Agency is a relationship based on an agreement authorizing one person, the agent, to act for another, the principal. An agency can be created for the purpose of doing almost any act the principal could do. In this form, a person is being given the authority to collect money for a corporation, the principal.

Connecticut Notice to Debtor of Authority of Agent to Receive Payment

Description

How to fill out Notice To Debtor Of Authority Of Agent To Receive Payment?

Selecting the appropriate legal document format can be a challenge.

Of course, there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, such as the Connecticut Notice to Debtor of Authority of Agent to Receive Payment, suitable for business and personal purposes.

You can review the form using the Preview button and read the form summary to make sure it is suitable for you.

- All the documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Obtain button to get the Connecticut Notice to Debtor of Authority of Agent to Receive Payment.

- Using your account, you can browse through the legal forms you have previously purchased.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure that you have selected the correct form for your city/region.

Form popularity

FAQ

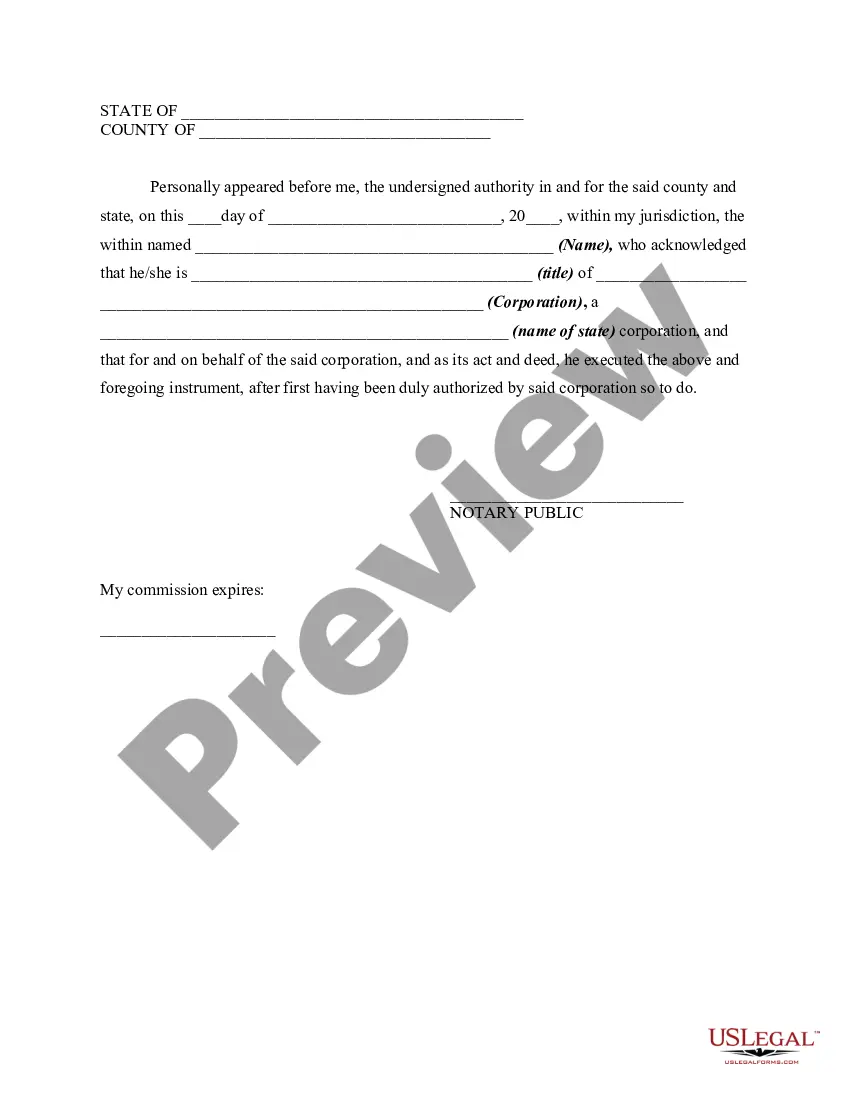

In Connecticut, a Power of Attorney typically requires notarization to ensure its validity. This notarization helps establish that the principal has given their authority to the agent, which is crucial for the Connecticut Notice to Debtor of Authority of Agent to Receive Payment. Notarization adds a layer of protection, as it confirms the identity of the principal and the voluntary nature of the agreement. If you are unsure about the process, consider using US Legal Forms to easily access the necessary documents and ensure compliance with state laws.

In Connecticut, judgments typically last for 20 years, providing ample time for creditors to enforce them. However, it is essential to understand that this duration can be impacted by various factors, such as the type of judgment and any relevant actions taken by the parties involved. By filing a Connecticut Notice to Debtor of Authority of Agent to Receive Payment, creditors ensure that they can efficiently communicate their rights and the authority to collect payments. This notice serves as an important tool in managing judgments effectively and protecting creditor interests.

In Connecticut, a judgment is typically good for 20 years from the date it is rendered. This means that the creditor has that period to enforce the judgment and collect the debt. During this time, the Connecticut Notice to Debtor of Authority of Agent to Receive Payment can be an effective tool for notifying debtors about the authority of agents designated to receive payment. If you need assistance with this process, USLegalForms provides valuable resources to help navigate debt collection and judgment enforcement.

Judgment liens in Connecticut remain effective for 20 years unless satisfied or removed earlier. This timeframe allows creditors to secure their interests in your property until the debt is fulfilled. If you receive a Connecticut Notice to Debtor of Authority of Agent to Receive Payment, it's important to recognize how their duration affects your financial responsibilities. Resources like uslegalforms offer insights into managing these liens better.

In Connecticut, a judgment usually lasts for 20 years. After this period, a creditor must renew the judgment or take action to enforce it. Understanding the specifics can help you navigate your obligations, especially if you receive a Connecticut Notice to Debtor of Authority of Agent to Receive Payment. Utilizing uslegalforms can help you manage these timelines effectively.

Not paying a judgment typically does not lead to jail time. However, if a court finds you willfully disobeying its orders regarding payment, that might result in contempt of court. Receiving a Connecticut Notice to Debtor of Authority of Agent to Receive Payment does mean you should take the matter seriously to avoid potential legal repercussions. It's crucial to explore your options with resources available on uslegalforms.

In most cases, you cannot simply get out of paying a judgment. If you receive a Connecticut Notice to Debtor of Authority of Agent to Receive Payment, it means the court has ruled in favor of the creditor. However, there are specific legal avenues available to challenge or appeal a judgment. Engaging with a legal expert and seeking assistance through platforms like uslegalforms can provide essential guidance.