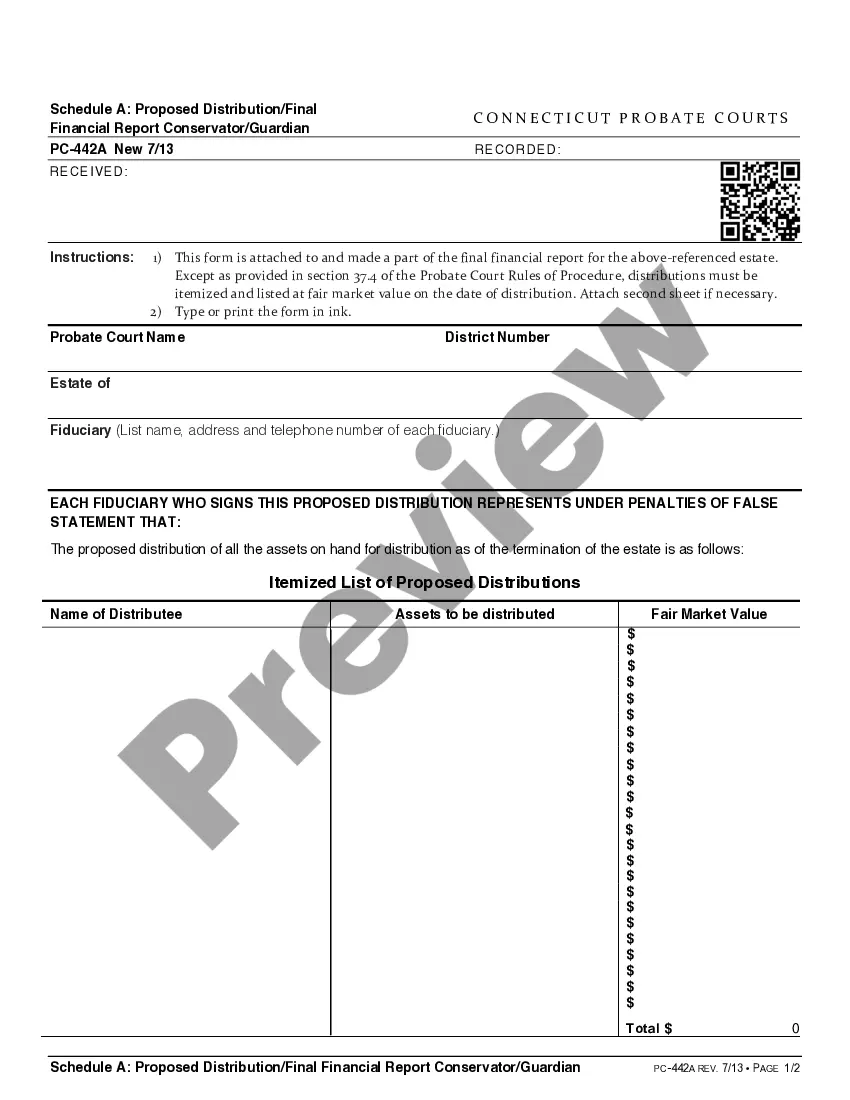

This form is used in probate matters to make a final financial report by a trustee. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust?

The larger quantity of documents you must arrange - the more anxious you become.

You can discover an extensive selection of Connecticut Schedule A: Proposed Distribution / Final Financial Report of Trust forms online, but it's unclear which ones are reliable.

Eliminate the frustration to make locating samples easier with US Legal Forms.

Simply click Buy Now to initiate the registration process and select a payment plan that fits your needs.

- Obtain expertly crafted forms that are created to meet state requirements.

- If you already possess a US Legal Forms subscription, Log In to your account, and you will see the Download option on the web page for the Connecticut Schedule A: Proposed Distribution / Final Financial Report of Trust.

- If you haven't utilized our service before, complete the registration process with these steps.

- Ensure the Connecticut Schedule A: Proposed Distribution / Final Financial Report of Trust is applicable in your state.

- Confirm your choice by reviewing the description or by using the Preview feature if available for the chosen document.

Form popularity

FAQ

Not all estates must go through probate in Connecticut. If assets are held in certain ways, such as through a trust like the Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust or have designated beneficiaries, they can bypass probate. Knowing your options can help you manage estate matters efficiently.

You need to file for probate in Connecticut within 30 days following the death of an individual. This deadline is crucial for ensuring that your estate, including any connected to a Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust, is administered according to the decedent's wishes.

The PC 264 form is a Connecticut probate court form required for submitting a proposed distribution of an estate. It documents how you intend to distribute assets, including those housed within a Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust. Completing this form accurately helps streamline the probate process.

You generally have 30 days after the death of an individual to file for probate in Connecticut. However, if the estate is complex or involves a Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust, it may be beneficial to engage a legal professional to ensure timely filing and proper handling of all matters.

In Connecticut, there is a time limit for probating a will. You should file the will within 30 days of the decedent's death for the probate process to begin effectively. This ensures the distribution of assets, including any Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust, proceeds as intended.

Yes, you can avoid probate in Connecticut by using certain strategies. For example, establishing a trust, such as a Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust, can help manage and distribute your assets without going through the probate process. Additionally, joint ownership of property and designated beneficiaries for accounts can also bypass probate.

To avoid probate fees in Connecticut, consider using a Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust. This trust allows you to designate beneficiaries and manage asset distribution without court involvement. By placing your assets in a trust, you can bypass the probate process entirely, reducing costs and expediting the transfer of property. If you're unsure how to create a trust, platforms like uslegalforms can provide the necessary forms and guidance for easy setup.

A trust does not have to go through probate in Connecticut, provided it is properly funded. When you place assets into a trust, those assets transfer directly to your beneficiaries upon your death, avoiding probate entirely. This can greatly enhance the efficiency of managing your estate. If you are utilizing a Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust, rest assured that it allows for smoother transitions without the probate burden.

In Connecticut, probate is not mandatory for all assets. If an estate includes only non-probate assets, like those in a trust, probate may not be necessary. However, it is essential to assess the value and type of assets involved. Utilizing a Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust can help streamline the management of your estate and clarify your options.

Certain assets do not go through probate in Connecticut, such as assets held in trusts, life insurance policies, and retirement accounts with designated beneficiaries. Additionally, jointly owned property typically bypasses probate as well. Understanding these assets can simplify the process for your Connecticut Schedule A: Proposed Distribution/Final Financial Report Trust. This knowledge can help you make informed decisions that protect your estate.