Are you in a situation where you require documentation for potential business or individual activities almost daily? There are numerous valid document templates accessible online, but finding reliable versions can be challenging.

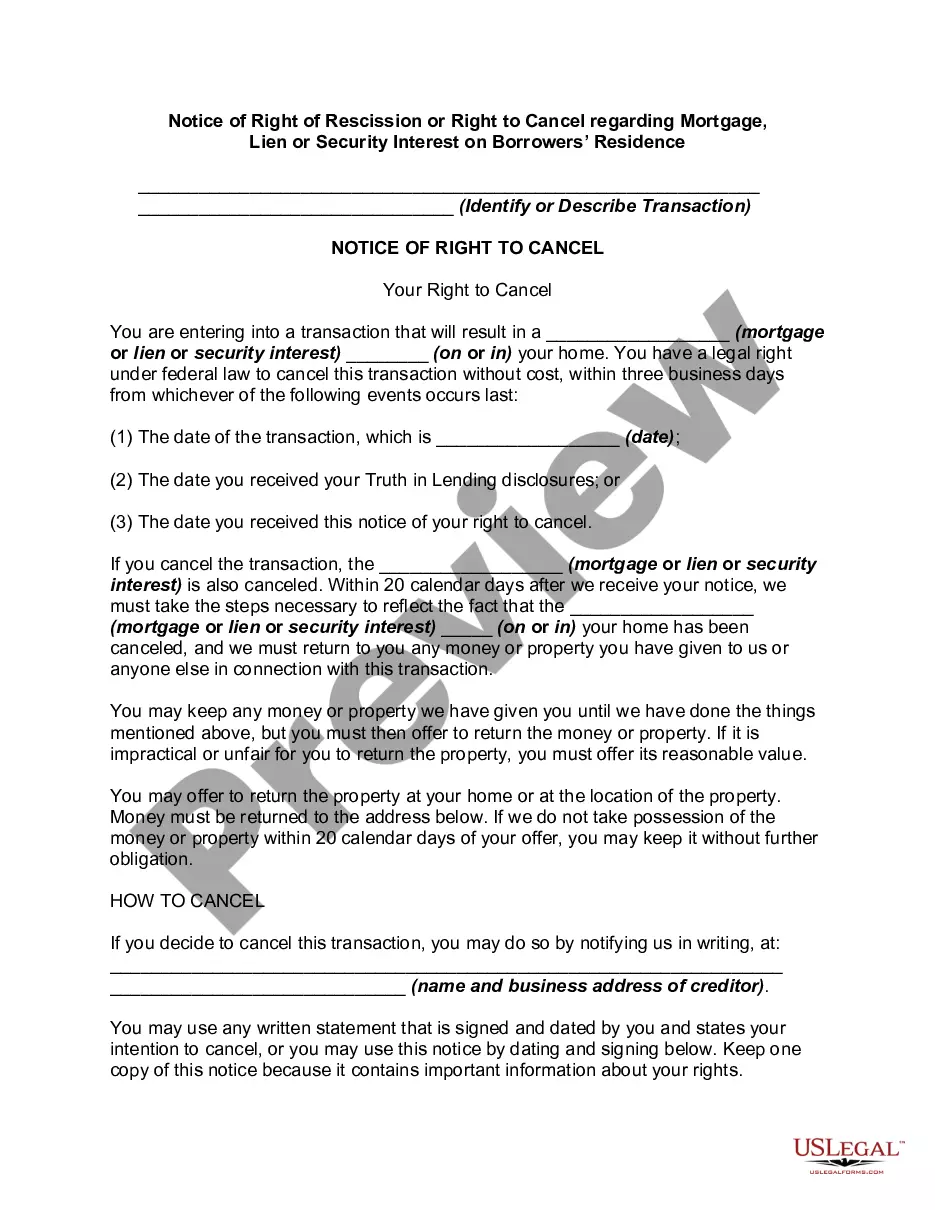

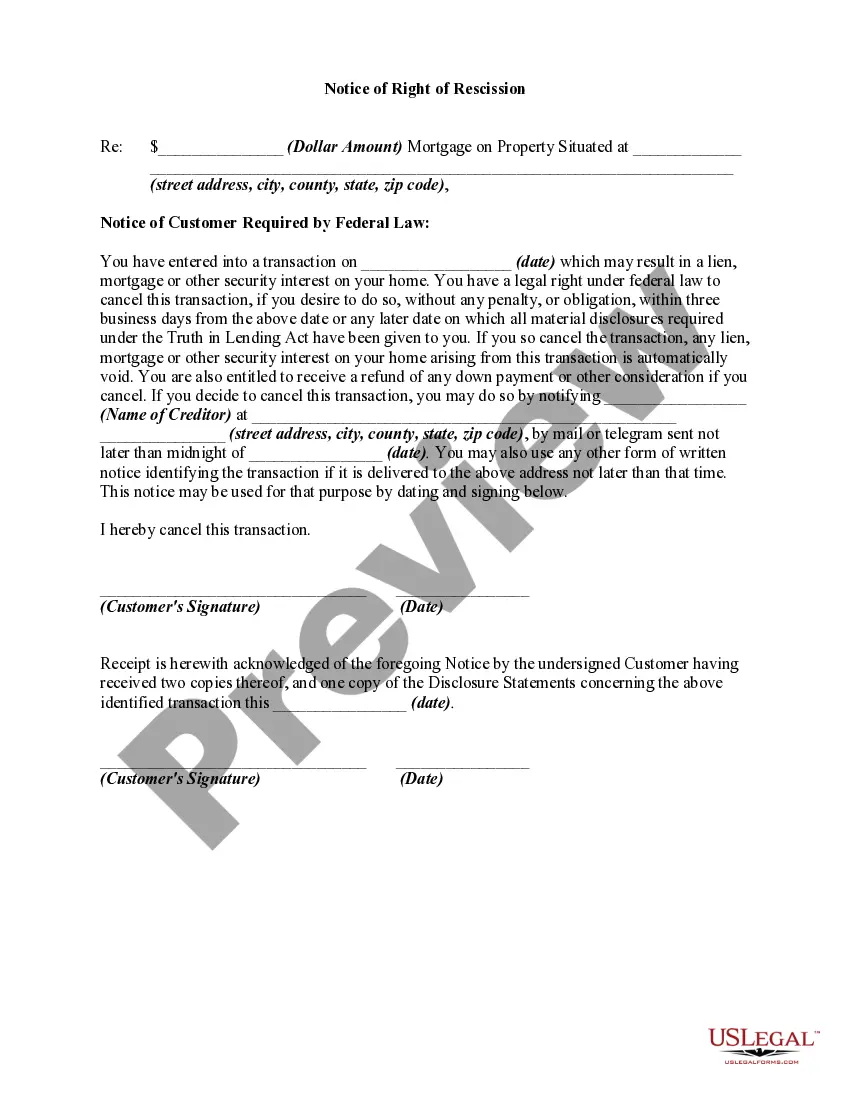

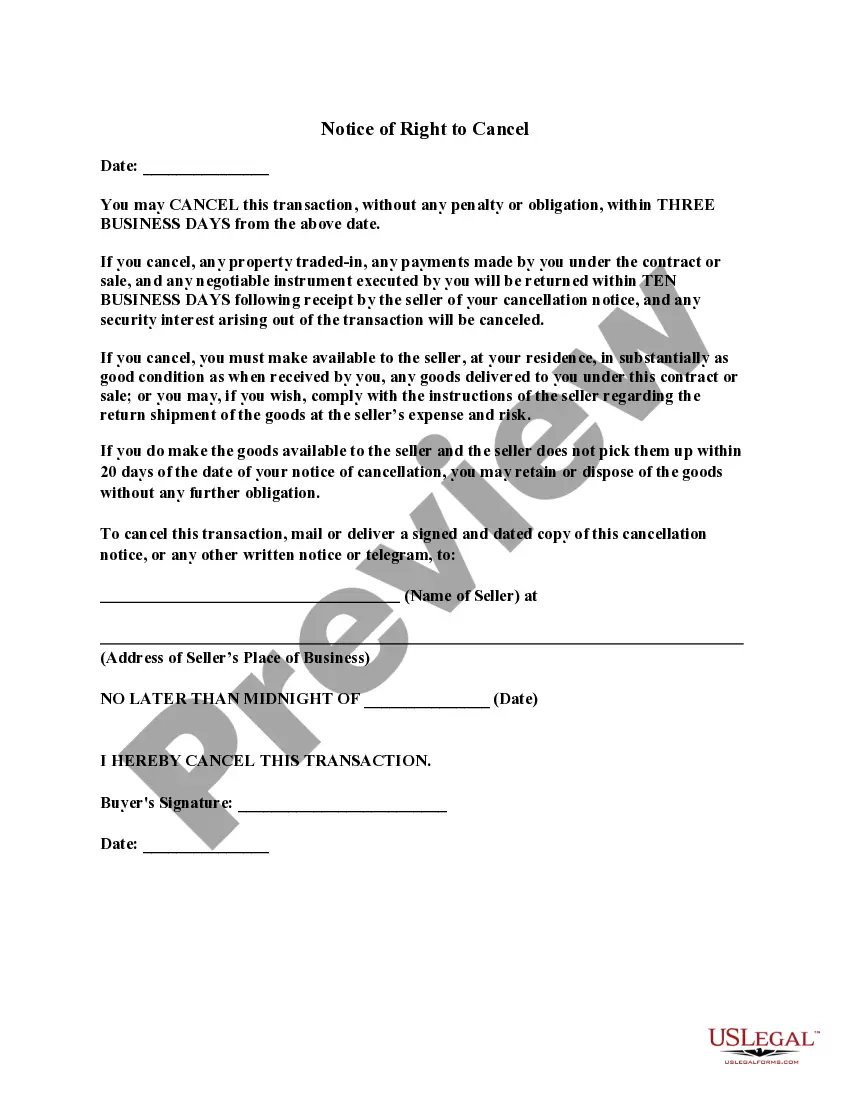

US Legal Forms offers thousands of template documents, such as the Connecticut Right to rescind when security interest in consumer's primary residence is involved - Rescission, which are designed to comply with both federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Connecticut Right to rescind when security interest in consumer's principal dwelling is involved - Rescission template.

Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the Connecticut Right to rescind when security interest in consumer's principal dwelling is involved - Rescission at any time, if needed. Just follow the form to download or print the document template.

Utilize US Legal Forms, one of the most extensive collections of legitimate forms, to save time and avoid mistakes. The service offers well-crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Obtain the form you need and verify that it corresponds to the correct jurisdiction.

- Use the Preview option to review the document.

- Check the description to ensure you have selected the right template.

- If the document is not what you're looking for, use the Search field to find a template that meets your needs and requirements.

- Once you locate the appropriate template, click Get now.

- Select the payment plan you prefer, provide the required information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.