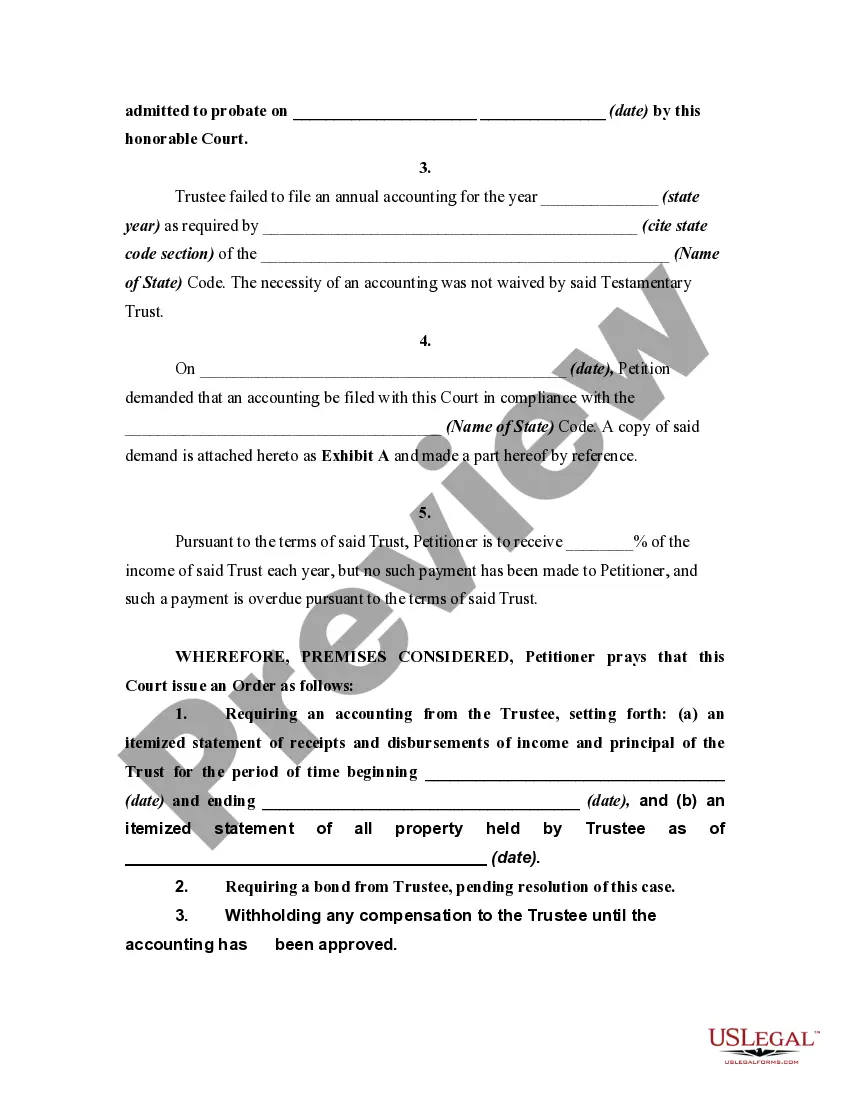

An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Connecticut Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

Choosing the best legal record format could be a have difficulties. Obviously, there are plenty of themes available on the net, but how do you get the legal kind you want? Utilize the US Legal Forms site. The support delivers a large number of themes, including the Connecticut Petition to Require Accounting from Testamentary Trustee, which can be used for business and personal requires. Each of the forms are inspected by specialists and meet up with state and federal demands.

In case you are previously signed up, log in to the bank account and click the Download option to have the Connecticut Petition to Require Accounting from Testamentary Trustee. Utilize your bank account to search throughout the legal forms you may have purchased in the past. Visit the My Forms tab of the bank account and acquire an additional copy of your record you want.

In case you are a fresh end user of US Legal Forms, listed here are straightforward instructions that you can comply with:

- Initially, make certain you have chosen the proper kind for the area/county. It is possible to look through the shape using the Review option and browse the shape explanation to ensure this is basically the best for you.

- In case the kind fails to meet up with your preferences, utilize the Seach industry to discover the appropriate kind.

- Once you are sure that the shape is acceptable, click on the Acquire now option to have the kind.

- Pick the costs plan you desire and enter the required information and facts. Design your bank account and buy an order utilizing your PayPal bank account or Visa or Mastercard.

- Pick the submit formatting and acquire the legal record format to the gadget.

- Total, change and produce and indication the acquired Connecticut Petition to Require Accounting from Testamentary Trustee.

US Legal Forms is the most significant local library of legal forms for which you can discover various record themes. Utilize the company to acquire appropriately-created papers that comply with express demands.

Form popularity

FAQ

An executor must account to the residuary beneficiaries named in the Will (and sometimes to others) for all the assets of the estate, including all receipts and disbursements occurring over the course of administration.

Section 36.5 Fiduciary to send copy of financial report or account and affidavit of closing to each party and attorney (a) A fiduciary submitting a financial report, account or affidavit of closing shall send a copy, at the time of filing, to each party and attorney of record and shall certify to the court that the ...

If you're wondering whether an executor can override a beneficiary, you're asking the wrong question. An executor can't override what's in a Will.

The final accounting shows all activity that occurred in the estate, starting with the value of the inventory (the value of all solely-owned assets on the decedent's date of death), showing all bills and expenses that were paid, and listing a proposed distribution of the remaining assets in the probate estate.

At the Law Offices of Glenn & West, LLC, one of the most commonly asked questions we hear is, ?Does an executor have to show accounting to beneficiaries?? The answer is, ?Yes!? As the executor of a will or administrator of an estate, you have a fiduciary duty toward the estate and its heirs.

Can your executor take money from the estate? The executor is not the owner of the estate, meaning they do not have rights to the assets within the estate. They are however permitted to be paid for their duties. This does not mean they are free to take whatever sum of money they wish from the estate account.

Next Steps If a Trustee Refuses Accounting Duties Your trust and probate attorney files a petition to compel the trustee to carry out their accounting duties. The court issues a citation to your trustee mandating them to appear in court on a specified hearing date.

Yes. You can add money into an existing testamentary trust. However, any money or assets you add to an existing testamentary trust will not enjoy the tax and asset protection privileges of a testamentary trust. Only that part of the estate allocated to the beneficiary by the Will owner enjoys these privileges.