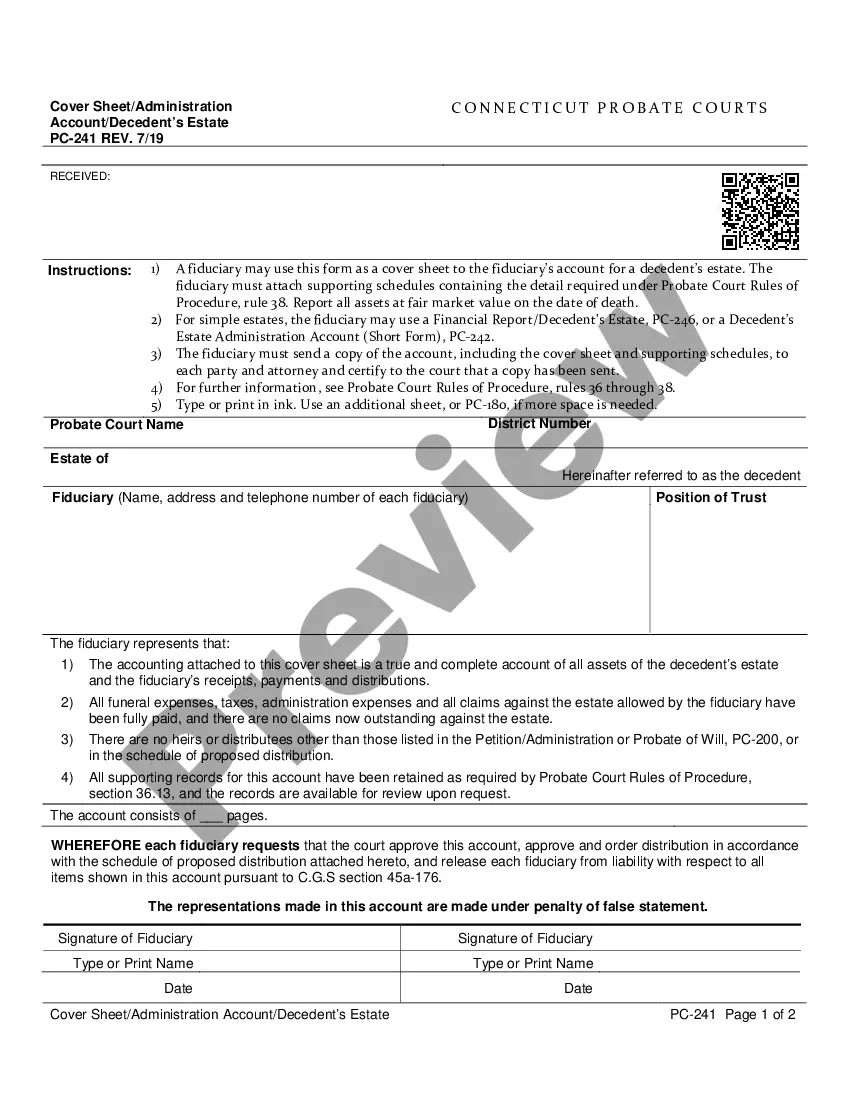

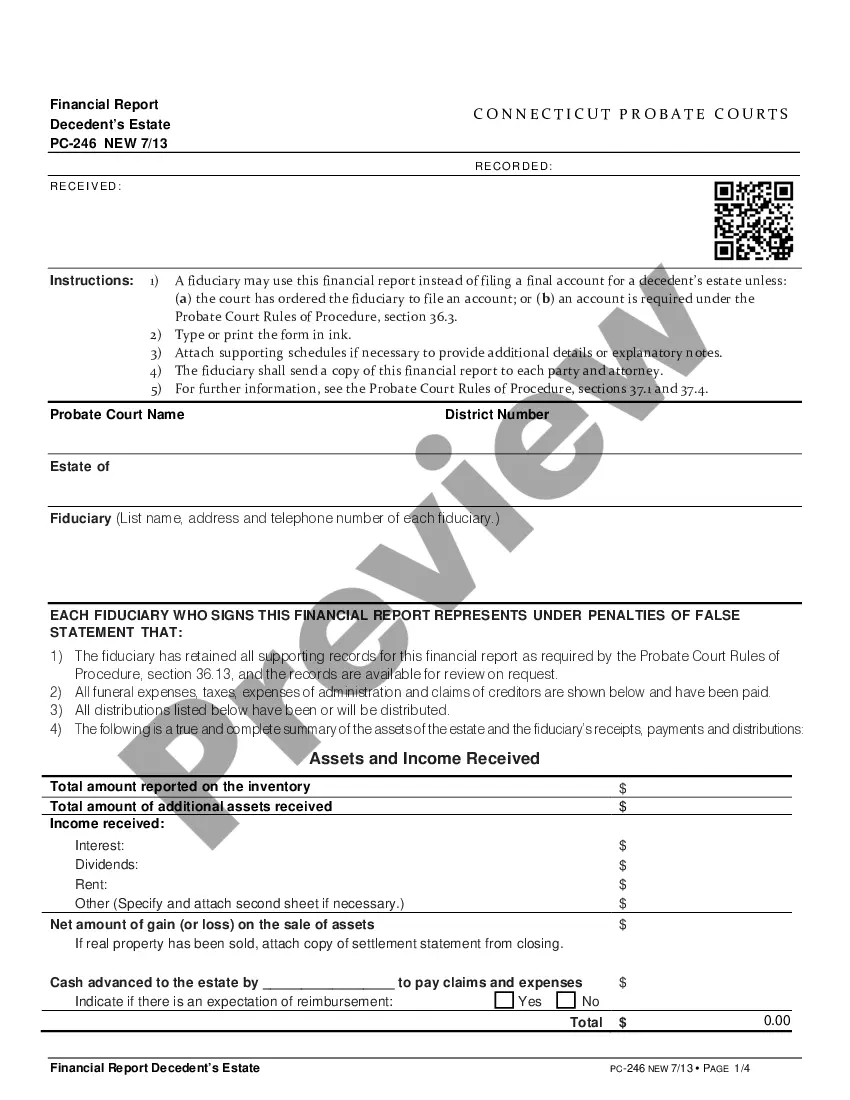

This form is the short form for a decedent's estate administration account used in probate matters. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Decedent's Estate Administration Account (Short Form)

Description

How to fill out Connecticut Decedent's Estate Administration Account (Short Form)?

The greater the number of documents you should create - the more anxious you become.

You can find an extensive collection of Connecticut Decedents Estate Administration Account - Short Form samples online, but you might be unsure which of them to trust.

Simplify the process of obtaining templates with US Legal Forms. Acquire professionally prepared documents that are designed to comply with state regulations.

Fill in the required information to create your account and process your payment with PayPal or a credit card. Choose a convenient file format and obtain your sample. Access all files you acquire in the My documents section. Just navigate there to prepare a new version of your Connecticut Decedents Estate Administration Account - Short Form. Even when utilizing professionally crafted templates, it’s essential to consider consulting a local attorney to review your completed form and ensure your document is correctly filled out. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, sign in to your account, and you’ll view the Download option on the Connecticut Decedents Estate Administration Account - Short Form page.

- If you’ve never used our platform previously, complete the registration process by following these steps.

- Verify if the Connecticut Decedents Estate Administration Account - Short Form is applicable in your state.

- Reassess your choice by reviewing the details or using the Preview feature if available for the selected file.

- Simply click Buy Now to initiate the registration process and select a pricing plan that suits your needs.

