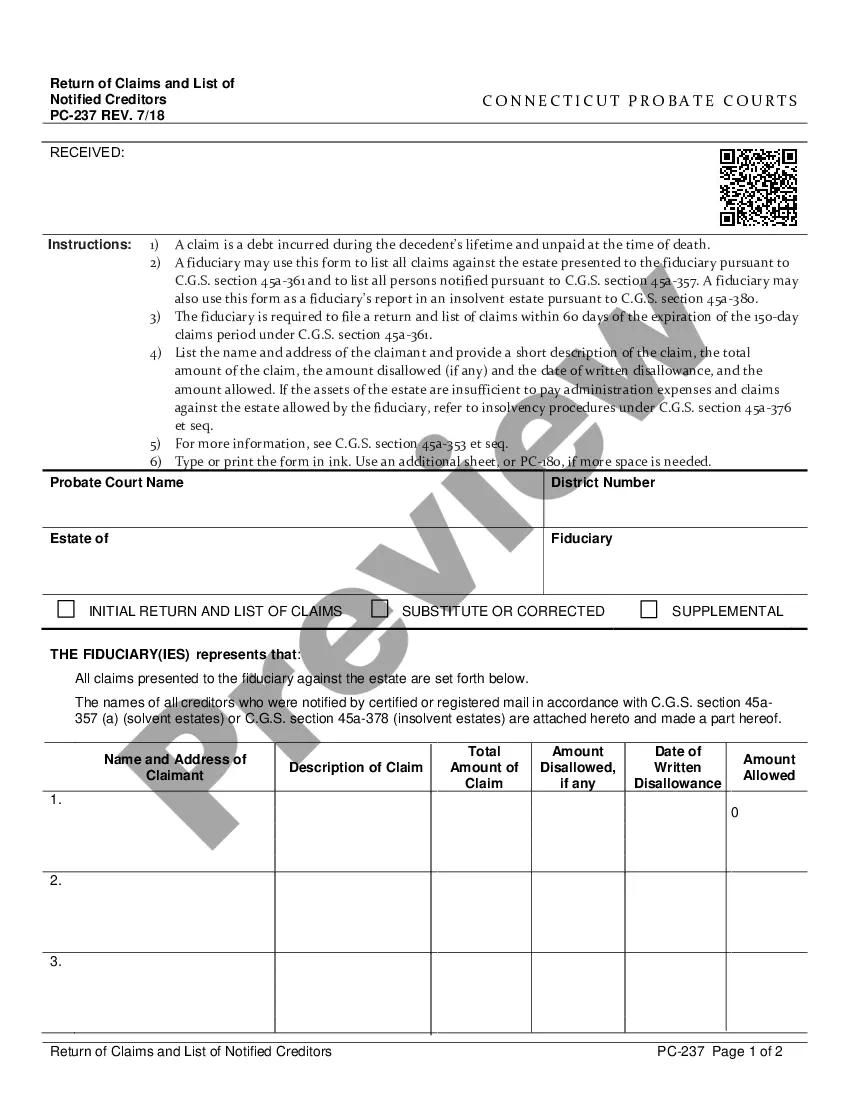

Connecticut Return of Claims and List of Notified Creditors is a legal document used to report creditors in a bankruptcy case. The document is required by the court to list all creditors and provide them with notice of the bankruptcy proceedings. It contains the names and addresses of all creditors who have a claim against the debtor and the amount of each claim. There are two types of Connecticut Return of Claims and List of Notified Creditors, namely the Statement of Claims and the List of Notified Creditors. The Statement of Claims is a list of all creditors and the amount of their claims. The List of Notified Creditors notifies creditors of the bankruptcy proceedings and provides them with information regarding the filing and the procedures.

Connecticut Return of Claims and List of Notified Creditors

Description

How to fill out Connecticut Return Of Claims And List Of Notified Creditors?

Managing official paperwork necessitates focus, precision, and utilizing well-prepared templates.

