Connecticut Personal Guaranty - General

Description

How to fill out Personal Guaranty - General?

Locating the appropriate authentic document template can pose a challenge. Indeed, numerous templates are accessible online, but how do you acquire the genuine form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Connecticut Personal Guaranty - General, suitable for both professional and personal needs.

All documents are reviewed by experts and comply with federal and state regulations.

Once you are confident the document is appropriate, click on the Acquire now button to obtain the form. Choose the payment plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the acquired Connecticut Personal Guaranty - General. US Legal Forms is the largest collection of legal documents where you can find numerous document templates. Take advantage of this service to obtain professionally crafted files that adhere to state regulations.

- If you are currently registered, Log In to your account and click on the Download button to find the Connecticut Personal Guaranty - General.

- Use your account to search through the legal documents you have acquired previously.

- Visit the My documents section of your account to retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

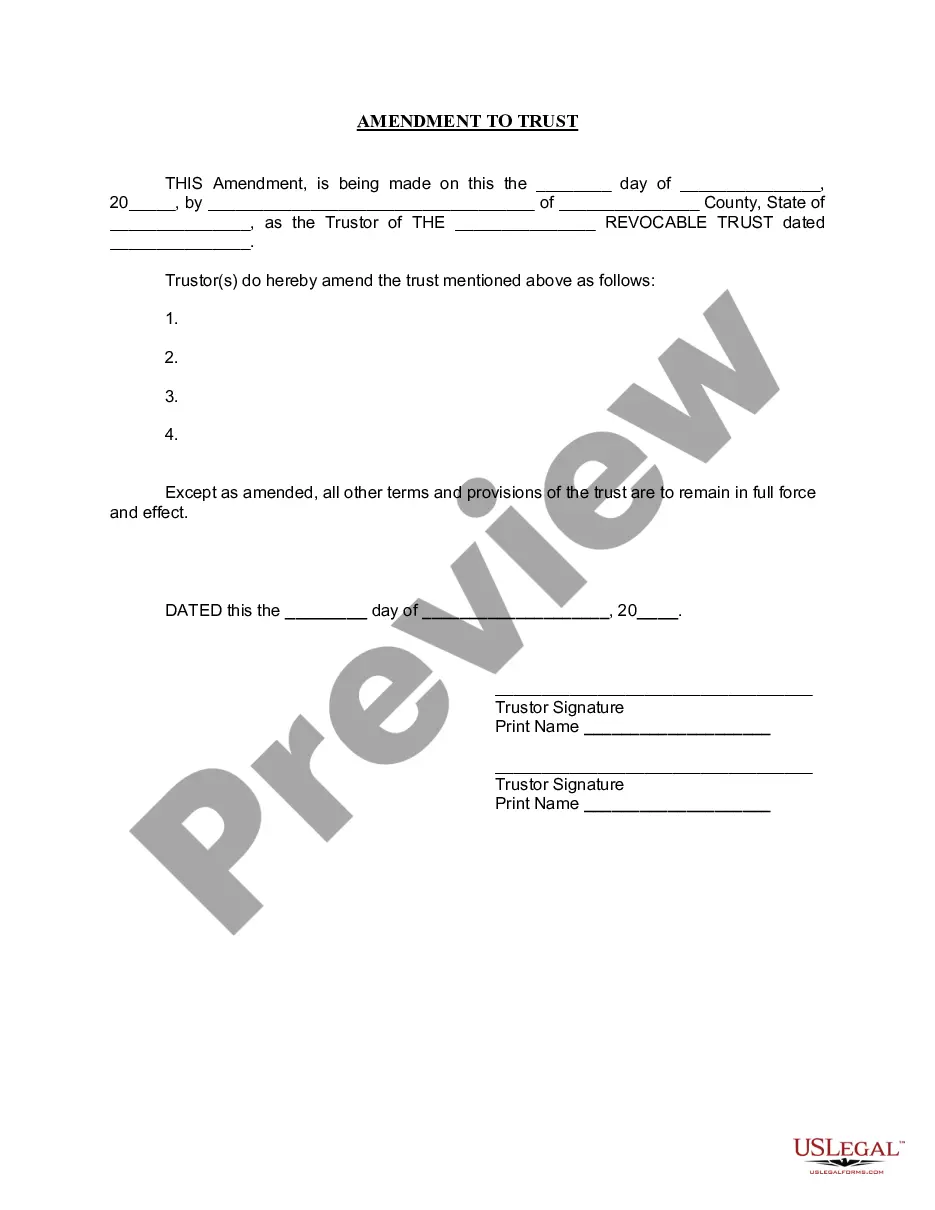

- First, ensure that you have selected the correct form for your city/county. You can review the document using the Preview button and examine the description to confirm it is the appropriate one for you.

- If the document does not suit your needs, utilize the Search field to find the right form.

Form popularity

FAQ

Requirements for a guarantee typically include a written document signed by the guarantor, outlining their obligation to cover a debt if the borrower defaults. Additionally, the guarantor should possess the financial capability to fulfill this obligation, as they may be held accountable for the debt once it is activated. Thoroughly documenting these details is vital for both parties. Utilize the US Legal Forms platform to ensure your Connecticut Personal Guaranty - General meets all necessary legal standards.

For a personal guarantee, the individual must provide clear and concise documentation stating their commitment to assume responsibility for the obligations of a business or individual. Typically, this includes signing a legal agreement that outlines the terms of the guarantee. It's crucial that the guarantor understands the financial implications involved, as their personal assets may be at risk. Using the US Legal Forms platform can help you obtain the right documentation for your Connecticut Personal Guaranty - General.

