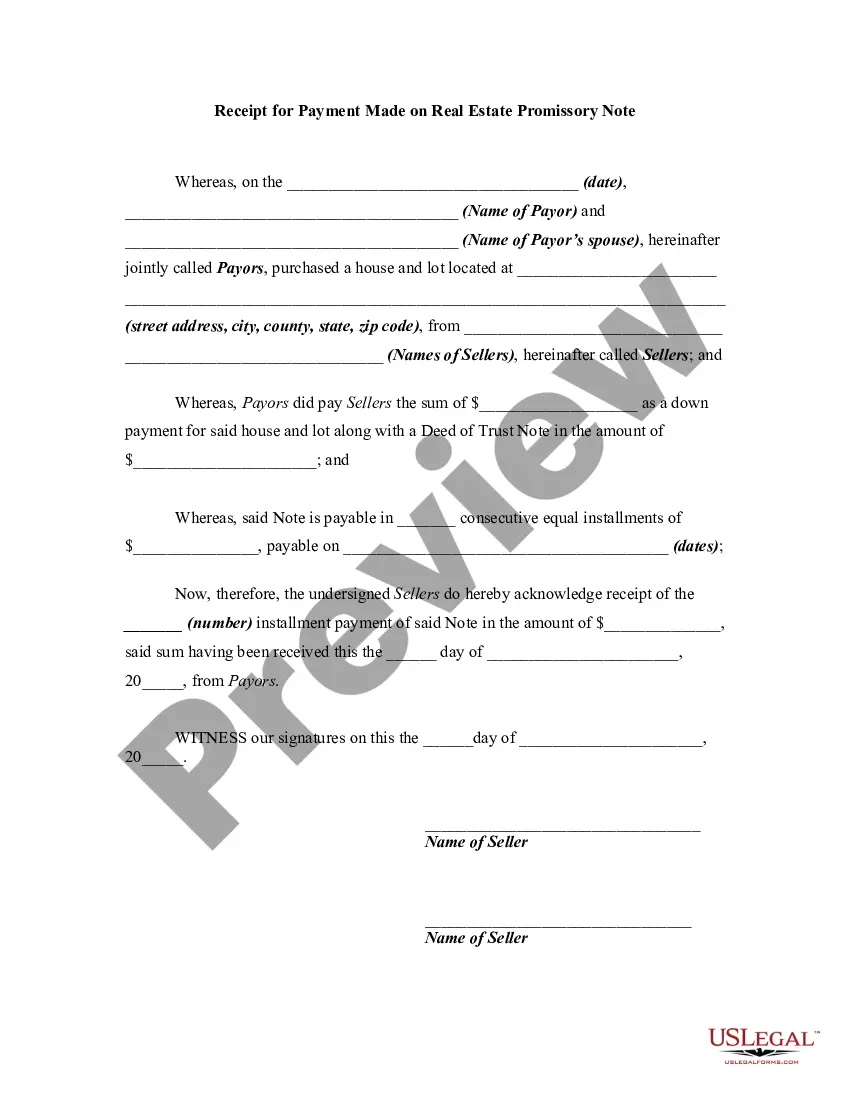

In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Receipt for Payment of Trust Fund and Release

