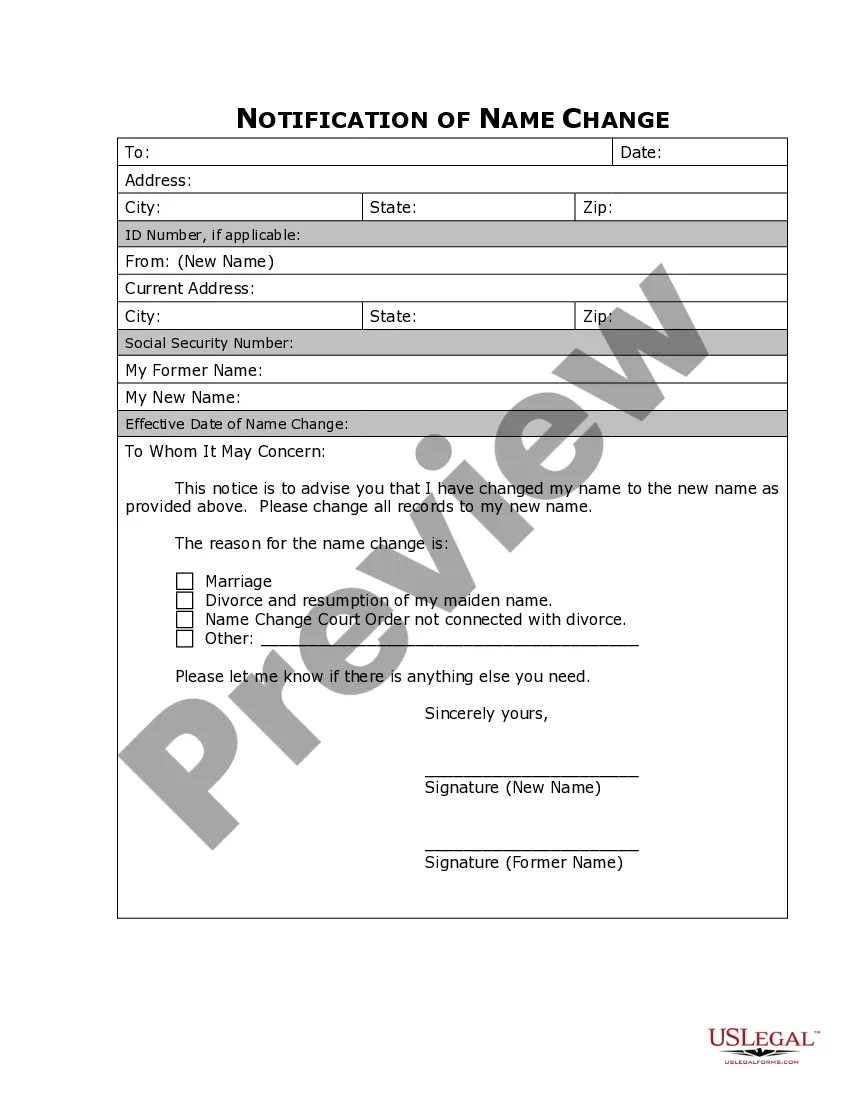

Connecticut Application for Unclaimed Funds is an online tool provided by the Connecticut Office of the Treasurer. It enables individuals to search for and claim any unclaimed funds they may be due from the state. These funds are typically from inactive bank accounts, forgotten utility deposits, abandoned safe deposit boxes, insurance policies, and other sources. The application can be accessed through the Connecticut Office of the Treasurer website. Users can search for funds by entering a name or social security number, and the results will include a list of funds that may be due. If the user confirms that the funds are indeed due to them, they can complete an online form to begin the claim process. The two main types of Connecticut Application for Unclaimed Funds are the Personal Claim Form and the Business Claim Form. The Personal Claim Form is used for funds due to an individual, while the Business Claim Form is used for funds due to a business. The user must provide proof of identity and a valid mailing address in order to complete the claim form. Once submitted, the claim will be reviewed by the State and the funds will be paid out to the claimant as soon as possible.

Connecticut Application for unclaimed funds

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Application For Unclaimed Funds?

Managing legal paperwork necessitates diligence, precision, and utilizing thoroughly crafted templates.

US Legal Forms has been assisting individuals nationwide in doing precisely that for 25 years, so when you select your Connecticut Application for unclaimed funds template from our platform, you can be assured it complies with federal and state regulations.

Select the format in which you wish to save your document and click Download. Print the form or import it into a professional PDF editor for electronic submission. All documents are prepared for multiple uses, similar to the Connecticut Application for unclaimed funds presented on this page. If you require them in the future, you can complete them without an additional fee - just access the My documents tab in your profile and finalize your document whenever needed. Experience US Legal Forms and organize your business and personal documentation swiftly and in complete legal compliance!

- Be sure to meticulously verify the content of the form and its alignment with general and legal standards by previewing it or reviewing its description.

- Seek an alternate official template if the one initially accessed does not fit your requirements or state guidelines (the tab for this is located in the upper corner of the page).

- Log in to your account and download the Connecticut Application for unclaimed funds in your desired format.

- If this is your first visit to our website, click Buy now to continue.

- Establish an account, choose your subscription plan, and process payment using your credit card or PayPal account.

Form popularity

FAQ

When you file a claim for unclaimed property in Connecticut, the state reviews your submission to verify your ownership. If your claim is approved, you will receive your funds or assets typically within a few weeks. By carefully completing the Connecticut Application for unclaimed funds, you streamline this process and enhance your chances of a quick resolution.

Unclaimed property rules in Connecticut stipulate that financial institutions and certain businesses must report unclaimed assets after a set period of inactivity. These rules protect consumers and help to ensure that lost funds are returned. Using a knowledgeable platform like uslegalforms simplifies the process of navigating these rules and submitting your Connecticut Application for unclaimed funds.

In Connecticut, property is considered abandoned after a specific period of inactivity, which can vary depending on the type of asset. Generally, it can take between three to five years of no activity for property to be classified as abandoned. Once this happens, the state takes custody, and you will need to file a Connecticut Application for unclaimed funds to reclaim your assets.

Connecticut holds unclaimed property indefinitely until the rightful owner claims it. The state actively works to reunite owners with their assets, which means you can submit a Connecticut Application for unclaimed funds at any time. By acting swiftly, you increase your chances of recovering your property sooner rather than later.

No, unclaimed property is not a trap. It is a legitimate process designed to help individuals retrieve funds or assets that they may have lost track of. The Connecticut Application for unclaimed funds provides a straightforward way to reclaim your property, and using a trusted service like uslegalforms can make this process seamless.

To successfully file a Connecticut Application for unclaimed funds, you typically need identification documents, such as a driver's license or state ID, and proof of ownership for the unclaimed property. This may include bank statements, insurance policies, or other relevant records. Having these documents ready ensures a smoother claim process and increases your chances of retrieving your funds.

Anyone can search the online database to see if the state owes you. Getting your money requires some work. The State Treasurer's Office says it typically takes about 90 days to process a claim once the proper documentation is received and some may take even longer due to their complexity.

Rightful owners may search our website (.CTBigList.com) or call 1-800-833-7318 (Monday through Friday between AM and 5 PM Eastern Time), and biennially we publish abandoned property reported and transferred to the Treasurer.

.unclaimed.org is the website of the National Association of Unclaimed Property Administrators. This is a legitimate site created by state officials to help people search for funds that may belong to you or your relatives. Searches are free.

Holders should reference our unclaimed property site, .CTBigList.com, for reporting information and to submit reports. These assets are held in the custody of the Treasurer until claimants come forward to claim their property.