This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary

Description

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

Are you presently in the location where you require documents for either business or personal purposes almost every day.

There are many legal document templates available online, but locating ones you can trust isn’t straightforward.

US Legal Forms offers thousands of form templates, such as the Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary, that are crafted to meet federal and state requirements.

Select the pricing plan you want, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a suitable file format and download your version. Locate all the form templates you have purchased in the My documents menu. You can obtain an additional copy of Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary at any time. Click on the desired form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

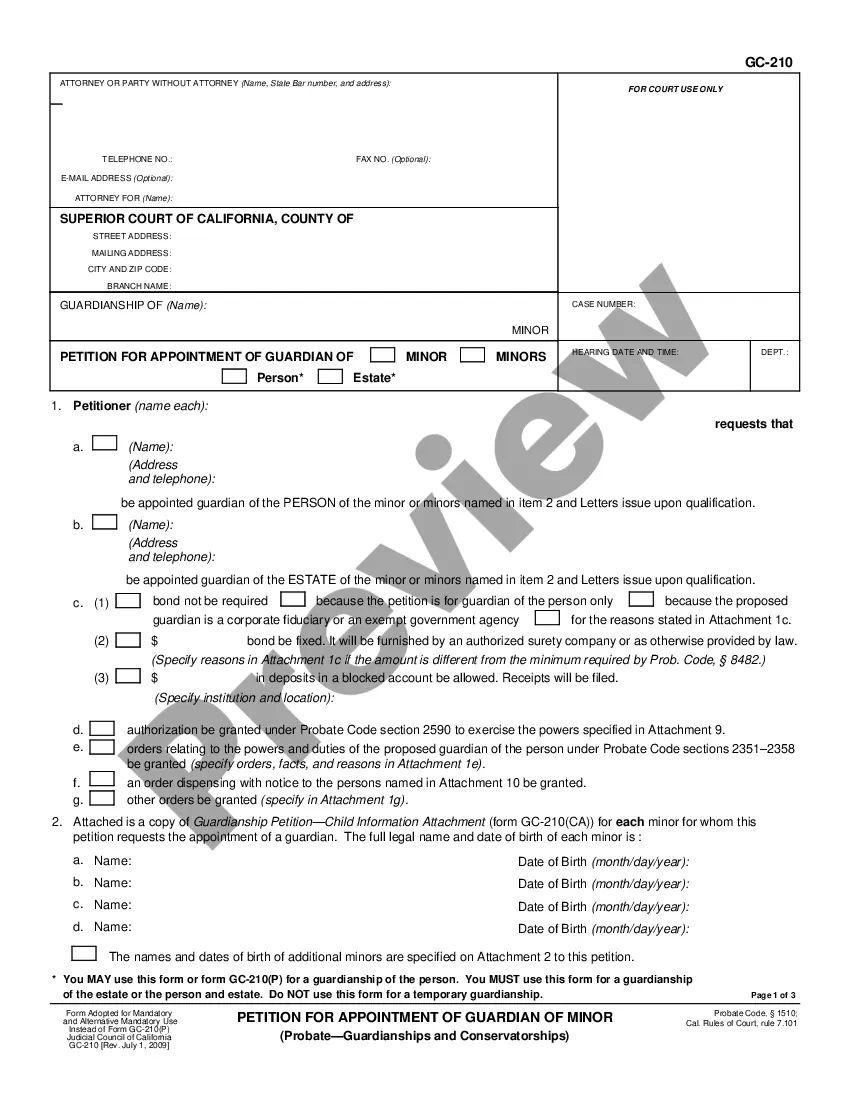

- Obtain the form you require and verify that it is for the correct city/state.

- Use the Review feature to evaluate the form.

- Examine the summary to confirm that you have selected the correct form.

- If the form isn’t what you’re seeking, utilize the Search field to find the form that meets your requirements and preferences.

- Once you find the appropriate form, click Buy now.

Form popularity

FAQ

Yes, an executor is required to provide receipts for all transactions related to the estate. This includes payments made to beneficiaries, showing direct accountability. Delivering receipts strengthens the integrity of the process and aligns with the principles behind the Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary.

A letter of release to beneficiaries is a formal document that indicates beneficiaries have received their inheritance. This letter also confirms that they release the executor from further obligations regarding those specific assets. It plays a vital role in the procedural groundwork of the Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary.

An executor should provide receipts to beneficiaries promptly after any payments or disbursements. Although there is no strict deadline, acting quickly fosters trust and transparency. Ensuring timely documentation supports the thoroughness of the Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary.

Valid proof of an executor typically includes the Letters Testamentary issued by the probate court. This document formally appoints the individual as the estate's representative and grants them the authority to act on behalf of the estate. Beneficiaries can request to see this proof, especially in relation to any Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary.

An executor cannot write checks to themselves for personal use. Payments should only be made for legitimate expenses related to the estate's administration. However, executors can receive compensation for their services, which must be documented properly. This is closely tied to the proper execution of the Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary.

Yes, an executor must provide accounting to beneficiaries to ensure transparency in the estate's management. This accounting typically includes a detailed record of all financial transactions, assets, and disbursements made during the estate administration process. Beneficiaries have the right to review this information, especially relating to the Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary.

The trustee has a critical responsibility to notify beneficiaries about important matters concerning the trust, including any significant actions taken concerning the assets. This includes the Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary, which serves as formal documentation when a trustee transfers property to a beneficiary. By adhering to these duties, the trustee ensures transparency and keeps beneficiaries informed of their entitlements. Engaging with platforms like US Legal Forms can simplify the creation of these necessary documents, enhancing the communication process between trustees and beneficiaries.

Getting releases signed by beneficiaries is crucial for legal protection and conflict resolution. These signed documents confirm that beneficiaries received their distributions and acknowledge that the trustee has fulfilled their obligations. Therefore, using a Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary is essential for safeguarding both the trustee and the beneficiaries.

A trustee release is a formal document that terminates the trustee's responsibilities after they have completed their duties. This release often accompanies a Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary to ensure transparency. It helps protect the trustee from any claims regarding the trust after distributions are made.

Distributing funds from a trust requires following specific terms outlined in the trust document. Typically, the trustee will calculate the amounts owed to each beneficiary and facilitate the transfer of funds, ensuring proper documentation is in place. Using a Connecticut Release by Trustee to Beneficiary and Receipt from Beneficiary is vital, as it ensures that beneficiaries acknowledge receipt and absolve the trustee of future claims.