Connecticut Reduce Capital - Resolution Form - Corporate Resolutions

Description

How to fill out Reduce Capital - Resolution Form - Corporate Resolutions?

If you want to complete, acquire, or print authentic document templates, utilize US Legal Forms, the largest collection of official forms available online.

Take advantage of the site’s user-friendly search feature to find the documents you require.

A range of templates for business and personal reasons is organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the official form format.

Step 4. Once you have found the form you need, click the Get Now button. Select the pricing plan you prefer and enter your credentials to register for an account.

- Use US Legal Forms to locate the Connecticut Capital Reduction - Resolution Form - Corporate Resolutions with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to obtain the Connecticut Capital Reduction - Resolution Form - Corporate Resolutions.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

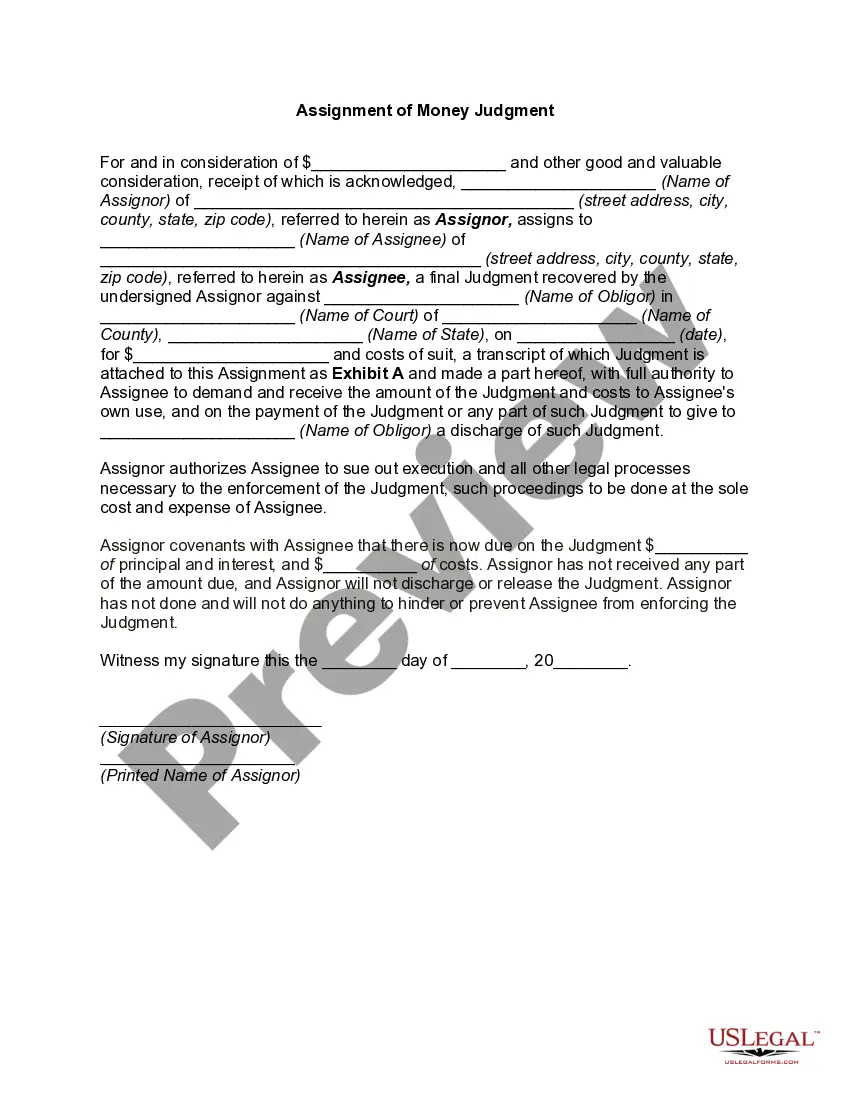

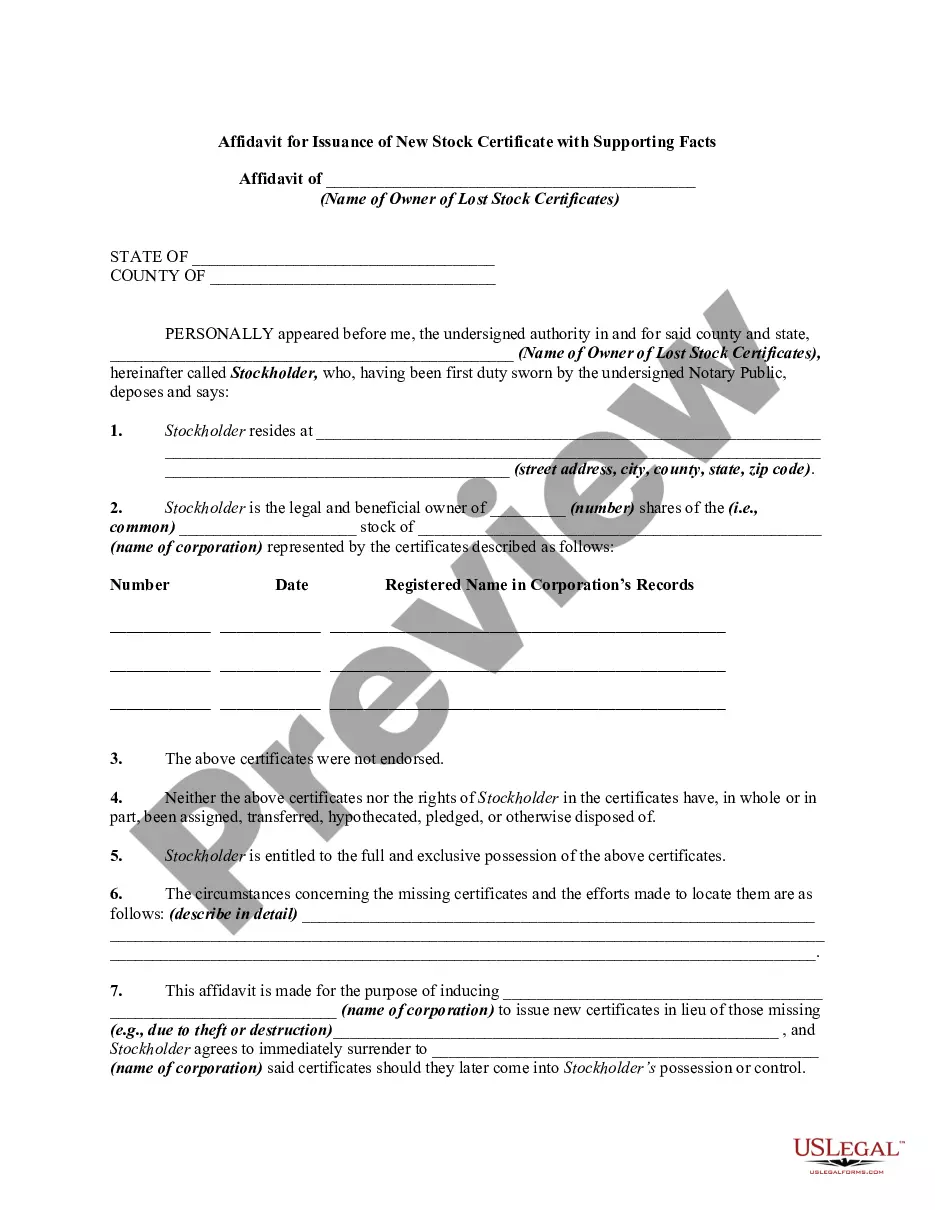

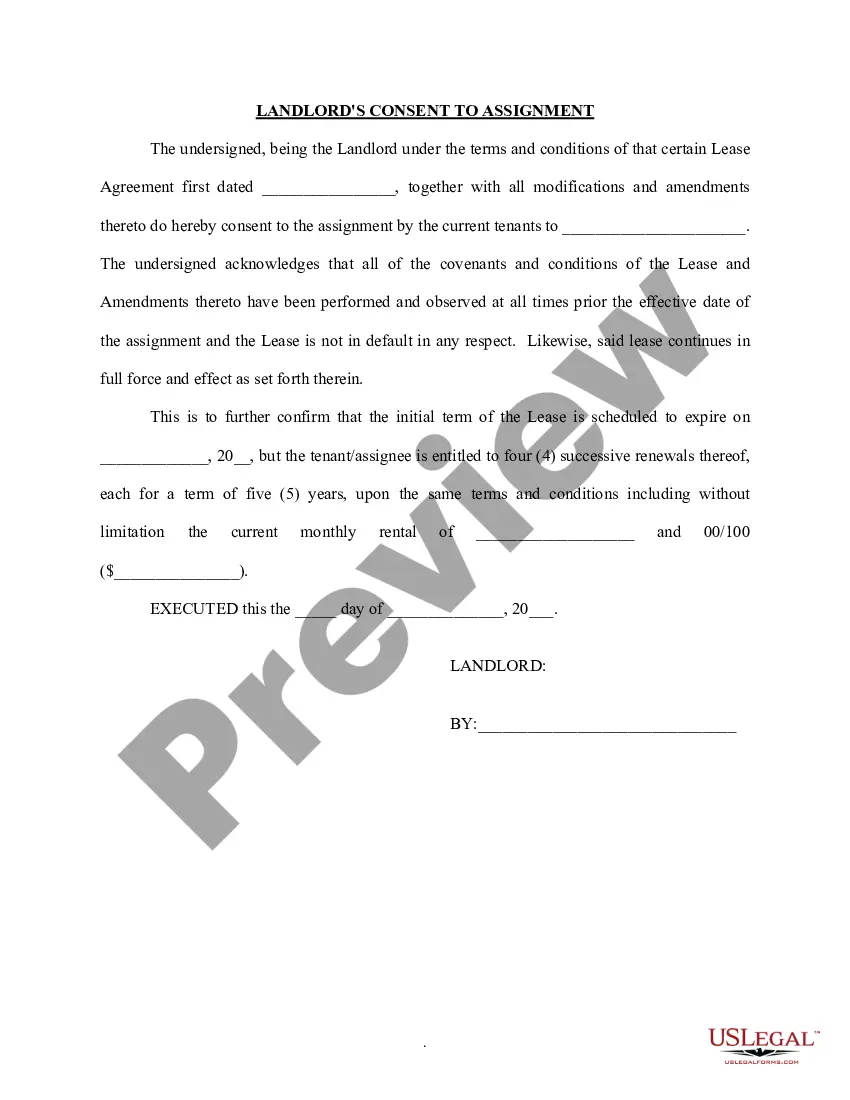

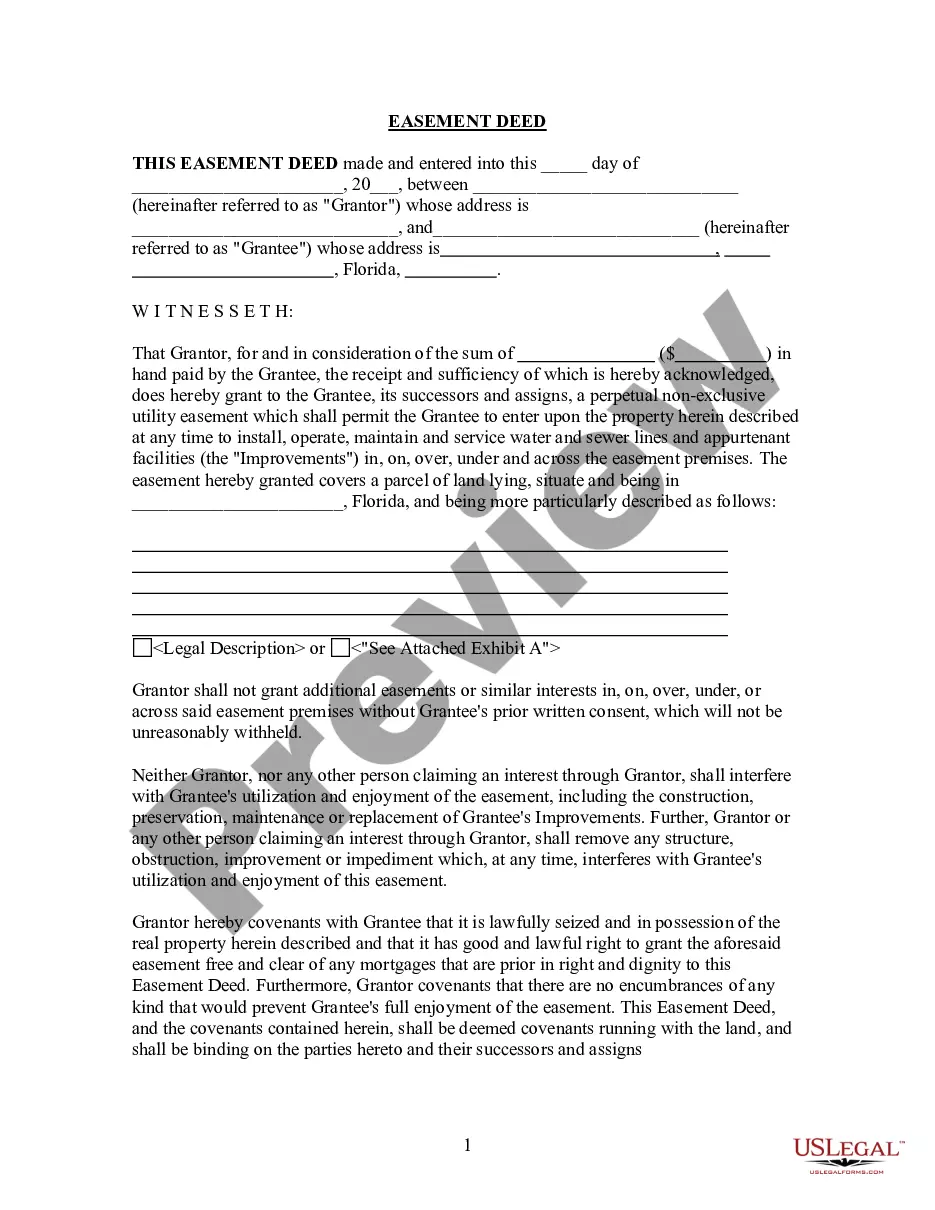

- Step 2. Use the Preview feature to review the form’s content. Don’t forget to check the summary.

Form popularity

