This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Physician's Evaluation/Conservatorship

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

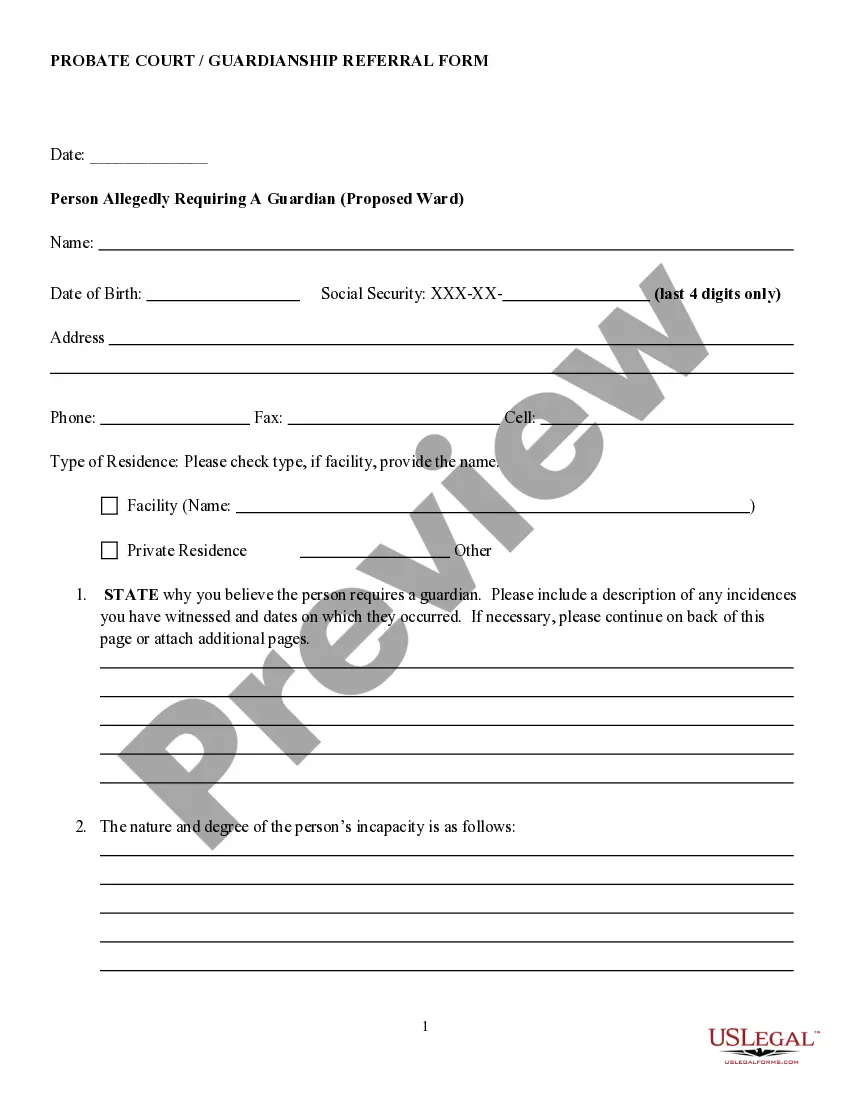

Physician's Evaluation for Conservatorship: This is a formal assessment conducted by a licensed physician to determine an individual's capacity to make financial, medical, and personal decisions. In the context of conservatorship, it identifies whether a person is able to manage their affairs or if a conservator is needed. Probate Courts are legal bodies that primarily handle matters such as wills, estates, and conservatorships. Financial Conservatorships involve the management of an individual's financial matters when they are incapable of doing it themselves, while handling personal property and real estate sometimes requires similar oversight.

Step-by-Step Guide to Obtain a Physician's Evaluation for Conservatorship

- Identify the need: Determine if the individual has significant difficulty in managing financial or personal affairs, potentially due to mental incapacitation or physical disability.

- Consult with a licensed physician: Schedule an appointment with a physician qualified to conduct mental and physical evaluations for legal purposes.