Form popularity

FAQ

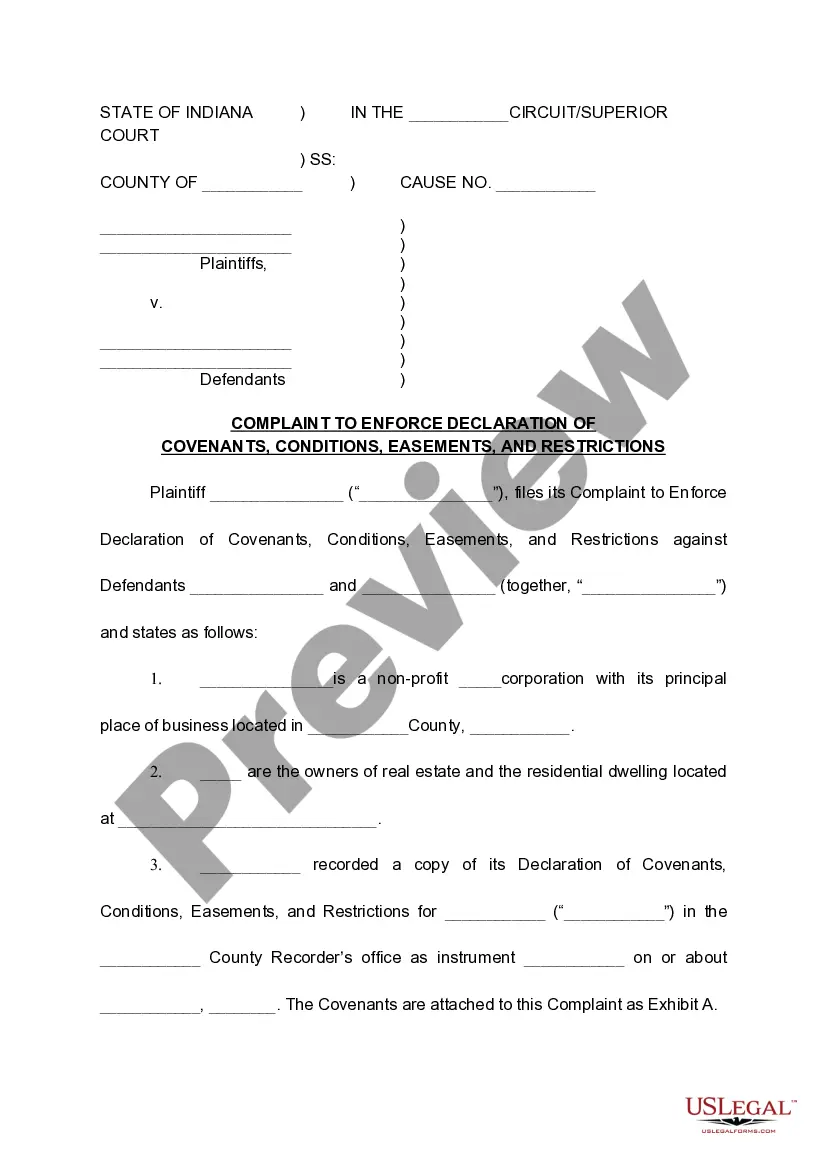

Date of entry of this decree means the date that the Court gives final approval to this Consent Decree by signing and entering the Decree as an Order of the Court.

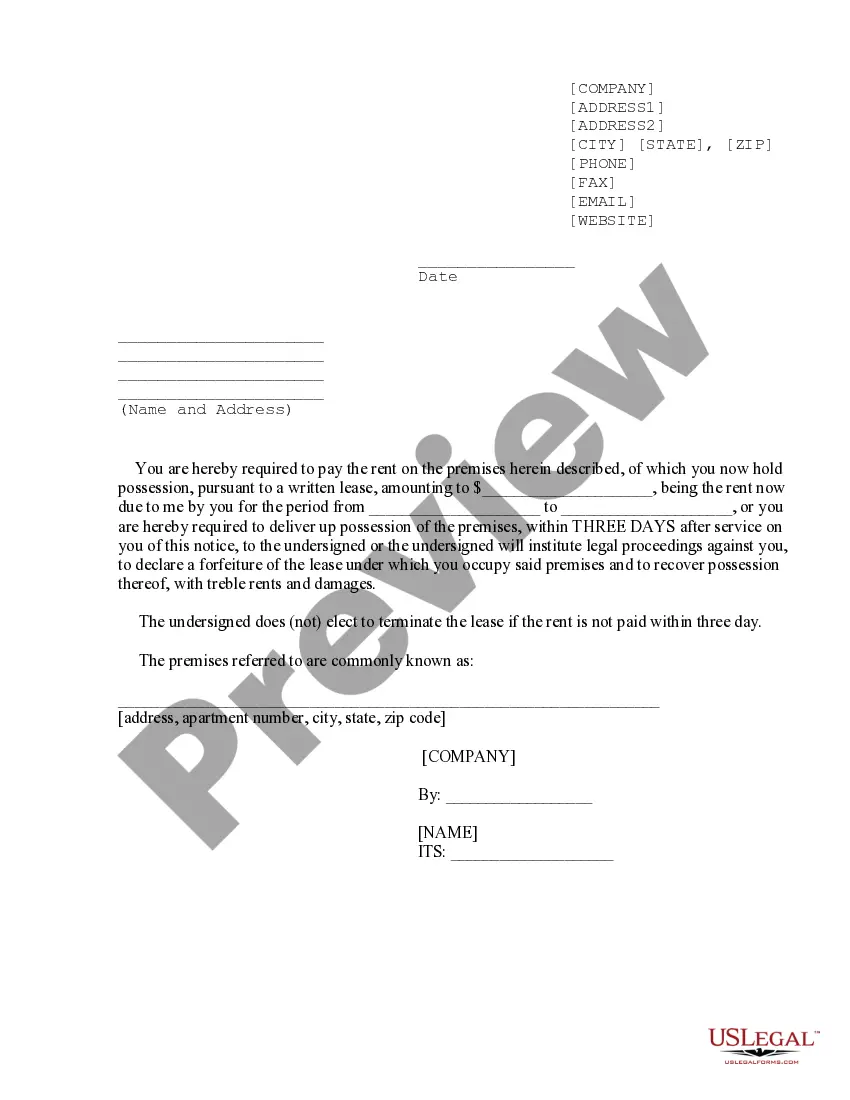

The first step in probating an estate is to locate all of the decedent's estate planning documents and other important papers, even before being appointed to serve as the personal representative or executor.

Connecticut has a simplified and expedited probate process for settling small decedent's estates. The entire process can be completed within 30 days, instead of six months or longer as is normally required for the regular probate process.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

File an application with the appropriate probate court, together with a certified death certificate and the original Will and codicils. The application will list basic information about the decedent, including the beneficiaries under any Will or codicil and all heirs at law.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

If no will exists, the property is divided according to Connecticut law. The Probate Courts ensure that any debt owed by the deceased person, funeral expenses and taxes are paid before the remaining assets are distributed. Often a family member or friend is responsible for settling the affairs of the estate.