FAQ

Finding corporate resolutions is straightforward, especially online. Numerous resources are available, including legal websites, which offer templates and guides. For a specialized resource, check out US Legal Forms where you can find the Connecticut Reduce Capital - Resolution Form - Corporate Resolutions tailored to your needs. These forms simplify the process and ensure compliance.

You may need a corporate resolution if your LLC is making significant decisions that could impact its structure or operations. Having a resolution helps provide a legal record and can protect members from potential disputes. Assess the nature of your decision to determine if a resolution is necessary. For the best practices regarding the Connecticut Reduce Capital - Resolution Form - Corporate Resolutions, visit US Legal Forms.

Typically, a corporate resolution is prepared by a member of the LLC, such as a manager or an officer. In some cases, hiring a legal professional can ensure that the resolution meets all necessary legal requirements. It's vital that whoever prepares the resolution clearly understands the decision being documented. For templates and assistance, check out US Legal Forms for the Connecticut Reduce Capital - Resolution Form - Corporate Resolutions.

A resolution typically follows a structured format that includes the heading, date, and a clear statement of the decision made. It should specify the details of the decision, who approved it, and any necessary signatures. Ensuring the resolution is formatted correctly is crucial for legal recognition. If you need a template, explore the Connecticut Reduce Capital - Resolution Form - Corporate Resolutions on US Legal Forms.

Not every LLC requires a corporate resolution, but it is often a good practice to have one. A corporate resolution serves as official documentation for significant decisions made by an LLC, such as changing ownership or reducing capital. This clarity helps protect the interests of all members involved. For guidance on creating a Connecticut Reduce Capital - Resolution Form - Corporate Resolutions, consider consulting US Legal Forms.

In general, a corporate resolution does not require notarization, but specific situations or state laws may dictate otherwise. Notarization can add an extra layer of verification if required. Consult the Connecticut Reduce Capital - Resolution Form - Corporate Resolutions for guidance on whether notarization is necessary for your situation.

Yes, a corporate resolution must be signed by designated individuals within the company to confirm its legitimacy. The signature represents consent and responsibility for the decisions outlined in the resolution. You can streamline this process by using the Connecticut Reduce Capital - Resolution Form - Corporate Resolutions, which specifies signing requirements.

Filling out a resolution form requires you to input vital details such as the name of the company, a description of the action being resolved, and the date. Be clear and concise in your language to avoid misunderstandings. The Connecticut Reduce Capital - Resolution Form - Corporate Resolutions provides a straightforward structure that can help ensure your form is filled out correctly.

Yes, a written resolution must be signed to ensure its validity and acceptance by the concerned parties. The signature represents approval from those authorized to make decisions for the LLC. Using the Connecticut Reduce Capital - Resolution Form - Corporate Resolutions streamlines this process and helps avoid any oversight.

Typically, a resolution should be signed by an authorized member of the company, such as a manager or a director. This signature verifies that the resolution has been officially approved. Utilizing the Connecticut Reduce Capital - Resolution Form - Corporate Resolutions simplifies identifying who needs to sign and ensures all necessary steps are taken.