US Legal Forms has been assisting individuals nationwide for 25 years, ensuring that when you choose your Connecticut Return of Claims and List of Notified Creditors template from our service, it adheres to federal and state regulations.

All documents are designed for multiple uses, like the Connecticut Return of Claims and List of Notified Creditors you see on this page. If you require them in the future, you can complete them without an additional payment - simply access the My documents tab in your profile and finish your document whenever necessary. Experience US Legal Forms and prepare your business and personal documents swiftly and in total legal adherence!

- Ensure to carefully review the form content and its alignment with general and legal requirements by previewing it or reading its description.

- Look for an alternative official template if the one you initially accessed does not suit your circumstances or state rules (the option for that is located at the top page corner).

- Log in to your account and download the Connecticut Return of Claims and List of Notified Creditors in your desired format. If it’s your first time using our service, click Buy now to proceed.

- Establish an account, choose your subscription plan, and make payment with your credit card or PayPal account.

- Choose the format in which you wish to save your document and click Download. Print the template or upload it to a professional PDF editor for paper-free submission.

Form popularity

FAQ

Not all wills in Connecticut must go through probate. If the estate is small or consists solely of assets that can transfer outside of probate, you may not need to navigate this process. However, if the will includes significant assets, obtaining a Connecticut Return of Claims and List of Notified Creditors can be crucial to ensure all parties receive proper notification. Platforms like USLegalForms can provide the necessary guidance to streamline this process.

In Connecticut, you typically have six months from the date of death to file for probate. However, it is wise to start the process as soon as possible to ensure all necessary documents, including the Connecticut Return of Claims and List of Notified Creditors, are properly prepared. This will help you meet deadlines and facilitate the resolution of the estate efficiently. Early action can lead to a smoother transition for the family.

To avoid probate fees in Connecticut, consider using a revocable living trust to manage your assets while you are alive. This strategy allows your heirs to bypass the probate process entirely. Additionally, you might want to ensure the inclusion of a Connecticut Return of Claims and List of Notified Creditors to streamline any claims against your estate. This proactive approach can help reduce expenses and make the process smoother for your loved ones.

Creditors may collect debts from an estate in Connecticut for up to six months after the probate notice is published. This timeframe allows creditors to assert their claims promptly. Understanding the nuances of the Connecticut Return of Claims and List of Notified Creditors can be beneficial for managing these processes effectively.

The PC 264 form is a Notice to Creditors form used in Connecticut probate cases. This form notifies creditors of the probate proceeding and serves to protect the estate's assets. Familiarizing yourself with the Connecticut Return of Claims and List of Notified Creditors and its associated forms can significantly streamline handling estate claims.

Creditor claims against an estate in Connecticut must be filed within six months of the probate notice. This is a strict deadline that helps ensure timely resolution of debts. Utilizing the Connecticut Return of Claims and List of Notified Creditors can aid both creditors and executors in this process.

In Connecticut, an estate must exceed $40,000 in gross value to enter probate. This ensures that significant estates are handled according to state laws. For those navigating the legal process, understanding the Connecticut Return of Claims and List of Notified Creditors can provide clarity on required steps.

In Connecticut, the statute of limitations generally allows creditors to collect debts for six years. After this period, the debts are considered uncollectible. Knowing these timelines is important for managing the Connecticut Return of Claims and List of Notified Creditors effectively and ensuring you fulfill your obligations properly.

In Connecticut, creditors typically have a specific timeframe to file claims against an estate. Generally, they can pursue claims for up to six months after the Appointment of a Probate Court. During this period, the Connecticut Return of Claims and List of Notified Creditors is crucial for managing any debts and obligations from the estate.

To file an estate tax return in Connecticut, you must complete the necessary forms, including the Connecticut Estate Tax Return (Form CT-706) and submit them within nine months of the date of death. The process can be complex, especially for large estates, and the Connecticut Return of Claims and List of Notified Creditors will play a vital role in managing claims. Using uslegalforms can simplify the estate tax filing process and ensure all obligations are met accurately.