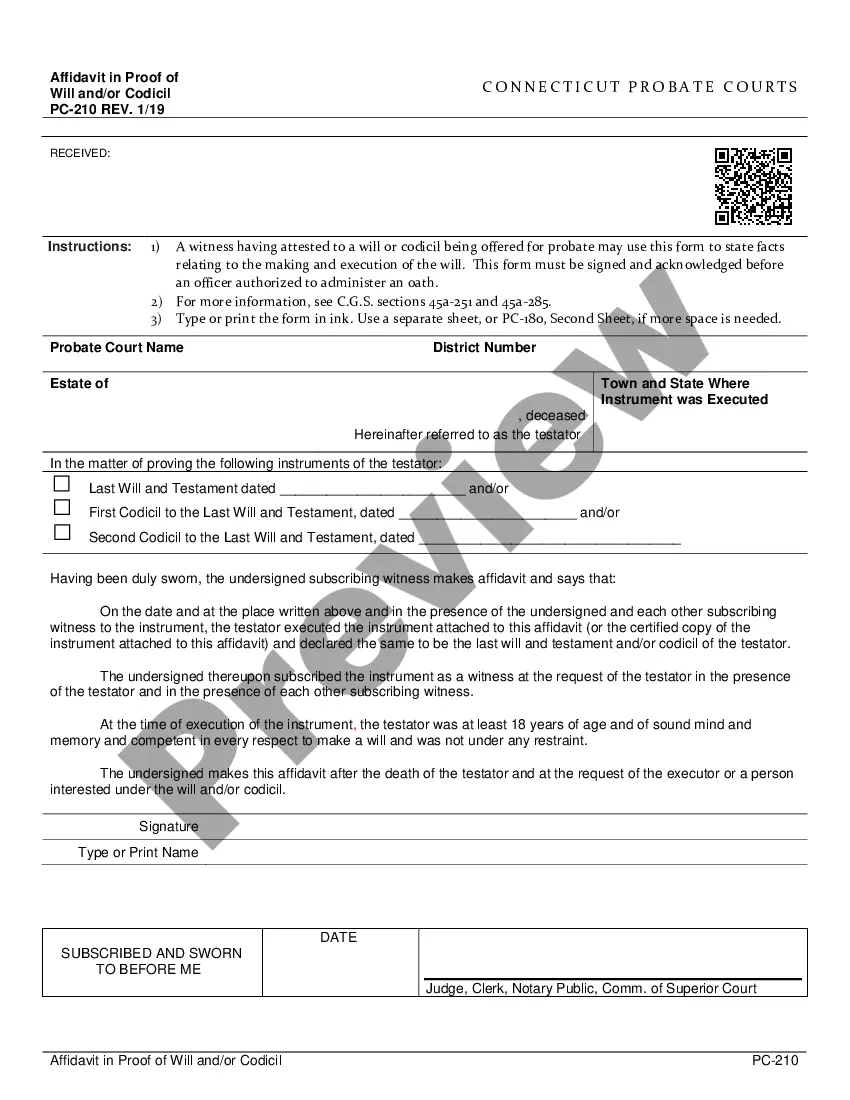

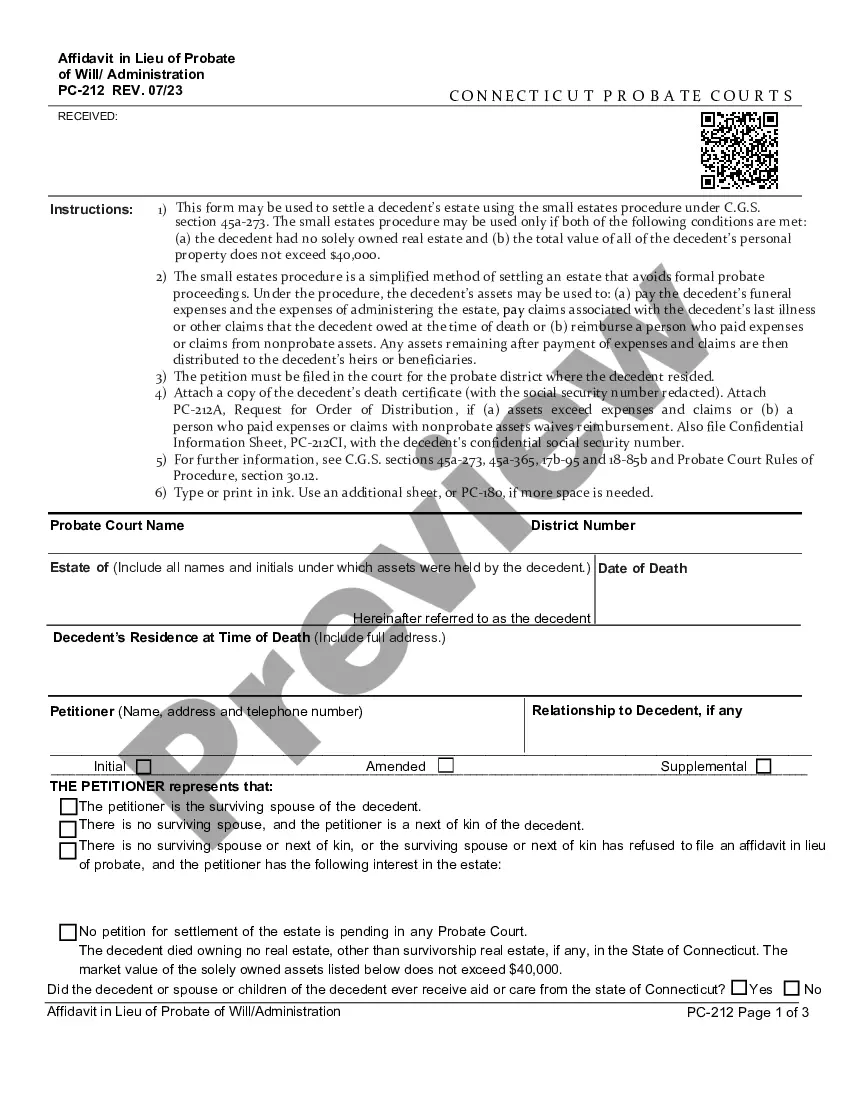

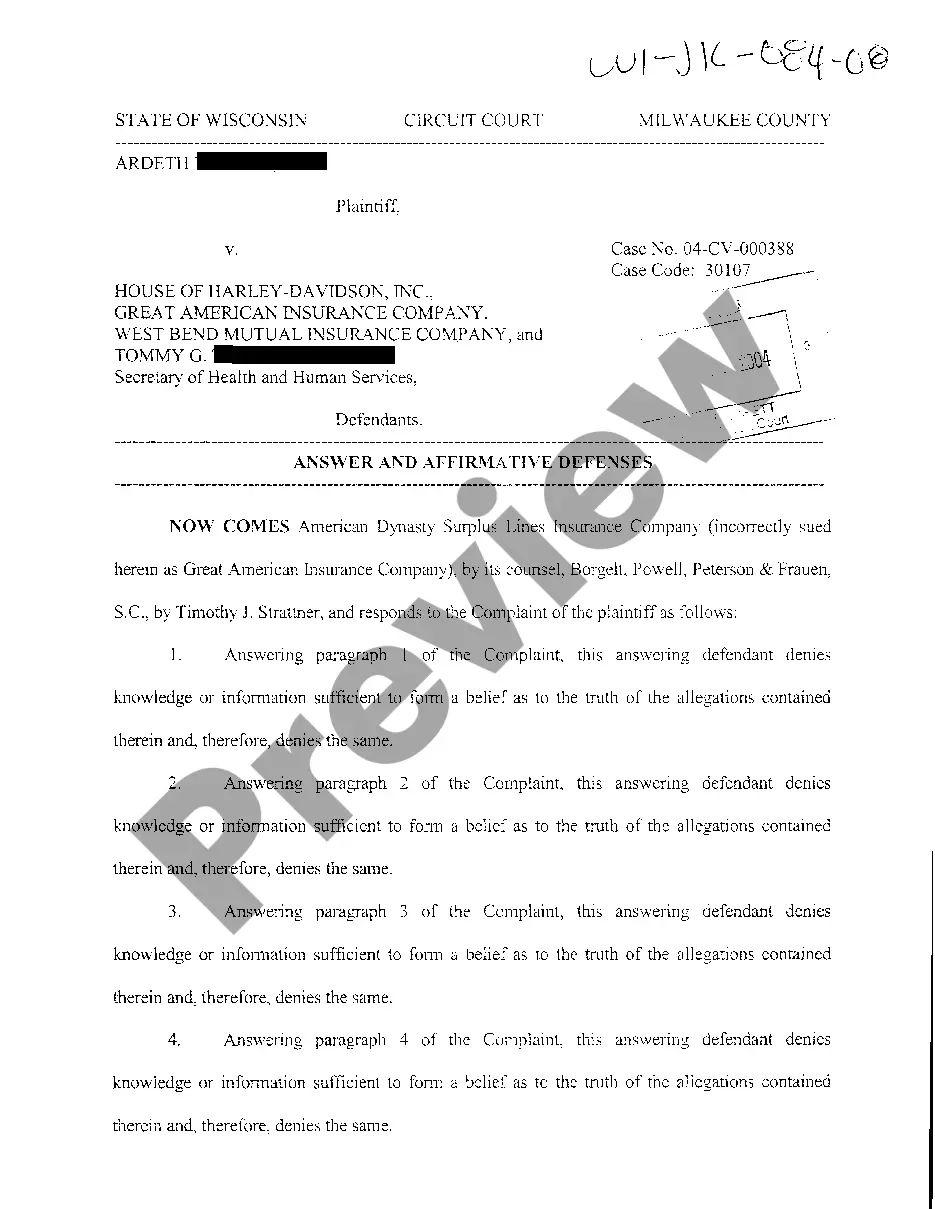

This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Affidavit for Filing Will Not Submitted for Probate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Affidavit For Filing Will Not Submitted For Probate?

The larger quantity of documents you need to produce - the more nervous you get.

You can find countless Connecticut Affidavit for Filing Will Not Submitted for Probate templates online, but you still don't know which ones to trust.

Eliminate the stress and make locating samples easier by using US Legal Forms. Acquire professionally prepared forms that are designed to meet the state requirements.

Fill in the required information to set up your profile and pay for your order using PayPal or credit card. Choose a convenient document format and obtain your sample. Access every document you receive in the My documents section. Just go there to complete a new copy of the Connecticut Affidavit for Filing Will Not Submitted for Probate. Even when using expertly crafted forms, it’s still vital to consider consulting your local attorney to double-check the filled-out sample to ensure your document is accurately completed. Achieve more for less with US Legal Forms!

- If you already have a subscription to US Legal Forms, Log In to your account, and you'll find the Download option on the Connecticut Affidavit for Filing Will Not Submitted for Probate’s page.

- If you haven't used our site before, complete the registration process by following these steps.

- Ensure the Connecticut Affidavit for Filing Will Not Submitted for Probate is acceptable in your state.

