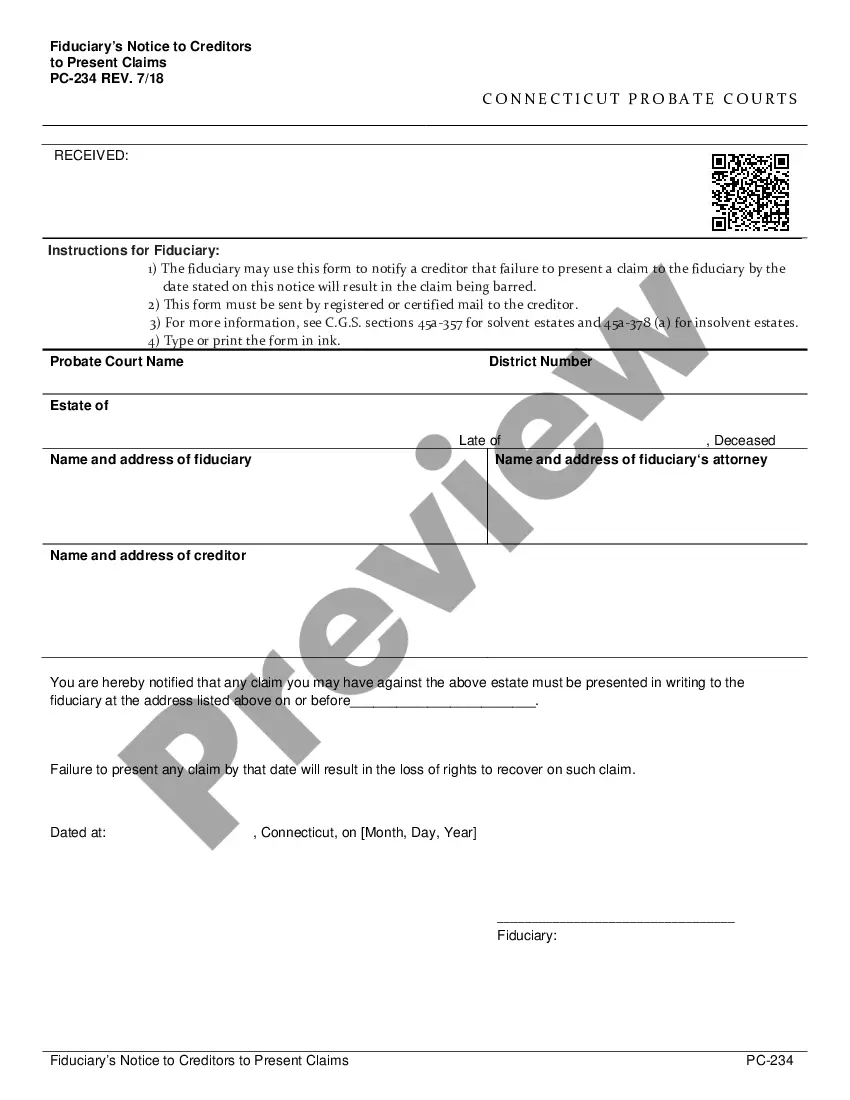

This form is a return of claims and list of notified creditors used in probate matters. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Return of Claims and List of Notified Creditors

Description

Key Concepts & Definitions

Return of Claims: In the context of probate, this refers to the formal submission of claims against the deceased's estate by creditors. List of Notified Creditors: This is a document that includes all creditors that have been formally notified of their debtor's death during the probate process.

Step-by-Step Guide on How to File a Return of Claims and Notify Creditors

- Identify the Estate's Assets: Compile a list of all assets and liabilities of the deceased. This includes real estate, bank accounts, stocks, and personal property.

- File for Probate: Submit the required documents to a probate court, such as Connecticut Probate, to officially start the process. This may involve submitting an initial financial report.

- Appoint a Guardian or Executor: The court may appoint a guardian or executor to manage the estate. Lawyer service may be needed to assist in this appointment.

- Creditors Notification: Identify all potential creditors and send them a notification about the probate process, inviting them to submit their claims.

- Submission of Claims: Creditors should submit their claims either by mail or ideally, submitting online for efficiency.

- Review and Approve Claims: The executor or guardian reviews all submitted claims against the estate and approves legitimate claims for settlement.

Risk Analysis in the Return of Claims Process

Handling the return of claims incorrectly can lead to potential legal issues, including but not limited to:

- Missed deadlines leading to penalties or legal action.

- Inaccurate reporting of estate assets and liabilities, resulting in legal complications or financial discrepancies.

- Failure to properly notify all relevant creditors, which can invite disputes or claims post the probate process conclusion.

Best Practices for Managing Estate Claims and Creditors

- Ensure accurate and comprehensive document collection and management.

- Use reputable lawyer services experienced in probate issues.

- Adopt robust online systems for creditor notifications and claim submissions to streamline the process.

- Maintain transparent communication with all parties involved in the probate process.

Common Mistakes & How to Avoid Them

- Omitting Creditors: Ensure all potential creditors are identified and notified to avoid legal repercussions.

- Inaccurate Financial Reporting: Maintain diligent financial records and consider professional accounting help if necessary.

- Misunderstanding Local Laws: Each state, such as the Connecticut probate laws, can have different rules; always consult with a local lawyer familiar with local probate courts.

Terminology Glossary

- Probate Court: A judicial process that deals with the legal process of administering the estate of a deceased person.

