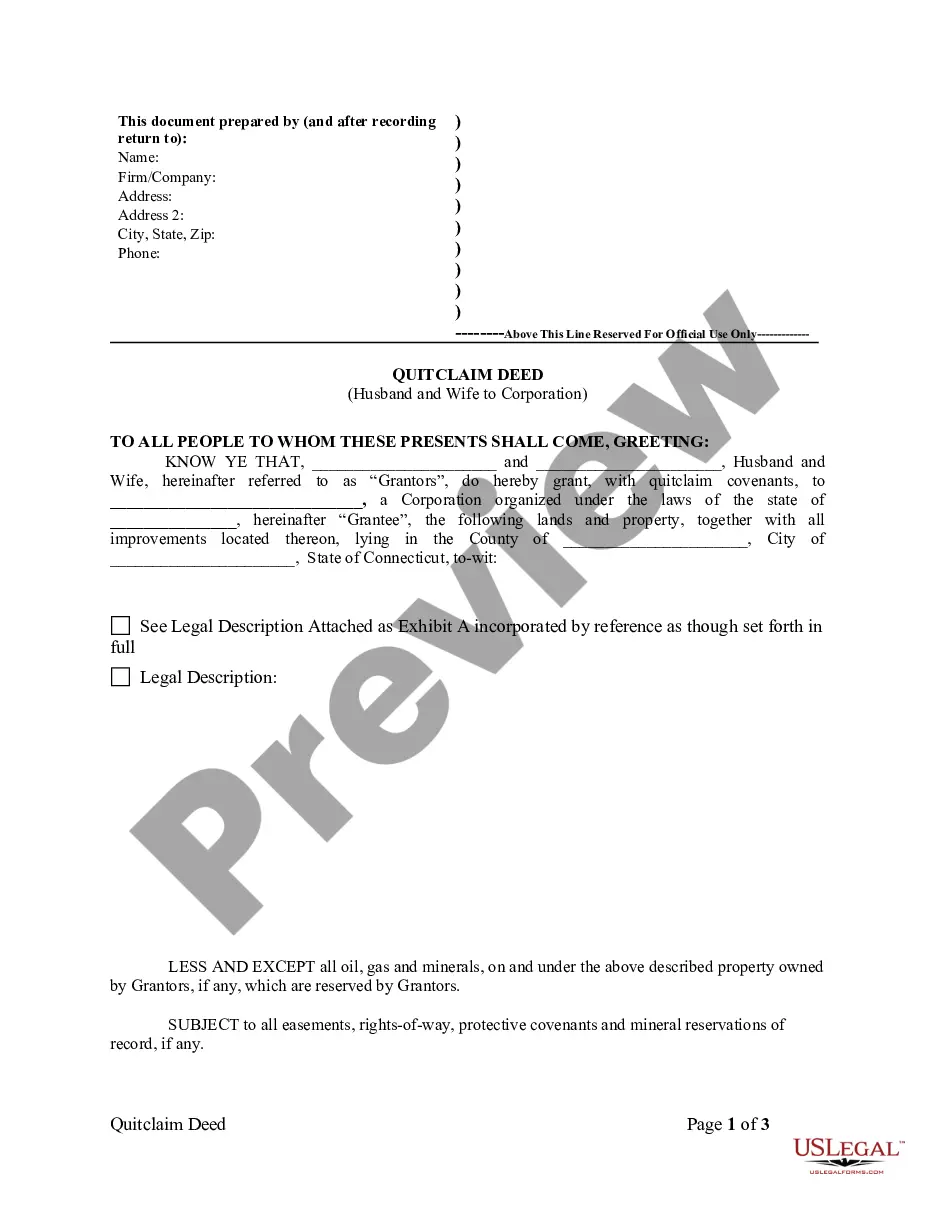

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Connecticut Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Connecticut Quitclaim Deed From Husband And Wife To Corporation?

The larger quantity of documents you should prepare - the more anxious you become.

You can obtain numerous Connecticut Quitclaim Deed from Husband and Wife to Corporation templates online, but you're unsure which to trust.

