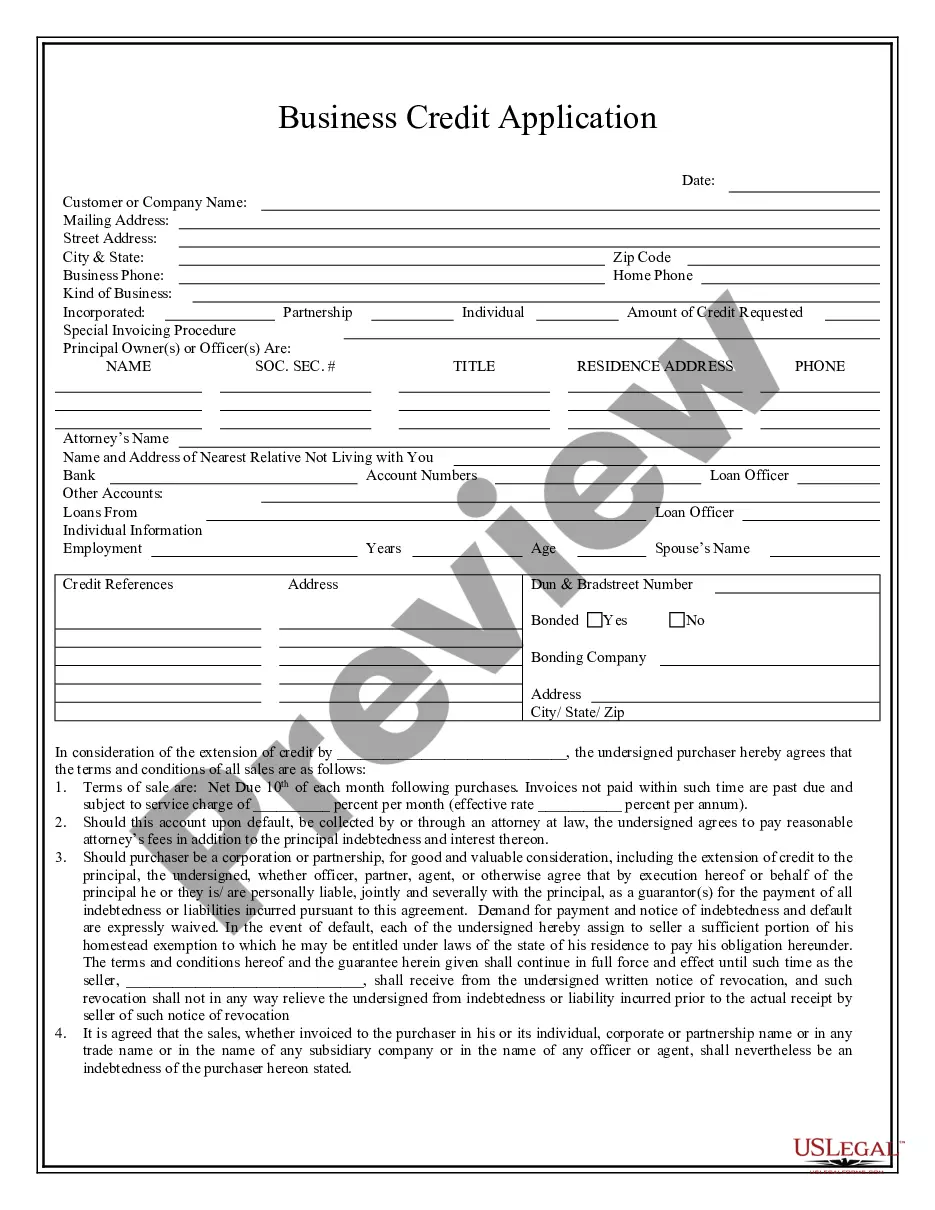

Connecticut Business Credit Application

What this document covers

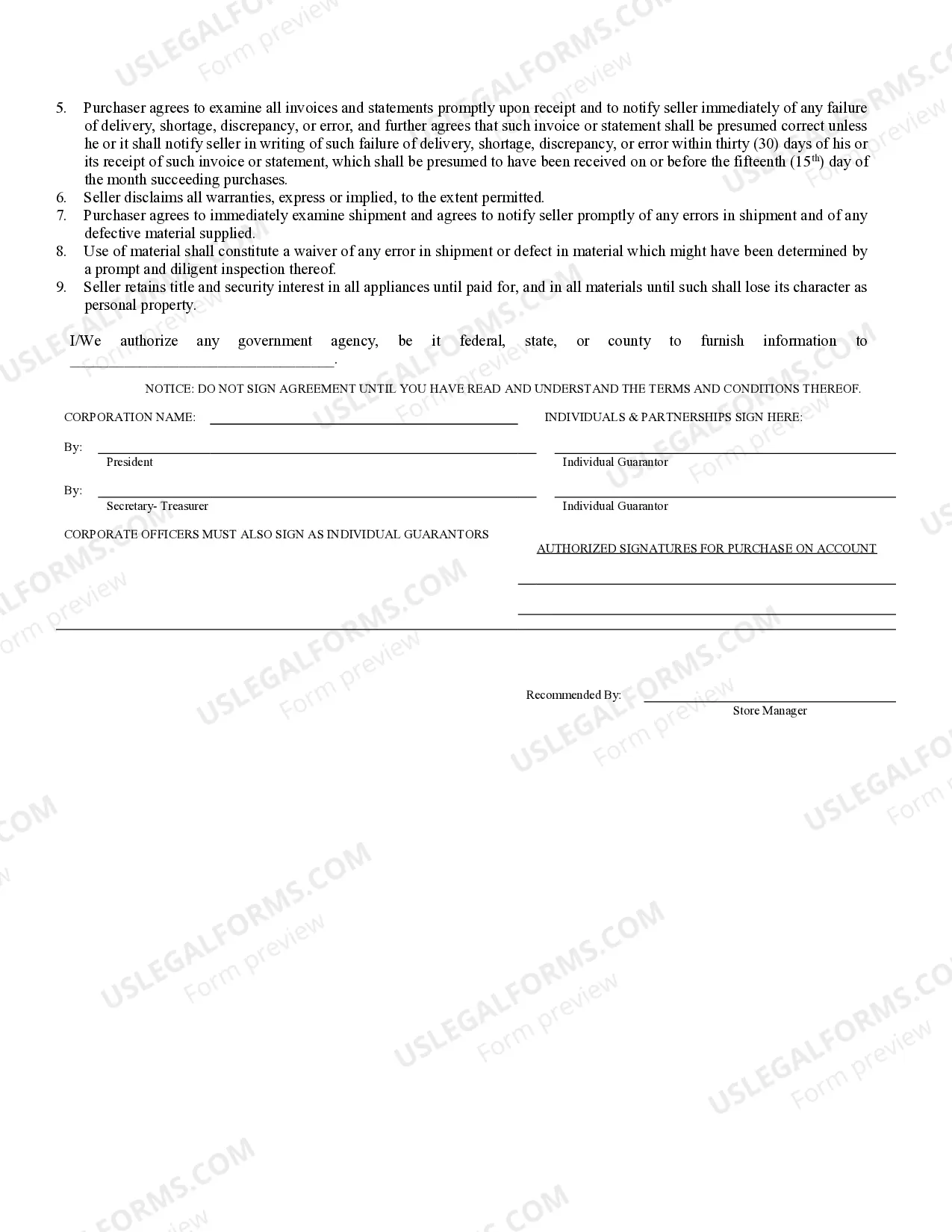

The Business Credit Application is a legal document used by individuals or businesses to apply for credit from a seller or supplier. This form establishes the terms and conditions of repayment, including interest charges and consequences of default. Unlike general credit applications, this form includes specific clauses regarding the sale of goods on credit, ensuring both parties are protected in the event of nonpayment.

Key parts of this document

- Terms of sale: Outlines payment due dates and service charges for late payments.

- Default provisions: Details consequences if the purchaser defaults on payments.

- Personal guarantee clause: Ensures that individual guarantors are personally liable for debts.

