Connecticut Sample Letter for Certificate of Administrative Dissolution - Revocation

Description

How to fill out Sample Letter For Certificate Of Administrative Dissolution - Revocation?

It is possible to spend hours online looking for the legitimate file web template that meets the state and federal requirements you want. US Legal Forms provides a large number of legitimate kinds that happen to be examined by professionals. You can actually obtain or produce the Connecticut Sample Letter for Certificate of Administrative Dissolution - Revocation from your services.

If you have a US Legal Forms account, you may log in and click on the Obtain option. Following that, you may complete, revise, produce, or indication the Connecticut Sample Letter for Certificate of Administrative Dissolution - Revocation. Every legitimate file web template you acquire is your own forever. To have yet another copy of the obtained develop, proceed to the My Forms tab and click on the related option.

If you work with the US Legal Forms web site the first time, keep to the basic directions under:

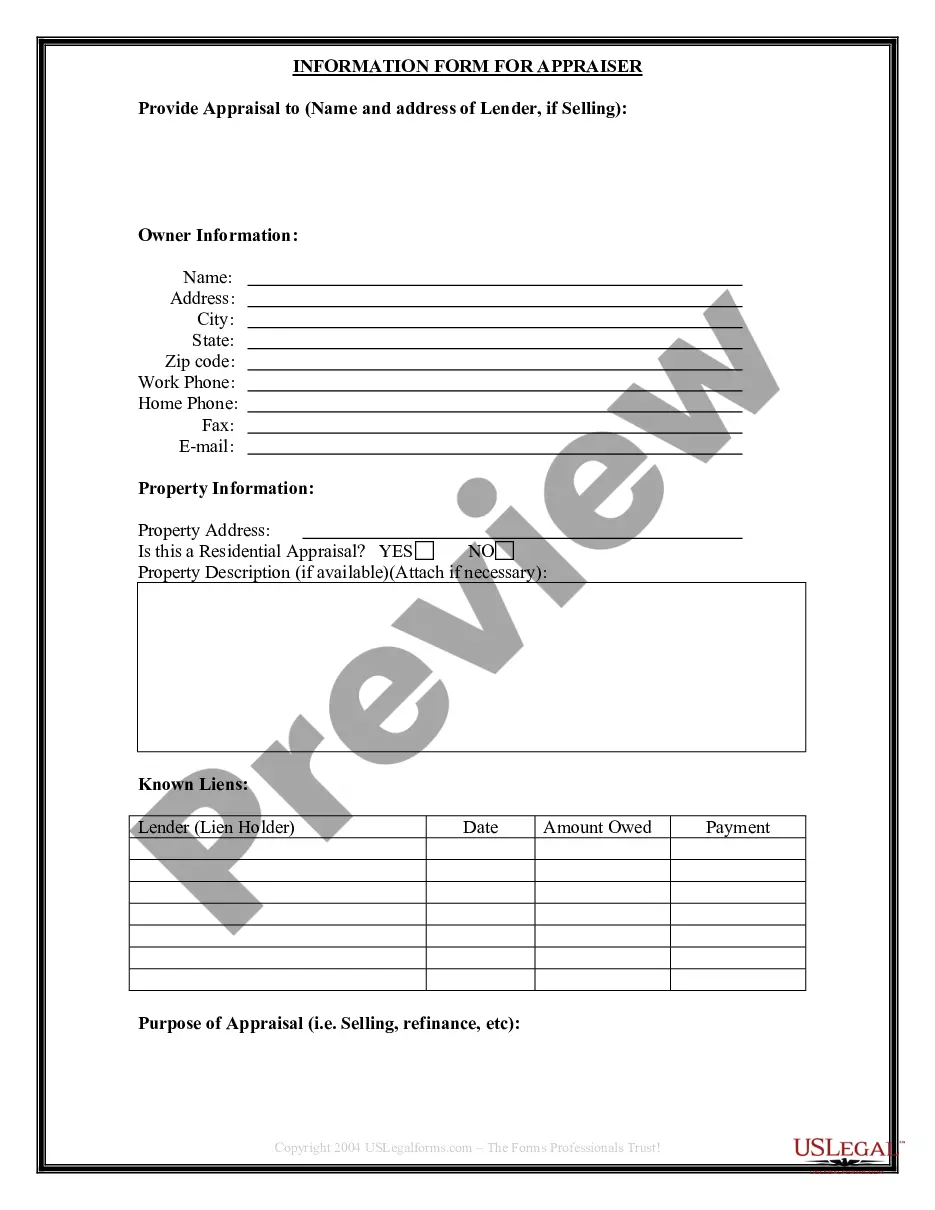

- Initially, make certain you have selected the best file web template for that area/city of your liking. Read the develop description to make sure you have picked the proper develop. If accessible, use the Review option to check through the file web template also.

- If you wish to locate yet another edition in the develop, use the Research area to obtain the web template that fits your needs and requirements.

- When you have identified the web template you want, click on Get now to move forward.

- Select the rates strategy you want, key in your accreditations, and register for an account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal account to fund the legitimate develop.

- Select the file format in the file and obtain it to your device.

- Make modifications to your file if possible. It is possible to complete, revise and indication and produce Connecticut Sample Letter for Certificate of Administrative Dissolution - Revocation.

Obtain and produce a large number of file themes while using US Legal Forms site, that offers the largest collection of legitimate kinds. Use skilled and state-distinct themes to tackle your small business or specific needs.

Form popularity

FAQ

To dissolve a Connecticut corporation, you just need to file a Certificate of Dissolution with the Connecticut Secretary of the State, Commercial Recording Division (SOTS). Connecticut has forms available for use but you can draft your own articles of dissolution as long as they contain the required information.

Connecticut SOTS does not require original signatures on your articles of dissolution. Submit your documents to SOTS by mail, fax or in person. Connecticut SOTS accepts walked in documents between am and pm, Monday-Friday.

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.

A business entity that has been administratively dissolved is given the status ?forfeited.? If the business wishes to become active again, it must file a reinstatement. Once a business is forfeited, the business name becomes available.

To officially dissolve your LLC, you must follow certain steps. Step 1: Follow the process in your Operating Agreement. ... Step 2: Check your business tax accounts. ... Step 3: Close your tax and state accounts. ... Step 4: Close your business tax withholdings. ... Step 5: Close your unemployment tax account.

This intent to dissolve should include the following information: A detailed description of the claim. Information regarding the claim, the amount of the claim, and whether it is admitted to or not. A mailing address where any claims can be sent. A deadline: This must be at least 120 days after the written notice date.

To reinstate your LLC, you'll have to submit the following to the Connecticut Secretary of the State: a completed Reinstatement Package. a $120 reinstatement fee. an annual report for the current year. any penalties owed.

If you voluntarily dissolve your LLC or Limited Partnership you may file a reinstatement, returning to active status while keeping your original date of formation. Reinstatement following a voluntary dissolution is only available for LLCs and Limited Partnerships.