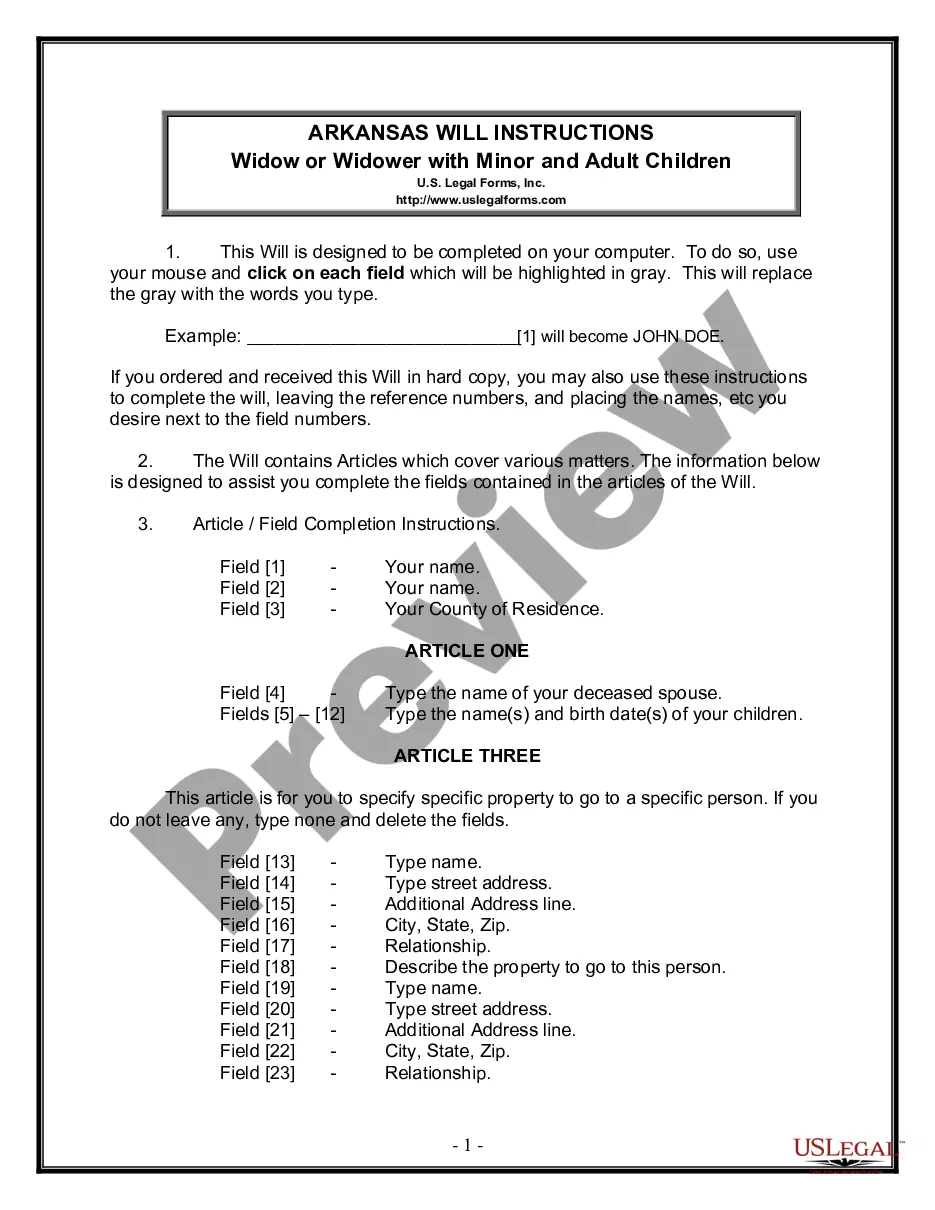

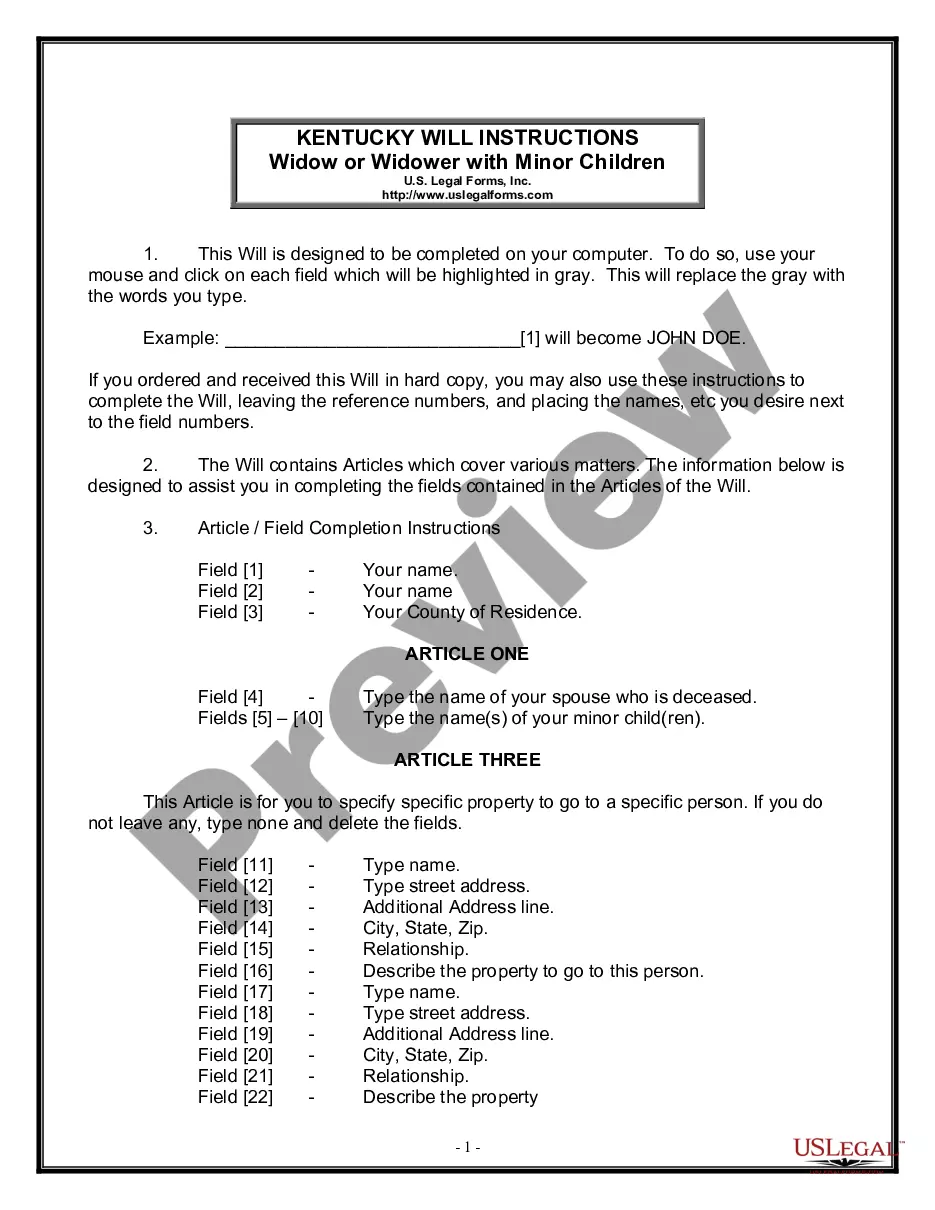

Connecticut Form ADV (Parts 1 and 2)) is a document that must be completed and filed with the Connecticut Department of Banking. It is intended to provide information to potential investors about the investment advisor and his/her activities. Part 1 is a uniform form that must be completed by investment advisors registered with the Securities & Exchange Commission (SEC) as well as state-registered advisors. It includes information on the advisor’s business operations, such as ownership and control, clients, affiliations, fees, and disciplinary information. Part 2 is a supplement that provides more detailed information about the investment advisor’s services, including financial planning activities, discretionary and nondiscretionary accounts, conflicts of interest, and custody of client funds. There are 3 types of Connecticut Form ADV (Parts 1 and 2) — a Form ADV-W for withdrawal of registration, a Form ADV-NR for non-reporting investment advisors, and a Form ADV-BR for branch registrations.

Connecticut Form ADV (Parts 1 and 2))

Description

How to fill out Connecticut Form ADV (Parts 1 And 2))?