- Undergo evaluation: The person in question must undergo a comprehensive assessment which includes mental, physical, and cognitive tests.

- Gather documentation: Collect all necessary medical evaluations, physician's notes, and other relevant health records.

- File for conservatorship: Submit the required documents to the probate court along with a petition for conservatorship.

Risk Analysis of Conservatorship

- Loss of autonomy: The individual under conservatorship might lose their personal freedom to make decisions.

- Potential for abuse: There is a risk of financial and emotional abuse by the conservator if not properly monitored.

- Legal and court fees: The process can be costly due to legal fees, especially if there are disputes in probate courts.

- Emotional impact: The process can be stressful and demeaning for the person subject to the conservatorship.

Comparison Table: Physician Evaluations Requirement Across States

| State | Medical Evaluation Required? | Additional Requirements |

|---|---|---|

| California | Yes | Two physician assessments required for dementia related cases. |

| Connecticut | Yes | Specific form 'PCA-2' must be completed by a physician. |

| New York | Yes | Mental Hygiene Law requires a 'functional assessment'. |

Real World Applications in Business: Small Business Impact

When a small business owner undergoes a conservatorship, the impact can be significant. Management of the company may shift, potentially altering operations, financial strategies, and even company culture. This places additional importance on the thoroughness of the physician's evaluation during the conservatorship process to ensure the most capable handling of both personal and business affairs.

How to fill out Connecticut Physician's Evaluation/Conservatorship?

The greater the documentation you have to complete - the more anxious you become.

You can find numerous Connecticut Physician's Evaluation - Conservatorships templates online, yet you remain uncertain about which ones to trust.

Eliminate the difficulty of obtaining samples more easily with US Legal Forms.

Enter the required information to set up your account and process your payment through PayPal or credit card. Choose a convenient document format and download your template. Access every file you download in the My documents section. Simply navigate there to create a new copy of the Connecticut Physician's Evaluation - Conservatorships. Even when utilizing professionally crafted templates, it’s still essential to consider consulting a local attorney to review the completed form to ensure your document is accurately filled out. Achieve more with less effort using US Legal Forms!

- If you already have a US Legal Forms subscription, Log In to your account, and you'll see the Download button on the page for Connecticut Physician's Evaluation - Conservatorships.

- If you haven’t utilized our service before, complete the registration process by following these steps.

- Ensure the Connecticut Physician's Evaluation - Conservatorships is applicable in your state.

- Verify your selection by reviewing the description or using the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

In Connecticut, the probate courts have sole jurisdiction over the appointment of conservators. A person filing an application for conservatorship must apply to the probate court in the probate district where the respondent (the person alleged to be incapable) resides at the time the application is filed.

A conservator of the person cares for and protects a person when the judge decides that the person cannot do it. The conservator is responsible for making sure that the conservatee has proper food, clothing, shelter, and health care.

A conservatorship is necessary for those individuals who have neither a power of attorney or healthcare directive, and have lost the ability to make informed decisions and/or care for themselves. A conservatorship may also be necessary for other reasons, such as an invalid or fraudulent power of attorney document.

In Connecticut, the probate courts have sole jurisdiction over the appointment of conservators. A person filing an application for conservatorship must apply to the probate court in the probate district where the respondent (the person alleged to be incapable) resides at the time the application is filed.

A conservator of the person cares for and protects a person when the judge decides that the person cannot do it. The conservator is responsible for making sure that the conservatee has proper food, clothing, shelter, and health care.

Conservator fees range from $50 an hour to $135 an hour or more. Trustee and other professional asset manager fees for high-value estates typically run from 1 to 1.5% of the asset value annually.

Conservator fees range from $50 an hour to $135 an hour or more. Trustee and other professional asset manager fees for high-value estates typically run from 1 to 1.5% of the asset value annually.

However, California law provides that conservators can receive reasonable compensation, payable from the conservatees estate. You may be paid an hourly fee for the work you perform as a conservator, which means you will need to maintain detailed records of the services you provide.