Connecticut General Form of Receipt

Description

How to fill out General Form Of Receipt?

If you require extensive, download, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's simple and user-friendly search to locate the documents you require. A variety of templates for business and personal purposes are organized by types and jurisdictions, or keywords.

Utilize US Legal Forms to retrieve the Connecticut General Form of Receipt with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Visit the My documents section and choose a form to print or download again.

Compete, download, and print the Connecticut General Form of Receipt with US Legal Forms. There are numerous professional and state-specific templates you can utilize for your personal or business needs.

- If you are already a US Legal Forms member, sign in to your account and then select the Download button to acquire the Connecticut General Form of Receipt.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the document for the correct city/state.

- Step 2. Utilize the Preview option to review the document’s details. Don't forget to read the summary.

- Step 3. If you are not satisfied with the document, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have identified the document you need, click on the Purchase now button. Choose the pricing plan that suits you and enter your information to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Connecticut General Form of Receipt.

Form popularity

FAQ

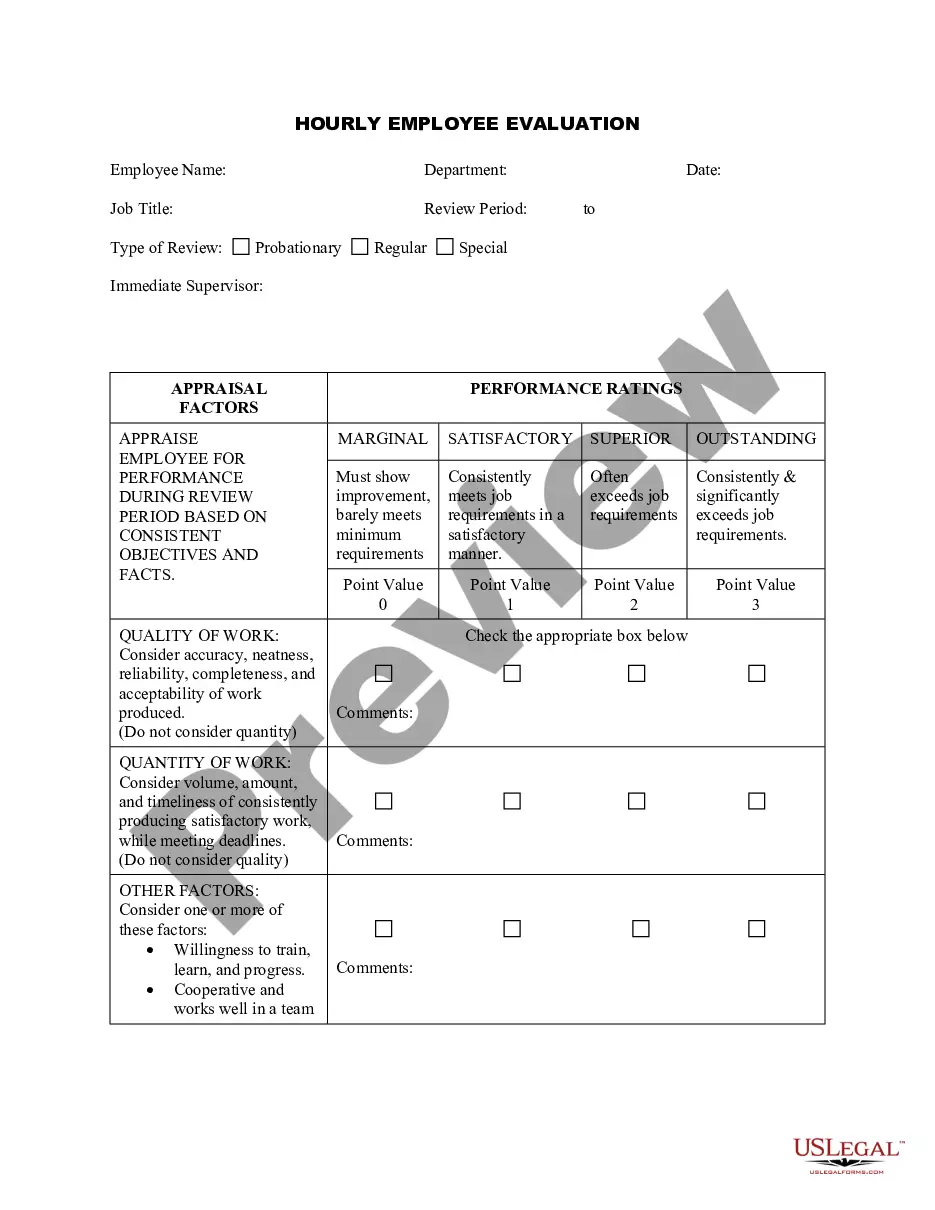

To fill out a general purpose receipt, start by specifying the date and the names of the parties involved. Then, document the specific items or services received with corresponding amounts. Using the Connecticut General Form of Receipt will streamline your process, providing a well-structured approach to creating clear and valid receipts.

Filling out a collection receipt requires you to clearly indicate the amount collected and the purpose of the payment. Ensure you include the payer’s name, the date, and any relevant transaction details. The Connecticut General Form of Receipt is a beneficial resource for capturing these details efficiently while ensuring compliance with legal standards.

To fill out a receipt example, refer to a template where you can include your own details. Include the transaction date, the name of the buyer and seller, and item descriptions with their respective prices. For an accurate and legally sound format, you may utilize the Connecticut General Form of Receipt as your guide.

Writing a receipt form begins with clearly stating the title 'Receipt' at the top of the document. Next, fill in the transaction date, the parties involved, and the itemized list of goods or services exchanged. Using the Connecticut General Form of Receipt can streamline this process, ensuring you include all vital elements and maintain professionalism.

To fill up a receipt form, start by entering the date at the top followed by the details of the transaction. List the items sold or services rendered, including quantities and prices. For ease and reliability, you might choose the Connecticut General Form of Receipt, which provides a simple template that ensures you capture all necessary information.

To properly fill out a receipt, start by including the date of the transaction, the amount received, and a description of the goods or services provided. Ensure that both the payer and payee's names are clearly printed. For a comprehensive solution, consider using the Connecticut General Form of Receipt, which standardizes the process and ensures no detail is overlooked.

To obtain your 1099 G form in Connecticut, go to the Connecticut Department of Labor's website and navigate to the 'Forms' section. After logging in, you can access electronic copies of your forms. Utilizing the Connecticut General Form of Receipt while retrieving your forms can provide clarity on how income is reported, helping you stay organized and compliant.

You can access your 1099-G online in Connecticut by visiting the Connecticut Department of Labor’s website. After logging into your account, you can view and print your 1099-G form. The Connecticut General Form of Receipt will assist you in understanding your entitlements and maintaining accurate financial records related to your state income.

To download an e-filing receipt, log into your account on the relevant state or tax platform. After you submit your tax return, you should receive an option to download or print your receipt. The Connecticut General Form of Receipt can serve as a helpful reference if you need to confirm your submissions or keep records of your filings.

Typically, it takes about four to six weeks to receive your Connecticut state tax refund if you file electronically. Paper filings may take longer, often up to eight weeks. To expedite the process, ensure you file the Connecticut General Form of Receipt accurately, as errors can delay your refund.