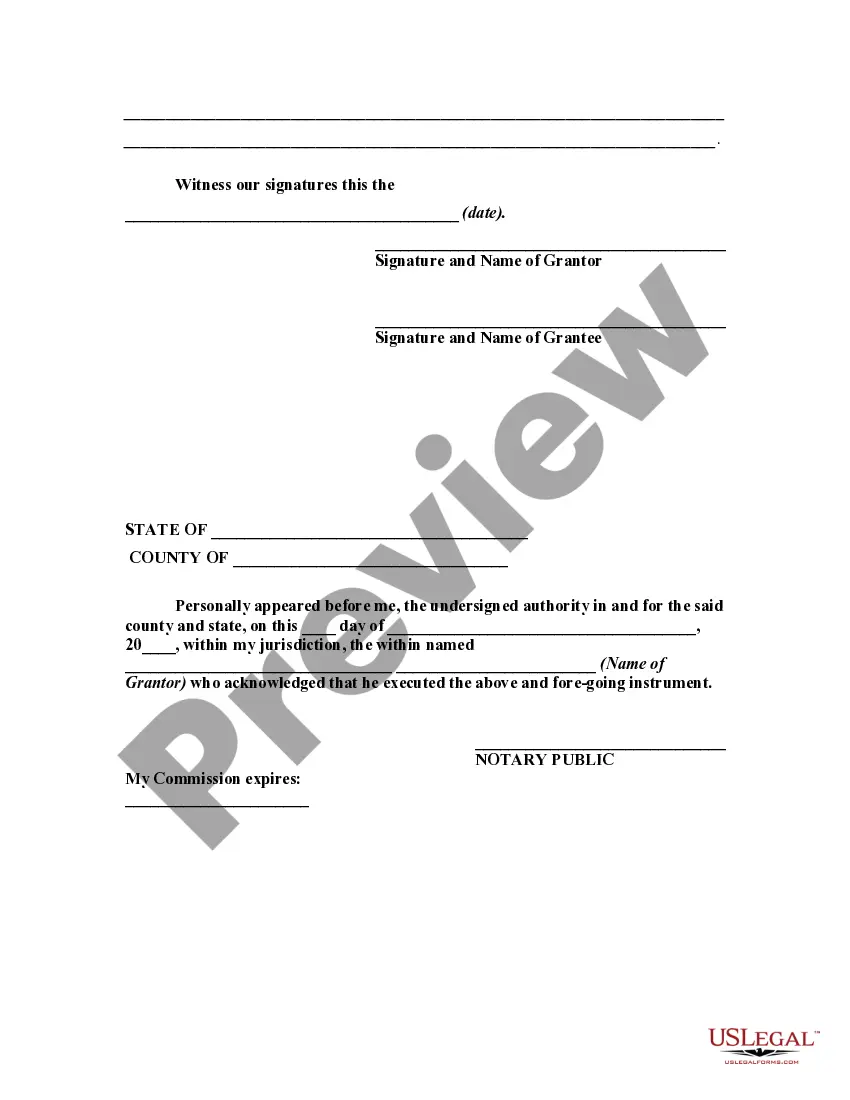

An alteration of a written instrument is a change in language of the instrument that is made by one of the parties to the instrument who is entitled to make the change. Any material alteration of a written instrument, after its execution, made by the owner or holder of the instrument, without the consent of the party to be charged, renders the instrument void as to the nonconsenting party. The party to be charged refers to that party or parties against whom enforcement of a contract or instrument is sought.

If a party consents to the alteration, the instrument will not be rendered invalid as to that party.

Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations

Description

How to fill out Ratification Of Re-Execution Of Recorded Instrument With Alterations?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

Using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the newest versions of forms such as the Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations within seconds.

If you already have a monthly subscription, Log In and download the Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously acquired forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill in, edit, print, and sign the downloaded Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations. Every template you add to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

- If you want to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your local area/region.

- Click on the Preview button to review the form's details.

- Read the form information to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