The Connecticut Real Estate Guaranty Fund was created to protect consumers during real estate transactions. It serves as a safety net for individuals who suffer losses due to actions by licensed real estate professionals. If you want to navigate these complex transactions effectively, having knowledge of Connecticut Personal Guaranty - General can help guide your decisions and safeguard your interests.

In Connecticut, an HIC refers to a Home Improvement Contract. This contract establishes the terms between a homeowner and a contractor for home improvements. Having a solid understanding of Connecticut Personal Guaranty - General ensures you know your rights and obligations, protecting both you and your contractor during the process.

In Connecticut, you must file a tax return if you earn income above a certain threshold. This applies to residents, part-time residents, and non-residents with Connecticut-source income. Filing helps you stay compliant with state regulations, and understanding Connecticut Personal Guaranty - General can aid in ensuring all financial aspects align with state guidelines.

The new home guaranty fund in Connecticut is designed to protect home buyers by providing security for certain financial obligations. This fund helps mitigate risks associated with personal guarantees, particularly for first-time homebuyers. Understanding this aspect of Connecticut Personal Guaranty - General can provide valuable insights into your options and protections when entering into real estate agreements.

Fighting a personal guarantee requires a solid understanding of your rights and responsibilities. Building a strong case with evidence and legal support can help you contest the guarantee if you believe it's unjust or unenforceable. It is essential to consult legal professionals who are experienced with Connecticut Personal Guaranty - General to ensure you have the best defense.

To exit a personal guarantee, you need to communicate with the lender directly. Discuss your circumstances and see if they can provide a release or modification of your obligation. Engaging with experts on Connecticut Personal Guaranty - General can also guide you through this process effectively.

Several factors can void a personal guarantee, including fraud or lack of consideration. If the lender fails to uphold their part of the agreement, or if significant changes occur in the contract without your consent, the guarantee may become void. Understanding these aspects of Connecticut Personal Guaranty - General can protect you from unforeseen liabilities.

A personal guarantee is generally enforceable in Connecticut, provided that it meets certain legal standards. Courts typically regard these agreements seriously, so it becomes crucial to read and comprehend the terms before signing. If you face a dispute, seeking legal advice can help you navigate the enforceability of your Connecticut Personal Guaranty - General.