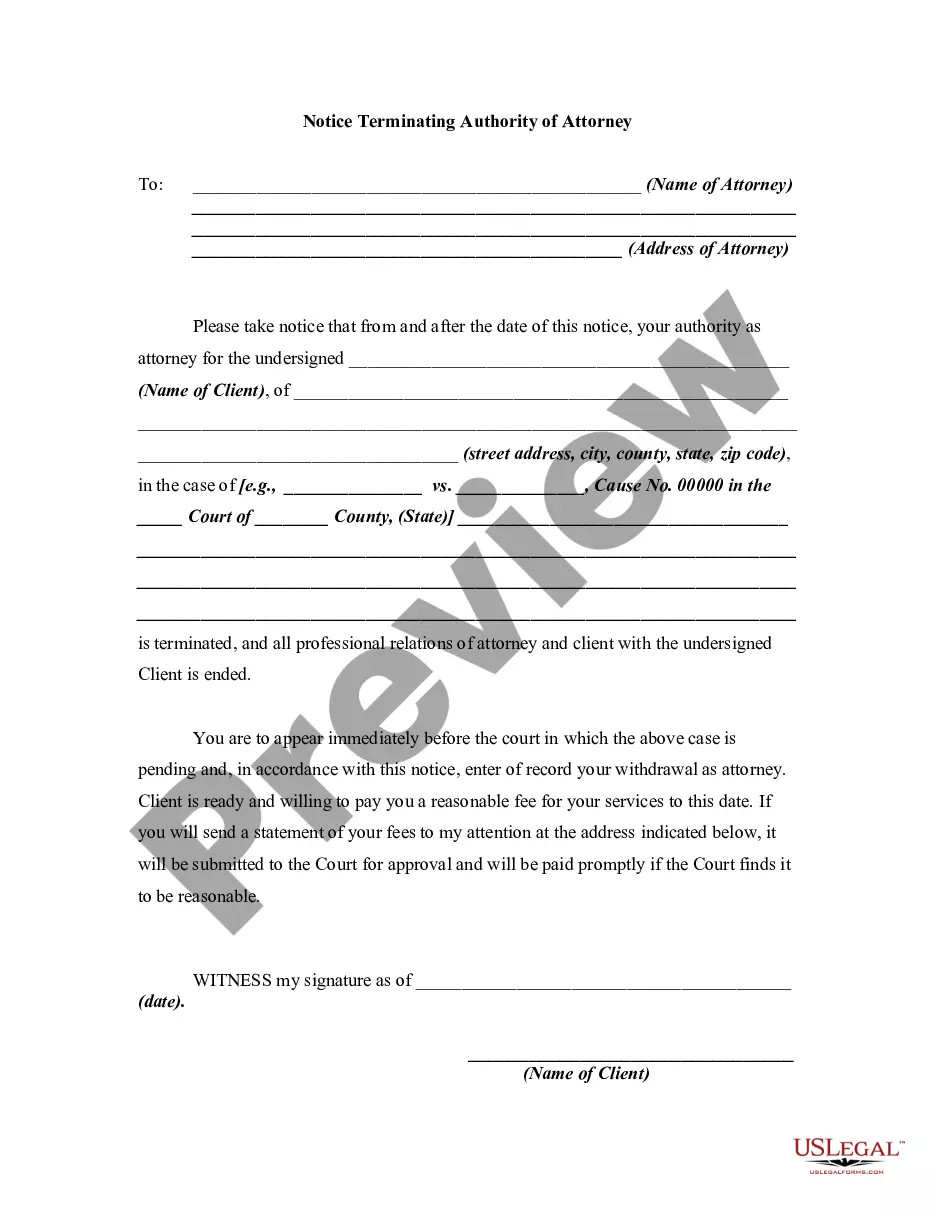

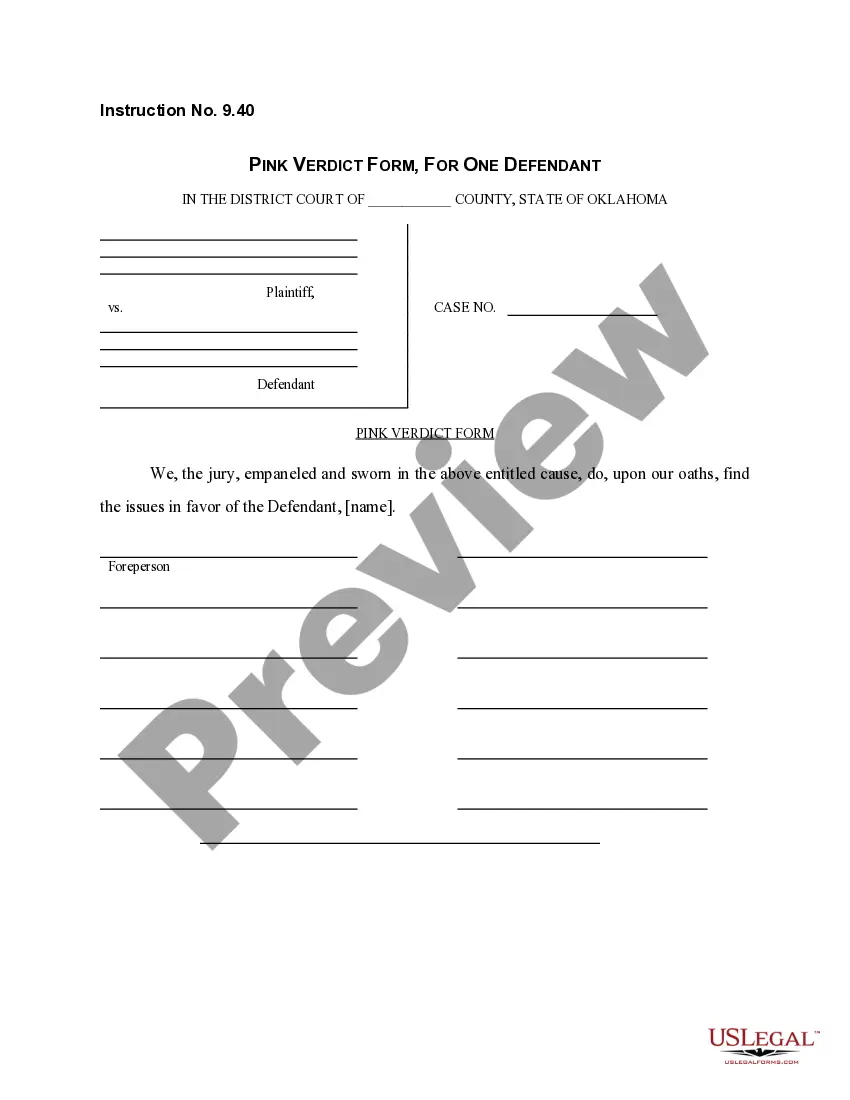