Description

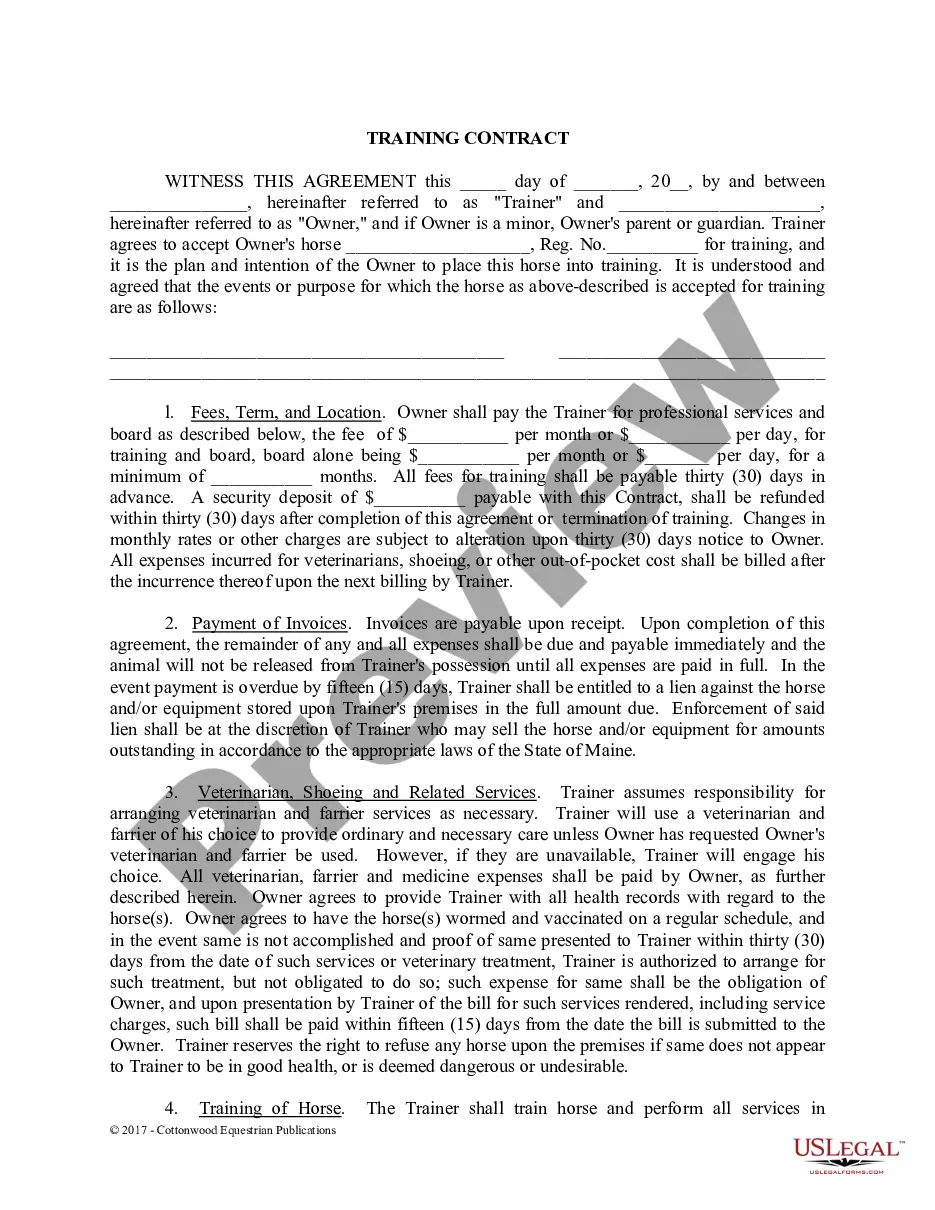

How to fill out Receipt For Payment Of Trust Fund And Release?

US Legal Forms - one of the largest collections of legitimate documents in America - provides a vast selection of legal form templates available for download or printing.

By utilizing the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords. You can quickly locate the latest versions of forms such as the Connecticut Receipt for Payment of Trust Fund and Release.

If you possess a monthly subscription, Log In to obtain the Connecticut Receipt for Payment of Trust Fund and Release from the US Legal Forms library. The Obtain button will be visible on each form you view. You can access all previously stored forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Edit. Complete, modify, print, and sign the stored Connecticut Receipt for Payment of Trust Fund and Release. Every template you added to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, just navigate to the My documents section and click on the form you desire. Access the Connecticut Receipt for Payment of Trust Fund and Release with US Legal Forms, the most extensive repository of legitimate document templates. Utilize a wide array of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have chosen the correct form for your city/county.

- Click the Preview button to review the form's content.

- Check the form description to confirm you have selected the right one.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose your preferred pricing plan and enter your information to register for an account.

Form popularity

FAQ

To report trust income, you need to fill out the appropriate tax forms, such as the CT 1041. This form details the income received by the trust and is crucial for compliance with tax regulations. You may also need to provide beneficiaries with Form K-1, reporting their share of the trust's income. Utilizing platforms like US Legal Forms can help guide you through the process, ensuring you accurately report your Connecticut Receipt for Payment of Trust Fund and Release.

The trustee is typically responsible for reporting income from a trust. This includes filing the appropriate tax forms, like the CT 1041, on behalf of the trust. Beneficiaries may also need to report income they receive from the trust on their personal tax returns. Therefore, understanding your obligations tied to your Connecticut Receipt for Payment of Trust Fund and Release is crucial.

Yes, you can file the CT 1041 electronically. The Connecticut Department of Revenue Services allows electronic submission for increased convenience and faster processing. By utilizing the online portal, you improve your chances of timely approval. This approach also helps in maintaining accurate records of your Connecticut Receipt for Payment of Trust Fund and Release.

The minimum estate value for probate in Connecticut is established at $40,000. If the decedent's assets fall below this value, the estate can often be settled without going through probate. This can simplify the process for heirs and beneficiaries. Regardless of the estate's value, using a Connecticut Receipt for Payment of Trust Fund and Release can provide clarity and structure in managing trust distributions.

An estate must generally exceed $40,000 in total value for it to necessitate probate in Connecticut. This threshold marks the point at which the state requires formal estate proceedings to oversee the distribution of assets. If the estate is smaller, there may be alternative methods available. Avoid complications by considering a Connecticut Receipt for Payment of Trust Fund and Release, which helps manage distributions smoothly.

In Connecticut, assets subject to probate include real estate, bank accounts, stocks, and personal property that solely belong to the deceased. However, assets held in joint tenancy or designated with payable-on-death beneficiaries usually bypass probate. Understanding which assets require probate can significantly impact estate management. To ease the process, obtaining a Connecticut Receipt for Payment of Trust Fund and Release ensures proper handling of trust assets.

In Connecticut, the probate threshold is generally set at $40,000 for probate assets. If the total value of a deceased person's assets exceeds this amount, the estate must go through the probate process. Small estates may qualify for simplified procedures, which can be beneficial for families. If you face probate issues, consider utilizing a Connecticut Receipt for Payment of Trust Fund and Release to facilitate your estate transactions.

In Connecticut, trust beneficiaries have the right to receive information regarding the trust, its assets, and how the trust is being managed. They can request financial statements and inquire about the distribution of the trust property. Additionally, beneficiaries can hold trustees accountable for any actions that may not align with the terms of the trust document. Understanding your rights as a trust beneficiary is essential, and using a Connecticut Receipt for Payment of Trust Fund and Release can help streamline the process of receiving your rightful benefits.

Trusts in Connecticut are subject to state income tax, and specific tax obligations will depend on the type of trust established and the income it generates. Beneficiaries may also be responsible for taxes on distributions received from the trust. To ensure compliance and clarity, a Connecticut Receipt for Payment of Trust Fund and Release can serve as a valuable tool in tracking trust transactions and tax responsibilities.

In Connecticut, a trust does not necessarily need to be notarized, but notarization can enhance its validity and provide an additional layer of protection. While creating your trust, consider including a Connecticut Receipt for Payment of Trust Fund and Release to formally document and legally affirm the terms within your trust.