Completing formal documentation can be quite daunting unless you have access to fillable templates that are ready for use. With the US Legal Forms online repository of official documents, you can trust that the forms you acquire meet both federal and state guidelines and have been reviewed by our experts.

Acquiring your Connecticut Form ADV (Parts 1 and 2) from our collection is as easy as can be. Existing users with a valid subscription simply need to Log In and click the Download button once they find the correct template. Afterward, if necessary, users can access the same document from the My documents section of their profile.

Haven't you tried US Legal Forms yet? Register for our service today to access any official document swiftly and effortlessly whenever you need to, and maintain your paperwork organized!

- Document compliance verification. It is important to thoroughly examine the content of the form you're interested in to ensure it meets your requirements and adheres to your state's legal standards. Reviewing your document and checking its general description will aid you in this process.

- Alternate search (optional). If you find any discrepancies, navigate the library via the Search tab at the top of the page until you identify the right blank, and click Buy Now once you find what you need.

- Account setup and form acquisition. Establish an account with US Legal Forms. Once verified, Log In and select the subscription plan that works best for you. Proceed with payment to continue (options include PayPal and credit cards).

- Template download and additional utilization. Select the file format for your Connecticut Form ADV (Parts 1 and 2) and click Download to save it onto your device. Print it to fill out your paperwork by hand, or utilize a comprehensive online editor to prepare a digital version more swiftly and efficiently.

Form popularity

FAQ

The responsibility for filing Form ADV/E lies primarily with investment advisers who operate as exempt reporting advisers. This means they must file to comply with state regulations without undergoing full registration. By utilizing Connecticut Form ADV (Parts 1 and 2), you can navigate the filing process more efficiently and ensure compliance with regulatory standards.

Yes, broker-dealers are required to file Form ADV, specifically if they also operate as investment advisers. This requirement ensures that they disclose relevant information about their business operations to both regulators and clients. By filing Connecticut Form ADV (Parts 1 and 2), broker-dealers maintain transparency and protect consumer interests.

The main difference between ADV Part 1 and Part 2 lies in the type of information they provide. Part 1 contains standardized data about the adviser's business, while Part 2 offers a more in-depth narrative that explains the adviser's services, fees, and fiduciary duties. Both parts together give potential clients a clearer picture of the adviser's qualifications and business practices.

Part 1 of the ADV is primarily a check-the-box form that asks for vital information about the investment adviser. This section includes details about the adviser's business structure, ownership, and any criminal or regulatory proceedings. It serves as an overview, helping clients get a quick sense of the adviser's background before moving to the more detailed Part 2 of the Connecticut Form ADV.

Form ADV consists of two parts: Part 1 and Part 2. Part 1 collects basic information about the adviser, such as business structure, ownership, and potential disciplinary history. In contrast, Part 2 provides a narrative of the adviser's services, fees, and any conflicts of interest, allowing clients to make informed choices regarding their investments.

To find Form ADV Part 2, visit the SEC's Investment Adviser Public Disclosure (IAPD) website. You can search for firms based in Connecticut and view their ADV Part 2 documents. This ensures you have access to the detailed information that investment advisers must disclose to their clients.

You can download Form ADV directly from the SEC’s official website. The site provides both Part 1 and Part 2 of the Connecticut Form ADV for your convenience. Having access to these forms can help you understand an adviser's disclosure obligations and evaluate their qualifications.

You can find Form ADV filings through the SEC's Investment Adviser Public Disclosure (IAPD) website. This platform allows you to search for investment advisers registered in Connecticut and other states. Simply enter the adviser’s name or firm to access their Connecticut Form ADV (Parts 1 and 2) filings and review their information.

An ADV Part 2 is a document that investment advisers must file with the SEC to provide potential clients with important information about their services, fees, and business practices. It is meant to help clients make an informed decision when considering an investment adviser. The Connecticut Form ADV (Parts 1 and 2) includes details about the adviser's qualifications, practices, and any potential conflicts of interest.

The Connecticut Form ADV is primarily used to register investment advisers with state authorities. It provides a comprehensive overview of the adviser's business operations, qualifications, and any affiliations. By understanding the information shared in Form ADV, clients can assess the adviser's credibility and make informed choices about their investments.