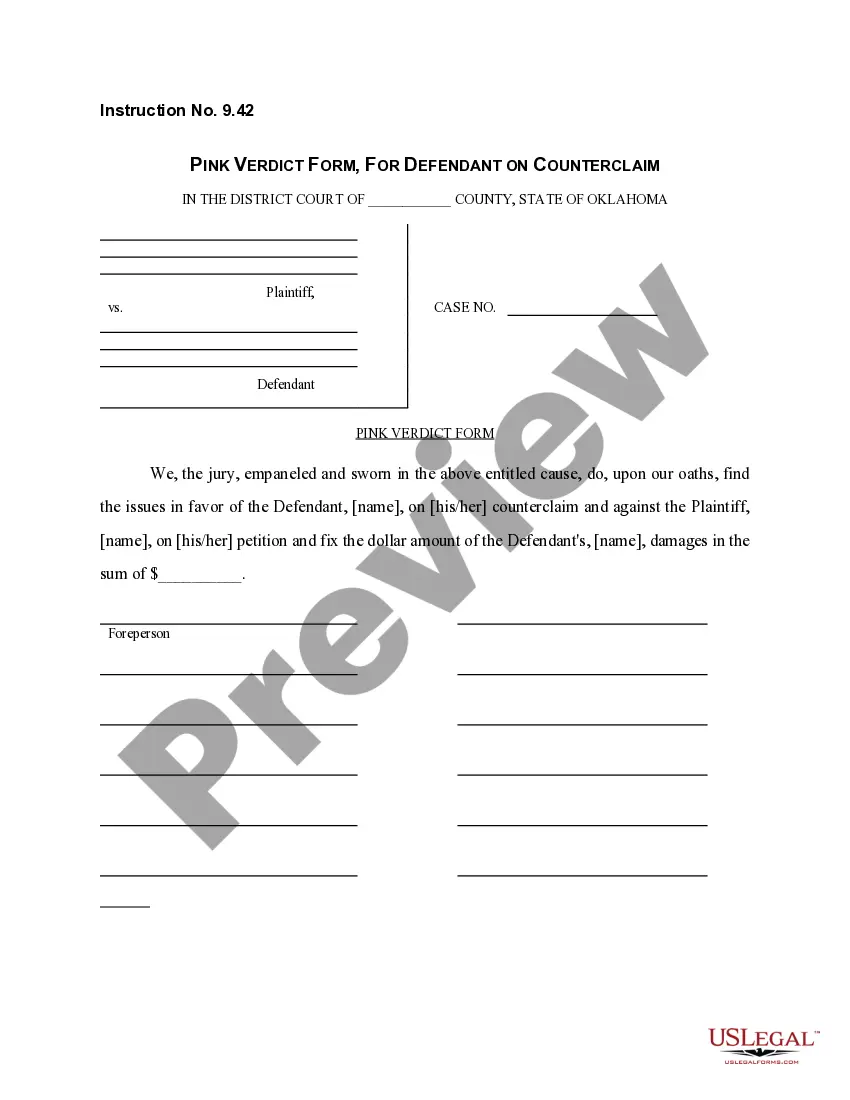

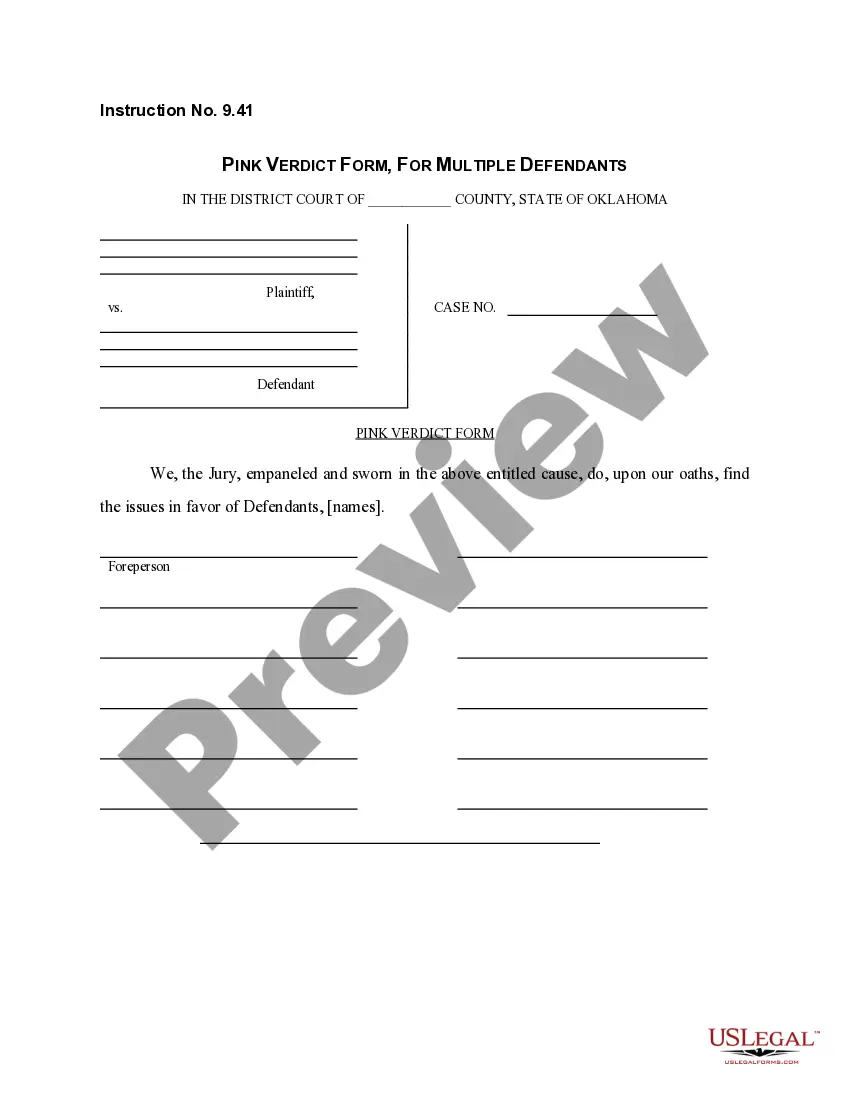

- Verify your choice by reviewing the description or by utilizing the Preview mode if available for the selected document.

