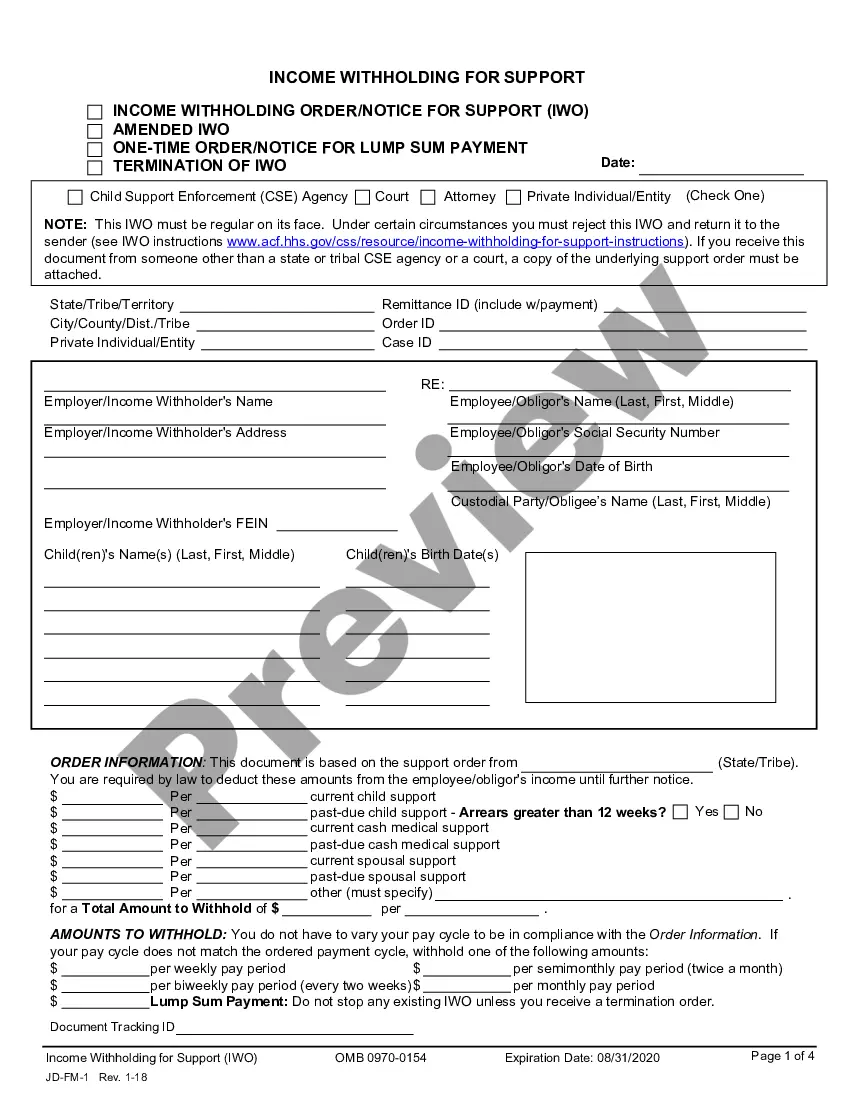

This form provides instructions for the notice and an order for withholding income for child support. This is an official form from the Connecticut Court System, which complies with all applicable laws and statutes. USLF amends and updates forms as is required by Connecticut statutes and law.

Connecticut Instructions to Complete the Income Withholding for Support

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Instructions To Complete The Income Withholding For Support?

The greater the number of documents you need to produce, the more stressed you become.

You can discover countless templates for Connecticut Instructions For Withholding Order For Support online, but you may not know which ones to rely on.

Eliminate the hassle of finding samples by utilizing US Legal Forms.

Proceed to purchase to begin the registration process and select a pricing plan that meets your needs. Enter the required information to establish your profile and process your payment using PayPal or credit card. Choose a preferred file format and download your document. Locate each template you acquire in the My documents section. Simply head there to generate a new version of the Connecticut Instructions For Withholding Order For Support. Even when utilizing expertly crafted templates, it remains essential to consider seeking your local attorney's advice to verify that the completed form is filled out correctly. Achieve more for less with US Legal Forms!

- Obtain professionally created documents that comply with state requirements.

- If you possess a subscription to US Legal Forms, Log In to your account, and you will spot the Download button on the Connecticut Instructions For Withholding Order For Support page.

- In case you’re using our service for the first time, follow these steps to register.

- Confirm that the Connecticut Instructions For Withholding Order For Support is valid in your state.

- Verify your selection by reviewing the description or utilizing the Preview feature if it is available for the chosen document.

Form popularity

FAQ

Child support cannot take your entire paycheck due to legal limits on withholding. In Connecticut, there are established maximums to protect your essential living expenses. By using the Connecticut Instructions to Complete the Income Withholding for Support, you gain clarity on what can legally be withheld, helping to prevent any financial hardship.

In Connecticut, the maximum amount that can be withheld for child support varies based on the number of dependents and your income level. The guidelines specify maximum percentages that cannot be exceeded, providing a structured approach. Utilizing the Connecticut Instructions to Complete the Income Withholding for Support assists you in understanding these limits clearly, ensuring fair treatment for all parties involved.

The maximum withholding amount for child support in Connecticut adheres to the guidelines set by federal and state law. Typically, your employer can withhold a specific percentage of your disposable income. Following the Connecticut Instructions to Complete the Income Withholding for Support helps ensure that the correct withholding is applied without exceeding permissible limits.

In Connecticut, the maximum amount of net earnings that can be deducted for child support primarily depends on your disposable income. Generally, a portion of your income, after taxes and necessary deductions, is subject to withholding. By following the Connecticut Instructions to Complete the Income Withholding for Support, you ensure compliance with state regulations and maximize proper deductions.

Typically, an income withholding order takes effect as soon as your employer receives it. However, the processing time can vary based on state and employer regulations. Understanding the Connecticut Instructions to Complete the Income Withholding for Support provides guidance on expediency and helps prevent delays in the delivery of necessary funds.

Income withholding works by automatically deducting a portion of your earnings to satisfy support obligations. This ensures that payments reach the intended recipient reliably and on time. By utilizing the Connecticut Instructions to Complete the Income Withholding for Support, you can streamline this process and avoid missed payments.

The percentage of income to withhold for taxes varies based on several factors, including your income level and filing status. Generally, you can estimate your withholding using IRS guidelines or state resources. Following the Connecticut Instructions to Complete the Income Withholding for Support can help you determine the appropriate percentage to ensure compliance and accuracy.

The tax withholding process involves deducting a specific amount from your paycheck to cover tax liabilities. Employers send this deducted amount to the IRS and state tax agency on your behalf. For those following the Connecticut Instructions to Complete the Income Withholding for Support, this process is crucial to ensuring that support payments are made timely and accurately.

The income withholding process begins when a court orders income to be deducted for child support. Employers receive official notifications, such as a withholding order, which specify the amount to deduct from an employee's paycheck. Understanding this process and utilizing the Connecticut Instructions to Complete the Income Withholding for Support can streamline compliance for both employers and employees.

Employers are required to remit child support payments to the appropriate state agency within a specific time frame, usually within seven business days of withholding from an employee's paycheck. Timely submission is crucial to ensure that custodial parents receive support without delay. Using the Connecticut Instructions to Complete the Income Withholding for Support provides clarity on procedures for employers.