- Estate Tax: A tax imposed on the total value of a deceased person's money and property and paid out of the deceased's estate.

- Financial Report: A detailed report of an estate's finances, including assets, liabilities, income, and expenditures.

- Guardian Appointment: Legal authorization for an individual to manage the personal and financial affairs of another, typically a minor or incapacitated person.

FAQ

- What is the probate process? It's a legal procedure to manage and distribute a deceased person's assets in the presence of a court.

- How do I file a return of claims for an estate? Begin by notifying creditors through an established protocol, either via mail or online submissions, followed by formal claim filing in the probate court.

- What should be included in a financial report for probate? Include all assets, liabilities, and any income or expenses pertaining to the estate.

How to fill out Connecticut Return Of Claims And List Of Notified Creditors?

The larger the quantity of documents you need to produce - the more anxious you become.

You can find numerous Connecticut Return of Claims and List of Notified Creditors forms online, however, you are unsure which ones to rely on.

Eliminate the stress and simplify the process of obtaining samples with US Legal Forms. Acquire precisely crafted documents that are designed to meet state requirements.

Enter the required information to create your account and complete your purchase using PayPal or credit card. Select a preferred document format and receive your copy. Access every document you obtain in the My documents section. Simply navigate there to generate a new version of the Connecticut Return of Claims and List of Notified Creditors. Even when you have adequately prepared templates, it remains important to consider consulting your local attorney to verify the completed sample to ensure that your document is correctly filled out. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms membership, Log In to your account, and you will find the Download button on the Connecticut Return of Claims and List of Notified Creditors page.

- If you have not used our site before, follow the registration steps outlined here.

- Confirm that the Connecticut Return of Claims and List of Notified Creditors is applicable in your jurisdiction.

- Verify your choice by reading the description or utilizing the Preview feature if available for the chosen document.

- Click on Buy Now to initiate the registration process and choose a pricing plan that aligns with your needs.

Form popularity

FAQ

The PC 450 probate form in Connecticut serves as a notice of the probate proceeding to interested parties. This form is crucial for listing the Connecticut Return of Claims and List of Notified Creditors, ensuring that all relevant creditors are informed of the probate status. Completing this form accurately promotes transparency and efficiency in the probate process. To facilitate the completion of this and other required forms, you can visit uslegalforms for comprehensive support.

In Connecticut, an estate generally must exceed $40,000 in value for it to go through the probate process. If the estate is below this threshold, it may not require formal probate, which simplifies the process for heirs and beneficiaries. Nonetheless, understanding the Connecticut Return of Claims and List of Notified Creditors can provide clarity on how to handle any claims that may arise. For more specific guidance, uslegalforms can be a valuable resource.

In Connecticut, creditors have a six-month period to file a claim against an estate after the notice of the estate's opening has been given. This timeframe is essential for ensuring that all claims are evaluated during the probate process. Understanding the Connecticut Return of Claims and List of Notified Creditors helps creditors effectively manage their claims within this timeline. If you have questions about filing claims, consider exploring resources on the uslegalforms platform for guided assistance.

In Connecticut, creditors have a specific time frame to file claims against an estate, typically within four months after receiving a notice from the executor. This timeline is essential for ensuring that all valid claims are evaluated during the probate process. Staying aware of the Connecticut Return of Claims and List of Notified Creditors can provide you with the necessary guidance. If you have questions, uslegalforms can offer additional support and resources.

When a creditor files a claim against an estate, the estate must address this claim during the probate process. The executor or administrator reviews the claim and determines its validity. If the claim is accepted, the estate pays the creditor from the available assets before distributing the remainder to beneficiaries. Understanding the Connecticut Return of Claims and List of Notified Creditors can help you navigate this process smoothly.

In Connecticut, you generally have two years from the date of the decedent's death to file a lawsuit against an estate. It is crucial to adhere to this timeline to protect your rights. Delaying your claim may result in losing the opportunity to seek the benefits you are entitled to. Consider consulting the Connecticut Return of Claims and List of Notified Creditors to stay informed about important timelines.

The PC 264 probate form is essential in the Connecticut probate process, specifically for filing the Connecticut Return of Claims and List of Notified Creditors. This form allows executors to notify all creditors about the probate proceedings, which is crucial for settling any debts of the deceased. By ensuring that this form is completed accurately, you maintain transparency and protect the interests of the estate. For assistance with forms and filing, consider using the uslegalforms platform, which simplifies the process for you.

To file an estate tax return in Connecticut, you must first gather all relevant documentation related to the estate. This includes asset evaluations and liabilities. You will need to complete the Connecticut estate tax return form and submit it along with the required payment. Furthermore, understanding the Connecticut Return of Claims and List of Notified Creditors can help you organize creditor notifications properly, ensuring compliance with state laws.

In Connecticut, creditors generally have four months to present their claims against an estate after the executor has published the Notice to Creditors. This timeframe is critical for ensuring that debts are settled appropriately. Following the Connecticut Return of Claims and List of Notified Creditors keeps all parties informed and compliant. It allows you to manage creditor claims effectively, providing peace of mind during a challenging time.

In Connecticut, the minimum estate value for probate is $40,000. This threshold determines whether the court must oversee the distribution of assets. If the estate value exceeds this amount, you will need to file a Connecticut Return of Claims and List of Notified Creditors. It is essential to understand this aspect to ensure compliance and proper management of the estate.