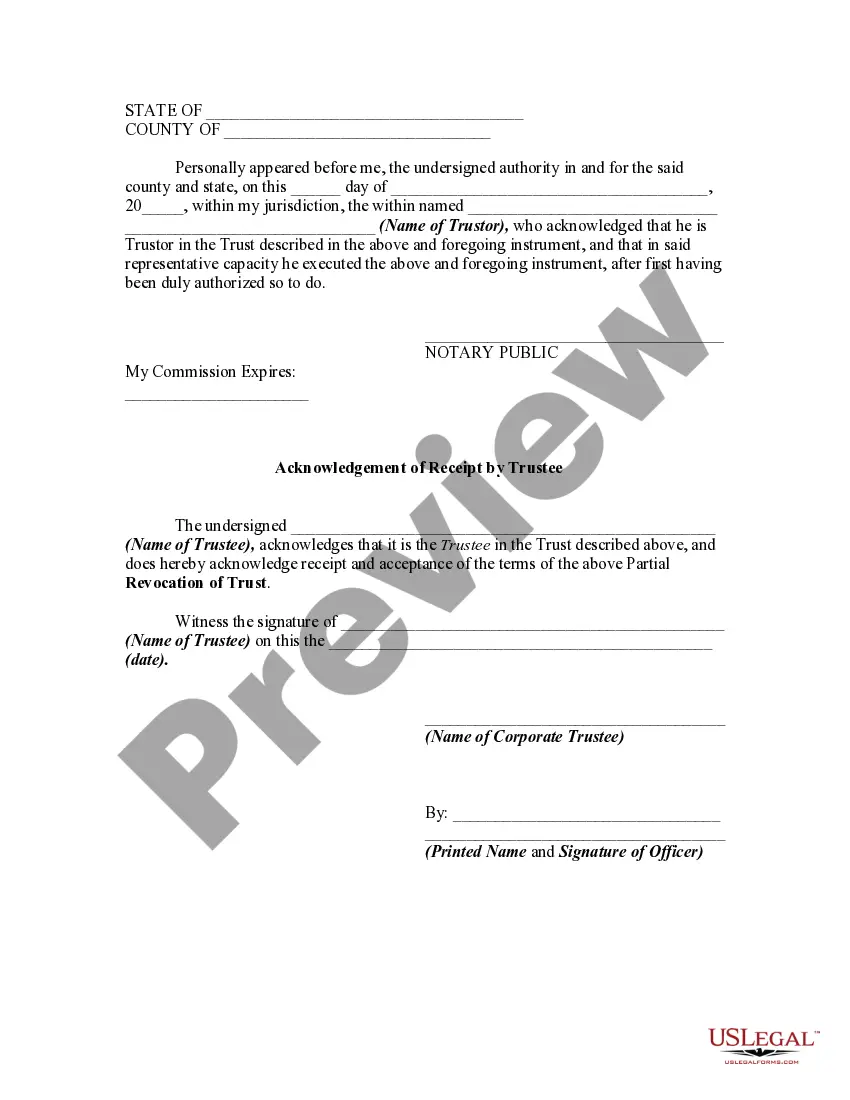

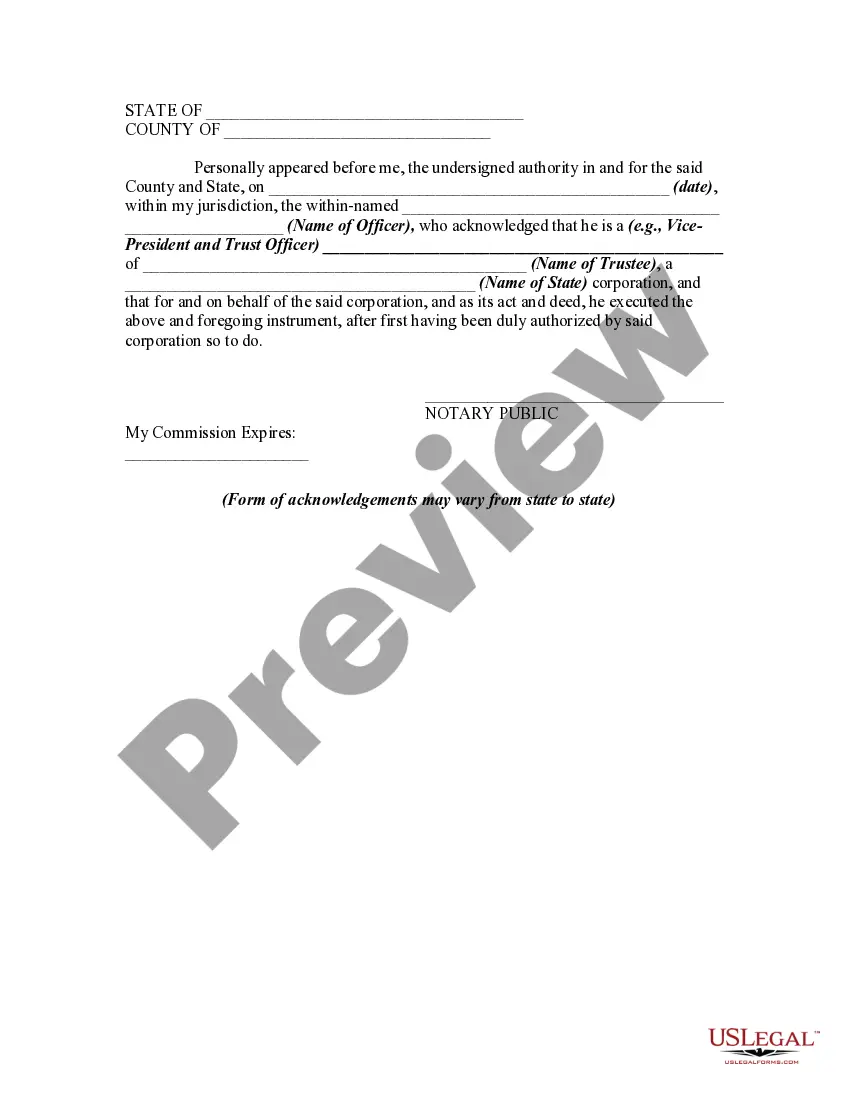

Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

Have you found yourself in a situation where you frequently require documentation for business or specific reasons almost every day.

There are numerous legal document templates accessible online, but locating ones you can depend on isn't straightforward.

US Legal Forms offers a vast collection of template forms, such as the Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, crafted to comply with state and federal regulations.

Once you find the appropriate form, just click Acquire now.

Select the pricing plan you want, fill in the necessary information to set up your account, and pay for the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Following that, you can download the Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee template.

- If you do not possess an account and wish to utilize US Legal Forms, follow these steps.

- Identify the form you require and ensure it is for the correct city/state.

- Utilize the Review button to examine the document.

- Read the description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search feature to find a template that suits your requirements.

Form popularity

FAQ

Resigning as a trustee of a revocable trust involves a few clear steps. First, you should review the trust document for specific instructions regarding resignation, as some trusts require formal notice. Secondly, you need to provide a written notice of resignation to the beneficiaries and any co-trustees. Finally, to ensure compliance with the Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, it is advisable to document the resignation properly, potentially using legal forms to maintain clarity and legality.

An example of revocation of trust is when a grantor signs a formal document stating their intent to revoke the trust, providing a clear directive to the trustee to discontinue its management. This action may also include redistributing the assets according to the grantor's preference at that time. By recognizing such examples, individuals can better understand the implications of Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Revoking a revocable trust can be a straightforward process if the grantor follows the required legal protocols. Typically, the grantor must provide written notice of revocation to the trustee and all beneficiaries, ensuring transparency throughout the process. Familiarity with these steps, particularly when utilizing resources like uslegalforms, can make revocation easier concerning Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Generally, revocable trusts do not need to be filed with the court during the grantor's lifetime, as they remain private documents. However, should the grantor pass away, the trust may need to be validated through the probate process, depending on the estate's complexity. It is essential to know how this applies when dealing with Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

