Connecticut SOTS accepts walked in documents between am and pm, Monday-Friday.