- Disclaimer of warranties: States that the seller does not guarantee the quality of goods sold on credit.

- Retention of title clause: Establishes that the seller retains ownership of goods until fully paid.

When to use this document

This form should be used when a business or individual seeks to purchase goods on credit. It is applicable in scenarios where the seller requires a formal agreement detailing the repayment terms before extending credit. Common situations include purchasing inventory, equipment, or supplies where a delay in payment is permissible.

Who needs this form

- Businesses seeking credit from suppliers or wholesalers.

- Individuals purchasing goods for a business purpose.

- Corporations and partnerships needing to outline credit terms and guarantees.

How to complete this form

- Enter the seller's name and contact information at the top of the application.

- Provide the purchaser's information, including name, address, and type of entity (individual, corporation, partnership).

- Specify the payment terms, including due dates and applicable service charges for late payments.

- Include any necessary guarantees by individuals if the purchaser is a business entity.

- Review and sign the document to acknowledge acceptance of the terms before submitting.

Does this document require notarization?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide accurate contact information for all parties involved.

- Not reviewing the payment and interest terms carefully before signing.

- Overlooking the necessity of individual guarantees when applicable.

- Ignoring the requirement to notify the seller of any discrepancies within the stipulated time frame.

Why complete this form online

- Convenient access to a legally sound template that can be downloaded anytime.

- Edit the form to suit specific needs and preferences before printing.

- Ensures compliance with legal standards set forth by licensed attorneys.

Looking for another form?

Form popularity

FAQ

To create your LLC in Connecticut, start by choosing a unique name and then file a Certificate of Organization with the state. You can accomplish this online or by mail. To simplify this process, consider using US Legal Forms, which provides straightforward templates and guidelines. Once formed, your LLC can help you prepare a Connecticut Business Credit Application, paving the way for better funding opportunities.

The time it takes to form an LLC in Connecticut can vary. Once you submit your Certificate of Organization, the state usually processes it within 1 to 2 weeks. However, utilizing professional services like US Legal Forms can help expedite this process and ensure all requirements are met. Completing your Connecticut Business Credit Application will also be easier once your LLC is established.

An LLC in Connecticut is generally treated as a pass-through entity for taxation purposes. This means that the business's income is passed on to the owners, who report it on their personal tax returns. It's beneficial to understand this tax treatment, especially when you consider how it may affect your financial strategy, particularly if you're exploring a Connecticut Business Credit Application.

Filing CT Form 1120 online is straightforward through the Connecticut Department of Revenue Services portal. You will need to create an account or log in, providing your necessary business information. Completing this form accurately is crucial to avoid issues and could be important when referencing your financials on a Connecticut Business Credit Application.

You should file your Connecticut Form 1065 with the Connecticut Department of Revenue Services (DRS). Filing can be done electronically through the DRS website or by mailing a completed paper form. It's important to stay compliant and timely, especially when managing your records related to a Connecticut Business Credit Application.

To close a business in Connecticut, you must file a Certificate of Dissolution with the Secretary of State. Be sure to settle all tax obligations before starting this process, as outstanding taxes can complicate dissolution. This process is vital for ensuring that your business officially ceases to exist, which may also impact any pending Connecticut Business Credit Application you might have.

To find out if a business name already exists, visit the Connecticut Secretary of State's online search portal. Enter the name you wish to check and see if there are any existing businesses with that name. If the name is clear, you can confidently move forward with your Connecticut Business Credit Application.

You can verify a business in Connecticut by searching the Secretary of State's business entity database. This tool will allow you to check the status and details of any registered business. You can use this verification process to ensure you have the correct details before submitting a Connecticut Business Credit Application.

To open a business in Connecticut, gather necessary information like your business plan, funding options, and tax details. Additionally, you need to decide on a business structure and register with the appropriate authorities. Completing your Connecticut Business Credit Application can be a vital step in securing the funds needed for your startup.

Finding out if a business name is available in Connecticut is easy. Simply use the Connecticut Secretary of State's business name search tool. This will show you if your desired name is already registered, allowing you to move on to your Connecticut Business Credit Application with full confidence.