Connecticut Sample Letter for Land Deed of Trust

Description

How to fill out Sample Letter For Land Deed Of Trust?

If you wish to comprehensive, obtain, or print lawful papers layouts, use US Legal Forms, the biggest selection of lawful types, which can be found on-line. Utilize the site`s simple and practical look for to get the files you will need. Various layouts for organization and personal uses are sorted by types and says, or keywords. Use US Legal Forms to get the Connecticut Sample Letter for Land Deed of Trust in just a few click throughs.

If you are already a US Legal Forms client, log in in your bank account and click the Download button to get the Connecticut Sample Letter for Land Deed of Trust. Also you can gain access to types you formerly downloaded within the My Forms tab of your own bank account.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have selected the form for that proper area/country.

- Step 2. Make use of the Preview method to examine the form`s content. Do not forget to read through the outline.

- Step 3. If you are unhappy together with the form, make use of the Search industry near the top of the display screen to get other types of your lawful form format.

- Step 4. After you have identified the form you will need, click the Get now button. Choose the costs program you like and include your credentials to register for the bank account.

- Step 5. Method the financial transaction. You should use your bank card or PayPal bank account to finish the financial transaction.

- Step 6. Choose the file format of your lawful form and obtain it on your system.

- Step 7. Full, modify and print or sign the Connecticut Sample Letter for Land Deed of Trust.

Each and every lawful papers format you purchase is your own forever. You have acces to each and every form you downloaded within your acccount. Go through the My Forms area and pick a form to print or obtain once again.

Contend and obtain, and print the Connecticut Sample Letter for Land Deed of Trust with US Legal Forms. There are millions of skilled and express-certain types you may use for your organization or personal needs.

Form popularity

FAQ

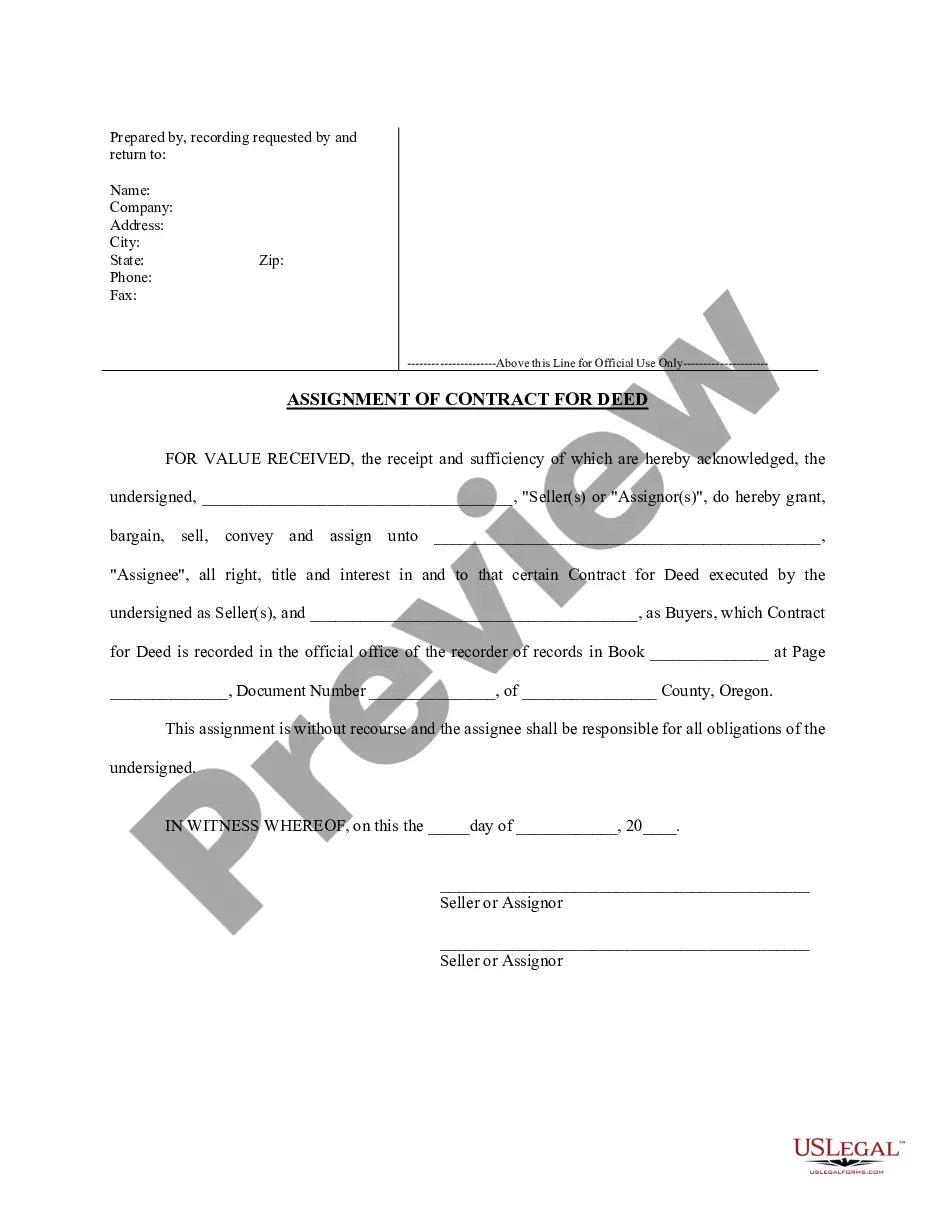

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

A "Short Form Deed of Trust" is a document that is used to secure a promissory note by using real estate as collateral. When filing a Deed of Trust, it places a lien against the property.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Notes: Not all states recognize a Trust Deed. Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

?Connecticut is considered a 'title theory' state wherein the mortgagor [debtor] pledges property to the mortgagee [creditor] as security for a debt and conveys 'legal title' to the mortgaged premises; the mortgagor retains 'equitable title' or the 'equity of redemption'?.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateLouisianaYMaineYMarylandYYMassachusettsY47 more rows

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.