Eliminate the frustration and make obtaining samples significantly simpler with US Legal Forms. Acquire skillfully composed documents that are tailored to meet state requirements.

Access any file you download in the My documents section. Simply navigate there to generate a new version of the Connecticut Quitclaim Deed from Husband and Wife to Corporation. Even when using expertly drafted forms, it remains crucial to consider consulting your local attorney to double-check the completed sample to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- Confirm if the Connecticut Quitclaim Deed from Husband and Wife to Corporation is acceptable in your state.

- Verify your selection by reading the description or utilizing the Preview feature if it's available for the chosen record.

- Click on Buy Now to initiate the registration process and select a pricing plan that suits your needs.

- Provide the required information to create your profile and complete your order payment via PayPal or credit card.

- Choose a convenient document type and obtain your copy.

Form popularity

FAQ

The process for a quitclaim deed in Connecticut involves several key steps. First, ensure you fill out the deed accurately with the names of all grantors and the grantee, along with a precise property description. Next, sign the deed in front of a notary public and file it with the appropriate town clerk. Using a service like uslegalforms can streamline this process by providing templates and guidance to ensure compliance.

The best type of deed for a married couple often depends on their specific situation, but a quitclaim deed can be advantageous when transferring property ownership between spouses. It is simple to prepare and requires fewer formalities compared to warranty deeds. For instances involving transfers to a corporation, a Connecticut Quitclaim Deed from Husband and Wife to Corporation is frequently recommended.

A quitclaim deed for a married couple is a legal document that transfers one spouse's interest in a property to the other spouse or a corporation. Unlike other deeds, it does not guarantee the property's marketability or clear title. This form is particularly useful for couples who want to restructure property ownership or streamline their assets under a corporate entity.

A spouse may execute a quitclaim deed to transfer their interest in the property to the other spouse or to a corporation. This can occur during a divorce, to clear title issues, or when making business arrangements. By using a Connecticut Quitclaim Deed from Husband and Wife to Corporation, couples can efficiently manage their property ownership.

The usual reason for using a Connecticut Quitclaim Deed from Husband and Wife to Corporation is to transfer ownership or remove a person's name from the title without making any warranties on the property. This type of deed is often used in family transactions, such as gifting property to a corporation for business purposes. It allows couples to simplify their asset management under a corporate structure.

To properly fill out a Connecticut Quitclaim Deed from Husband and Wife to Corporation, start by writing the names of both grantors, along with the corporation's name as the grantee. Include the property description, which must be clear and precise. Ensure all parties sign the deed before a notary public, and record it with your local town clerk to complete the process.

Quitclaim deeds, including the Connecticut Quitclaim Deed from Husband and Wife to Corporation, are often used to transfer ownership easily and quickly. They come in handy during divorce proceedings, estate settlements, or to add or remove individuals from property titles. Additionally, they are suitable for transactions among friends or family where trust exists. This flexibility makes quitclaim deeds a popular option for straightforward property transfers.

The Connecticut Quitclaim Deed from Husband and Wife to Corporation primarily benefits the corporation when transferring property without extensive title searches. Typically, individuals looking to simplify asset transfer or resolve estate matters also gain significant advantages. In these instances, the streamlined process may save time and costs compared to traditional real estate transactions. Therefore, both the corporation and those involved in the property transfer can see practical benefits.

A quitclaim deed, such as the Connecticut Quitclaim Deed from Husband and Wife to Corporation, may lack important protections. It does not guarantee clear title, which can lead to issues if existing liens or claims arise. Furthermore, without proper legal advice, both parties could find themselves in a complicated position should disputes occur in the future. It often leaves a lot of potential risks for both the grantors and the recipients.

To create a valid Connecticut Quitclaim Deed from Husband and Wife to Corporation, both spouses must sign the document. You need to include the legal description of the property being transferred, as well as the current owner's names. Additionally, you must ensure the deed is notarized and filed with the town clerk's office where the property is located. Using uslegalforms can simplify this process, providing you with the necessary forms and guidance to meet all legal requirements.