An example of revocation would be when a grantor of a revocable trust decides to cancel the trust entirely and redistributes the assets among the beneficiaries. This process often involves drafting a formal declaration that specifies the revocation, followed by clear communication with the trustee. Being aware of these procedures aligns with understanding Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Several factors can lead to the breakdown of a trust, including changes in the grantor's marital status, failure to comply with legal requirements, or the death of the trust creator. Additionally, if the trust becomes illegal or impossible to execute, it may also become void. Understanding these potential pitfalls can guide you to manage trust-related issues effectively, especially regarding Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Conn Gen Stat 45a-499 details the legal framework for the revocation of trusts in Connecticut. It outlines the conditions under which a revocable trust may be revoked or amended and highlights the necessity for formal procedures. Comprehending this statute is essential for anyone involved with a trust and can clarify the implications of Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

To deactivate a trust, you need to follow similar procedures as termination, often beginning with the grantor’s decision to revoke a revocable trust. This typically requires submitting a written revocation document to the trustee and notifying all beneficiaries. Understanding your rights and responsibilities in this process is vital, particularly when addressing Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Shutting down a trust involves formally terminating it through a legal process. This may include notifying the trustee, distributing assets to beneficiaries, and filing necessary documentation with relevant authorities. It is important to follow the guidelines specific to Connecticut law to ensure a smooth closure. Resources from uslegalforms can simplify your understanding of shutting down a trust involving Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

A trust can be terminated in several ways: revocation by the grantor, fulfillment of the trust's purpose, or expiration of the trust period. For revocable trusts, the grantor has the authority to revoke it at any time, while irrevocable trusts may require a court's permission for termination. Understanding these options can help you navigate complexities involving the Connecticut Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.