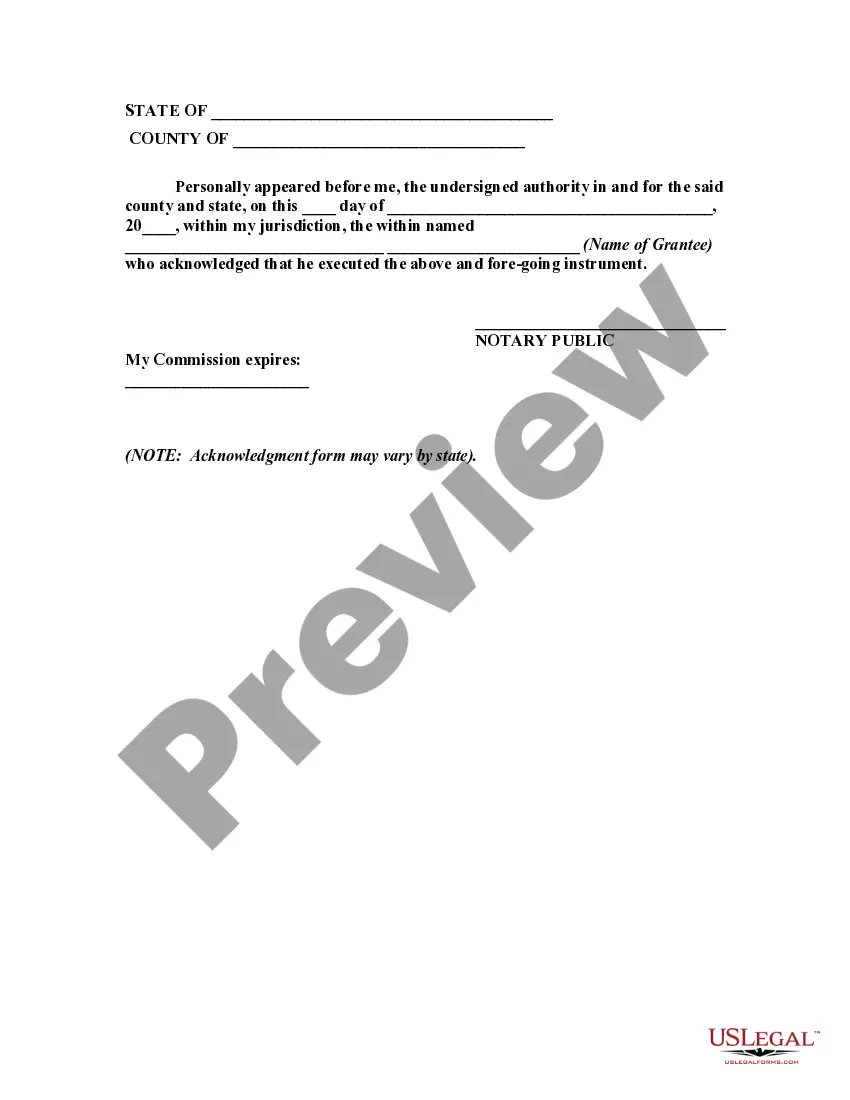

An attorney in Connecticut can notarize documents, adding their legal authority to the process. This dual role benefits clients who are dealing with legal documents requiring the Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations. By utilizing an attorney who is also a notary, you streamline your document handling, ensuring precision and compliance.

A Connecticut notary can perform notarial acts within the state of Connecticut. However, if you are outside Connecticut but have a document that needs notarization, it is best to find a notary in that location. The notary's jurisdiction is important, especially for documents related to the Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations.

Yes, a notary seal is required in Connecticut. The seal must contain the notary's name, the words 'Notary Public,' and the state of Connecticut. Using this seal on your documents, such as those regarding the Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations, adds legitimacy and helps prevent fraud.

Yes, a Connecticut attorney can serve as a notary public. If you work with an attorney, they can notarize documents related to your legal affairs. This capability is beneficial when you need to handle legal matters like the Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations. Their legal expertise adds an extra layer of assurance.

To get a document notarized in Connecticut, you need to find a licensed notary public. Make an appointment with them, and bring your document, along with valid identification. The notary will verify your identity, witness your signature, and apply their seal. This process is essential for ensuring the validity of your Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations.

Yes, in Connecticut, a notary can notarize documents for family members, provided there is no conflict of interest and the notary follows proper protocols. This practice ensures that all parties can confidently execute necessary documents, including those related to the Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations. It's essential to maintain transparency throughout the process. If you need reliable forms or resources to assist with notarization, US Legal Forms is an excellent platform to explore.

In Connecticut, the notary oath is a formal pledge taken by a notary public to perform their duties with honesty and integrity. This oath requires the notary to uphold the law while confirming the identity of the signer and ensuring that the documents are executed freely and willingly. The Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations often involves notarization, underscoring the importance of the notary's responsibility in verifying alterations made to a document. If you're navigating this process, consider using US Legal Forms to simplify your compliance needs.

Yes, in Connecticut, there is a statute of limitations on foreclosure actions, generally set at six years from the date of default on the mortgage. This timeframe is crucial for both lenders and borrowers to understand, as it dictates how long a lender has to initiate foreclosure proceedings. Awareness of these timelines, along with the Connecticut Ratification of Re-Execution of Recorded Instrument With Alterations, is vital for effective legal planning in real estate.

In Connecticut, interfering with an officer typically falls under statutes related to obstructing justice. This statute prohibits individuals from unlawfully hindering law enforcement or emergency personnel while they are performing their duties. Knowing your responsibilities and the legal boundaries in such situations can help prevent misunderstandings and legal issues.

Connecticut General Statutes Section 4a 60 focuses on the state's policies regarding procurement and the fair selection of contractors for state projects. This section emphasizes transparency and competitive bidding to promote integrity. Understanding this statute is important for businesses looking to engage with state contracts and secure opportunities.