- Click Buy Now to initiate the registration process and select a payment plan that suits your needs.

Form popularity

FAQ

Yes, you can petition for probate without a will in Connecticut, but the process may differ. In such cases, you can use a Connecticut Affidavit for Filing Will Not Submitted for Probate to establish the rightful heirs. This affidavit helps clarify estate distribution without a formal will. Utilizing services like US Legal Forms can guide you through the necessary steps and provide the appropriate forms to streamline the process.

In Connecticut, the statute of limitations for initiating probate proceedings generally aligns with the terms outlined in the will or the laws governing estates. Typically, you must file for probate within five years after the death of the individual. If you file a Connecticut Affidavit for Filing Will Not Submitted for Probate, this can effectively alter the timeline and process for your specific situation. Always review details with a legal advisor for precise guidelines.

Not all wills in Connecticut require probate. If the estate's value is below a certain threshold or if you can utilize a Connecticut Affidavit for Filing Will Not Submitted for Probate, you may avoid the probate process altogether. It's essential to evaluate the estate's circumstances to determine the best course of action. Consulting legal resources or professionals can provide clarity on this issue.

An executor in Connecticut may start the probate process at any time after the death of the testator, but delaying can lead to complications. It is advisable to file the will within a reasonable timeframe, preferably within 30 days. If the executor needs to use a Connecticut Affidavit for Filing Will Not Submitted for Probate, that can help expedite matters and provide more flexible options. Timely action helps maintain the estate’s integrity and protects beneficiaries.

Yes, Connecticut law sets a time limit for probating a will. You typically have 30 days from the date of death to file the will with the Probate Court. However, if you need to submit a Connecticut Affidavit for Filing Will Not Submitted for Probate, this allows for alternative processes outside standard probate time constraints. Always check with local regulations for specific guidance.

To close an estate in Connecticut, first ensure all debts and taxes are settled. You must gather the necessary documents, including the Connecticut Affidavit for Filing Will Not Submitted for Probate, if applicable. Next, file the final account with the Probate Court and obtain approval to distribute remaining assets to beneficiaries. Always consider consulting a legal expert to navigate any complexities.

There are several reasons someone might choose not to probate a will in Connecticut. Some individuals prefer the simplicity and privacy that comes with using a Connecticut Affidavit for Filing Will Not Submitted for Probate. This method allows for a quicker transfer of assets and avoids the public scrutiny of the probate process. Additionally, avoiding probate can minimize court fees and attorney costs, making it an appealing option for many families.

Yes, you can avoid probate in Connecticut by utilizing a Connecticut Affidavit for Filing Will Not Submitted for Probate. This legal document allows you to transfer estate assets without going through the lengthy probate process. Many people choose this option to save time and reduce costs associated with probate court. By avoiding probate, you can ensure that your loved ones receive their inheritance more quickly and with fewer legal complications.

You can obtain a probate affidavit by consulting with a legal professional or visiting your local probate court in Connecticut. They can provide you with the necessary forms and guidance to fill them out correctly. Additionally, visiting platforms like USLegalForms may help you find accurate templates and instructions for preparing your affidavit properly. This simplifies the process and ensures compliance with state requirements.

If you fail to file for probate in Connecticut when necessary, it can lead to significant complications. The estate may remain unresolved, causing delays in asset distribution to beneficiaries, and creating potential legal issues for heirs. Moreover, creditors may attempt to collect debts owed by the deceased, which could complicate things further. It is crucial to understand your responsibilities and consider using the Connecticut Affidavit for Filing Will Not Submitted for Probate if eligible.